ICRA Cuts Spinning Industry Outlook To Negative

ICRA has cut the outlook for India's spinning industry to negative from stable on account of high cotton prices, low consumption growth and weak export prospects. On the financial health of the Indian spinning industry, the rating agency said that apart from profitability pressure, high cotton prices will translate into higher working capital requirements and hence borrowings, and will translate into weaker credit metrics. Some stronger players who had stocked cotton prior to increase in prices may see improved profitability driven by inventory gains during July-September. However, Icra predicted that from the third quarter onwards, the profitability will decline.

The growth in domestic yarn consumption hit the lowest in four years during 2015-16 (0.8% for cotton spun yarn and 2.5% for total spun yarn), and the spun yarn production stayed flat in the first quarter 2016-17 on-year. "Given the tepid domestic consumption and weak prospects of textile exports, yarn demand is unlikely to get any support. Thus, spinners will need to sacrifice profitability to maintain capacity utilisation," Icra said.

Industry slows down

Almost 50% of spinning mills in the India have stopped production. Weavers too are faced with dull market conditions. Almost 60% of the powerlooms and 40% sizing units in Ichalkaranji have stopped operations. The situation is no better in Bhiwandi. Fabric movement remains dull even at low prices.

As cotton arrivals gain ground, the Haryana Cotton Ginners Association has called for an indefinite strike from Oct 17 demanding reduction in market fees and to resolve issues of VAT refund.

And earlier this month, the National Green Tribunal ordered a shutdown of Pali's processing units for a month. The NGT committee, after a dry inspection, will give its report to the tribunal. Almost all the powerloom fabric from Ichalkaranji is processed in Pali.

Mills in Southern India are continuing to take a two-day break every week to manage inventories and costs. It is learnt that some cooperative spinning mills in Maharashtra were considering longer shut-downs this Diwali, than the normal 3-4 day holiday.

The slowdown of the industry is probably the worst that the industry has faced in the last few years. Offtake of yarn in many months has been negligible, causing a financial crunch in the market.

The speculations in the cotton market have been more prolonged this season than in earlier seasons, further hurting the entire textile value chain.

Spinners do not see much reason to go on manufacturing to full capacity, with prices remaining weak. Reduced exports have furthered the woes of the industry. The industry is trying to balance out losses from not producing yarn, to building inventories.

But is it all bleak? There are some signs of a pick-up. Some mills in Telangana and Andhra Pradesh are booked for both domestic and export orders. Some enquiries have begun from China, for coarser cotton yarn counts.

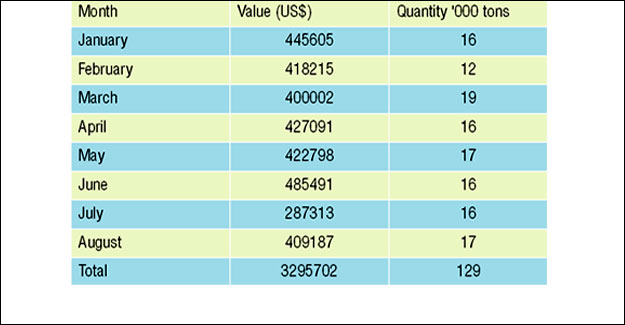

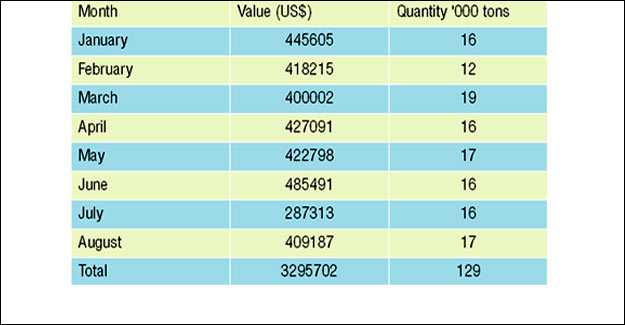

China's imports of cotton yarn have been increasing for the last 4-5 months. Imports in August were to tune of US$ 445,605, compared to July's imports of US$ 418215. Bangladesh is expected to also remain an important market for cotton and cotton yarns in 2017-18. However, exports to Pakistan will certainly face a setback, even as there may be some trade via third countries.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.