Despite Crude Rise, Polyester Prices Sinking

PTA

PTA prices in Asian markets first rose on rising crude oil and paraxylene prices but gave back some gains later in line with falling feedstock values, implying they were losing the capability of resisting price drop despite upstream moderating in the past few weeks. Asian markets were up US$16 on the fortnight with CFR China at US$785-787 per metric ton while offer from Taiwan/Korea at US$795-805 per metric ton. In India, prices were at US$805 per metric ton CIF, up US$15.

MEG

MEG markets in Asia kept falling in the first two weeks of March on weak energy market. In China, domestic MEG prices softened on continuing weak demand and ample supply including climbing inventories which piled up to 664 kilo ton. Sinopec also reduced its March MEG list prices in east China indicating softer demand. Spot prices plunged US$130 on the fortnight CFR China at US$890-895 per metric ton and CFR South East Asia down US$102 at US$930-935 per metric ton. In India, CIF values were down US$75 at US$950 per metric ton. In Europe, spot bulk prices decreased Euro 5-20, assessed at Euro 775-790 per metric ton NWE while initial March price emerged down Euro 12 from February.

PET Chips

Fibre grade polyester chip market fundamental weakened in Asia and prices edged down on feedstock and weak demand during the first fortnight of March. Semi dull chip market was in weak fluctuation with thin trading. Amid weak fundamentals and feedstock, converters were unwilling to stock. Super bright chip market mirrored the trend in SD as trading sentiment was tepid, covered by wait-and-see sentiment. Semi dull chip offers fell US$15 to US$1,245-1,260 per metric ton while super bright chip offers were reduced to US$1,250-1,260 per metric ton, down US$30. Asian benchmark, SD continuous spinning fibre grade chip offers of Taiwan/Korea origin were down US$25 at US$1,225-1,275 per metric ton FOB.

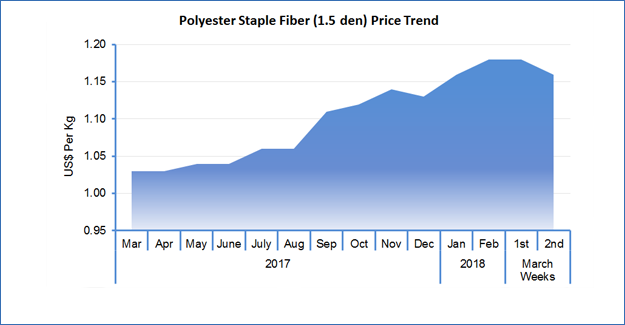

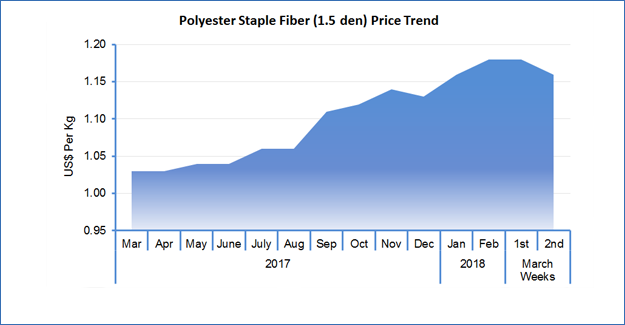

PSF

PSF prices fell in China, despite rebounding crude oil and feedstock cost in the first half of March as producers offloaded goods with discounts given lackluster buying interest. In the second half, as crude oil plummeted both PTA and MEG followed the suit, PSF producers cut offers to boost demand. However, buyers were unwilling to purchase, with negotiation stalemated. In Jiangsu and Zhejiang, offers for 1.4D direct-melt PSF fell US cents 2-3 to US$1.40-1.43 per kg (converted to USD from RMB), while the same in Fujian and Shandong fell to US$1.40-1.47 per kg. In India, PSF prices were raised from 1 March, but demand weakened as downstream spinning mills were not active amid cautious sentiment and moderate trading. 1.4D price were raised INR1.50 to INR96.75 per kg or (US$1.49 per kg) and 1.2D to INR98 per kg (US$1.50 per kg) but traded price remained lower. Polyester spun yarn prices moved up in the first week and down in the second with offers lowered amid moderate transaction. However, finer count 60s yarn price moved up rapidly. Regular count 32s polyester yarn offers were flat at US$2.19 per kg while 60s were up US cents 3 at US$2.51 per kg. In India, polyester yarn prices fell in early March, although PSF prices were raised. 30s polyester knit yarn was traded at INR132 per kg (US$$2.03 a kg) in Ludhiana market.

PFY

PFY prices edged down in China, given the slump of PTA futures and plunge in MEG cost. Trading atmosphere was thin, although some producers offering discounts enjoyed good liquidity. Pessimistic mood was spreading, and downstream mills were mostly in wait and watch mode. In Zhejiang, trading atmosphere was anaemic, as downstream mills were cautious in buying as selling indications for POYs, FDYs and DTY100D were falling. POY offers were down US cents 2 with 75/72 at US$1.45-1.47 per kg in Shengze and 75/36 to US$1.43-1.45 per kg (converted from RMB to USD). In India, POY demand was mute on poor global feedstock performance. On the other hand, few buyers observed demand from converter weakened after the mid-February price hike. POY offers for 130/34 POY were at INR102 per kg (or US$1.57 per kg) and 115/108 at INR110 per kg (or US$1.69 per kg).

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.