Cotton Production In India Could Drop To Lowest In 9 Years

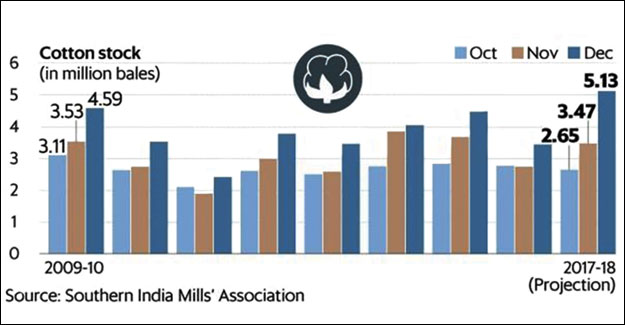

Annual cotton output in India might drop 12% to the lowest in nine years as inadequate rainfall in the top two producing states has cut crop yields, potentially reducing exports from the world's leading producer. And due to lower cotton consignments from India, the US, Australia and Brazil will increase cargoes to leading Asian buyers including China and Pakistan. It might also endorse global prices that have fallen 16% since hitting a 4-year peak in June. According to estimates, India can produce 32.5 million bales in the marketing year 2018-19 that started on October 1; the lowest since 2009-10-because farmers in Maharashtra and Gujarat have reported poor yields, informed Chirag Patel, CEO, Jaydeep Cotton Fibres Pvt Ltd. Rains in both the states, which account for over half of the country's cotton production, were almost a quarter below normal in June to September. Patel also said, "Many growers had to deracinate plants after first cotton picking as there will not be a second or third picking like every year". State-run Cotton Advisory Board said, India produced around 37 million bales in 2017-18 and was estimated to yield 36.1 million bales in 2018. Patel added, "In spite of higher prices, supplies are not lifting up and hence the crop is lower than expected". President of Cotton Association of India (CAI), Atul Ganatra said fresh season cotton supplies generally start from October and peak in November and December. But spot supply in the last two months reached just 7 million bales compared to 10 million bales in the same period last year. Earlier in June, dealers were hoping India to export at least 10 million bales amid high demand from China after trade dispute with the US. But smaller crop size will restrict surplus for overseas sales and raise local prices, according to managing director of D. D. Cotton, Arun Sekhsaria. He said, "We could export 5-6 million bales. Export demand is expected to lift up in coming months as Indian cotton is economical than other origins". It must be noted that Indian cotton is offered about 84-85 cents per lb, cost and freight, to the buyers in Vietnam and Bangladesh, against around 90 cents for those from the US and Brazil. In the current season, traders have contracted to export around 2.5 million bales and have shipped around 1 million bales, said Ganatra of CAI. Mills aren't worried about low cotton production yet News reports that cotton crop yields will hit a three-year low in the October 2018-September 2019 season have set alarm bells ringing on the Street. A low yield implies lower output and higher cost of production. This could raise cotton prices and put spinning mills in distress. The moot question is how severe the impact on profits of spinning mills will be. Will they spin a woeful yarn with high input costs in the near future? Estimates from the Cotton Advisory Board point to production of 36 million bales during the 2018-19 cotton season compared to 37 million bales in the previous year. Drought and uneven rainfall in Gujarat and Maharashtra is likely to pull down the average yield. However, spinning mills do not look distraught, at least yet. According to K. Selvaraj, secretary general of the Southern India Mills' Association, "The situation is comfortable after the arrival of the initial crop in the market. Also, the last season ended with higher than normal cotton stock position that would act as a buffer for the current season." So far, cotton prices have softened. After touching Rs 136 per kg (Shankar-6 variety), the price has eased to Rs 124 per kg. On the other hand, robust demand for yarn both in domestic and international markets has supported yarn prices.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.