Polyester Faces Minor Corrections As Crude Continues to Stay Low

PTA

PTA prices witnessed a fluctuating trend within a narrow range during August second half. The commodity prices were weak and witnessed a downward movement since mid-month as crude oil prices softened. However, towards the end of the month there was a reversal of the downward trend and PTA prices started looking up. However, the upward movement may not last long as crude oil prices weakened again. Benchmark Brent index has come down to US$ 50 a barrel mark on 28th of August and may go further down in the next fortnight. Thus, the support from feedstock side to PTA prices would not be there. On the other hand, inventory of the commodity is low and demand is just passable. In this situation, spot PTA goods are quoted higher but buyers are reluctant. Current spot market offer prices for PTA are around US$ 640-680 per metric ton CFR CMP while traded prices are around US$ 635 per metric ton or marginally higher. Outlook for PTA prices indicates a fluctuating price trend in the coming fortnight and may soften.

MEG

MEG prices witnessed a volatile trend during second half of August which was inherited from previous fortnight. Prices went down and then moved upward as there were couple of plant shutdowns and news of delayed start-up of a new plant. So, supply concerns have helped the prices to move up in the spot market. However, future delivery prices of the commodity remained lower. The demand for MEG has been average as many downstream players had to replenish stock but it is the supply issues which are supporting higher MEG prices. Couple of MEG plants have been shut for maintenance and Reliance Industries has postponed start-up of its new 750 kilo ton MEG plant after some glitches during trial run. Current spot offer prices of MEG are above US$ 900 per MT CFR China and traded prices are around US$ 890 per metric ton. MEG prices are expected to exhibit a fluctuating trend in the coming weeks and might subsequently soften.

PET Chips

PET chips prices witnessed marginal upward trend during August second half. The changes in MEG prices have helped the PET chips prices to move up marginally. The demand for PET chips looks passable but seasonal peak demand phase has been over. Current Water Bottle Grade PET chips offer prices are around US$ 990-1000 per MT FOB China while deals were done around US$ 980 - 990 per MT FOB China. Fiber grade chips quoted prices are around US$ 950-955 per MT FOB Korea. Polyester chips prices are expected to remain stable in the coming weeks.

PSF

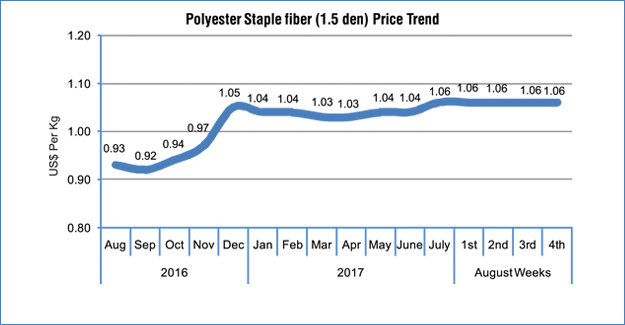

Quoted prices of PSF have witnessed a stable trend during August second half. On the other hand, raw material prices witnessed a firm trend toward the end of the fortnight and MEG prices moved up substantially. Fiber suppliers are therefore, well supported by raw material cost and it is just matter of time before PSF prices get an upward thrust. However, the demand for PSF has been weak and downstream sector is consuming only hand to mouth. Also, inventory levels are a bit higher than the normal level which is a cause of concern. In Chinese local markets, prices of PSF have increased while trading activities have come down leading to growth in inventory levels. In Indian local markets, PSF prices remained stable amid weak demand. Buying of the fiber is need based and discounts are available for firm deals. Current offered price for 1.4 denier raw white semi dull PSF is around US$ 1.05 – 1.09 FOB China/Taiwan. CNF India prices are around US$ 1.10 – 1.13 per kg.

Prices of PSF are expected to witness minor corrections in the coming weeks.

PFY

Polyester Filament Yarn prices witnessed upward movement during second half of August after the sizable correction during previous half. The changes in raw material prices have helped the filament yarn prices as cost support improved. On the other hand, inventory level has come under control as many producers have cut production rates. However, price corrections were significant in POY and FDY while DTY prices remained nearly stable. Prices of polyester filament in Chinese local markets have increased too during the last fortnight and stock levels have been down. In Indian market, demand for polyester yarn continues to be weak which has been attributed by downstream plant closures. However, as downstream knitting and weaving sector has gradually resumed operation, demand for polyester yarns are improving. But the yarn suppliers have missed the seasonal peak demand phase (ahead of festivals) due to protest by weavers and knitters. Current quoted price for 115D/36F POY is US$ 1.04-1.05/kg FOB China/Taiwan, 150D/48F POY price is US$ 0.99 – 1.0/kg FOB, whereas 75D/36F DTY price remained unchanged at US$ 1.44-1.46/kg and 75D/72F FDY price increased sizably to US$ 1.22 – 1.23/kg FOB China/Taiwan. PFY market forecast indicates that yarn prices would witness a fluctuating trend if in the coming weeks.

ACN

Acrylonitrile prices witnessed upward movement during second fortnight of August. Volatile propylene prices have supported the ACN price which is backed by a stable demand from downstream. However, towards the month end, crude oil took a plunge and that might have adverse impact on petrochemical prices. Current spot prices for ACN to Far East Asian market is around US$ 1485 – 1486 per MT CFR Far East Asia and around US$ 1455 per MT CFR South East Asia and around US$ 1420 per MT CFR South Asia. ACN prices are expected to remain steady in the coming weeks.

ASF

Acrylic fiber prices remained steady during August. The demand for ASF has been passable and there are signs of further improvement. Inventory levels have been thus, reduced marginally and also reduced plant operating rates have helped it. Current offered prices for regular 3 den fiber are around US$ 1.95 – 2.0 per kg FOB Taiwan. Offers for 3 den bright ASF tow and anti-pilling 1.5 den tow were at US$ 1.98 - 2.04/kg and US$ 2.05-2.18/kg respectively. ASF prices are expected to witness stable trend in the coming weeks.

CPL

Caprolactam prices remained stable during second half of August after the upward swing in the previous half. The commodity prices are on a shaky ground as both crude oil and Benzene prices declined towards the month end. Demand for CPL remained slack as downstream polymerisation plant operating rate has witnessed downward trend. Similarly, yarn sector has reduced its operating rate too. Current spot offer price for CPL originating from Eastern Europe are around US$ 1700-1720 per MT CFR China. CPL price may witness correction in the coming weeks.

NFY

Nylon filament yarn prices witnessed marginal decline during second half of August after the substantial price hike in the first half. Yarn spinning plant operating rates have come down as demand for POY and DTY has reduced. However, demands for FDY and Monofilament yarns are favourable. Current offer prices of 70D/24F Nylon DTY is in the range of US$ 3.20 – 3.22 per kg FOB China whereas Nylon FDY of 70D/24F quoted US$ 3.10-3.12 per kg FOB Far East Asia. Nylon filament yarn prices are expected to witness corrections in the coming weeks.

Pulp

RGWP prices witness marginal upward trend during second half of August. However, VSF plant operating rates were lower during the fortnight which is expected go up in coming fortnight. Offered price for high quality RGWP was US$ 965 per MT and above while regular grade imported hard wood RGWP prices were around US$ 860 per MT CFR China. Pulp prices are expected to witness stable trend in the coming fortnight.

VSF

Viscose fiber price witnessed a stable trend during August second half. However, the demand for the fiber has improved from previous fortnight and traded volumes have moved up. Fiber prices in Chinese local markets have increased and inventory levels have come down too. Current offered price for 1.4 denier fiber is around US$ 1.8 – 1.86 per kg FOB originating from China and offers originating from Indonesia are around US$ 1.85 -1.90 per kg

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.