Indian Cotton Prices Weaken Even As Cotton Arrivals Are Slow

Market arrivals of cotton have slowed as farmers have begun to hold back their produce anticipating better prices. However, the decline in market arrivals in the early part of the marketing season does not appear to deter the mill sector, which is sitting on ‘comfortable’ stocks.

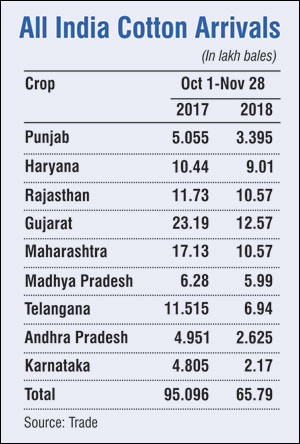

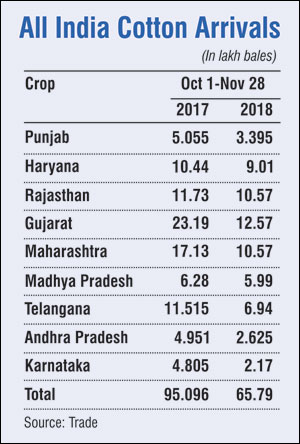

Arrivals this year during October 1-November 28 stood at 65.79 lakh bales (of 170 kg each), about 31% lower than the 95.09 lakh bales in the corresponding period last year. However, this huge drop does not seem to have triggered a demand. Industry sources say that the stock position at the mills’ end is comfortable, with most holding close to two months stock.

“Yarn movement has been slow; there is a slowdown across the entire value chain. So, the mill sector is not chasing the farmer/trader,” said Indian Texpreneurs' Federation (ITF) secretary Prabhu Damodharan.

Interestingly, despite lower arrivals, prices have cooled a bit on slack demand from textiles mills and multinational traders. “The mills are not keen on buying at higher prices. At the same time, the MNC traders are still not active in the market as the current pricing is not working in their favour,” said Ramanuj Das Boob, a sourcing agent in Raichur. Also, the Assembly election in Telangana and Rajasthan is seen having an impact on market arrivals, he said.

Prices of cotton candy, each weighing 356 kg, are now hovering between Rs 44,200 and Rs 44,800 across various markets, depending on the quality as against around Rs 48,000 in early October. Arrivals are likely to improve mid-December, Ramanuj Das Boob said.

While the kapas or raw cotton prices are hovering at Rs 5,800-5,860 per quintal in Maharashtra and Gujarat, they are ruling around the MSP levels of Rs 5,450 in Telangana. The Cotton Corporation of India has already begun purchases in Telangana and Odisha.

Industry sources also feel that the white fibre might not be exported at this juncture as the rupee has fallen below 70 to a dollar.

“The mill sector has not taken a call on cotton imports as the quality of the Indian cotton is good, and prices are lower compared to the prevailing international prices,” said Selvaraju, Secretary-General, The Southern India Mills Association (SIMA).

“Mills will import, but this requirement will arise during August-September, towards the close of cotton season. Imports could hover around 15 to 20 lakh bales,” he said.

Industry sources by and large feel that 2018-19 season would be a good year for the cotton textile industry. “With elections in Telangana, a clear picture of the scenario would be possible only by mid-December,” said Prabhu.

Reverting to crop production, Selvaraju said it could hover around last season's figure of 370 lakh bales. “There's been no report of pink boll worm infestation. The drought in Gujarat and Maharashtra can impact crop prospects.”

“We also learnt that the sale of refuge seeds (non-Bt) has been on the rise and the quality of the fibre extremely good as compared to the previous year. That's not all. The area has picked up and there is a 26-28% increase in the MSP. The prices cannot go down, but the position is comfortable and mills need not be wary of the situation,” he said.

ITF secretary on the other hand contended that cotton is a globally connected commodity. “The industry should understand that the trade is no more a business between a ginner and a miller. “Cotlook Index, Chinese decisions on stock levels, Indian farmers’ holding capacity and so be with ginners, influence of commodity trading platforms, global fund houses activity in cotton, position taken by speculators, stagnant yield, lack of authentic data on production and pressing, MNCs participation in cotton trade – all of these, tend to impact the price. Volatility and speculation is the new normal,” he said, stressing the need for evolving better management strategies.

The Cotton Advisory Board had, at its first meeting for the 2018-19 season estimated the production at 361 lakh bales against 370 lakh bales during the corresponding period of the earlier season.

Prices of cotton candy, each weighing 356 kg, are now hovering between Rs 44,200 and Rs 44,800 across various markets, depending on the quality as against around Rs 48,000 in early October. Arrivals are likely to improve mid-December, Ramanuj Das Boob said.

While the kapas or raw cotton prices are hovering at Rs 5,800-5,860 per quintal in Maharashtra and Gujarat, they are ruling around the MSP levels of Rs 5,450 in Telangana. The Cotton Corporation of India has already begun purchases in Telangana and Odisha.

Industry sources also feel that the white fibre might not be exported at this juncture as the rupee has fallen below 70 to a dollar.

“The mill sector has not taken a call on cotton imports as the quality of the Indian cotton is good, and prices are lower compared to the prevailing international prices,” said Selvaraju, Secretary-General, The Southern India Mills Association (SIMA).

“Mills will import, but this requirement will arise during August-September, towards the close of cotton season. Imports could hover around 15 to 20 lakh bales,” he said.

Industry sources by and large feel that 2018-19 season would be a good year for the cotton textile industry. “With elections in Telangana, a clear picture of the scenario would be possible only by mid-December,” said Prabhu.

Reverting to crop production, Selvaraju said it could hover around last season's figure of 370 lakh bales. “There's been no report of pink boll worm infestation. The drought in Gujarat and Maharashtra can impact crop prospects.”

“We also learnt that the sale of refuge seeds (non-Bt) has been on the rise and the quality of the fibre extremely good as compared to the previous year. That's not all. The area has picked up and there is a 26-28% increase in the MSP. The prices cannot go down, but the position is comfortable and mills need not be wary of the situation,” he said.

ITF secretary on the other hand contended that cotton is a globally connected commodity. “The industry should understand that the trade is no more a business between a ginner and a miller. “Cotlook Index, Chinese decisions on stock levels, Indian farmers’ holding capacity and so be with ginners, influence of commodity trading platforms, global fund houses activity in cotton, position taken by speculators, stagnant yield, lack of authentic data on production and pressing, MNCs participation in cotton trade – all of these, tend to impact the price. Volatility and speculation is the new normal,” he said, stressing the need for evolving better management strategies.

The Cotton Advisory Board had, at its first meeting for the 2018-19 season estimated the production at 361 lakh bales against 370 lakh bales during the corresponding period of the earlier season.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.