Will US Cotton Export Sales Hit A New Record In 2017-18 Season?

From March 2017, 2016-17 US cotton export sales continue to be stronger than expected, and the United States Department of Agricultural (USDA) has revised up the forecast on US cotton exports for many times. By August 3, 3.448 million tonnes of 2016-17 U.S. cotton have been sold and actual export shipments reached 3.269 million tonnes. USDA adjusted the exports to 3.248 million tonnes in 2016-17 season. For 2017-18 season, sales reached 1.36 million tons by August 3, up 71.71% year on year, reaching 44.1% of the 2017-18 export target (3.09 million tonnes). Will the 2017-18 U.S. cotton continue to see good sales like 2016-17 season?

Currently, it is a transition period from old crop year to new crop year. Based on the review of 2016-17 export sales, we may analyse the sales of 2017-18 cotton and make a forecast.

1. 2016-17 US cotton export sales

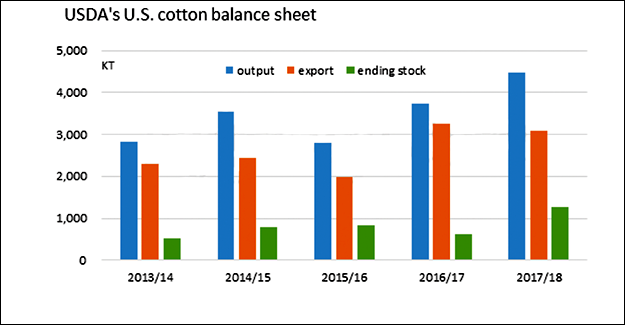

In US, cotton exports usually account for about 70-80% of its output and the output is decisive to its exports. Viewed from US cotton balance sheet, exports in 2016-17 hit a new high in recent years, taking a share of 87% of the output.

In 2017-18 season, anticipating higher global cotton output, USDA estimates that the export competitiveness of U.S. cotton may weaken and export volumes are likely to inch down.

If the output and exports reach the forecast, ending stocks will increase sharply to a high level in recent years. Therefore, compared to 2016-17 season, U.S. cotton export was restricted by the output, while in 2017-18, exports have larger development space and the key problems are demand of cotton importers and competition from other exporters.

According to the US cotton weekly sales over the past three years, the buoyant period for US cotton sales is from August to March 2018. US cotton export sales have been good from the beginning of 2016-17 season, and by March 2017, the US cotton export has been oversold. After April, sales decreased, due to insufficient supply in late period of crop year and the inferior quality of remnant cotton.

Considering the general situation of US cotton sales in 2016-17, Vietnam, China, Turkey and Indonesia were the major importers, and the increases were mainly from Vietnam, China, Indonesia, Pakistan, India and Bangladesh.

As a large cotton producer, India mainly exports cotton and its imports are limited. So it's the largest competitor for the US. However, from April 2016, Indian cotton prices moved up sharply as it exported too much previously, leading to supply shortage in domestic market. Its increment was larger than US cotton, and trading prices once reached or even exceeded US cotton prices. Therefore, India increased imports of US cotton during May and June 2016.

The significant increase of US cotton imports were from December 2016, as the currency ban by Indian government posted severe impact on the sales of seed cotton. Cotton prices also rose significantly on the back of tight supply. So India imported large quantity of US cotton to ease the tight situation. In recent two years, major cotton export destinations for India were Bangladesh, China, Vietnam, Pakistan and Indonesia, but those countries started to import cotton from the US, as Indian cotton has lost its competitiveness.

2. 2017-18 US cotton export sales

By August 3, 2017-18 US cotton export sales have reached 1.36 million tons, reaching the 44.1% of the export forecast, much higher than previous two seasons.

Orders for 2017-18 US cotton increased gradually from February 2017. In March 2017, US cotton has been oversold, and some orders transferred to 2017-18. Besides, Indian cotton prices maintained high, while US cotton prices have been decreasing from June, supportive to its exports. Currently, the largest cotton importers are China and Vietnam, after Indonesia, Bangladesh and Pakistan. For China, imports of US cotton are probable to increase in 2017-18 owing to reduction of cotton imports from Central Asia, lower cost performance of West African cotton and the tight relationship with India.

For cotton demand in other countries, India may reduce cotton imports, and exports are likely to be flat compared to 2016/17, according to USDA. Imports in Bangladesh and Vietnam may increase largely, while imports of Indonesia and Pakistan are forecast to inch down.

3. Conclusion

Based on the forecast of Indian cotton imports and exports and its current cotton prices, the competition is still weaker than US cotton. And the major cotton import countries see higher demand overall. Moreover, sales of 2017-18 US cotton have reached historical high by now, and so export sales may hit a new high later. Pay attention to cotton prices in India later, whether it will fall after arrivals of new cotton, to weigh on US cotton somewhat.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.