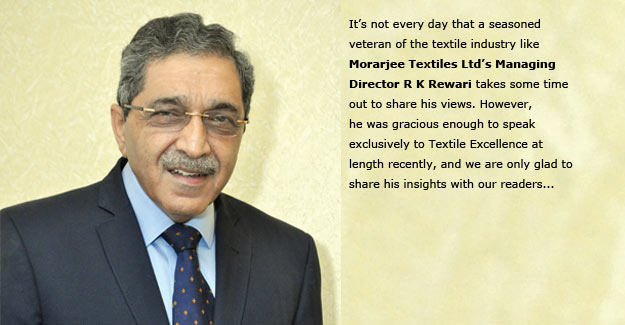

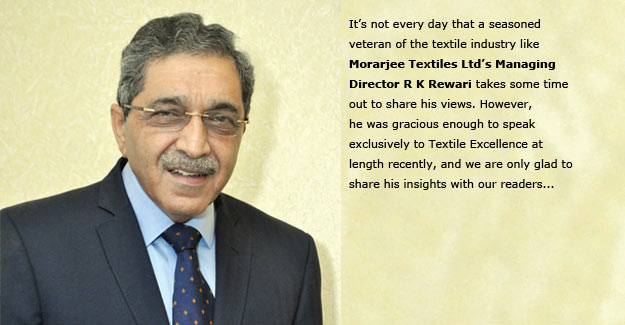

‘At Morarjee, We Are Trying To Become Self Reliant In Spinning And Weaving’

Please tell us how Morarjee has evolved over the years...

Morarjee Textiles Ltd. is a 145 years old company, one of the oldest textile companies in operation in India. The company came into existence in 1871 and was known as Morarjee Goculdas Spinning & Weaving Co. Ltd. It was acquired by the Piramals in 1934. Post-acquisition, a modernisation programme was implemented and Morarjee Mills was awarded a gold medal for this. By 1940, the mills had 120 jiggers for piece dyeing and 100 vats for yarn dyeing.

When the textile industry faced industrial unrest it impacted our company as well. However, in 1996, Morarjee formed a joint venture with an Italian company called Manifattura di Valle Brembana to manufacture high-end shirting fabric at Nagpur. The aim was to supply high-end shirting material to Europe. Brembana transferred machinery and technology to this joint venture, which was then known as Morarjee-Brembana Ltd. However, unfortunately in 2005, Mr. Brembana passed away. The company then purchased Brembana's shares and became the sole owners. Morarjee Textiles has an integrated manufacturing facility in Butibori near Nagpur in Maharashtra (Western India). It manufactures high-end and premium cotton shirting fabric, highly fashionable printed fabric, voiles and Guthra.

Recently the group has invested Rs. 315 crore in the textile business for major backward integration and modernisation of our process house. It has three parts, namely - a fully automated spinning unit with 22 ring frames, each having 1,824 spindles, supplied by Saurer, installation of 112 Toyota airjet looms, modernisation and expansion of our process house, where we have added new processing, printing and finishing machines. Now we will be self-reliant and have a fully integrated plant producing about 9 million metres of high-end shirting material and about 20 million meters of printed fabrics per annum. With this expansion, we expect to capture additional topline along with improved margins. With this expansion, the growth in the company's topline will be around Rs 80 crore to Rs 90 crore. Our dependency on yarn or fabric suppliers will come to an end with this expansion.

So Morarjee would be supplying products to top line brands around the world?

Yes, most of our shirting fabric will go to premium segments of various brands.

So, if we understand right, Morarjee is trying to protect itself from recession, because when recession takes place, the mass market takes a hit, but the premium market remains unaffected...

I agree, as well as disagree with you. Because when recession comes, it affects the mindset which may hamper buying spirits of customers. So, nobody can escape recession, because most of apparel buying decision is not need based, but impulse based - I mean it is fashion driven as well. At Morarjee, we are trying to become self-reliant in spinning and weaving. We are also trying to understand fashion better.

You have sealed the value leakage that was happening in the manufacturing chain. So how will this impact your bottom line?

I hope it will impact our bottom line positively...

Generally, if we look at the balance sheet of textile companies, we find a PAT of 7 to 8 %.

Yes, I think Morarjee’s bottom line should also remain close to these numbers. However cotton prices, demand and supply equation always influence the textile business.

Will you enter value added garmenting sector as well?

No, not at this moment,

What is the reason you have opted for Saurer as your machinery suppliers, when you have so many alternatives?

I would say that we have chosen all our machines on merit. We have gone for machinery which suited us the most. When we were evaluating ring frame machines, we found that Saurer is a good technology provider and some of the features of the machine are unique e.g.compact system and few others. We also checked with other users of Saurer machines and received a positive feedback. That is how we have installed Saurer machines.

What is the future of the Indian textile industry? It missed the bus in 2005. Do you think it will miss the bus again?

Today, India is the largest producer of cotton in the world. Indian factories have the most modern technology due to government policies like Technology Ugradation Fund (TUF) Scheme. A lot of money has been invested in machines in the last 10 years. So, we are strong in textiles segment and I don't see any reason for it to go down.

The reason for not gaining momentum because India is not strong in garmenting. Even in garmenting, I think the government has helped, by giving a bonanza of Rs 6,000 crore to the apparel industry. Fundamentally, India is strong in textiles. We have people, we have technology and we also have raw materials. We also have a huge internal consumption.

If we look at the future, China and India are going to be the largest producers of textiles and also one of the largest consumer centres of textiles. So in my view, it is a win-win situation. One of the challenges today is that we function in a disintegrated manner. The industry is trying to come together on a single platform so that we can talk in one voice to the government and customers. The other challenge is that China has more diversity of textile products than we in India do.

We have to catch up in this area. We are very weak in consumption as well as production of synthetics and industry pundits feel that in the coming decades, both consumption as well as production of synthetics could be more than cotton. These are the challenges.

We find that the young generation at Morarjee is still interested in the textiles business, when the general trend is of the young generation getting into other businesses. What has kept Morarjee's young generation focused on textiles?

Whenever I have interacted with the promoter's family I have found that they have love and passion for this industry. They also have a vision to do something in technical textiles. They want to take Morarjee Textiles to a different level of technological edge. I won't say that we will grow to Rs 5,000 crore or Rs 10,000 crore, but whatever growth will be available to us, we will take that opportunity.

We have been witnessing a trend where businesses with integrated manufacturing are doing well rather than others in decentralised sectors. So, looking at the future, do you think that the textile industry should look at forward and backward integration to seal leakage in value?

I think you are very right. Actually the scale also matters. When you are supplying to larger retailers, there is a better chance that you will be able to serve them better if integrated. Secondly, you will be able to have a complete control over your costs as well. So, I think Indian textile businesses must scale up from small scale to medium to large scale. If you look at looms, a couple of years ago, we found that only five per cent of fabric is produced in the organised sector, while around 95 per cent of fabric came from the unorganised sector. But fortunately now, the unorganised sector is also getting modernised.

We hope there will be some good news for your shareholders as your production facilities come on stream...

For the past six years or so, our shareholders seem to be happy. We have been making profits for the past few years and we hope we will keep doing so. It is our endeavour to ensure that our shareholders' interests are always taken care of. Our promoters are also careful about our shareholders' interests. Many a time, the company pays more dividend than shareholders expect.

Apparently, you have plans to set up 'wasteless' plant. Could you elaborate?

That's right. Our Executive Vice Chairman Harsh Piramal has such a plan. In fact, we have already planned our existing plant at Butibori in Nagpur along these lines. Even our ongoing expansion is based on the same idea. There are two set of activities going on. One, a mandate has been given to European consultants to give us a proposal to set up a 'zero waste' factory. This has not been done in the textiles industry earlier. The other aspect is Zero Liquid Discharge (ZLD) from the plant. We have already implemented this at our Butibori plant. Our new effluent treatment plant is up, which is a biological treatment plant, followed by a reverse osmosis process. So, 94 per cent of water will be recovered. Also, the spinning shed has been made in a manner that we could put up a solar panel plant above it. We have already put up heat exchangers on every machine so that all waste heat is recovered. Two leading companies from the United Kingdom are helping Morarjee Textiles and most probably our next expansion project will be along these lines. Our Executive Vice Chairman is very passionate about this initiative and he wants to go in a direction where carbon footprint is reduced every year.

Do you see GST being a growth driver for the industry? How will it impact the pricing of your finished products?

I think so. There could be some initial teething trouble in terms of rollout, but I think that the government will fix it. GST as a concept will be a booster for the industry and I don't have any doubts about it. For us, it will be revenue neutral.

Do you see any other opportunities in textile sector?

I think the biggest opportunity is in technical textiles and we have some plans to tap it. However, the difficulty is that in developed countries, the usage of technical textiles is mandated by law, which is not the case here in India.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.