Market Witnesses Mixed Trends In Polyester

PTA

PTA prices in Asia rose 2.5% up on the back of tight supply amid unplanned outages at regional plants, although demand was weak in key China market. Supply tightness is expected to last well into June and provide firm support to regional prices – which are currently at their highest since 2014. In China, domestic prices were under pressure from weak downstream polyester sales. PTA markers were up USD 15-20 in the last two weeks with CFR China at USD 831 per metric ton while offer from Taiwan/Korea were at USD 845.

MEG

MEG prices continued their steady fall in the last two weeks as inventory in the key China market remained high. Stock at eastern China ports stood at 938 kilo tons, up 9% from April-end, although they fell 2% in the last week. This implies more cargoes will flow in domestic market which could exert further pressure on prices. Prices were down by 5.3% on the two weeks which ended with discussions capped around US$ 900 per metric ton, after a bout of panic-selling on previous day. The CFR China market fell to US$ 908 per metric ton and CFR South East Asia to US$ 901 per metric ton.

Polyester Chips

Fibre grade polyester chip prices fell 2-3% during the past two weeks on the back of flagging demand amid ample supply. With approaching off season, terminal demand turned weak as chip-based spinning mills were inactive to make any procurement given declining sales. Semi dull chip market edged down as suppliers cut offers on thin trading. Super bright chip markets were on a weak note while CDP chip markets were range bound in weakness. Semi dull chip offers fell to 7,850-7,900 Yuan per metric ton (US$1,230-1,235 per metric ton, down US$40) while super bright chip offers were almost flat at 8,150-8,200 Yuan per metric ton (US$1,275-1,285 per metric ton).

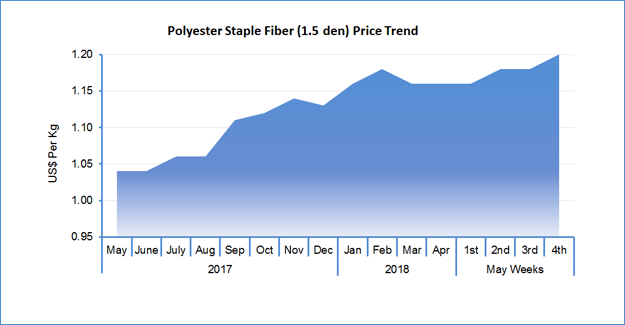

PSF

PSF makers in China and India kept their offers stable to slightly up as PTA market firmed up but downstream polyester market was on a weak note. In Jiangsu and Zhejiang, Offers for 1.4D direct-melt PSF rolled over at USD 1.39-1.42 per kg, while the same in Fujian and Shandong were unchanged in the range of USD 1.38-1.44 per kg. In India, no revision was heard in PSF offers while market prices rolled over with support firm cost. 1.4D at INR 94.75 per kg or USD 1.39 per kg and 1.2D at INR 96 per kg (USD 1.41 per kg), both down US cents 2 due to weak INR. Spun polyester yarn prices were seen lifted in China due to rise in cost in recent past while downstream demand remained normal. In Shengze, offers were raised across popular spec but finer count above 50s remained unchanged. Transaction for some specs was moderate during the week. 32s polyester yarn offers were lifted to 14.30 Yuan per kg (USD 2.24 per kg, up US cents 5) 21s were also up at 13.20 Yuan per kg (USD 2.07 per kg, up US cents 5). In India, polyester yarn prices remained stable on the back of range-bound PTA and lower MEG. 30s polyester knit yarn prices remained unchanged at INR 132 per kg (USD 1.93 per kg, down US cents 3 due to weak INR) in Ludhiana market.

PFY

PFY markets were generally stable across China and India during the last two weeks. In China, domestic PFY prices were generally stable, with sporadic declines seen in POYs, amid fluctuation of upstream feedstock cost. Trading atmosphere remained soft, as downstream mills showed wait-and-see stance. In Zhejiang, PFY prices were mostly stable, with some specs down as trading atmosphere was insipid. In China, POY offers were cut US cents 2 with 75/72 at USD 1.55-1.57 per kg in Shengze and 75/36 at USD 1.53-1.55 per kg. 75/72 intermingled DTY prices rolled over at US$ 1.99-2.00 per kg and 75/144 at US$ 1.97-1.99 per kg. In India, POY prices rolled over amid weak transactions recently, as downstream mills showed weaker demand with normal to lower run rates. Offers remained flat for 115/108 at INR 110 per kg or USD 1.62 per kg and 130/34 POY at INR 102 per kg or USD 1.50 per kg, both down US cents 2 due to weak INR.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.