US Retailers Not So Optimistic In 2017

While the majority of US retailers remain confident about the five-year outlook for the US fashion industry, the percentage of those who are `optimistic' or `somewhat optimistic' dropped to a record low, since the USFIA began conducting the Fashion Industry Benchmarking study in 2014. This change could be due to concerns about the protectionist trade policy agenda in the United States and market competition in the US from e-commerce, the top two concerns this year.

The 2017 Fashion Industry Benchmarking study finds that the percentage of those who are optimistic or somewhat optimistic fell from 92.3% in 2016 to 71% in 2017. As many as 12.9% of respondents are `somewhat pessimistic' about the next five years, mostly large scale retailers with more than 3000 employees.

Despite the challenges, demand for human talent remains robust. Around 80% of respondents plan to hire more employees in the next five years, especially supply chain specialists, data scientists, sourcing specialists, and marketing analysts.

Cost is no longer one of the top concerns; respondents are less stressed about increasing production or sourcing cost, which slipped from number 2 challenge in 2016, to number 7 challenge in 2017. Only 34% rate the issue among their top five challenges this year, significantly lower than 50% in 2017, and 76% in 2015. Labour cost remains the top factor driving up sourcing cost in 2017.

Sourcing will diversify

Although US fashion companies continue to seek alternatives to ‘Made In China’, China's position as the top sourcing destination remains unshakable. Meanwhile, sourcing from Vietnam and Bangladesh may continue to grow over the next two years, but at a relatively slow pace.

91% of respondents source from China; while 100% sourced from China in the past three studies. The percentage of those expecting to decrease sourcing from China fell from 60% in 2016 to 46% this year - and many more expect to maintain their current sourcing value or volume from the country in the next 2 years.

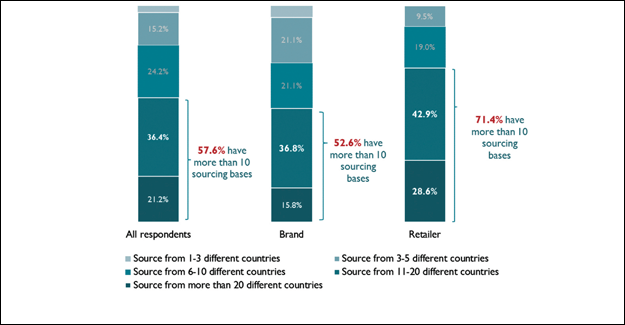

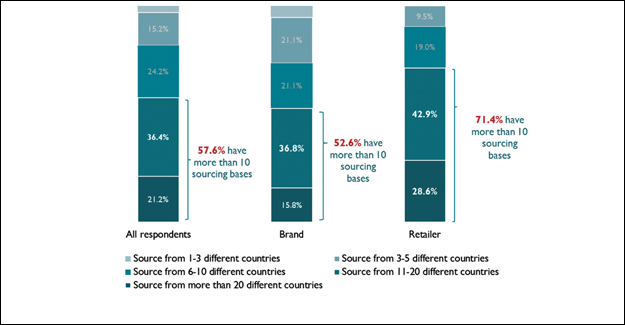

Only 36% of respondents expect to increase sourcing from Vietnam in the next two years, much lower than 53% who said the same in 2016. Respondents are cautious about expanding sourcing from Bangladesh in the next two years, with only 32% expecting to somewhat increase sourcing there, as the country is viewed as having the highest risk for compliance. Respondents source from 51 countries or regions in 2017, close to the 56 in last year's study. 57.6% source from over 10 different countries or region in 2017, up from 51.8% in last year's survey. Additionally, retailers maintain a more diversified sourcing base than brands, importers/wholesalers and manufacturers. Around 54% expect their sourcing base will become more diversified in the next two years, up from 44% in 2016. While Asia as a whole remains the dominant sourcing region for US fashion companies, the Western Hemisphere is growing in popularity. This year, there is a noticeable increase in sourcing from the US (70%, up from 52% in 2016), and countries in North, South and Central Americas which offer shorter lead time and relatively lower risk of compliance.

Official trade statistics indicate China has no major competitors in the US import market:

1. Of the 11 categories of yarn, China was the top supplier for 2 categories (or 18%)

2. Of the 34 categories of fabric, China was the top supplier for 25 categories (or 74%)

3. Of the 106 categories of apparel, China was the top supplier for 88 categories (or 83%)

4. Of the 16 categories of made-up textiles, China was the top supplier for 12 categories (or 68%).

In comparison, among Asian suppliers regarded as China's top competitors:

1. Vietnam was the top supplier for only 5 categories of apparel

2. Bangladesh was top supplier for only 2 categories of apparel

3. India was top supplier for 2 categories of fabric, 1 category of apparel and 5 categories of made-ups.

Rating destinations

According to the study, the following influence sourcing decisions:

1. Speed to market: Not surprisingly, the US, Mexico and member of the CAFTA-DR, outperform all Asian suppliers because of geographical location. Within Asia, China and Vietnam are preferred for their shorter lead time.

2. Sourcing cost: Bangladesh offers the most competitive price, according to respondents, followed by members of AGOA and several other Asian suppliers. In comparision, sourcing from the US, Mexico, CAFTA-DR will incur higher cost.

3. Risk of compliance (factory, social, environmental): US demonstrates a competitive edge, whereas Bangladesh, Cambodia and India are relatively high risk in terms of compliance.

Sustainability will drive decisions

Sustainability and ethical sourcing remains important for US fashion companies, and unmet compliance standards are the top supply chain risk. For 87.5% of the respondents, ethical sourcing and sustainability has become more important in their sourcing decision than five years ago. 100% of respondents audit their suppliers, and 90% map their supply chains.

Industry wants freer trade

Free trade agreements and trade preference programs remain underutilized and several FTAs, including CAFTA-DR, are utilized even less this year than in previous years. Of the 19 FTAs/preference programs, only NAFTA is used by more than 50% of respondents for import purposes. Some US fashion companies source from countries/regions with FTAs, but do not claim benefits.

Respondents unanimously oppose the US Border Adjustment Tax, and call for further removal of trade barriers, including restrictive rules of origin and high tariffs, even as the US government is going in the opposite direction.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.