Brief Outlook Of China's PX-PTA Market In 2017

Near the end of 2016, many Chinese companies have been working out strategies for the next year. There are many concerns about PX-PTA market, including price spread, long-term contract discounts, major players and price trend. These concerns can be divided into two categories: balance (including price spread, discounts, players etc.) & cost (energy, logistics, technical progress and new investment etc.).

Balance

New capacities of PX and PTA may be similar. If Reliance commissions 2,300 kta new capacity in the first half of 2017, it can largely cover the increase of PTA capacities, including 1,400 kta of Reignwood Group, 900 kta of Pengwei, and 1,100 kta (1,500 minus 400) of OPTC. Corresponding PX demand is about 3,400 kt. If new PX capacities are 2,040 kta in the second half of 2017 (Petro Rabigh's 1,340 kta in Saudi Arabia and Nghi Son's 700 kta in Vietnam) while PTA new capacities are 2,400 kta (JBF's 1,200 kta and M&G's 1,200 kta), PX is a bit surplus but not seriously imbalanced. However, if Jiaxing Petrochemical commences operation of 1,800 kta second phase PTA project, PX will be tighter. In total, global PX/PTA may not be apparently imbalanced in 2017 while major suppliers and buyers are similar with 2016. China remains largest importer without new capacity while Dragon Aromatics is lowly possible to restart. In such balanced circumstance, discounts in 2017 are highly probably to maintain current level.

Price spreads

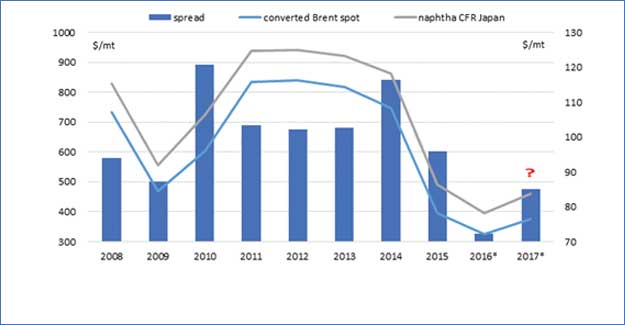

Price spreads include naphtha, PX and PTA.

Naphtha: Naphtha-Brent spread in 2016 is extremely low, about $24/mt lower than that in 2015, which contributes to relatively high PX-naphtha spread. In 2017, it seems that naphtha-Brent spread is hard to recover evidently, given continuous expansion of refineries and tepidly increasing demand.

PX: In 2016, PX-naphtha spread enlarges about $42/mt from 2015, with $24/mt from naphtha, and another $18/mt from PTA. In 2017, it is uncertain how naphtha-Brent spread, PX-naphtha spread and PX-PTA spread would present. Actually, on the back of similar supply-demand estimation, periodic capacity change is sensitive, which plays important role in affecting price spreads.

PTA: In fact, PTA-PX spread does not lose $18/mt but even gains close to $30/mt. This is attributed to the difference between actual operation and theoretical calculation on daily spot prices. Perhaps PTA plants benefit from relatively low ACP. Besides, they may also benefit from downstream polyester or speculation, such as hedging in futures market. In 2017, besides PTA supply, polyester demand will be an important uncertainty.

Cost

1. In 2017, both PX and PTA see no new technology while the process of coal-based PX and PTA remains slow, especially on the back of $40-50/bbl crude oil price.

2. Energy and logistics costs in China have already increased in China in 2016. Crude oil cost currently has not pressured on PX, but it is likely to rise in 2017.

In total, PX-PTA is estimated to largely maintain current balance in 2017, and the balance in different periods depends on the time of supply change. Besides, industrial enterprises still face increasing cost and lack the assistance of new technology.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.