Polyester Prices To Stay Stable In The Coming Fortnight

Purified Terephthalic Acid (PTA)

PTA prices continued with minor fluctuations within a narrow range during May second half too. The volatility in crude oil prices had initially boosted the PTA prices but later (towards the month end) the trend has reversed as PX prices weakened. The prices of the commodity would not fluctuate much as cost support is healthy though eased marginally. Also, the downstream polyester sector is running at a healthy capacity which would help the traded volume of PTA in the coming fortnight. However, supply demand scenario seems to be balanced and that would offer support to the spot PTA prices. Current spot market offer prices for PTA are around US$ 625-635 per metric ton CFR CMP but buying prices are around US$ 620-625 per metric ton. Outlook for PTA prices indicates towards a stable price trend in the coming fortnight.

Monoethylene Glycol (MEG)

MEG prices witnessed volatility during second half of May. Prices went up to US$ 780-790 per MT range and then slipped down to US$ 740-750 per MT range before looking up again. The supply tightness arising out of few plant shutdowns and lower inventories kept the MEG prices volatile during May. Also, downstream polyester sector has performed well in terms of capacity utilisation which kept the traded volume of MEG at a healthy level. Current spot offer prices of MEG are around US$ 760-775 per MT CFR China and traded prices are around US$ 760-765 per metric ton. MEG prices are expected to exhibit a fluctuating trend in the coming weeks.

Polyester Chips (PET Chips)

PET chips prices witnessed marginal decline in line with raw material prices during first half of May. It is expected the raw material price scenario would not change drastically in the short term and PET chips price would also follow the same. The demand for the commodity is slack and procurement is mostly need based. Therefore, prices of PET chips would be governed by cost support from raw materials. Current Water Bottle Grade PET chips offer prices are around US$ 905-910 per MT FOB China while deals were done around US$ 900 - 905 per MT FOB China. Fiber grade chips quoted prices are around US$ 880-890 per MT FOB Korea. Chips prices are expected to move in line with raw material prices in the coming weeks.

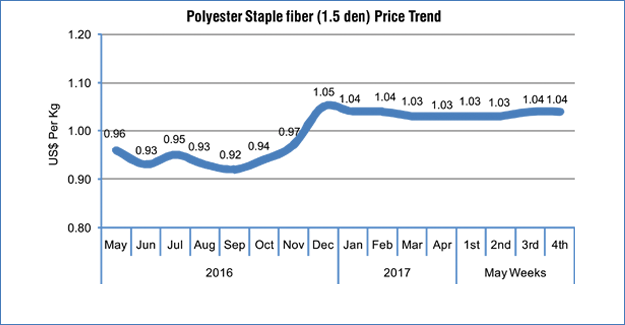

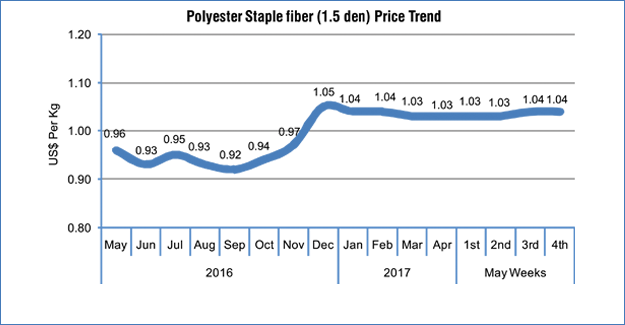

Polyester Staple Fibre (PSF)

PSF export offer prices remained stable during second half of May. However, there are changes in the polyester raw material prices and therefore, there are chances of price hike in the coming weeks. Also, PTA availability might be an issue in the coming weeks though demand supply is balanced at this moment. On the other hand, demand for PSF has been improving gradually and plant operating rates are moderately high. Though the inventory level of fiber has been growing, it is under manageable level and thus, there might be some upward price corrections in PSF in coming month. In Chinese local markets, trading activities for PSF has witnessed improvement during the fortnight and fiber prices have witnessed an upward trend. In Indian local markets, PSF prices were stable and may witness a price rollover in the coming weeks. Current offered price for 1.4 denier raw white semi dull PSF is around US$ 1.04 - 1.06 FOB China/Taiwan. CNF India prices are around US$ 1.08 - 1.10 per kg. Prices of PSF are expected to witness some corrections in the coming weeks.

POY, PTY & Flat Yarn

Polyester Filament Yarn prices witnessed marginal price hike backed by cost support during second half of May. The polyester raw material prices have compelled the filament yarn producers to revise prices. Also, demand for filament yarn has improved and plant operating rates are well above 80% of the rated capacity. Also the inventory has been under manageable level. This has provided ground for healthy traded volume and marginal price. The current scenario is expected to prevail for few more weeks which means, PFY prices might witness further upward trend. Prices of PFY in Chinese local markets have increased marginally during the fortnight while Indian market witnessed a stable price regime. Current quoted price for 115D/36F POY is US$ 1.01-1.02/kg FOB China/Taiwan, 150D/48F POY price is US$ 0.89-0.90/kg FOB, whereas 75D/36F DTY price is US$ 1.43-1.45/kg and 75D/72F FDY price is US$ 1.01 - 1.02/kg FOB China/Taiwan. PFY market forecast indicates that yarn prices would witness marginal corrections as raw material prices have changed.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.