Polyester Prices Flat And Unlikely To Rebound

PTA

PTA prices remained flat to slightly up in Asian markets in the first half of April amid limited offers in spot while participants held wait-and-see stance. Players were anxious over the trade war between China and US, and PTA market may not show any sign of significant rebound in coming weeks. However, there is limited room for price to decline with support from fundamental market. PTA markers inched up US$4 on the fortnight CFR China at US$765-767 per metric ton and offer from Taiwan/Korea at US$775-800 per metric ton. In India, prices were up at US$795 per metric ton CIF.

MEG

MEG prices surged in Asian markets as demand continued to improve rapidly while inventories fell in China. Inventory levels dipped by around 8% to 693 kilo ton in East China after transportation along the Yangtze River was disrupted by poor weather conditions. However, if compared to inventory levels in early March, the current inventory is by up 4%. Spot prices jumped US$85 in the first two weeks with CFR China at US$980-985 per metric ton and CFR South East Asia at US$985-990 per metric ton. In Europe, April contract price settled marginally down from March and failed to meet the expectations of buyers. Spot prices fell throughout March as market turned bearish due to lack of demand. Bulk spot prices rolled over at Euro 760-770 per metric ton CIF NWE while truck prices at Euro 820-835 per metric ton FCA NWE.

PET Chips

Fibre grade polyester chip markets were calm and silent as most markets in China and Taiwan were closed for Qingming Festival during the second half of the fortnight. As raw material MEG rose sharply and PTA inching up, cost support remained firm. Semi dull chip offers were flat at 7,750-7,850 Yuan a ton (US$1,230-1,245 per ton) while super bright chip offers also rolled over at 7,750-7,850 Yuan a ton (US$1,230-1,245 per ton).

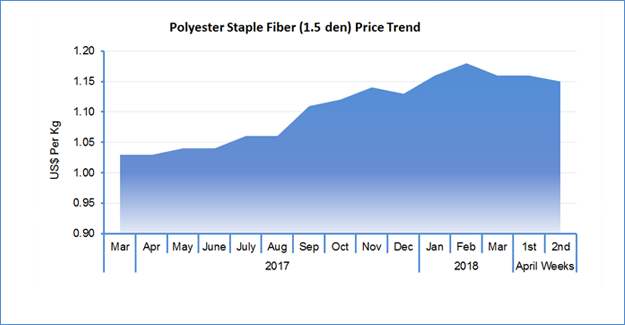

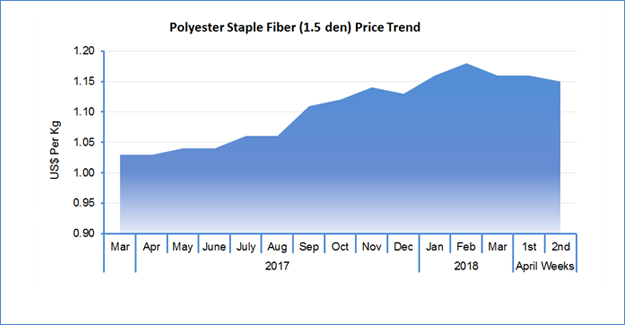

PSF

PSF markets were under fluctuation with most deals in China under negotiation. Mainstream offers for 1.4D direct-melt-spun PSF in Jiangsu and Zhejiang were cut in the second half of the fortnight. Offers for 1.4D direct-melt PSF were down US cents 1-2 and traded at US$1.37-1.41 per kg (price Yuan converted to equivalent USD). In India, PSF offers were cut for April due to previous softening of PTA while downstream spinners bought hand to mouth volume as yarn markets were range bound on a weak note. Prices were reduced INR2 or US cents 3 with 1.4D at INR94.75 per kg or US$1.46 per kg and 1.2D at INR96 per kg (US$1.47 per kg). Polyester spun yarn prices moderated in China following decline in PSF. 32s polyester yarn offers edged down further to 13.60 Yuan per kg (US$2.16 per kg, down US cent 1) while 60s remained flat at 16.00 Yuan per kg (US$2.54 per kg). In India, polyester spun yarn prices did not change after the PSF prices were lowered. 30s polyester knitting yarn prices at INR132 per kg (US$$2.03 per kg) in Ludhiana market.

PFY

PFY markets were quiet in China they mostly remained closed for second half of the fortnight with local prices were mostly stable, with sporadic offers adjusted up slightly. POY offers for 75/72 were at US$1.46-1.48 per kg in Shengze and 75/36 to US$1.45-1.46 per kg. In India, PFY market sentiment was stable, with few large-volume deals negotiable. Trading atmosphere was gentle, and downstream mills enjoyed passable margins. Selling indications for POYs mostly rolled over. POY offers rolled over with 115/108 at INR110 per kg or US$1.69 per kg and 130/34 POY at INR102 per kg or US$1.57 per kg.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.