India's Textile Machinery Exports Upsurge In Q2 FY 18-19

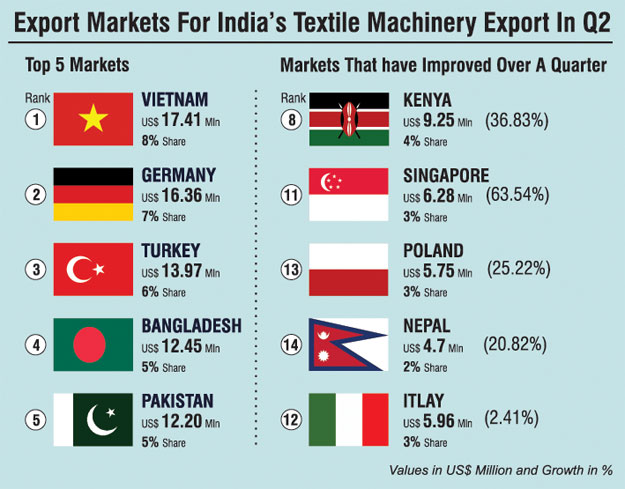

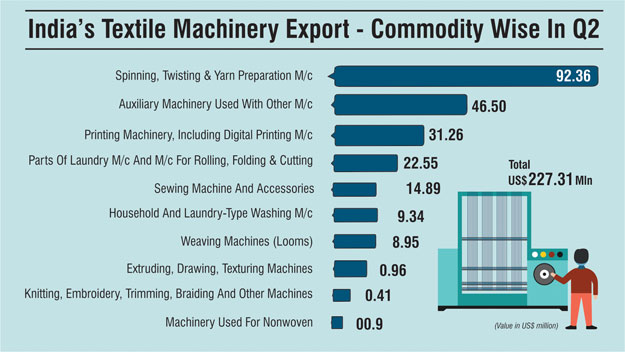

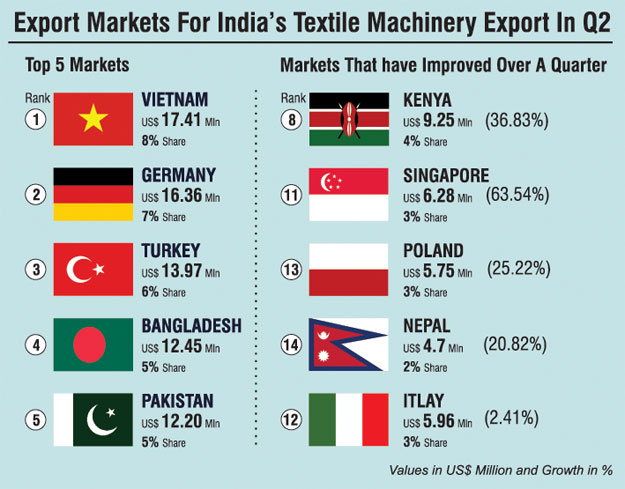

Exports of textile machinery have witnessed a boost in the second quarter of FY 18-19. Exports totalled to US$ 227.31 million in Q2 FY 18-19, delivering a growth of 11.10% over the previous quarter and 26.61% over CPLY (corresponding period of last year). Spinning, twisting and yarn preparation machinery accounts for a major portion of 41% from the total textile machinery exports of India in Q2 with an export value of US$ 92.36 million. In Q2 Vietnam is the top export market for India's textile machinery, exports totalled to US$ 17.41 million. Whereas in Q1 for this fiscal year, Vietnam was the fifth largest market and in Q2 of FY 17-18 was the eighth largest market for Indian textile machinery.

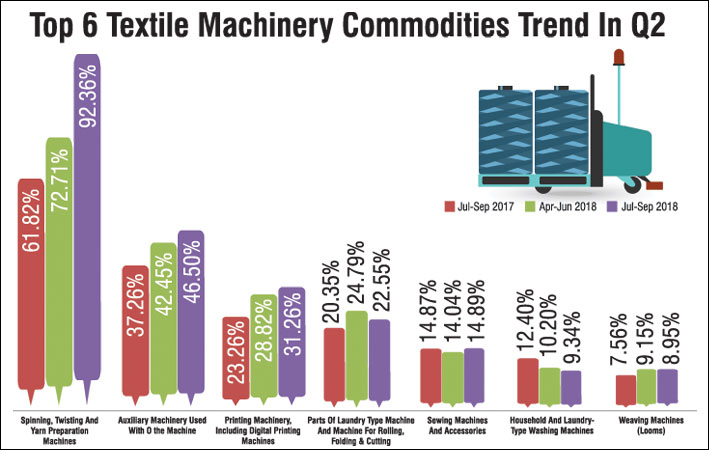

Commodity-wise exports from India

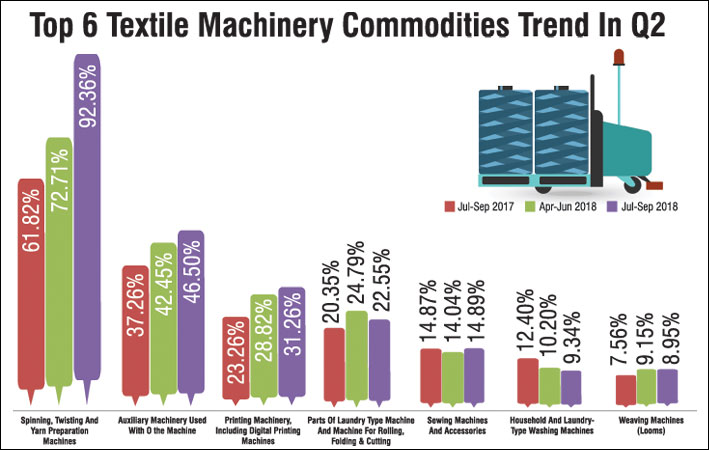

In Q2 FY 18-19, many commodities under the textile machinery segment have generated a good export value in the global market when compared to the previous quarters and CPLY. Spinning, twisting and yarn preparation machine which is top exported commodity in Q2, has perceived a growth of 27.03% over the previous quarter and 49.40% over the CPLY with an export of US$ 92.36 million in Q2 FY 18-19. Under spinning, twisting and yarn preparation machine exports, cotton spinning ring frames were exported the most from India with an export value of US$ 53.39 million and perceiving a growth of 32.19% over the previous quarters and 33.48% in CPLY.

Cotton combing machine which is the second topmost export machinery has increased exports in Q2 by 250.54% over the previous quarter and 119.39% over CPLY totalling to US$ 6.45 million.

Blowroom machines have witnessed a robust growth of 39.16% in Q2 over the previous quarter with an export value of US$ 3.66 million. Cotton carding machine and drawing/ roving machine exports fell in the second quarter this fiscal year. Other fibre textile spinning machine exports went up marginally, exports in this Q2 totalled to US$ 0.31 million with growth of 63.16% over the previous quarter.

Printing machine exports fare well

Exports of printing machinery, including digital printing machines grew by 8.47% in Q2 FY 18-19, over the previous quarter and 34.39% over the CPLY. Exports in this commodity totalled to US$ 31.26 million. Under this commodity, offset printing machinery reel feed is the topmost commodity with value of US$ 4.38 million in Q2 FY 18-19 and the growth declined by 20.36% over the previous quarter. But compared to the CPLY, exports went up 253.23%. Ink jet printer machine exports have surprisingly increased in Q2 by 268.25% over the previous quarter and 1188.89% over CPLY, to US$ 2.32 million.

Auxiliary machine exports up

Auxiliary machinery used with other machine is the second highest commodity with respect to the export value in Q2 FY 18-19. This commodity's export value totalled to US$ 46.50 million with a growth of 9.45% over the previous quarter and 24.80% over CPLY and it stakes 20% from the total textile machinery export in Q2 of this fiscal year. Under this category, parts and accessories of machine used for manmade textile material is the topmost commodity exported from India in the second quarters of this fiscal. The commodity totalled to US$ 10.50 million with a growth of 14.63% over the previous quarter and 47.06% over the CPLY. Parts and accessories for other textile fibre processing machine also witnessed a positive growth of 44.91% to US$ 5.84 million in Q2 over the previous quarter and 40.83% over CPLY.

Indian weaving loom exports fell

Weaving machine (looms) has witnessed a negative growth of 2.19% to US$ 8.95 in Q2 FY 18-19 over the previous fiscal. But over the CPLY the commodity has witnessed a positive growth of 18.39%. Knitting machine exports have gone down in the second quarter, the exports totalled to US$ 0.41 million with negative growth of 30.51% over the previous quarter and 55.91% over CPLY. Machinery used for nonwoven sector has witnessed a slight rise in the exports by 50% totalling to US$ 0.09 million over the previous quarters and 80% over CPLY.

Cotton combing machine which is the second topmost export machinery has increased exports in Q2 by 250.54% over the previous quarter and 119.39% over CPLY totalling to US$ 6.45 million.

Blowroom machines have witnessed a robust growth of 39.16% in Q2 over the previous quarter with an export value of US$ 3.66 million. Cotton carding machine and drawing/ roving machine exports fell in the second quarter this fiscal year. Other fibre textile spinning machine exports went up marginally, exports in this Q2 totalled to US$ 0.31 million with growth of 63.16% over the previous quarter.

Printing machine exports fare well

Exports of printing machinery, including digital printing machines grew by 8.47% in Q2 FY 18-19, over the previous quarter and 34.39% over the CPLY. Exports in this commodity totalled to US$ 31.26 million. Under this commodity, offset printing machinery reel feed is the topmost commodity with value of US$ 4.38 million in Q2 FY 18-19 and the growth declined by 20.36% over the previous quarter. But compared to the CPLY, exports went up 253.23%. Ink jet printer machine exports have surprisingly increased in Q2 by 268.25% over the previous quarter and 1188.89% over CPLY, to US$ 2.32 million.

Auxiliary machine exports up

Auxiliary machinery used with other machine is the second highest commodity with respect to the export value in Q2 FY 18-19. This commodity's export value totalled to US$ 46.50 million with a growth of 9.45% over the previous quarter and 24.80% over CPLY and it stakes 20% from the total textile machinery export in Q2 of this fiscal year. Under this category, parts and accessories of machine used for manmade textile material is the topmost commodity exported from India in the second quarters of this fiscal. The commodity totalled to US$ 10.50 million with a growth of 14.63% over the previous quarter and 47.06% over the CPLY. Parts and accessories for other textile fibre processing machine also witnessed a positive growth of 44.91% to US$ 5.84 million in Q2 over the previous quarter and 40.83% over CPLY.

Indian weaving loom exports fell

Weaving machine (looms) has witnessed a negative growth of 2.19% to US$ 8.95 in Q2 FY 18-19 over the previous fiscal. But over the CPLY the commodity has witnessed a positive growth of 18.39%. Knitting machine exports have gone down in the second quarter, the exports totalled to US$ 0.41 million with negative growth of 30.51% over the previous quarter and 55.91% over CPLY. Machinery used for nonwoven sector has witnessed a slight rise in the exports by 50% totalling to US$ 0.09 million over the previous quarters and 80% over CPLY.

Sewing machine exports slightly up

Sewing machine has also shown a slight increase in exports to US$ 14.89 million in the Q2 FY 18-19 with growth of 6.05% over the previous quarter and 0.13% over CPLY. Under this category, needles used for sewing machines other than HH type were exported the most from India in the second quarter, with value totalled to US$ 4.38 million in Q2. But the growth has declined both over the previous quarter and CPLY by 14.62% and 12.75% respectively. Hand operated sewing machine and other sewing machine have shown an improvement in Q2 with a growth of 30.86% and 40.11% over the previous quarters respectively.

Top Export Markets For India's Textile Machinery Commodities

Vietnam is booming market for India's textile machinery

Vietnam, which was the fifth largest export market of India's textile machinery commodities in Q1 for this fiscal year has turned the tables in the Q2 making itself the top export market. Exports to Vietnam totalled to US$ 17.41 million in Q2 with growth of 43.29% over the previous quarter and 154.16% over CPLY and stakes 8% share only from the total textile machinery exports of India.

Spinning, twisting and yarn preparation machines were the most exported commodity to Vietnam in the quarter with an export value of US$ 13.85 million in Q2 FY 18-19 with a growth of 32% over the previous quarter and 189% over CPLY. Exports of printing machinery, including digital printing machines have remained the same in Q2 totalling to US$ 0.28 million over the previous quarter, but increase of 180% over CPLY was witnessed where the exports were US$ 0.10 million in Q2 FY 17-18.

Weaving machines (looms) have witnessed a good increase in its export value with growth of 1322% in Q2 over the previous quarter with export value of US$ 1.28 million. Auxiliary machinery used with other machine is the second top commodity exported to Vietnam in the Q2, with an export value of US$ 1.58 million and growth of 37% over the previous quarter and 72% over CPLY.

Vietnam is emerging as the clear leader in low-cost manufacturing and sourcing. Currently, labour costs in Vietnam are 50% of those in China and around 40% of those reported in Thailand and the Philippines. With the country's workforce growing annually, Vietnamese workers are inexpensive, young, and, increasingly highly skilled. Many major brands have invested in the country and are outsourcing their manufacturing from Vietnam. With TPP and other preferential trade agreements in place, rules of origin come into play strongly in Vietnam, pushing up investments in its primary textile sector. Vietnam will become a much larger market in the coming months, as it becomes an important apparel supplier to the world markets.

Sewing machine exports slightly up

Sewing machine has also shown a slight increase in exports to US$ 14.89 million in the Q2 FY 18-19 with growth of 6.05% over the previous quarter and 0.13% over CPLY. Under this category, needles used for sewing machines other than HH type were exported the most from India in the second quarter, with value totalled to US$ 4.38 million in Q2. But the growth has declined both over the previous quarter and CPLY by 14.62% and 12.75% respectively. Hand operated sewing machine and other sewing machine have shown an improvement in Q2 with a growth of 30.86% and 40.11% over the previous quarters respectively.

Top Export Markets For India's Textile Machinery Commodities

Vietnam is booming market for India's textile machinery

Vietnam, which was the fifth largest export market of India's textile machinery commodities in Q1 for this fiscal year has turned the tables in the Q2 making itself the top export market. Exports to Vietnam totalled to US$ 17.41 million in Q2 with growth of 43.29% over the previous quarter and 154.16% over CPLY and stakes 8% share only from the total textile machinery exports of India.

Spinning, twisting and yarn preparation machines were the most exported commodity to Vietnam in the quarter with an export value of US$ 13.85 million in Q2 FY 18-19 with a growth of 32% over the previous quarter and 189% over CPLY. Exports of printing machinery, including digital printing machines have remained the same in Q2 totalling to US$ 0.28 million over the previous quarter, but increase of 180% over CPLY was witnessed where the exports were US$ 0.10 million in Q2 FY 17-18.

Weaving machines (looms) have witnessed a good increase in its export value with growth of 1322% in Q2 over the previous quarter with export value of US$ 1.28 million. Auxiliary machinery used with other machine is the second top commodity exported to Vietnam in the Q2, with an export value of US$ 1.58 million and growth of 37% over the previous quarter and 72% over CPLY.

Vietnam is emerging as the clear leader in low-cost manufacturing and sourcing. Currently, labour costs in Vietnam are 50% of those in China and around 40% of those reported in Thailand and the Philippines. With the country's workforce growing annually, Vietnamese workers are inexpensive, young, and, increasingly highly skilled. Many major brands have invested in the country and are outsourcing their manufacturing from Vietnam. With TPP and other preferential trade agreements in place, rules of origin come into play strongly in Vietnam, pushing up investments in its primary textile sector. Vietnam will become a much larger market in the coming months, as it becomes an important apparel supplier to the world markets.

Germany remains the second largest market

Germany remains the second largest market in the Q2 over the previous quarter of FY 18-19 and has witnessed a growth of 1.43% to US$ 16.36 million. Whereas over CPLY the exports growth declined by 2.27%. Germany stakes 7% share from the total exports of India's textile machinery. Auxiliary machinery used with other machine is top commodity exported from India to the country. Exports of this commodity totalled to US$ 6.07 million with a growth of 59.74% in Q2 over the previous quarter and 62.30% over CPLY. Parts of laundry type machine and machine for rolling, folding and cutting is second top commodity exported to the country and export of this commodity totalled to US$ 4.14 million in Q2, but perceived a negative growth of 14.11% over the previous quarter and 44.87% over CPLY.

Turkey has moved one spot higher over the previous quarter

Turkey stands as the third largest export market of India's textile machinery exports. Exports totalled to US$ 13.97 million in Q2, a progressive growth of 4.64% over the previous quarter and 161.61% over CPLY. Spinning, twisting and yarn preparation machines were the most exported commodity to Turkey.

The country imported machinery worth US$ 5.86 million from India in Q2 with growth of 67.06% over the previous quarter and 402.05% over CPLY. Printing machine including digital printing and auxiliary machine exports have witnessed a drop in Q2 FY 18-19 by 89.19% and 27.73% over the previous quarter. But if compared over CPLY printing machine exports to Turkey have gone by 300%.

Bangladesh's rank goes down by three positions

Bangladesh was the topmost export market for Indian textile machinery in the first quarter of this fiscal, but as the export to Bangladesh have dropped drastically over a quarter, the country now stands as the fourth largest export market. The country's textile machinery imports from India totalled to US$ 12.45 million in the second quarter while in the first quarter exports had totalled to US$ 30.12 million. The growth has declined by -58.67% over the previous quarter and 20.40% over CPLY.

Except printing machine and auxiliary machine commodity, rest all commodities under the textile machinery sector have dropped significantly in Q2 over both the previous quarter and CPLY. Spinning, twisting and yarn preparation machines are the topmost commodity exported to Bangladesh with an export value of US$ 10.22 million and growth of 31.32% over the preceding quarter and 7.09% over CPLY. Printing machine which registered an export value of US$ 5.32 million in Q2 is the second topmost commodity exported to Bangladesh with a growth of 9.47% over the previous quarter and 130.30% over CPLY.

Germany remains the second largest market

Germany remains the second largest market in the Q2 over the previous quarter of FY 18-19 and has witnessed a growth of 1.43% to US$ 16.36 million. Whereas over CPLY the exports growth declined by 2.27%. Germany stakes 7% share from the total exports of India's textile machinery. Auxiliary machinery used with other machine is top commodity exported from India to the country. Exports of this commodity totalled to US$ 6.07 million with a growth of 59.74% in Q2 over the previous quarter and 62.30% over CPLY. Parts of laundry type machine and machine for rolling, folding and cutting is second top commodity exported to the country and export of this commodity totalled to US$ 4.14 million in Q2, but perceived a negative growth of 14.11% over the previous quarter and 44.87% over CPLY.

Turkey has moved one spot higher over the previous quarter

Turkey stands as the third largest export market of India's textile machinery exports. Exports totalled to US$ 13.97 million in Q2, a progressive growth of 4.64% over the previous quarter and 161.61% over CPLY. Spinning, twisting and yarn preparation machines were the most exported commodity to Turkey.

The country imported machinery worth US$ 5.86 million from India in Q2 with growth of 67.06% over the previous quarter and 402.05% over CPLY. Printing machine including digital printing and auxiliary machine exports have witnessed a drop in Q2 FY 18-19 by 89.19% and 27.73% over the previous quarter. But if compared over CPLY printing machine exports to Turkey have gone by 300%.

Bangladesh's rank goes down by three positions

Bangladesh was the topmost export market for Indian textile machinery in the first quarter of this fiscal, but as the export to Bangladesh have dropped drastically over a quarter, the country now stands as the fourth largest export market. The country's textile machinery imports from India totalled to US$ 12.45 million in the second quarter while in the first quarter exports had totalled to US$ 30.12 million. The growth has declined by -58.67% over the previous quarter and 20.40% over CPLY.

Except printing machine and auxiliary machine commodity, rest all commodities under the textile machinery sector have dropped significantly in Q2 over both the previous quarter and CPLY. Spinning, twisting and yarn preparation machines are the topmost commodity exported to Bangladesh with an export value of US$ 10.22 million and growth of 31.32% over the preceding quarter and 7.09% over CPLY. Printing machine which registered an export value of US$ 5.32 million in Q2 is the second topmost commodity exported to Bangladesh with a growth of 9.47% over the previous quarter and 130.30% over CPLY.

Exports To Pakistan have significantly increased

Pakistan has jumped right from 12th position to now as the fifth largest export market for India's textile machinery. Exports to Pakistan totalled to US$ 12.20 million in Q2 with growth of 133.72% over the previous quarter where the exports totalled to US$ 5.22 million and the growth over the CPLY was only by 25.64%. The rise in spinning, twisting and yarn preparation machine exports is the only reason to have Pakistan as the fifth largest market, with exports totalling to US$ 9.76 million with a growth of 184.55% in Q2 over the previous quarter and 26.75% over CPLY

Demand from China has been sluggish over a quarter now

India's textile machinery exports to China dropped by 12.76% in Q2 over the previous quarter, with the exports totalling to US$ 10.39 million. But over CPLY, exports have witnessed a rise of 19.29%. China stakes 5% share from the total textile machinery export from India, and is its seventh largest market. Auxiliary machine was the most exported commodity to China from India in Q2. Exports of this commodity totalled to US$ 3.73 million, but perceived a negative growth of 30.02% over the previous quarter and 21.80% over CPLY. The second top commodity exported is spinning, twisting and yarn preparation machines with an export value of US$ 3.64 million in Q2, but this commodity too perceived a negative growth of 24.64% over the previous quarter and 2.15% over CPLY. Weaving machine (looms) have witnessed a slight growth of 50.43% to US$ 1.73 million in Q2 FY 18-19 over the previous quarter where the export value totalled to US$ 1.15 million.

Exports To Pakistan have significantly increased

Pakistan has jumped right from 12th position to now as the fifth largest export market for India's textile machinery. Exports to Pakistan totalled to US$ 12.20 million in Q2 with growth of 133.72% over the previous quarter where the exports totalled to US$ 5.22 million and the growth over the CPLY was only by 25.64%. The rise in spinning, twisting and yarn preparation machine exports is the only reason to have Pakistan as the fifth largest market, with exports totalling to US$ 9.76 million with a growth of 184.55% in Q2 over the previous quarter and 26.75% over CPLY

Demand from China has been sluggish over a quarter now

India's textile machinery exports to China dropped by 12.76% in Q2 over the previous quarter, with the exports totalling to US$ 10.39 million. But over CPLY, exports have witnessed a rise of 19.29%. China stakes 5% share from the total textile machinery export from India, and is its seventh largest market. Auxiliary machine was the most exported commodity to China from India in Q2. Exports of this commodity totalled to US$ 3.73 million, but perceived a negative growth of 30.02% over the previous quarter and 21.80% over CPLY. The second top commodity exported is spinning, twisting and yarn preparation machines with an export value of US$ 3.64 million in Q2, but this commodity too perceived a negative growth of 24.64% over the previous quarter and 2.15% over CPLY. Weaving machine (looms) have witnessed a slight growth of 50.43% to US$ 1.73 million in Q2 FY 18-19 over the previous quarter where the export value totalled to US$ 1.15 million.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.