China State Reserves Sales Review

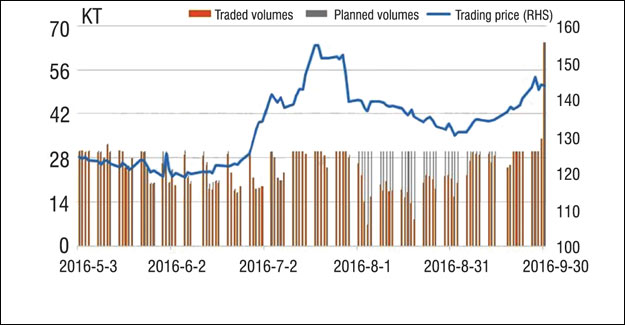

State reserved cotton sales ended on September 30 & about 2.66 million tons of cotton have been sold, including 296,306.06 tonne of imported cotton & 2.36 million tonne of domestic cotton. It is seen that quantity of reserved cotton offered for sale was mostly maintained at 30 kt per day. While in the beginning period, due to less quantity, trading prices witnessed large upswing, but after mid-July, as the quantity offered was steady, prices moved lower. In August, influenced by the state cotton auction extension, which was originally planned to end on August 31 but was prolonged to September 30, trading volumes cooled down obviously. After the auction extension was confirmed, prices and trading volumes recovered gradually. Looking from the trading proportion, from May 3 and late July, reserved cotton was basically 100% transacted per day, but in August, the transactions were volatile and during the last two weeks of September, the trading proportion reached 100% again and prices also stepped upward in September. The volatile base selling prices of reserved cotton resulted from the flexible price mechanism this year, influencing the mindset of buyers.

Flexible policy

The successful auction this year comes along with the reasonable price mechanism. State reserves can be sold during March and August every year except during the period from September to February that new crop cotton comes into the market.

Normally, the daily selling volumes will be no more than 50 kt and the actual volumes will be based on the actual transactions. If the domestic and international cotton prices soar quickly during one period and trading proportion is above 70% for three days in one week, then the selling volumes will be added. The reserved cotton will be sold with First In First Out strategy.

The price mechanism related to domestic and international cotton prices this year makes the base selling price close to market price, even influencing the market price, which differs much from the auction in previous years. Moreover, the quantity offered for sales is also adjusted flexibly to meet textile mills' demand. If the policy continues next year, the enormous state reserved cotton inventory can be digested obviously, which supports the Chinese cotton prices to be firm somewhat.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.