Polyester Prices Face Down Trend

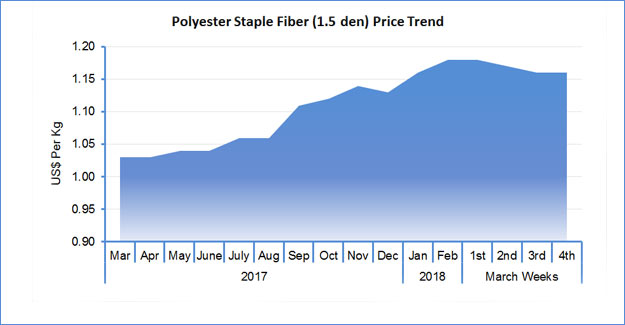

PTA PTA markets in Asia were in weak fluctuation, with price falling consecutively in both weeks. Upstream, paraxylene markets changed little upwards but PTA prices showed slight volatility but slightly weak. Offers for bonded goods and for nearby-month cargoes in China fell with both buyers and sellers on standstill. PTA markers moderated US$25 on the fortnight with CFR China at US$760-762 per metric ton while offer from Taiwan/Korea were down at US$780-800 per metric ton. In India, prices fell US$15 to US$790 per metric ton CIF. MEG MEG prices, which were on a downtrend recently halted the fall in the last week, rising above US$900 per metric ton mark. Demand improved with gradual increase in polyester production though an upward drive was limited. Inventories in east China decreased to 672 kilo ton but were still 1% up from levels seen in late February. European MEG spot prices fell and the prevailing bearish sentiment continued to characterise the market. Asian MEG spot prices gained US$4 in the last fortnight with CFR China at US$894-899 per metric ton and CFR South East Asia at US$900-905 per metric ton. Offers for nearby-month cargoes were at US$905 per metric ton, and counter offers at US$895-900 per metric ton in China. PET Chips Fibre grade polyester chip prices moderated in Asian markets on falling cost and demand. Semi dull chip market extended the weakness as offers were kept stable in the last week. As PTA and MEG futures extended the weakness chip offers and discussions declined slightly as trading sentiment cooled down gradually. In China, semi dull chip offers fell to 7,800-7,850 Yuan per metric ton (US$1,230-1,240 per metric ton, down US$20 on the fortnight). Asian benchmark, SD continuous spinning fibre grade chip offers of Taiwan/Korea origin were US$25 down at US$1,200-1,250 per metric ton FOB. PSF PSF prices moderated a bit in China while they were hiked in Pakistan seeing the currency weaken sharply which made imports costlier. PSF market in Shandong and Hebei rolled over with sidelined stance while in Fujian, PSF market moved sideways. In India, PSF prices were held unchanged for the rest of the month. In Jiangsu and Zhejiang, offers for 1.4D direct-melt PSF moderated US cents 3 to US$1.38-1.41 per kg, while the same in Fujian and Shandong fell to US$1.37-1.44 per kg. Export offers were down to US$1.18-1.20 per kg FOB China. In India, PSF prices rolled over with 1.4D at INR96.75 per kg or US$1.49 per kg and 1.2D at INR98 a kg (US$1.50 per kg). Polyester spun yarn offers in China moved both ways according to spec’s demand while regular count yarn prices remained steady on modest demand. Mainstream offers for high-quality virgin PSF-based 32s yarn were stable while coarser 21s were cheaper and finer 60s dearer. In China, 32s polyester yarn offers were flat at US$2.17 per kg, down US cents 3 while 60s were up US cents 4 at US$2.54 per kg. 21s were US cents 4 at US$1.99 per kg. In India, polyester yarn prices were stable in line with steady cost of PSF. 30s polyester knit yarn prices were at INR132 per kg (US$$2.03 per kg) in Ludhiana market.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.