Polyester Value Chain

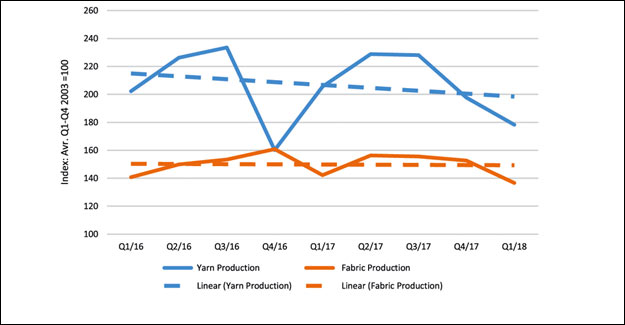

India's Polyester Demand May Pick Up After November 15 Polyester input prices have continued to rise in the second half of October, even as crude prices came down. PTA went up by as much as 6.5% to Rs 87 a kg, and MEG by 2.4% to Rs 74 a kg. Prices are however expected to fall by Rs 4-5 a kg in November. However, demand in the Indian polyester market is dull. This is a seasonal trend, but a little more marked this time. While input prices have increased, polyester yarn prices have fallen by 2-4% compared to the first half of October. Texturisers are learnt to be offering discounts of Rs 6-8 a kg, over the quoted price, to get orders. The lower input prices in November will bring some relief to the market. Demand is expected to pick up after November 15. A Dull Polyester Market In China Chinese polyester makers are facing the same hurdles as their Indian counterparts. Dull demand for polyester filament yarn has resulted in huge inventories. Fabric and apparel demand in China is dull. This will keep prices under pressure. New PTA Capacities Coming Up Meanwhile, a number of PTA plants are expected to come up in Asia in 2018 and 2019. In China, two PTA plants are scheduled to start up in 2019, namely Hengli's 2.5 million mt/year No. 4 plant at Dalian and Xinfengming's 2.2 million mt/year plant. Two PTA plants, Ningxia Baota Chemical Fibre's 1.2 million mt/year line and Sichuan Chengda's 1.2 million mt/year line, have completed construction, but are pending commission due to problems related to feedstock sourcing. Over in Europe, the Artlant PTA plant in Sines, Portugal, with a production capacity of 700,000 mt/year, successfully started production in July. In Indonesia, Asia Pacific Fibres was also heard to have considered restarting its PTA plant, which has laid dormant since late 2015, to service its downstream polyester fibre production. The plant has a production capacity of around 300,000 mt/year. At the same time, market participants are eagerly following news of Indian JBF Industries' 1.25 million mt/year PTA plant in Mangalore. The startup has been repeatedly delayed due to financial issues since commissioning was announced on March 31. However, market participants now expect the project to successfully start up in 2019, after JBF Industries recently sold its petrochemicals business to private equity firm KKR and Co. China's polyester market is likely to remain bearish, on the back of weak demand, adequate supply and higher stocks. Polypropylene prices in China are expected to fall this week amid a supply glut. In southeast Asia, however, demand was rising amid falling stocks, which might prompt buyers to restock. US Demand For Synthetic Textiles And Apparel Is Growing According to a recent release by OTEXA, US imports of cotton textiles and apparel were 12623 million square metres equivalent, during January-August 2018, a growth of 2.4% compared to the same period of the previous year. In contrast, US imports of man-made fibre textiles and apparel amounted to 30843.3 million square metres equivalent, during January-August, 2018, growing 6% over the same period of the previous year. Global Yarn, Fabric Production Falls Global yarn production decreased by 9% between Q4/17 and Q1/18. Output reductions in Africa (-13%), Asia (-11%), and Europe (-1.5%) have cancelled out the increase in Brazil (+12%) and the relatively small improvement in the USA (3%). Most responding countries from Africa, Asia, and North America are optimistic about the evolution in Q2/18 while Europe and Brazil expect a decline in production. Global yarn stocks decreased in all regions in Q1/18 except in Brazil (+1.5%). The strongest reduction occurred in Asia (-6%), followed by Europe (-3%), and Egypt (-1.5%). Altogether, yarn stocks reach 89% of their previous year level for the same quarter. Global yarn orders decreased in all countries by 5% on average, except in Japan where it increased by 2%. Global fabric production too decreased from Q4/17 to Q1/18 by 10% at world level. It fell by 12% in Asia, 5% in Africa and 2% in Europe. It increased by 1% in Brazil. The world output level now reaches 96% of its Q1/17 level. South Africa, Pakistan, and Turkey expect an increase in fabric production in Q2/18. All other countries foresee stability or decrease. In Q1/18, the global fabric stock level grew by 1%. It was driven by Brazil's stocks improvement of 5%, which was sufficient to bring fabrics stocks 13% over their Q1/17 level. Fabric stocks remain stable in Asia, Europe, and the USA. They continue to steadily drop in Egypt and South Africa and constantly increase in Brazil. Global fabric orders have reduced between Q4/17 and Q1/18 by 6%. Europe's small improvement (+2%) was balanced out by reductions in Brazil and Africa (-10% and -18%, respectively), which brought the global index to 88% of its previous year level.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.