Greece Officially Joins The BRI

Greece and China signed a memorandum of understanding for cooperation within the framework of the Belt and Road Initiative, on August 27, 2018.

Greece is strategic for China's BRI, positioned at the crossroads of three continents, and traditionally the gateway to Europe. China's COSCO Shipping, the world's largest shipping company had acquired Greece's Piraeus Port in 2016, with the aim of making it the largest port in the Mediterranean and the world by 2019.

By participating in BRI, Athens hopes to become the main hub between Asia and Central Europe. The railway line connecting Budapest, Hungary to Belgrade, Serbia is being modernised by Chinese companies. The project of both Beijing and Athens is to continue this line to Piraeus to facilitate trade from Europe's hinterland.

Greece is slowly recovering from the financial crisis that severely hit the country almost ten years ago, and gradually inching towards an export economy. By dint of reforms and privatisations (including that of the port of Piraeus), Athens gains new hope. In August 2018, Greece exited third economic bailout programme offered by the European Union and the IMF. The country's new economic stability, and the BRI has attracted Chinese investors to the country. Since last year, Air China offers non-stop flights from Beijing to Athens.

Greece needs BRI to boost production, jobs, trade

The Chinese government is being blamed for creating huge debts for very weak economies, which if they go bad, could hurtle the global economy to one of its worst financial crisis. However, Greece is already ridden with debts, public debt accounts for 180% of its GDP, the result of the IMF and eurozone loans. The country was forced to follow severe austerity measures for eight years. During this time, tax rates were among the highest in Greece, earnings across the job sector took a severe beating, many industries relocated outside of Greece, the weak ones could not survive. Job creation was at the lowest, and unemployment rate as high as 24-25%. Capital sanctions has meant that the country can give up hopes of having a strong heavy industry any time soon.

Despite all this, exports have helped the economy stay afloat. And the industry will have to look at agricultural commodities to build its export sector further. Greece is the third largest cotton producer in Europe, which is an important commodity in its export basket to nearby Turkey. In this background, the Greek economy will need China's BRI as a means to build its infrastructure, improve connectivity with the rest of Europe and Asia, transport its goods and commodities efficiently to the rest of the world, and steadily strengthen its industry and create employment for its youth.

Unemployment among its youth is as high as 40%, a disturbing scenario. To an extent, COSCO's activities in Piraeus Port have created jobs, and improved business for the country. Hopes on BRI are thus riding high. For Greece, the BRI brings more hopes than fears.

Pireaus to become one of the world's leading ports

COSCO is determined to upgrade Piraeus as the central gateway for Euro-Asian trade since it is the first European port after Suez. The Chinese group has contributed to the development of the port, creating 1,600 jobs. It is expected that 125,000 jobs will be created over the next few years.

Chinese investment at Piraeus port has also upgraded the surrounding region, increasing the investment interest of Greek and foreign companies directed at the construction of hotels, conference centres and shopping areas around the cruise terminals in order to benefit from the upgrading of the city.

After the recent proclamation by German newspaper Die Zeit that Piraeus is "the world's fastest growing port, and will be the largest port in the Mediterranean by 2019," Zhang Anming, deputy general manager of COSCO Shipping's subsidiary PCT at Piraeus predicts that in one and a half years it will "become the largest port of the Mediterranean, from third as it is today."

"The transport of goods has more than tripled over the last years in Piraeus. In 2017, 3,691 million containers were transported (Teus) compared with 3,471 million in 2016. In 2018 we can surpass the five million. This year, we seek to increase freight traffic by 35%," said Zhang Anming. "Every week 16-18 freight trains depart from Piraeus for central and western Europe. The China and Europe Marine and Land Line Interconnection Programme is being implemented and Piraeus is being transformed into one of the largest freight forwarding centres in one of the region's largest Logistics Services Centres," he explained.

"Piraeus is the centre of the European maritime world," Zhang added, explaining: "Rail transport of containers from Piraeus, via FYROM and Serbia, to Central Europe will take two days. More quickly, that is, than the time that a merchant ship from Asia needs to cross Suez, the Mediterranean and sail through the straits of Gibraltar, Spain, and France, to dock and unload in the ports of Rotterdam or Hamburg. Austria, for example, which imports goods mainly through the ports of the European North, could benefit from the new route in the future."

"Our course is already successful. We are very proud. Our plans are to create the largest trading port of the Mediterranean in the next 1-2 years. We have been preparing for the past eight years," Zhang said in a statement.

Three more Greek ports are being privatised, creating more business opportunities for the country. US trade sanctions and protectionism could, in the future, lead to a lesser flow of container traffic to that country. Already, Chinese customs report increased trade with Central Asia and Europe due to its various BRI projects.

Greece's economy is rebounding

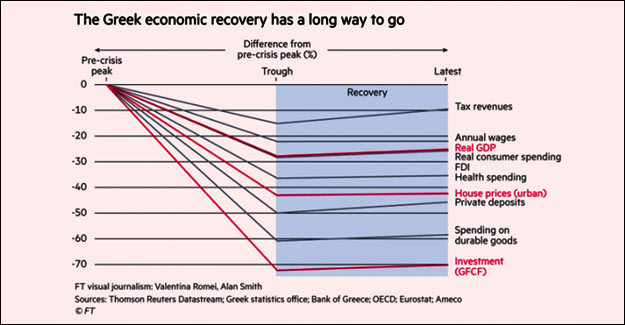

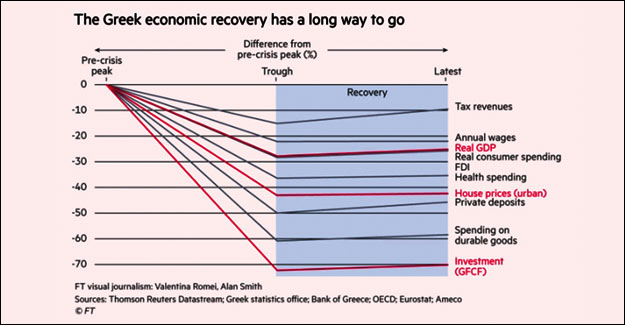

Greece's recovery from its deep economic recession is finally gaining traction. That was the opening statement in the Organisation for Economic Cooperation and Development's latest economic survey of the country, which applauded Greece's "remarkable reform effort" of the last two years. As the country comes to the end of its eighth year of external financial assistance, the economy is expected to grow faster than the eurozone average next year. However, the journey to complete recovery is still a long one.

Unemployment is falling, consumer spending is rising and poverty is declining. But Greece has a long way to go on the road to recovery: the recent bounceback offers only limited comfort to an economy still far below its pre-crisis level. Greek output is now 3.7% higher than its trough in mid-2015, which makes it 25% below 2007 levels. Despite strong growth expectations, Greece's economic output in 2023 is forecast to be 17% below 2007 levels, according to International Monetary Fund data. In contrast, output in Spain and Portugal - two EU countries also hit hard by the global financial crisis - has recovered and, in the second quarter of 2018. In Italy, output was 5% below its pre-crisis peak.

Greece's housing market, which has traditionally been the preferred investment of the country's households, has struggled to recover. Property prices, which fell year on year until the start of 2018, are on average 42% below the levels of 10 years ago. When adjusted for inflation, prices are still sliding. But housing is also at the heart of the recovery in foreign investment, which has increased 34% from a trough in 2014. According to data from the Bank of Greece, an additional Euro 850 million of foreign investment poured into Greek real assets between 2014 and 2016, the largest absolute increase across all sectors.

Greece's recovery continues to be challenged by high levels of non-performing loans, which make up almost half of all loans in Greece. So far, the recovery has failed to lift Greek living standards to pre-crisis levels. The joblessness rate is around 20%, which corresponds to almost 1 million people. Though more than 300,000 new jobs have been added since March 2015, many are temporary or part-time positions, and average wages in real terms are 22% below 2009 levels.

In Spain, Italy and Portugal, average wages in real terms have recovered to between 4% and 6% below pre-crisis peaks.

In 2007, Greeks were better off than people in half of the countries that now form the EU. After adjusting for price differences - so-called purchasing power parity - Greece had a similar per capita output to Spain, was 21% more well off than Portugal and 71% richer than Poland. Now, Greeks are almost 9% worse off than Portuguese and Poles, while Spaniards are almost 40% better off. Greece has become the fourth-poorest EU country, after Bulgaria, Croatia and Romania. Although the Greek recovery is slow, forecasts for the economy are optimistic. "The economic recovery should continue to broaden gradually over this year and next, driven by a stronger labour market and improving sentiment," Angela Bouzanis, an economist at Focus Economics, wrote in an August note. This may be good news for Greece, but the data show that normality, judged against pre-crisis figures at least, remains a long way off.

Rise in hiring prospects

After a decade of stagnation there are encouraging signs of employment generation. The net employment outlook stood at 16% for the October-December period, which is the highest level recorded in more than a decade. More than one in five bosses (21%) expects an increase in the number of people employed, 9% anticipate a reduction and two in three (66%) foresee no change. The sectors where the most hirings are anticipated are those of electricity and natural gas, financial and insurance services, and wholesale and retail commerce.

Govt. will now spend, spend, spend

After eight years of austerity, or big cuts to public spending on everything from wages to pensions to building new roads, Tsipras says Greeks deserve a break. He's promised backdated pay rises, lower taxes and increase in welfare benefits.

Greece's bailout programme ended in August, which means the EU and IMF think its economy is now good enough that they no longer have to give Greece money to pay its debts. They're unlikely to be happy about Tsipras' plan to end austerity though, as they think the reason Greece got into trouble in the first place was that its wages were too high, its taxes too low, and its welfare too generous. But Tsipras says the extra spending will boost the economy, and plenty of economists would agree with him. They point out that one person's spending is another person's income, so the more money Greeks have to spend the more jobs and business will be created to make and sell stuff for them to spend money on.

However, Greek policy makers must note that the country has been living in uncertainty, with high unemployment rate, and low wages. It will take more than just putting money into the hands of people by raising wages and welfare benefits. Secure employment and job opportunities should be a priority of the government.

Being part of the BRI, the government realizes the importance of logistics and shipping, and this is where the country's growth will need to come from.

Exports keep Greece afloat

In the last eight years, industry drain has been a serious problem in Greece. To avoid the high tax rates, many companies relocated to other Balkan countries.

Increased exports of goods and services held a key role in Greece's exit from the bailout programmes after eight years, according to official data. By focusing on exports, Greek businesses tackled the sharp fall in domestic consumption, the experts explained in regular reports.

When the crisis broke out in late 2009, exports accounted for about 19% of Greece's GDP. By 2017, the share had climbed to 30% and the positive trend continues. According to a recent National Bank of Greece survey, the dynamic products that supported the ailing economy include basic commodities which had secured significant shares in international markets for years, such as aluminum, marble and olive oil, as well as quite new products in Greece's export portfolio, like yoghurt.

Greek exports grew strongly also in the first half of this year by 15.7% to Euro 16.4 billion (US$ 19 billion) compared to the same period in 2017, according to a Panhellenic Exporters Association report. In the same January-June period, imports stood at Euro 27 billion. Over taxation and the introduction of capital controls in the summer of 2015 were pinpointed as main factors obstructing further improvement, by the Panhellenic Exporters Association.

Although the indexes of industrial production and exports look good, the image is not entirely rosy. "We are not selling our products at the prices we would like in order to have profit, but we export, because there is no domestic demand and we do not want to keep them on the shelves," said association officials. The association believes the focus should shift to sectors which can give more, like agricultural production. According to experts, Greece cannot have a profitable heavy industry yet, and should look at more traditional industries, including textiles and clothing.

The association has also suggested a gradual reduction in taxation rates from the current 29% to 26% and then to 20% within a couple of years. Yorgos Kavvathas, President of the Hellenic Confederation of Professionals, Craftsmen and Merchants (GSEVEE) suggested also a national growth plan and emphasis on how to resolve the businesses' financing issues. "A country with four systemic banks cannot move ahead to growth. She needs a Development bank of special purpose which will support those sectors of the economy which can become the steam engines that will pull forward the train of growth," he told Xinhua. "What we need to do is to eventually draft a national strategic plan for growth which will determine the sectors that will be the drivers. And we do have such sectors," he stressed.

Slide in Turkish lira has Greek exporters on edge

Greek companies that export to Turkey are concerned that the collapse of the Turkish lira against the euro and the deterioration of consumer and business confidence in the neighbouring country will affect their exports this year.

Greece currently has a trade surplus with Turkey but there are fears that this could be reversed if the Turkish economy dips into recession.

In 2017, total exports to Turkey surged 44.5% (20.7% excluding fuel), reaching Euro 1.9 billion (Euro 879 million excluding fuel), with bilateral trade exceeding Euro 2.77 billion, based on data from the Greek Embassy in Ankara. In the same period, imports from Turkey rose 2.6%, amounting to Euro 1.4 billion. "These results, which can be mostly attributed to the improvement of both countries' economies, resulted in a significant improvement in the trade balance, with the surplus amounting to Euro 519 million in total trade," according to the Foreign Ministry's trade department.

The main Greek export to Turkey - after oil and fuel - is cotton, while exports of industrial products, plastics, mechanical and electrical equipment, aluminum and copper tubes are also significant. Greece imports readymade garments, furniture, steel products, plastics, vehicles and electromechanical equipment, while in recent years, there has been a notable rise in fish imports (from fish farming).

Overall Greek investments in the neighboring country have dwindled since 2015, when National Bank of Greece (NBG) sold Finansbank for Euro 2.7 billion. According to the Greek Foreign Ministry and Turkey's central bank, the total amount stood at just Euro 150 million at the end of 2017, from Euro 114 million in 2016 and a whopping Euro 4.9 billion in 2015.

Greek textile and apparel market is not too big

Greece, with a population of 10.74 million, is not a very big market for the giant textile and apparel manufacturers in South Asia. Moreover, being a developed economy with a high per capita income, European apparel is preferred to the mass produced apparel from South and southeast Asia.

Greece exported textiles and apparel worth US$ 1.33 billion in 2016, of which raw cotton accounted for a share of 26%. Knit apparel and fabric accounted for most of the exports in this segment. Greece imported textiles and apparel worth US$ 2.56 billion in 2016. Knitted and woven shirts, suits and other apparel made up the bulk of its imports in this segment.

Greece's top export destinations include Italy, Germany, Bulgaria, United Kingdom, Romania, France, Spain, Cyprus, Turkey, Lebanon, Egypt. Main import origins are Germany, Italy, Russia, Netherlands, France, the Benelux countries, Spain, Bulgaria, China, South Korea. Greece has a large number of textile and apparel manufacturing units. However, the near absence of domestic consumption and capital sanctions, has held back growth of this sector.

Textile and apparel industry can help in industrialisation and in employment generation. But the industry will have to be export oriented to grow, as domestic consumption, even if at its peak, will remain limited. China is exploring tourism opportunities in Greece, and this will give a fillip to retail and shopping too. Moreover, the improved connectivity due to the BRI projects in Central Asia and Europe can help Greece explore these markets better. The Russian fashion and apparel market is coming of age. It is noteworthy here that Greece boasts of a number of luxury fashion brands that have made a mark on the catwalks of the fashion capital.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.