Global Home Textiles Market Picks Up

India's home textile exports registered a growth of a little less than 4% in 2017-18. The destocking that some big US retailers had to undertake impacted exports to the world's largest market, where India enjoys a substantial share of over 30%. India's top exporters such as Indo Count, Welspun and others are optimistic about the growth in the US market in 2018.

And they have reasons to be upbeat. According to the latest US customs data, India's total textile and apparel exports to the US in the first five months of 2018 have climbed 7.2% compared to the same period of 2017.

US imports of home textiles and made-ups during January-May grew a robust 7.7% to 8740 million square metres. Imports of made-ups and home textiles of man-made fibres grew 10% to 6093.6 million square metres during the period. In contrast, cotton made-ups and home textile imports at 2375.5 million square metres grew 1.6%.

The picture is however different in value terms.

US imports of cotton made-ups and home textiles during January-May 2018, were US$ 3034.7 million, 1.41% lower than during January-May 2017. China enjoys a share of 36% in total US cotton home textile imports, but witnessed a fall of 0.57% in exports to the US, at US$ 1091.6 million. Close on the heels is India, with a share of 32.66% of total US imports of cotton made-ups. However, at US$ 990.99 million, India's exports to the US in this category witnessed a drop of 6%.

In MMF made-ups and home textiles, India's share is a meagre 4.43%, while China enjoys the majority share of 61%. In dollar terms, India's exports of MMF home textiles to the US grew 6.66% to US$ 100 million during January-May 2018. China's exports during the period were to the tune of US$ 1390.92 million, growing 7.52%.

High CAGR forecast for global home textiles market

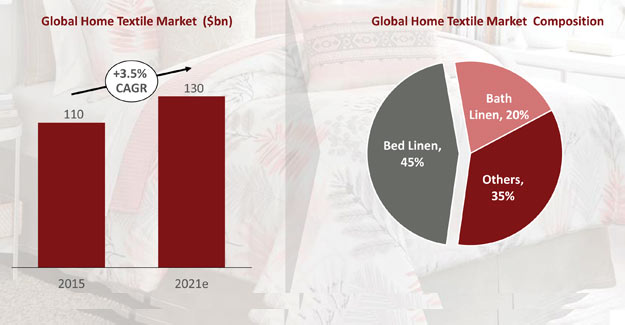

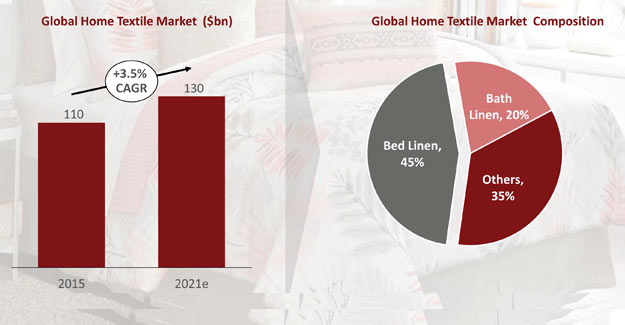

A report by Technavio forecasts a CAGR of 6.65%% for the global home textile retail market during the period 2018-2022. Other reports have forecast a CAGR of 3.5% and a high of 11% from 2011-2021. All of this just goes to show that the home textiles market has potential, especially in the US and Asia.

Asia is the largest market for home textiles, and also the largest exporter of the products. US remains the largest importer of home textiles. The US-China trade war could see a slowdown in China's exports of home textiles to this market. And India, alongwith Turkey and to some extent Pakistan, could receive more orders from the US.

The global home textile market is estimated to reach US$ 130 billion by 2021. Bedlinen accounts for the largest share of 45% in this segment, while bath linen constitutes 20%. Other segments such as floor coverings, furnishings, table and kitchen linen make up 35% of the home textile market. The bedlinen and bedspreads segment is expected to grow at a CAGR of 4.4% to reach US$ 60 billion by 2020. The US is the world's single largest home textiles market accounting for 21% market share. The US market is projected to grow at CAGR of 3% to reach US$ 27 billion by FY2020. Europe is the second largest home textiles market, accounting for a share of 26.8%. Bed and bath linen market of Europe is expected to grow at CAGR of 1.7% to US$ 17 billion by 2020.

Meanwhile, Asia Pacific is the largest home textile market in the world, accounting for 44% of the market. It remains the most dominant producer and consumer of home textiles. Here, China is the largest manufacturer and consumer of home textiles. Its market size is estimated to be US$ 30 billion.

India is the third largest home textiles market in the Asia Pacific region, projected to grow at a CAGR of 7.2% to reach US$ 5.6 billion by 2020. India's bedlinen consumption is expected to reach Rs 19350 crore by 2021, growing at a CAGR of 8% from 2011-2021. Towels consumption in the country is estimated to reach Rs 7060 crore by 2021, curtains Rs 4790 crore, blankets Rs 2850 crore, upholstery Rs 3080 crore, kitchen linen Rs 2400 crore, and rugs and carpets Rs 1250 crore by 2021. The strong growth expected in the market over the next three years has pushed up investments in the sector in India.

Welspun continues to focus on innovative, branded products

Every 5th towel and every 10th sheet sold in the US is made by Welspun, the company claims. The company currently manufactures 80,000 metric tons of terry towels, 90 million metres of bed linen, and 10 million square metres of rugs and carpets.

In FY18, the company's effective utilisation in towels and sheeting capacity was 80% each, and in rugs, 65%. The company has planned an investment of Rs 9 billion in FY19, most of which is aimed at the flooring solutions project.

The company has done well over the years, due to its strategy of moving towards innovative and branded products.

Today the two segments (innovative and branded) together account for more than 45% of Welspun's revenue. And Welspun plans to take this share to 50% by 2022.

Welspun's 2022 vision is to attain a revenue of US$ 2 billion, be a zero debt company, attain domestic market revenue share of 20%, and women employees should account for 20% of total employees in the company.

During FY2018, Welspun's revenue was Rs 6132 crore, and EBITDA was Rs 1205 crore, which is 19.65%, is in line with the guidance of 20% the company had given in the beginning of the year. During FY2018, the company's domestic retail business grew by 19%.

Its global brand Christy registered a growth of 71% in the ecommerce business.

According to Rajesh Mandawewala, Managing Director, Welspun India Ltd, "In terms of innovation, we have almost 30 innovations, and we added three more innovations during the year. Total revenue coming out of innovative products is about 37% now and the total revenue coming from the branded product is 17%."

WIL's flooring project is now proposed to start in Telangana, instead of Gujarat as planned earlier. The project cost will be approximately Rs 1100 crore, and will have a capacity to manufacture 27 million square metres of floor coverings. Commercial production is expected to begin by October-December 2019.

The company expects to achieve topline growth of 8-10% in FY19. "We will have an EBITDA margin of 19-20% for the full year and a capex guidance of Rs 900 crore, which will be mostly because of the flooring project," informed Mandawewala.

The company had initially planned to target the domestic institutional buyers of floor coverings, but will now also get into the Indian residential market, which is much bigger.

"The Indian floor coverings market is anywhere between Rs 30,000-50,000 crore market. And is serviced by imports more than anything else. With our product range, we hope to take a sizeable pie of this market," hopes Mandawewala.

Indo Count Industries bets big on Indian market, widens export market base too

The company is one of the leaders in home textiles in the country, meeting 11% of the US demand for bedlinen. The company has successfully launched three new brands for the US market. And realising the potential of the Indian market, it has given a push to its brand Boutique Living, which is now present in 465 multi-brand outlets in 96 cities of India.

The company expects its sales (exports and domestic) to move up to 58-60 million metres in FY 2019, from 54 million metres in 2018. The company's current capacity is 90 million metres per annum, with a capacity utilisation of 60%. The company plans to utilise all of its capacity by 2021.

The company's results for FY2018 were dented by sudden changes in the domestic policies and destocking by some of the big retailers in US market. ICIL's consolidated total revenue for FY 2018 was Rs 1958 crore, The consolidated EBITDA for FY18 stood at Rs 262. Consolidated profit after tax for FY18 was Rs 125 crore as against Rs 232 crore in FY17. The profit after tax margin was 6.4% for consolidated FY18. For FY19, the company has planned a capital budget of Rs 60-70 crore, which will be used towards modernisation of its spinning mill, cut and sew and other ancillary processes and routine modernisation. The company plans to start Phase II Capex in FY19 and hopes to commission the same by the end of FY20.

According to ICIL Executive Director, K.K. Lalpuria, "We are seeing that the rupee is depreciating which would help us in becoming a little bit more competitive and attracting more business out of India. We are also seeing traction in the value-added products which will improve the margin going forward. We are reducing our dependency on the US market and exploring some other markets and for this we are opening offices worldwide. We are also stepping up our operational efficiencies which by better utilising our volume and exporting better volumes we will be able to take advantage of economies of scale. So all these factors going forward will support us to absorb the overall impact both on the revenue side and on the margin side."

Raw material strategy

Cotton price volatility can hurt a company's bottomline. To avoid this problem, ICIL buys cotton in the beginning of the cotton season, to cover its requirement of 5-6 months. "So, we hedge our raw material situation and also address the quality issues associated with cotton. Good quality cotton is available in the beginning of the season," says Lalpuria.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.