Sun Shines On Vietnam's Textile And Garment Industry Despite Recent Dip In FDI Inflow

The Vietnam Textile and Apparel Association (VITAS) is making full-fledged efforts to coerce the government into enabling more foreign direct investment in the textile sector with a view to revise the development plan for the year 2020. They also have charted out a futuristic vision document for the progress of the sector by 2030.

According to a VITAS estimate, between 1988 and 2012, the textile segment attracted Foreign Direct Investment (FDI) projects numbering 1,551. The break up figure for these FDI projects were given as 1,193 garment projects and 358 fibre production projects that brought in FDI worth US$ 3.5 billion. Post 2012, the floodgates of FDI open up where textile and garment sector become one of the major foreign investment guzzling industry. In 2015 alone, this sector attracted over US$ 1 billion in FDI for three major projects including Hyosung Dong Nai (Turkey), Polytex Far Eastern (Taiwan) and Worldon Viet Nam (Hong Kong). The year 2015 marked a record high for investment in the sector as investors wanted to take advantage of opportunities presented by the new FTAs.

In the recent past too, the companies that invested in the Vietnam textile sector include US firms like Huntsman Group and Avery Dennison; Chinese companies and Japanese companies like Kuraray Trading, Itochu, Toray Industries and Shikibo. Chinese companies have invested actively in the Vietnam textile sector to take advantage of cheap labor, natural resources and the "yarn forward rule" in TPP. Also, other foreign trade pacts such as Vietnam-Korea Free Trade Agreement (VKFTA) and Vietnam-EU Free Trade Agreement (EVFTA) have helped bringing investment..

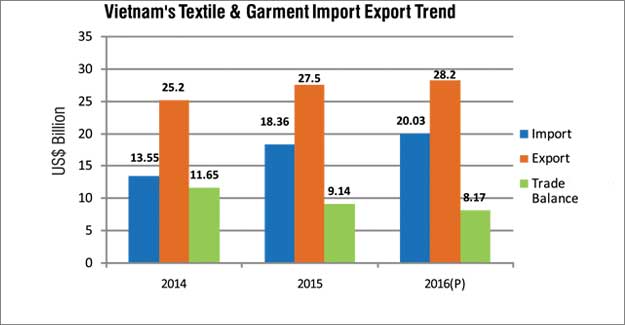

In an earlier plan envisaged in April 2014, it was estimated that by 2020 the Vietnam textile export turnover will reach the US$ 20 to 25 billion mark. However, the robust FDI in the textile sector ensured that in 2015 alone the export turnover stood at US$ 27.5 billion. VITAS has estimated that given the current growth figures, the export sector might register a turnover between US$ 40 to US$ 50 billion by the visualized target year of 2020.

As a result the high investment, export turnover of the garment sector reached US$ 24 billion in 2014 and US$ 27.5 billion in 2015, and is projected for an upward swing towards US$ 29 billion in 2016. However, a strong Vietnamese dong and a sluggish demand from key markets are causing Vietnam to face hurdles in further growth. Also, US President-elect Donald Trump has dumped the much discussed TPP which has sealed the FDI flow to textile and garment sectors in the country. Consequently, 2016 was a year which saw very minimal increase in foreign investment in this sector in the country. In terms of numbers, foreign players in the Vietnamare far fewer than the local firms but they account for upward of 60 percent of Vietnam's total garment and textile export turnover. Statistics indicates that there are around 3000+ garment and textile firms in Vietnam. Only 25% of them were FDI companies.

Despite the temporary let down towards the second half of the year 2016, it is expected that foreign investors will continue with their investment slew in the Vietnamese textile sector in the coming months to avail benefits from the existing free trade agreements and advantage of cheaper manufacturing cost. An investment expert said that the government must invest on infrastructure development in the textile sector. In addition, the government should add incentives for investors to make it sweeter. Also, industry association, VITAS urged the Vietnamese government to change the regressive laws that led to shutting down of companies.

Vietnam Emerges As A Major Market For Textiles

With the continuous large flow of FDI into the textile and garment industry, Vietnam has emerged as a large market for textile raw materials. The growth of capacity inspun yarn spinning sector propelled the country to become world's second largest cotton importer after Bangladesh. Its cotton consumption doubled in last four years from 2.4 million bales in 2012-13 to 5 million bales in 2016-17. At the same time, Vietnam has developed self sufficiency in yarn sector & become a large exporter of cotton yarn competing with India and Pakistan. Similarly, growth in garment sector has also opened up a huge market for fabrics and accessories which is primarily met through imports. Textile raw material import has been rapidly growing over last 3 years keeping in pace with the garment exports. Statistics for last three years i.e. 2014, 2015 and 2016 indicate that total import of textile raw materials and accessories were US$ 13.55 billion, US$ 18.36 billion and US$ 20 billion (estimated). With the booming garment export, it is inevitable that the size of the textile raw material market would grow further in the coming years. On the other hand, slowdown of foreign investments in the Vietnamese textile sector would increase the dependency on imports of raw materials.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.