Will China Cotton Supply And Demand Balance In 2016-17?

In 2016-17 season, China's spinning mills are profitable and cotton textile industry is promising. As imported cotton yarn prices remain high, the consumption of cotton may only decrease slightly in the slack season, which is estimated at 645 kt during May and Aug 2017. According to the sales of reserved cotton since March this year, this CCF article analyses the supply and demand from two extreme situations of reserved cotton transaction. In general, supply is relatively loose.

Since the start of reserved cotton sales on Mar ch 6, 2017, the reserved cotton has showed its price edge and is accepted by the market gradually. Reserved Xinjiang cotton is almost transacted fully per day, while for reserved upcountry cotton, buyers show lower interests due to its inferior quality, but there is no big problem to produce cotton yarn with counts 32 or below. Therefore, the planned selling volumes of Xinjiang cotton poses obvious impact on the whole trading volumes.

Since May, the planned selling volumes of Xinjiang cotton per day hovers around 35% to 50%. The lower volumes have confused cotton buyers whether the cotton supply is sufficient before the new crop year. Then, analysts forecast on the cotton supply and demand before September 2017 according to different expectations on state reserves sales.

Forecast based on average daily trading volumes of 22.3kt during March and April

For imported cotton, the supply is limited later as US cotton sales have been very good previously. Import volumes of Indian cotton have fallen sharply due to low competitiveness. Moreover, imported cotton sales are unsmooth in China. Therefore, the imports of cotton may be restricted later, to be around 80kt. For exports, the volumes can be negligible.

Due to the state cotton auction ended on September 31, 2016 last year, the supply of reserved cotton in 2016/17 season should add the trading volumes of 618.1kt in Sep 2016. The detailed supply and demand is showed below: According to CCFGroup, cotton consumption in 2016/17 season is estimated at 7.77 million tons. After calculation, the monthly cotton consumption from May to August is about 579.2kt and the ending social stocks are projected at 2.248 million tons. In 2014-15 season, the social stocks by end Aug was about 1.47 million tons and during that time, the transactions were dull and ZCE cotton futures market moved downward. In 2015-16 season, the social stocks by end Aug 2016 was 1.22 million tons and during that time, supply was short with smooth sales and ZCE cotton futures market surged, so state reserves sales extended one month. Under such condition, the ending stocks of 2.248 million tons are much higher than 1.468 million tons in 2014-15 season, so the supply is supposed to be loose in late months of 2016-17 season.

Forecast on average daily trading volumes of 15kt during May and August

In May, planned selling volumes of reserved Xinjiang cotton is seldom over 50% per day. Later, if the selling volumes of reserved Xinjiang cotton are hard to rebound in slack season, demand from downstream sector on cotton may weaken somewhat. Therefore, we estimate the extreme situation that if the daily trading volumes of reserved cotton only reach 15kt to view the supply and demand.

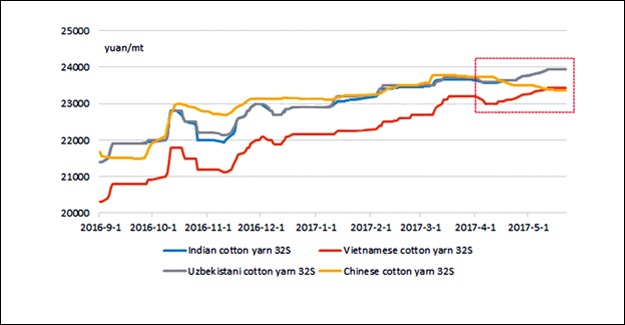

Then, the ending stocks by August 2017 (excluding state reserved cotton stocks) are estimated at 1.73 million tons, still higher than the 1.468 million tons in 2014-15 season, so the supply is relatively loose. However, after the expectation that we estimate in two ways mentioned above, the monthly cotton consumption is about 580kt from May to August, which is lower by 100kt compared to the first eight months of 2016/17 season, which is not normal. In 2017, due to strong international cotton prices, imported cotton yarn saw no obvious competitiveness in China. In April, domestic cotton yarn sales turned thinner and prices also moved lower, but cotton costs reduced somewhat due to the use of reserved cotton, especially for cotton yarn 32S and below. Therefore, spinning mills still witnessed profits. For high imported cotton yarn prices, some weavers who used imported cotton yarn turned to use China-made cotton yarn. So, the cotton consumption from mills is not expected to weaken largely and the forecast on cotton consumption needs to be revised.

Supply and demand forecast after the cotton consumption is adjusted

In 2015-16 season, monthly cotton consumption was about 620-630kt. In 2016-17, higher demand for domestic cotton yarn tends to increase the cotton consumption, so we revise up the cotton consumption during May and August, 2017. Meanwhile, June and July are the traditional slack season for textile industry, so the cotton consumption may be slightly lower than the average level of the first eight months of 2016-17. Therefore, the monthly cotton consumption is estimated at 645kt during May and August, 2017.

After revision, the ending stocks excluding state reserved cotton stocks in end August 2017 remains large under the two expectation, both higher than the 1.22 million tons in 2015-16.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.