Polyester Fiber And Yarn Prices Decline As Buyers Turn Cautious

Overall, trends indicated that the polyester based items witnessed a slight downward slide in the markets partly due to anxiety of buyers on high prices of procurement and some instances due to fall in prices of raw materials.

The individual trends however, indicated that there was no let up on the demand front and future prospects remain strong. Presented below are the summaries of the fluctuations and slides that took place.

PTA

PTA prices witnessed a fluctuating trend in February second half. The volatility in PX prices also influenced the PTA prices throughout the month. However, PTA prices remained strong though average buying prices came down marginally. Chinese polyester sector has started resuming their plant operations after the Lunar New Year holidays and increasing the plant operating rates gradually which has supported the demand for PTA. Though high price of the commodity is resisting the buyers to resume procurement, the market remained busy and the demand may pick up further. Even if the buyers continue procuring hand to mouth, the demand for PTA would be enough to consume the current supply. Therefore, PTA prices are expected to remain healthy. Current spot market offer prices for PTA are around US$ 690-710 per metric ton CFR CMP but buying prices are around US$ 675-680 per metric ton. Outlook for PTA prices indicates towards a strong trend in the coming fortnight.

MEG

MEG prices witnessed a fluctuating trend during the second half of February as well. MEG prices started declining since the mid February which continued before rebounding towards the month end. The supply concerns for MEG are over but couple of plant shut-downs in Singapore and India might disrupt the supply. As polyester plants are increasing capacity utilisation in China after the Lunar New Year holidays, MEG demands will increase gradually. However, high price of the commodity has dampened the demand recently and therefore; demand of the commodity might be determined by price in the short term. Current spot offer prices of MEG are around US$ 900 per MT CFR China and traded prices are around US$ 870-875 per metric ton. MEG prices are expected to exhibit a strong trend in the coming weeks.

PET Chips

PET chips market prices witnessed marginal downward trend as raw material prices back tracked. The demands for PET chips are good but high prices kept the buyers in dilemma on procurement decisions. However, as lower offers emerged in the market, buying volumes might improve substantially. Current Water Bottle Grade PET chips offer prices are around US$ 1020-1030 per MT FOB China while deals were done around US$ 1015-1020 per MT FOB China. Fiber grade chips quoted prices are around US$ 985-990 per MT FOB Korea. Chips prices are expected to move in line with raw material prices in the coming weeks.

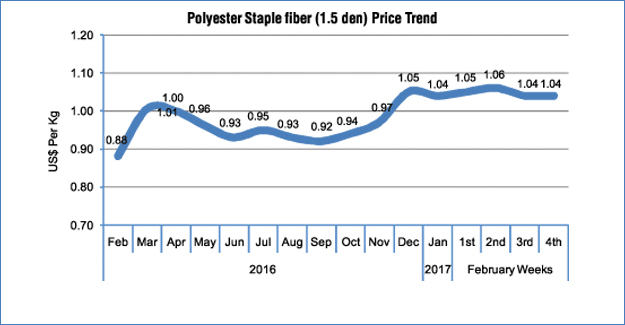

PSF

PSF prices witnessed a marginal downward trend during the second half of February. As raw material prices lost upward steam and came down during the fortnight, cost support to fiber manufacturers fell and slack demand compelled them to revise prices. PTA and MEG prices moved downward in second half of the month which coupled with weak fiber procurement by yarn spinners resulted in softening of PSF prices. Fiber buyers are resisting high PSF prices and therefore, traded volume has been low at elevated price. In Chinese local markets, trading activities for PSF were extremely dull as the prices moved up after the holidays. However, local market prices are in declining trend and buyers should resume buying in the market from next month. In Indian local markets, PSF prices have gone up substantially and that has adversely affected the demand. Current offered price for 1.4 denier raw white semi dull PSF is around US$ 1.04 – 1.06 FOB China/Taiwan and fiber prices are expected to remain steady to strong in the coming weeks.

PFY

Polyester Filament Yarn prices witnessed downward correction during second half of February. The primary reason for the price revision in polyester filament yarn was due to the negative correction in PTA and MEG prices during February second half. The substantial hike in the raw material cost had jacked up yarn prices to new peaks and that has resulted in subdued demand in February. Traded volume of polyester filament yarn has reduced due to higher prices and buyers have kept themselves in wait and watch mode. So, suppliers have revised filament yarn prices to push some volume to the market. Prices in Chinese local markets revised downward as well. In India, prices of polyester filament yarns remained high but some players have offered lower prices to clear inventory. Current offered price for 115D/36F POY is US$ 1.13-1.14/kg FOB China/Taiwan, 150D/48F POY price is US$ 1.06-1.07/kg FOB, whereas 75D/36F DTY price is US$ 1.5-1.51/kg and 75D/72F FDY price is US$ 1.28 – 1.29/kg FOB China/Taiwan. PFY market forecast indicates that prices may witness stable trend in the coming weeks.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.