Indian Cotton Prices Defy Global Trend, To Remain Strong

Cotton prices continued with the upward price trend in the Indian market during May first half. Scarcity of quality cotton and the slow arrival has helped the suppliers to jack up prices in the recent months. Indian cotton prices for the first time in this season, moving opposite to the international market sentiments, where cotton prices are languishing. Also, buyers were back to the market and spinners are looking at procuring available good quality cotton. Further, as the harvested crop size has been lower in this season, many traders, ginners and Cotton Corporation of India (CCI) is still holding sizable quantity of the fiber which has created a bit of supply tightness. Cotton Association of India’s (CAI) has procured nearly 840,000 bales of cotton during the current cotton season and data indicates that, it has sold nearly 375,000 bales holding the remaining stock. Here to note that India's cotton production is expected to be around 34.1 million bales (previous season’s production stood at 38.27 million bales) for the current season. So, with the current trade dynamics, the outlook on cotton prices indicates a healthier price scenario and improved demand would keep the fiber prices stronger for the remaining period of the season. On the supply side, daily average arrivals have drastically come down as the seasonal arrival period is at its fag end. Estimated cotton arrivals to be in the range of 30,000-40,000 bales which to dry up soon. Current domestic price of benchmark Shankar-6 variety stood around Rs.34800 per candy (355.6kg, on 12th May 2016) after some price fluctuations in first fortnight of May.

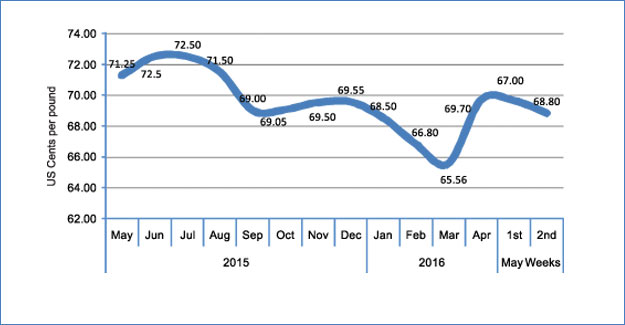

On the global front, cotton prices witnessed a sharp fall after upward trend witnessed during April. As China’s proposed plan to auction 2 million metric tonnes of cotton from May through August started from 2nd of this month, international cotton prices seen moving down. The benchmark A index which touched as high as 72 cents at the beginning of May, has slipped down below 70 cents mark. ICE Cotton futures for July also witnessed some biggest fall in recent weeks during the fortnight. On the key data on the cotton crop from USDA’s latest forecast for the next season indicates that world cotton production to be further down to 104.4 million bales (of 480 lb, down from last season’s 99.5 million bales), consumption estimates at 110.8 million bales (marginal increase from last season’s 109 million bales) and ending stock to be at 96.5 million bales as against last season’s 102.8 million bales.

To look at the cotton price trend, benchmark ‘A’ index fall sizably from the beginning of the month (72 cents) to settle at 68.8 US Cents on 12th May. ‘A’ Index was at 69.55 US cents per pound in December 2015 end and was 67.65 US cents per pound a year before in December 2014 (28th of Dec 2014). To compare further, ‘A’ index was 89.25 on 29th December 2013 and was at 84.80 US cents on 28th December 2012.

On the yarn front, demand for cotton yarn has improved further during the fortnight. Buyers were back as yarn prices have started moving north but as the fiber prices have fallen in the international markets, it might be difficult for suppliers to hold on to the revised prices. There are expectations that demand for cotton yarn might revive further but price might witness some corrections.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.