Downstream Support Stabilizes Polyester Prices Despite Low Crude

Purified Terephthalic Acid (PTA)

PTA prices remained nearly stable during second half of April with minor fluctuations within a narrow range. However, the weakness in crude oil prices that has been observed towards the fourth week of April has helped marginal negative correction in PTA prices. The cost support to PTA has eased and supply has increased as some capacities have come on stream. However, the downstream polyester sector is running at a healthy capacity which helped the trading volume of PTA during this fortnight. This has also lead to lower inventory with the suppliers. These positive factors would not let the PTA prices to go down much but if cost support weakens as result of lower PX prices in the coming weeks, one can expect corrections. Current spot market offer prices for PTA are around US$ 635-660 per metric ton CFR CMP but buying prices are around US$ 630-645 per metric ton. Outlook for PTA indicates towards a stable to weak price trend in the coming fortnight.

Monoethylene Glycol (MEG)

MEG prices witnessed a fluctuating trend during second half of April and gradually declined. Prices came down below US$ 700 per MT mark during the fortnight and again recovering marginally. The downward correction in the crude oil prices since mid April had adverse impact on MEG prices. However, few sudden plant shutdowns in Asia helped the MEG prices to recover. Downstream polyester sector has been performing well and traded volumes of MEG have been healthy which helped the inventory level to lie low. Current spot offer prices of MEG are around US$ 705-710 per MT CFR China and traded prices are around US$ 690-700 per metric ton. MEG prices are expected to exhibit a fluctuating trend and may decline in the coming weeks.

Polyester Chips (PET Chips)

PET chips prices witnessed a declining trend as raw material prices eased along with the crude oil prices during second half of April. At the current scenario, PET chips prices are heavily dependent on raw material prices and buyers are negotiating for better prices or buying hand to mouth. However, inventory levels are normal and plant operating rates are stable. Current Water Bottle Grade PET chips offer prices are around US$ 920-930 per MT FOB China while deals were done around US$ 915-920 per MT FOB China. Fibre grade chips quoted prices are around US$ 890-895 per MT FOB Korea. Chips prices are expected to move in line with raw material prices in the coming weeks.

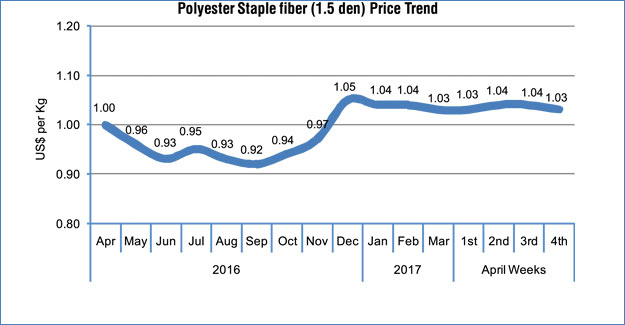

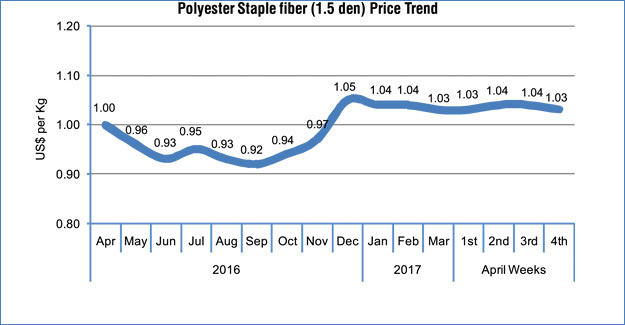

Polyester Staple Fibre (PSF)

PSF prices remained stable during second half of April but under stress as raw material prices declined. Fall in crude oil prices in the last two weeks has pulled down polyester raw material prices which eventually bring down fiber prices as well. However, PSF manufacturers have kept their offers steady while buyers are in wait and watch mode as spun yarn segment is not performing well. Therefore, traded volumes of PSF have come down during last fortnight. Also, inventory level is growing as plants are operating over 70% of its rated capacity. So, it is expected that there would be pressure on fibre suppliers to get rid of the inventory and reduce price. At the same time, buyers are expected to resume procurement as price comes down. Considering the current scenario, PSF prices may fluctuate and remain weak unless there is substantial increase in the demand side. In Chinese local markets, trading activities for PSF has witnessed substantial fall during the fortnight while and prices were depressed. In Indian local markets, PSF prices were stable but discounts were available. Current offered price for 1.4 denier raw white semi dull PSF is around US$ 1.03 - 1.05 FOB China/Taiwan. CNF India prices are around US$ 1.07 - 1.09 per kg. Prices of PSF are expected to witness fluctuations & may witness some corrections in the coming weeks.

POY, PTY & Flat Yarn

Polyester Filament Yarn prices remained stable during second half of April. However, the weakness in the crude oil price and subsequent decline in the polyester raw material prices has generated pressure on the polyester filament yarn prices. On the demand front, buyers have restrained procurement as raw material prices have weakened and they are expecting better prices. This has resulted in lower traded volumes and helped the inventory levels to grow marginally as the polyester filament sector operating at a healthy rate. In the last fortnight, offered prices of POY, DTY and FDY though remained stable; some suppliers have offered discounts for firm deals. Considering the current scenario, polyester filament yarns might witness some corrections in the coming weeks as cost support has eased. Prices in Chinese local markets have come down marginally while Indian market witnessed a stable price regime. Current quoted price for 115D/36F POY is US$ 1.04-1.05/kg FOB China/Taiwan, 150D/48F POY price is US$ 0.94-0.96/kg FOB, whereas 75D/36F DTY price is US$ 1.44-1.46/kg and 75D/72F FDY price is US$ 1.04 - 1.06/kg FOB China/Taiwan. PFY market forecast indicates that yarn prices would witness marginal corrections as raw material prices have come down.

Acrylonitrile (ACN)

Acrylonitrile prices witnessed marginal correction during second half of April. The weakness in crude oil prices and propylene values during the fortnight has helped the ACN prices to ease. The demand for the commodity was stable as downstream ASF and ABS sector is operating at high capacity. Current spot prices for ACN to Far East Asian market is around US$ 1570 - 1575 per MT CFR Far East Asia and around US$ 1530 per MT CFR South East Asia and around US$ 1515 per MT CFR South Asia. ACN prices are expected to remain steady in the coming weeks.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.