Domestic PTA prices fall flat

POLYESTER

PTA

Purified terephthalic acid markets gradually entered a weak zone as prices remained flat to down in the fortnight week and moderated in the week before Christmas Day holiday. Prices could not be swayed away by the recovery in paraxylene markets. In China, spot PTA prices were firm as suppliers kept offers for bonded goods and for nearby-month cargoes unchanged. In US and Europe, demand for PTA was flat pegging prices stable. Asian PTA marker, CFR China retreated US$ 5 on the fortnight to US$ 710-712 per metric ton. In India, prices were flat at US$ 740 per metric ton CIF. Prices of PTA may look up in the coming fortnight.

MEG

Mono ethylene glycol prices in Asia were up in fortnight but the hike was moderated weakening demand from the downstream industry in China. MEG spot prices inched up US$ 7 on the fortnight with CFR China at US$ 915-920 per metric ton and CFR South East Asia to US$ 937-942 per metric ton. In Europe, MEG spot truck prices were flat to up as sentiment remained firm, despite markets ending on a quiet note ahead of Christmas break. Truck spot prices were assessed at an increased of Euro 30 in two weeks to Euro 870 per metric ton. In US, MEG prices were stable as there was some demand coming from the de-icing and antifreeze sectors due to winter weather. Prices of MEG may look up in the coming fortnight.

PET Chips

Polyester fibre chip prices moved down in a narrow range amid quiet and stable market sentiment. Downstream, PFY and PSF reported higher sales production ratio and in turn trading sentiment warmed for semi dull chips. Super bright chip market mirrored the trend in semi dull chip market with offers rising. Meanwhile, chip-based spinning mills bought hand to mouth volume on range-bound feedstock. Water bottle grade PET chip offer prices are around US$ 1060-1090 per metric ton FOB China while discussions were at US$ 1050-1055 per metric ton FOB China.

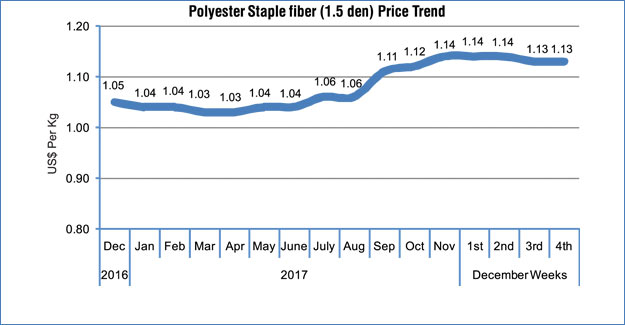

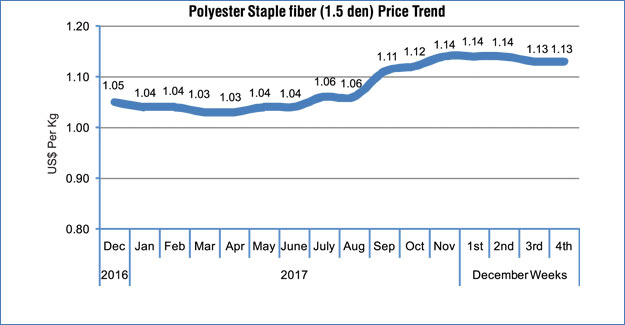

PSF

Polyester staple fibre prices edged down in China, rose in Pakistan and rolled over in India during the second fortnight. Upstream PTA cost moderated a bit, but MEG remained firm at higher level. In China, offers fell but strong currency negated the moderation. In Jiangsu and Zhejiang, offers for 1.4D direct-melt PSF were at US$ 1.33-1.37 per kg. PSF market in India moved sideways with sidelined stance and offers were flat at INR 90.25 per kg for 1.4D (or US$ 1.41 per kg) and 1.2D at INR 93.50 a kg (US$ 1.46 per kg). In Pakistan, producers lifted offers while weaker PakRe made imports costlier. 1.4D PSF prices were at PakRs.140-142 per kg (US$ 1.27-1.28 per kg, down US cents 4 due to weak currency), while import prices remained flat at US$ 1.13 per kg, CNF Karachi.

PFY

Polyester filament yarn prices declined in China while they rolled over in India and Pakistan in the second fortnight of December. In China, trading atmosphere cooled down somewhat, but remained passable. Downstream mills mainly consumed their raw material stocks in the meantime. POY offers rolled over on the week with 75/72 at US$ 1.43-1.44 per kg in Shengze and 75/36 at US$ 1.41-1.43 per kg. In Pakistan, local offers for DTYs 150/48 DTY were stable at PakRs 81 per pound (US$ 1.61 per kg) and imported at US$ 1.59 per kg. Downstream mills still purchased rational volumes amid thin trading atmosphere. In India, POY offers were flat for 130/34 POY at INR 98.75 per kg or US$ 1.54 per kg and 115/108 at INR 106.75 per kg or US$ 1.67 per kg.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.