Domestic Textile Industry At The Crossroads

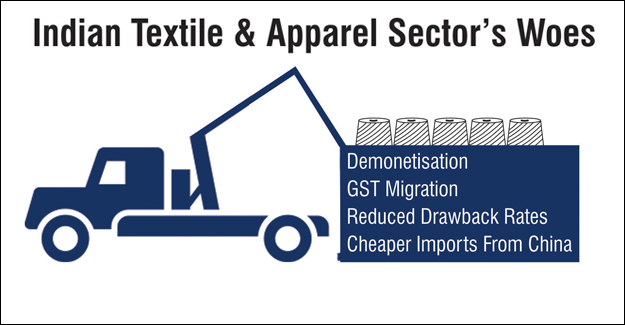

The textile industry is passing through a stressful situation. While on one hand exports have shown a declining trend, on the other domestic consumption has also turned subdued following a series of event led by demonitisation. Several export-oriented textile units which had diverted a significant portion of their production to the domestic market in the last few years in order to de-risk the business from export-related headwinds as also to explore the growing opportunities in the domestic market amidst rising economy, seem to be ruing their decision.

More so since these units have to put efforts as also resources towards this end and hence are desperately looking from some payback. Adverse impact on their already-impacted balance sheet has put them in a very desperate situation at a time when both the markets are not expected to improve in hurry. Demonitisation followed by GST migration has already taken their toll on the overall business in a very big way.

Exporters are in a challenging situation as on one hand they are faced with demand slow down, on the other struggling to get back their tax and other refunds in the new GST regime.

Already, the global competition has intensified in the wake of various trade agreements & formation of blocs, even as India has failed to make much of headway. There has hardly been any progress in case of FTA with EU. After showing a dip of around 2% for the entire period last year, garment exports were down 16.2% in May and 12.4% in June this year. On the production side, for garment units raw material prices (cotton and cotton yarn prices) are up by around 20% since this April, making their lives further difficult. Aggravating the situation further is unprecedented rise in textiles and apparel imports.

"The apparel and textiles industry is in a flux. The market condition is adverse. On top of that, policies and regulations are not bringing the desired results. Exporters are finding it difficult to face market challenges in the wake of reduced drawback rates and unable to get back the tax refunds. We expect the government to take some urgent measures to address these issues," Premal Udani, managing director, Kaytee Corporation.

"The situation is stressful. We exporters are faced with multiple disadvantages and there is need to provide us with some sort of level-playing field or else the industry will lead to a position from where recovery will be difficult. Units are closing down and many are reducing their capacities to cope up with this situation. I strongly believe that the government will take up this on a priority basis and come up with some solution to address these issues," states Vijay Agarwal, chairman, Creative Group which has recently closed down couple of their garment manufacturing facilities due to ongoing issues.

Meanwhile, the government taking note of the overall condition of the industry has finally decided to increase the import duty on 76 textile & apparel items at six digit level to protect the domestic manufacturers from rising imports. The import duty which was earlier 10% will now be 20% for these items. There has been increase in import duty of 24 knitted apparel categories, 24 woven apparel categories, 10 categories of carpet, six non-woven categories, three categories of laminated fabric, two knitted fabric, two categories of woven fabric, two categories of made-ups and three other categories.

"This shows that the government is concerned about our plight and has taken an apt decision to increase import duty to put some check on the growing imports. The industry is already in a very difficult scenario and these imports are only adding to the woes," says Sanjay Jain, chairman, CITI, who is of the view that there is a big issue of imports from Bangladesh where there is full exemption of basic customs duty and hence it is a gateway for Chinese fabric entering India duty free. This is because no rules of origin are in place for duty free imports from Bangladesh.

"The government should consider imposition of safeguard measures such as Rules of Origin on the countries that have FTAs with India to prevent cheaper fabrics produced from countries like China routed through these countries. Further, there is need to increase import duty on MMF spun yarn, MMF- based Fabrics as huge surge of imports have been seen in this category post GST which is impacting yarn and fabric manufacturers in a big way," adds Jain.

"The move is expected to give some cost advantage to the Indian textile manufacturers. In line with government's Make In India initiative, the increase in import duty will encourage domestic manufacturing and help boost growth," says Madan Sabnavis, Care Ratings.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.