Cotton Prices To Remain Strong For 2017-18 In Domestic Market

Cotton prices in India’s local markets remained nearly stable during August first half. The demand for the fiber has been weak and traded volumes were low. Also, after the implementation of the new tax regime (GST), demand for cotton and cotton yarn declined as several textile clusters have shut plants to protest against it. However, slowly manufacturers are resuming production but it would take more time to recover. Therefore, buying of the fiber has been need based as of now and should improve as fresh fiber arrives in October.

On the production front, it was forecasted that in the upcoming cotton season, India’s production to increase by 12-15% compared to 2016-17, but there are fear that actual increase could be around 5% only. After floods have played havoc in cotton producing states, there has been whitefly attack on the crop in Punjab and Haryana, while farmers have reported pink bollworm attack in Maharashtra, Andhra Pradesh and Gujarat. Summing up, it is expected that India’s cotton prices to remain strong in the short term and may not change significantly even after fresh crop arrival. In the price front, current domestic price for benchmark Shankar-6 variety is around Rs. 42400 per candy (355.6kg, on 14th August 2017) which is lower by just Rs 100 per candy if compared to end July prices.

On the global front, cotton prices continued with a volatile trend during August first half. However, prices of fiber have softened as larger crop are on the cards in the coming season. Further, China’s home grown cotton volume is expected to increase significantly which would lower the country’s appetite for imported fiber (though China has been importing minimum quantity of the fiber as per the commitment under WTO and auctioning its fiber reserve). USDA’s forecast for upcoming season indicates that world cotton production to be at 115.4 million bales up from earlier estimates of 114.7 million bales (of 480 lb). Consumption estimates increased to 117 million bales from earlier estimate of 116.5 million bales while ending stock to increase to 88.7 million bales.

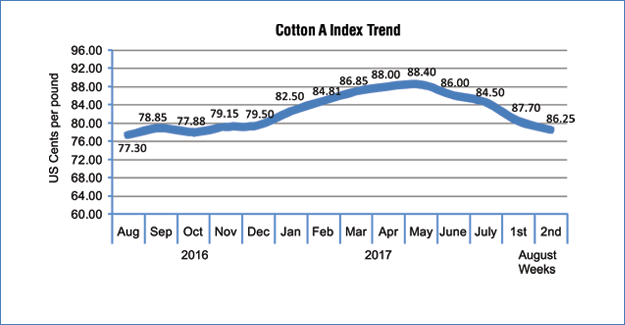

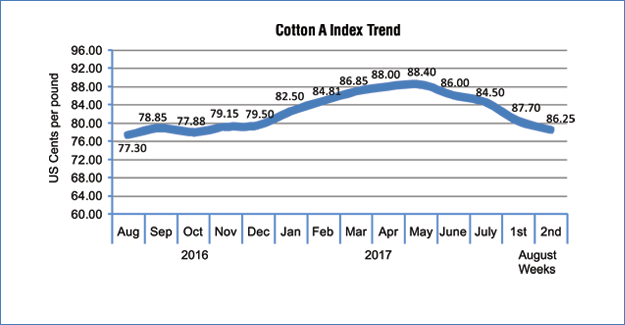

To look at the price trend, ‘A’ index has witnessed significant slide in the last fortnight. A index slipped down to 78.45 (on 11th August) from 85.0 US Cents per pound (on 28th July). The index was at this season’s high of 94.9 US cents per pound on 15th May. Historically, ‘A’ Index was at 78.55 US Cents in December 2016 end and was at 69.55 US cents per pound in December 2015 end.

On the yarn front, cotton yarn prices remained stable. But buyers are asking for better prices as cotton prices have slumped. However, demand for cotton yarn from overseas markets has been good and yarn prices might see a stable trend.

Cotlook ‘A’ Index: 78.45 (As on 11th August 2017)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.