USDA Raises Estimates For Cotton Consumption, Production, Ending Stocks

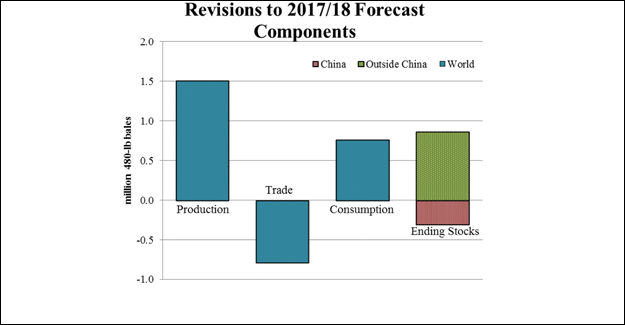

USDA's June forecasts show an upward revision for consumption growth from 2.2% last month to 2.6%. This consumption revision is smaller than the upward revision to global production, resulting in higher forecast ending stocks. Furthermore, global trade forecasts are lowered, driven by lower import demand in producer countries, especially Pakistan. These higher forecast 2017/18 ending stocks are located outside of China (where forecasts of the degree of destocking have been increased), with the result that USDA continues to expect pressure on prices, forecasting a year-over-year decline in the US farm price.

USDA's June forecasts show an upward revision in global production, from 113.2 million bales to 114.7, or about 1.3%. In combination with some slight revisions in the current and previous crop years, production is forecast to grow 8.2% from 2016/17 to 2017/18, rather than 6.9% as forecast previously. These changes reflect price-driven area increases for most major cotton producers, & significant improvements in the outlook for a few countries, namely Pakistan, China, and Mexico.

Despite this improving outlook, however, global production remains below the levels seen before the extremely poor-yielding 2015/16 crops. Recovery in production has varied by region, but it is notable that almost alone among major cotton-producing regions, the African Franc Zone is forecast to yield its largest crop ever obtained, at about 5.2 million bales.

Consumption, meanwhile, is forecast higher in several large consumer-producer countries. Forecasts for China, India, & Pakistan were all raised appreciably, boosting the forecast growth rate for consumption without greatly increasing forecast demand for imports, especially as China and Pakistan have larger forecast 2017/18 production, and thus comparatively ample expected supplies.

Overview

For 2017/18 global production is forecast up on higher area; yield is essentially unchanged. Consumption is forecast higher also, especially in China. Global ending stocks are raised, especially outside of China. Trade is forecast down, led by lower imports in Pakistan. US exports are reduced, raising ending stocks.

The US season-average farm price forecast is unchanged at 64 cents per pound. For 2016/17, production and use are raised, resulting in ending stocks being reduced. Global trade is down marginally. The US balance sheet is unchanged. The U.S. season-average farm price forecast is reduced half a cent to 68.5 cents per pound.

2017/18 Trade Outlook

Major Importers

1. Pakistan is cut 600,000 bales to 2 million on a much larger expected crop as sowings have proceeded at a very rapid pace.

2. Bangladesh is raised 100,000 bales to 7.1 million on abundant supplies among trade partners.

3. Mexico is lowered 125,000 bales to 850,000 on a larger expected crop.

Major Exporters

1. United States is dropped 500,000 bales to 13.5 million on less global import demand given strong & improving crop forecasts in many import partners.

2. India is reduced 300,000 bales to 4.2 million on less global import demand, particularly in one of its major export markets in recent years, Pakistan.

3. Pakistan is raised 100,000 bales to 450,000 on a larger expected crop.

2016/17 Trade Outlook

Major Importers

1. China is raised 200,000 bales to 5 million on the strong pace of trade to date, possibly reflecting more quota used earlier in the year or more imports under the processing regime.

2. Pakistan is down 100,000 bales to 2.6 million on weakening nearby demand reflected in Bank of Pakistan data; Bank data remains substantially above trade data reported by the Pakistan Bureau of Statistics.

3. Thailand is down 100,000 bales to 1.2 million on a weak pace of trade to date.

Major Exporters

1. No 2016/17 export changes in excess of 100,000 bales.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.