India's Textile Machinery Imports In Q2 Surpasses Records

India imports printing machinery, including digital printing, the most from the world and China is the top sourcing market for the commodity.

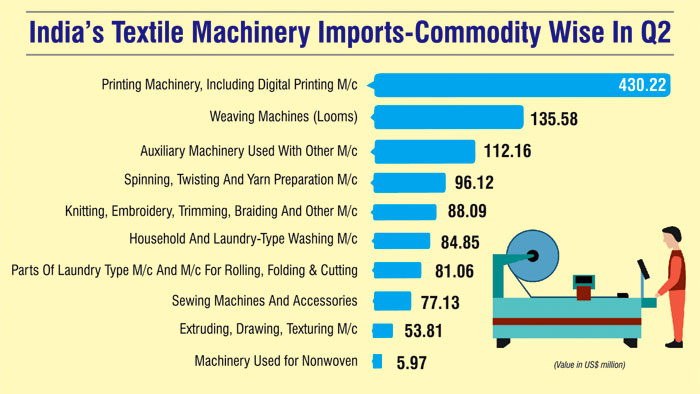

India's textile machinery imports have witnessed a skyrocketing growth in the Q2 of this fiscal year. The imports totalled to US$ 1164.99 million with growth of 23.90% over the previous quarter and 3% over CPLY. All the commodities except nonwoven machines have perceived a positive growth in the second quarter of this fiscal. Printing machines, including digital printing machines account for a major portion of 37% from the total textile machinery imports of India in Q2 with an import value of US$ 430.22 million.

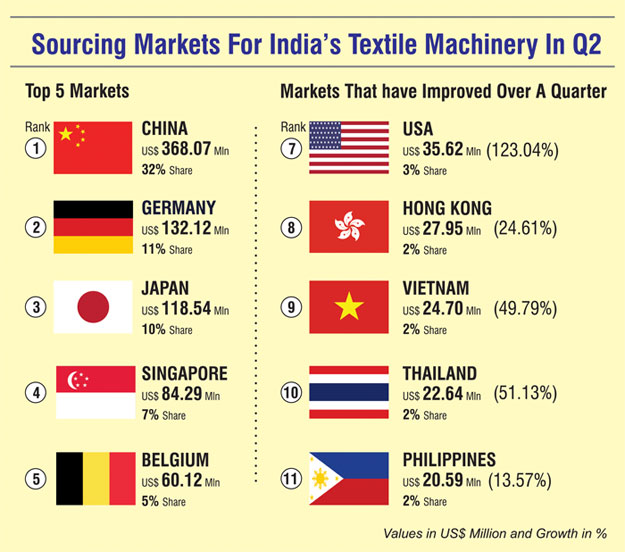

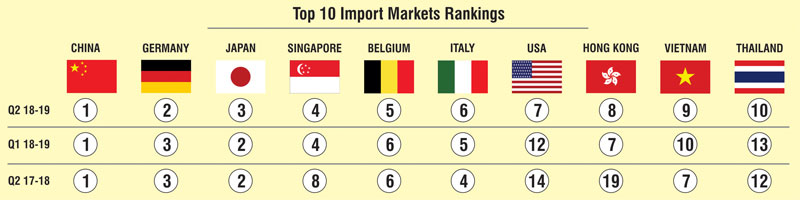

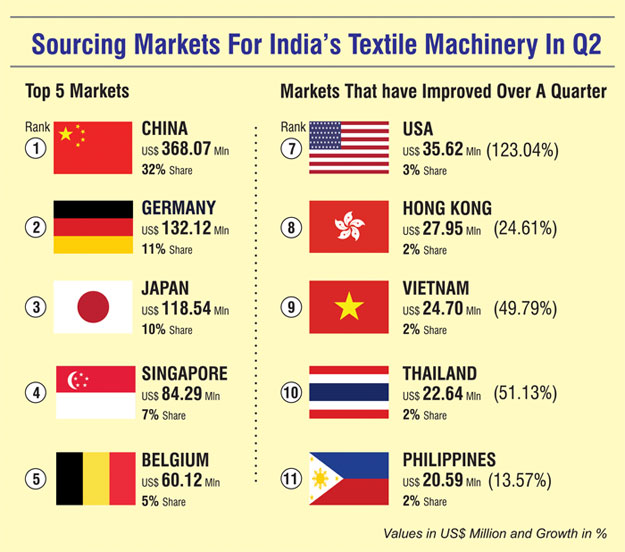

For India, China remains the top sourcing market of textile machinery in Q2 too. The imports in the quarter totalled to US$ 368.07 million. In the previous quarter and CPLY too China was the top import destination for India's textile machinery requirements.

Commodity-wise imports of textile machinery

Printing machinery items were imported the most to India from the world, the commodity perceived a growth of 13.13% over the previous quarter and 14.29 over CPLY. Under this commodity, machine which performs two or more functions of printing have been imported the most to India. Imports totalled to US$ 111.06 million in Q2 with a growth of 37.54% over the previous quarter and 27.16% over CPLY. Inkjet printing machinery has shown an average growth of 20.80% over the previous quarter and 20.09% over CPLY and imports totalled to US$ 20.56 million in Q2 FY 18-19. Offset printing machine other than sheet fed and reed feed have witnessed a substantial growth of 24.29% to US$ 44.40 million in Q2 FY 18-19 over the previous quarter and 78.53% over CPLY. Flexographic printing machinery also have shown an impressive progress in the quarter, the imports totalled to US$ 14.36 million in Q2 FY 18-19 with growth of 26.86% over the previous quarter and 84.58% over CPLY.

India's weaving loom imports on the rise

Imports of weaving machine (looms) are the second topmost commodity in this segment. The imports of weaving machine in Q2 totalled to US$ 135.58 million with growth of 13.51% over the previous quarter, but over CPLY the commodity has witnessed a fall of 4.41%. Shuttleless weaving machine not exceeding a width of 30 cms was imported the most to India under the weaving machine commodity in Q2. The imports of shuttleless weaving machines totalled to US$ 131.77 million with growth of 13.58% over the previous quarter. But the same commodity perceived a negative growth of 2.17% over CPLY.

Auxiliary machines used with other textile machines have shown an interesting growth in Q2 over the previous year as well as over the CPLY. The commodity's import value totalled to US$ 91.58 million, making it the third largest commodity to be imported to the country from the world. This was 22.47% higher over the previous quarter and 1.54% over CPLY.

Nonwoven machine is the only commodity that has witnessed a drop in imports in Q2 over the previous quarter and CPLY. The commodity's imports totalled to US$ 5.97 million in the second quarter, 14.84% and 26.30% lower compared to the previous quarter and CPLY respectively.

Spinning machine imports too pick up in Q2

Spinning, twisting and yarn preparation machine imports have witnessed a rise in the Q2 by 41.85% to US$ 96.12 million over the previous quarter, but while compared to CPLY, the commodity has down by 23.13% and the commodity stakes 8% share from the total imports of India's textile machinery in Q2. Under this commodity, other textile fibre spinning machine is imported the most to India from the world. The product registered a growth of 565.04% in Q2 totalling to US$ 25.87 million over the previous quarter, while over the CPLY the growth declined by 3% only.

Knitting machine imports show mixed trend

Knitting machinery imports has witnessed a seesaw trend in the second quarter of this fiscal. The commodity registered a positive growth of 33.35% over the previous quarters while over the CPLY the same commodity registered a negative of 39.45%. The commodity imports in Q2 totalled to US$ 88.09 million. Under this one, machines used for making embroidery have been the imported the most to India, with import value of US$ 34.17 million in Q2 with a growth of 57.99% over the previous quarter.

Sewing machine imports have gone up by 19.38% over the previous quarter totalling to US$ 77.13 million in Q2 and it perceived a growth of 21.91% over the CPLY. Under this commodity, other sewing machine was largely imported product to India from the world, the imports of the same totalled to US$ 52 million with growth of 21.35% over previous quarter.

Country-wise textile machinery imports to India

China remains the top sourcing destination for India

China remains the top sourcing market for India's textile machinery. India imported textile machinery worth of US$ 368.07 million in Q2 from China. China managed to perceive a minute positive growth of 1.48% over the previous quarter, while over the CPLY imports from China declined 7.87%.

China accounted for 32% of India's textile machinery imports in the Q2. Printing machinery including digital printing is the topmost commodity exported from China to India. Textile printing machinery, including digital printing, imports to India from China totalled to US$ 85.62 million in Q2, but while compared to the previous quarter and CPLY the growths have dropped for the commodity by 37.04% and 1.01% respectively.

Imports of knitting machines have done quite well in the second quarter. Imports totalled to US$ 52.47 million with growth of 27.08% over the previous quarter. Auxiliary machine used with other machine and sewing machine too have done well, with import value of US$ 32.55 million and US$ 36.7 million respectively.

India's weaving loom imports on the rise

Imports of weaving machine (looms) are the second topmost commodity in this segment. The imports of weaving machine in Q2 totalled to US$ 135.58 million with growth of 13.51% over the previous quarter, but over CPLY the commodity has witnessed a fall of 4.41%. Shuttleless weaving machine not exceeding a width of 30 cms was imported the most to India under the weaving machine commodity in Q2. The imports of shuttleless weaving machines totalled to US$ 131.77 million with growth of 13.58% over the previous quarter. But the same commodity perceived a negative growth of 2.17% over CPLY.

Auxiliary machines used with other textile machines have shown an interesting growth in Q2 over the previous year as well as over the CPLY. The commodity's import value totalled to US$ 91.58 million, making it the third largest commodity to be imported to the country from the world. This was 22.47% higher over the previous quarter and 1.54% over CPLY.

Nonwoven machine is the only commodity that has witnessed a drop in imports in Q2 over the previous quarter and CPLY. The commodity's imports totalled to US$ 5.97 million in the second quarter, 14.84% and 26.30% lower compared to the previous quarter and CPLY respectively.

Spinning machine imports too pick up in Q2

Spinning, twisting and yarn preparation machine imports have witnessed a rise in the Q2 by 41.85% to US$ 96.12 million over the previous quarter, but while compared to CPLY, the commodity has down by 23.13% and the commodity stakes 8% share from the total imports of India's textile machinery in Q2. Under this commodity, other textile fibre spinning machine is imported the most to India from the world. The product registered a growth of 565.04% in Q2 totalling to US$ 25.87 million over the previous quarter, while over the CPLY the growth declined by 3% only.

Knitting machine imports show mixed trend

Knitting machinery imports has witnessed a seesaw trend in the second quarter of this fiscal. The commodity registered a positive growth of 33.35% over the previous quarters while over the CPLY the same commodity registered a negative of 39.45%. The commodity imports in Q2 totalled to US$ 88.09 million. Under this one, machines used for making embroidery have been the imported the most to India, with import value of US$ 34.17 million in Q2 with a growth of 57.99% over the previous quarter.

Sewing machine imports have gone up by 19.38% over the previous quarter totalling to US$ 77.13 million in Q2 and it perceived a growth of 21.91% over the CPLY. Under this commodity, other sewing machine was largely imported product to India from the world, the imports of the same totalled to US$ 52 million with growth of 21.35% over previous quarter.

Country-wise textile machinery imports to India

China remains the top sourcing destination for India

China remains the top sourcing market for India's textile machinery. India imported textile machinery worth of US$ 368.07 million in Q2 from China. China managed to perceive a minute positive growth of 1.48% over the previous quarter, while over the CPLY imports from China declined 7.87%.

China accounted for 32% of India's textile machinery imports in the Q2. Printing machinery including digital printing is the topmost commodity exported from China to India. Textile printing machinery, including digital printing, imports to India from China totalled to US$ 85.62 million in Q2, but while compared to the previous quarter and CPLY the growths have dropped for the commodity by 37.04% and 1.01% respectively.

Imports of knitting machines have done quite well in the second quarter. Imports totalled to US$ 52.47 million with growth of 27.08% over the previous quarter. Auxiliary machine used with other machine and sewing machine too have done well, with import value of US$ 32.55 million and US$ 36.7 million respectively.

Germany is an important supplier to India

Germany has gone one notch up, making itself the second largest sourcing market for India's textile machinery. Germany's exports to India totalled to US$ 132.12 million and share of 11% from the total imports of India's textile machinery. Germany perceived a growth of 45.55% in Q2 over the previous quarter, but has gone down by 18.86% over CPLY. Printing machinery including digital printing exports from Germany to India was recorded to be the highest in the Q2.

The exports of printing machinery totalled to US$ 35.42 million with growth of 66.21 % and 29.89% over the previous quarter and CPLY respectively. With a few digits away is the auxiliary machine used with other machines, which is registered to be the second topmost commodity imported in Q2. The imports of auxiliary machinery totalled to US$ 33.20 million with growth of 28.83% over the previous quarter and 28.33% over CPLY.

Japan loses share to Germany

As Germany has exported textile machinery in larger quantity to India, Japan has lost its ranking to third place. In Q2, Japan stands as the third largest sourcing market for India's textile machinery. Japan's exports to India totalled to US$ 118.54 million with growth of only 6.57% in Q2 over the previous quarter, while over the CPLY, Japan's exports declined by 27.69%. Japan stakes 10% share from the total imports of India's textile machinery. Weaving machinery (looms) remains the topmost commodity imported from Japan to India. Weaving machinery imports totalled to US$ 52.96 million in Q2 with growth of 53.24% over the previous quarter and 9.72% over CPLY. Printing machinery including digital printing, imports from Japan have gone by 29.74 in Q1 over the previous quarter with a value of US$ 27.12 million, but has dropped by 52.11% over CPLY.

Germany is an important supplier to India

Germany has gone one notch up, making itself the second largest sourcing market for India's textile machinery. Germany's exports to India totalled to US$ 132.12 million and share of 11% from the total imports of India's textile machinery. Germany perceived a growth of 45.55% in Q2 over the previous quarter, but has gone down by 18.86% over CPLY. Printing machinery including digital printing exports from Germany to India was recorded to be the highest in the Q2.

The exports of printing machinery totalled to US$ 35.42 million with growth of 66.21 % and 29.89% over the previous quarter and CPLY respectively. With a few digits away is the auxiliary machine used with other machines, which is registered to be the second topmost commodity imported in Q2. The imports of auxiliary machinery totalled to US$ 33.20 million with growth of 28.83% over the previous quarter and 28.33% over CPLY.

Japan loses share to Germany

As Germany has exported textile machinery in larger quantity to India, Japan has lost its ranking to third place. In Q2, Japan stands as the third largest sourcing market for India's textile machinery. Japan's exports to India totalled to US$ 118.54 million with growth of only 6.57% in Q2 over the previous quarter, while over the CPLY, Japan's exports declined by 27.69%. Japan stakes 10% share from the total imports of India's textile machinery. Weaving machinery (looms) remains the topmost commodity imported from Japan to India. Weaving machinery imports totalled to US$ 52.96 million in Q2 with growth of 53.24% over the previous quarter and 9.72% over CPLY. Printing machinery including digital printing, imports from Japan have gone by 29.74 in Q1 over the previous quarter with a value of US$ 27.12 million, but has dropped by 52.11% over CPLY.

Imports from other destinations

Singapore's textile machinery exports to India in Q2 have gone up by 5.07% to US$ 84.29 million. Whereas compared over CPLY the country has witnessed a growth of 293.14% and stakes 7% share from the total imports of India's textile machinery in Q2 FY 18-19. Printing machines including digital printing was exported the most from Singapore with value of US$ 58.17million, but the growth has declined by 5.48% and over the CPLY the country has witnessed a growth of 369.87%. Auxiliary machine exports from Singapore have done quite well in the Indian market. It perceived a growth of 65.71% over the previous quarter with import value of US$ 2.32 million.

The other top sourcing countries for India's textile machinery are Belgium with 5% share and imports of US$ 60.12 million, Italy with 4% share and imports of US$ 49.49 million, USA with 3% share and imports of US$ 35.62 million, Hong Kong, Vietnam and Thailand with 2% share each and imports of US$ 27.95 million, US$ 24.70 million and US$ 22.64 million, respectively.

From the top ten countries, imports from Italy (the sixth top sourcing destination for India's textile machinery), recorded a drop of 17.97% in Q2 over the previous quarter.

Imports from other destinations

Singapore's textile machinery exports to India in Q2 have gone up by 5.07% to US$ 84.29 million. Whereas compared over CPLY the country has witnessed a growth of 293.14% and stakes 7% share from the total imports of India's textile machinery in Q2 FY 18-19. Printing machines including digital printing was exported the most from Singapore with value of US$ 58.17million, but the growth has declined by 5.48% and over the CPLY the country has witnessed a growth of 369.87%. Auxiliary machine exports from Singapore have done quite well in the Indian market. It perceived a growth of 65.71% over the previous quarter with import value of US$ 2.32 million.

The other top sourcing countries for India's textile machinery are Belgium with 5% share and imports of US$ 60.12 million, Italy with 4% share and imports of US$ 49.49 million, USA with 3% share and imports of US$ 35.62 million, Hong Kong, Vietnam and Thailand with 2% share each and imports of US$ 27.95 million, US$ 24.70 million and US$ 22.64 million, respectively.

From the top ten countries, imports from Italy (the sixth top sourcing destination for India's textile machinery), recorded a drop of 17.97% in Q2 over the previous quarter.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.