India's T&C Exports In 2017-18 Rose 0.7%, Cotton Exports Shine

Trends

- T&C export share in India’s total exports is falling

- Apparel exports fell 7.5% in 2017-18

- USA remains single largest market for India’s apparel exports

- Apparel exports to the UAE fell by 57%

- Bangladesh has become India’s third largest market for T&C exports

- UK goes down to fourth rank

- Asia is the largest region for India’s cotton exports

- Cotton yarn exports were up by 2.5% after three years of negative growth

- Cotton exports to Vietnam went up 55% in 2017-18

- Turkey emerges top market for India’s MMF and MMSF textile exports

India's textile and clothing exports in 2017-18 grew marginally by 0.7% totaling to US$ 36737.93 million over the previous fiscal as per data released by the Ministry of Commerce, India. But the textile and clothing exporters have failed to meet the target US$ 45000 million set by the government of India. The T&C exports account for 12% of the country's total exports for the last fiscal year, whereas for 2016-17 it was 13% and 14% for 2015-16. Apparel exports have been dominating the sector for quite a long time now and currently apparels stake 46% of the total T&C exports share, but has witnessed a negative growth of -7.5% in 2017-18. Followed by apparels are cotton exports with 19% share and a growth of 6.4%.

Countries-wise T&C Exports

Countrywise, USA remains the topmost market for India's T&C exports. Exports to USA have witnessed a growth of 1.6% to US$ 7745.51 million in the last fiscal and accounts for a share of 21% in India's total T&C exports. Apparel exports are ruling the basket in USA market with total of US$ 3864.53 million and it accounts 50% share from the total T&C export to USA.

UAE is second topmost market for India's T&C exports, but the country has lost it export value by -28% totaling to US$ 3421.68 million in 2017-18 and accounts for a share of 9% in India's total T&C exports. Here too apparel exports are ruling the basket, but the export value has dropped drastically by -57.3% totaling to US$ 2817.35 million in the last fiscal. Bangladesh has taken the third position from UK, with exports totaling to US$ 2308.91 million, an increase by 8.3% whereas UK exports totaled to US$ 2275.61 million with an increase growth of 3.52%. The other top six T&C export markets for India are Germany, China, Spain, Italy, France and Turkey respective to their T&C export value.

Region-Wise T&C Exports

Region-wise, Asia is the largest market for India's T&C commodities. The T&C exports to Asia totaled US$ 13395.39 million in 2017-18, but the export value dropped by -6.53%. Cotton was majorly exported in Asia; the export value totaled to US$ 5062.09 million and perceived a growth of 2.7% in 2017-18 over the previous fiscal. Apparel is the second major commodity exported in Asia, the export value touched to US$ 4762.36 million, but export value has dropped massively by -37.72% in 2017-18 over the previous fiscal.

Europe has positioned itself as the second largest importer for Indian T&C commodities. The continent totaled an export value of US$ 10668.98 million with an increase of 6.4% in the export value. Apparel is the major commodity exported to Europe, the exported value totaled US$ 6521.18 million with an increase of 9.8% in the export value in 2017-18. Africa also has shown a positive trend. The continent has summed an export value of US$ 2563.89 million, increased by 6.9% in 2017-18. Cotton is the major commodity exported to Africa with an export of US$ 775.97 million, with an increase of 20.1%.

Cotton exports shine

After India witnessing a drop in the cotton export market for three fiscal years in a row, the segment has shined in 2017-18 export with a growth of 6.4% totaling US$ 7036.17 million over the previous fiscal year. The commodity has gained 19% share from the total T&C exports. Bangladesh remains the largest importer of India's cotton as the demand from China continues to drop over the last fiscal year. Cotton exports to Bangladesh in 2017-18 valued to US$ 1816.21 million with growth of 13.8% over the previous fiscal year. The country takes 26% share from the total cotton exports. While exports to China have dropped by -25.2% totaling to US$ 1003.2% with share of 14% in 2017-18.

Pakistan has retained its position as the third largest market for India's cotton exports, although cotton exports have increased by 14% totaling US$ 544.40 million. Pakistan takes 8% share from the India's total cotton exports. In terms of exports growth, Sri Lanka had gained 4.2 % in 2016-17, but in 2017-18 cotton exports dropped significantly by -7.3% totaling US$ 222.66 million.

Vietnam is another important market for India's cotton exports. In 2017-18 the exports totaled US$ 435.64 million with a growth of 54.9% over the previous fiscal year. The country has imported increasingly higher volumes of cotton in recent years. This surge in volumes mainly serves to feed the growing needs of its textile and garment production and export endeavor.

Cotton yarn exports upsurge after 3 years

India's cotton yarn exports have witnessed a positive growth after three consecutive years. In 2017-18, India's cotton yarn exports have totaled US$ 3367.19 million with a growth of 2.5%. Cotton yarn commodity takes 48% share from total cotton exports of India. Exports to China have dropped by -17.8% totaling to US$ 858.2 million, but it has still managed to remain the top importer for India's cotton yarn. Bangladesh which is the second topmost market increased its export value by 15.1% totaling to US$ 663.2 million. Turkey has shown remarkable growth in the last fiscal year. The country has witnessed a growth of 119.07% totaling US$ 89.38 million.

MMF exports gets a boost

India's Man-Made Filament (MMF) exports grew 9.2% in 2017-18 totaling US$ 2169.82 million over the previous year and it stakes 6% share from total T&C exports. Turkey is the top market for MMF commodity, the country has perceived a growth of 26% totaling to US$ 321 million in 2017-18 and shares 25% portion from total MMF exports. UAE which stands as the third largest importer of the commodity has witnessed a negative growth -25.4% totaling to US$ 149.92 million.

MMSF exports down

Man-Made Staple Fibre (MMSF) exports in 2017-18 perceived a negative growth of -4.3% totaling to US$ 2049.35 million over the previous fiscal year. Turkey has taken topmost position from Bangladesh in this commodity, the exports to the country totaled US$ 239.17 million with a growth of 24.1% in 2017-18 over the previous fiscal year. Bangladesh which now stands second has witnessed a negative growth of -12.5% totaling to US$ 224.58 million in the 2017-18.

Apparel exports continue to rule the sector

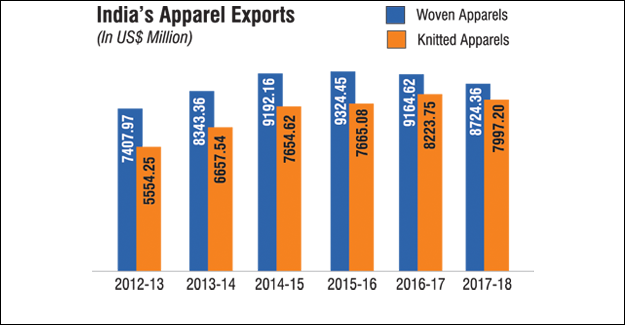

Apparel export which have been ruling the sector and receiving a good growth in total for many fiscal years now has witnessed a negative trend in the export market with a -7.5% growth. Though it has seen negative trend, it is still dominating the sector. Apparel exports totaled to US$ 16721.55 million in 2017-18. Woven apparel exports shares 52% of the portion from the total apparel exports and remaining is shared by knitted apparels.

Knitted apparel exports have witnessed a drop by -2.7% in 2017-18 totaling to US$ 7997.20 million. T-Shirts and singlets which has always contributed the most exports to the commodity, has gone down by -2.7% totaling to US$ 2616.53 million in the last fiscal year. From 2012-13 to the last fiscal year (17-18), babies garments exports has shown a startling increase in exports by 66.2% in the last six years. In the last fiscal year, babies garment exports totaled to US$ 876.69 million with a growth of 1.35%.

Men's innerwear's and nightwear exports have shown good improvement in the past six years. In 2017-18 the commodity exports totaled to US$ 670.4 million with a growth of 11.7% over the previous fiscal year. Tights, stockings and socks have doubled its exports in the last fiscal totaling to US$ 157.2 million with growth of 116.4%.

Woven apparel exports dropped by -4.8% totaling to US$ 8724.36 million in 2017-18 over the previous fiscal year. Women's suits and jackets exports top the list in woven apparels with export value of US$ 2421.05 million. Tracksuit and swimwear exports have performed well with an export value of US$ 1284.66 million and a growth of 10.11%. Shawls and mufflers lost quite an export value in the last fiscal, it perceived a negative growth of 32% totaling US$ 524.99 million over the previous fiscal.

(Data Source: DGCI&S, Kolkata)

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.