China's Polyester Market Weakens

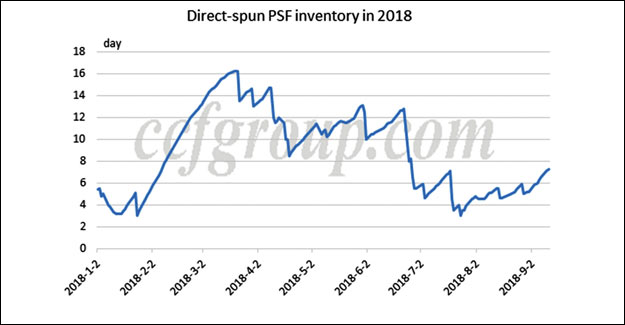

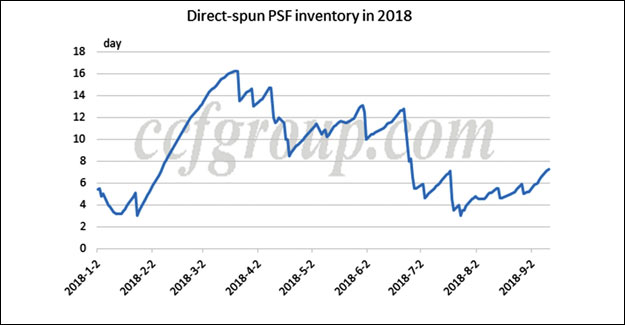

Many PSF plants reported poor sales since entering September. The market is covered with sidelined mood amid sluggish demand and high prices. Some plants said the market was even slacker than that during Spring Festival. As a result, product inventory in direct-spun PSF plants kept mounting and reached 5-10 days generally with higher at over half a month and lower at 2-3 days. Accumulating inventory and risks of price decline are forcing manufacturers to cut production.

At present, operating rate of direct-spun PSF has decreased below 70%, close to the lowest during Spring Festival. Huaxicun and Hengyi High-tech Materials both plan to cut production later. Therefore, operating rate of direct-spun PSF is predicted to decline to the level during Spring Festival or lower in mid-to-late September.

However, most plants do not have clear restart plan. It may depend on the decline of polyester feedstock, positive cash flow of direct-spun PSF and the recovery of downstream demand. Under current high price, downstream fabric plants cannot transfer cost and some of them even plan to take holidays during Mid-autumn Festival and National Day. Thus, in short term, downstream will not restock intensively and direct-spun PSF will stay in weak correction.

In addition, if the sales keep soft, the low inventory may increase to normal level or higher. With larger inventory pressure, PSF plants are possible to discount more in actual trading.

PFY plants have also cut production, which affected polyester operating rate greatly and restricted PTA demand. Although PTA spot price is still partly supported in short run, market fundamentals will finally return to balance, and that is also one of the factors that market participants stand on the sidelines.

China's MEG prices down, inventory to increase in Sept-Oct

China's MEG market retreated since last Friday, and prices dropped around 600yuan/mt or more than 7% in three trading days. Confidence of long position holders collapsed due to the weakness in end-user market. PFY sales ration weakened since end August, and remained at 40-50%. Polyester product inventories increased gradually and the inventory value depreciated gradually. By September 11, POY inventory was above eight days.

In addition, profits of polyester products shrank apparently amid the rise in feedstock prices previously. More polyester plants chose to cut production. Besides PET fibre chip, PET bottle chip and PSF plants, some PFY producers also reduced production. Operating rate of polyester plants fell to around 88.5% by August 11, and the rate was expected to decrease further amid reduction plans of Huaxicun, Shuangtu, and Dongnan.

MEG supply-demand condition keeps weakening with decreasing operating rate of polyester plants. Inventory build-up is expected to be around 150kt in September-October. In terms of new units in China, Qianxi 300kt/year and Tianying 150kt/year syngas-based MEG units have achieved on-spec products, and are raising operating rate. Xinjiang Tianye 100kt/year, CNSG Hongsifang 300kt/year and Hualu Hengsheng 500kt/year syngas-based units are under commissioning. Domestic output is expected to increase apparently since mid-October if these units could run smoothly.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.