Centre Woos Textiles With Rebate For Central and State Embedded Taxes

The Union Cabinet chaired by Prime Minister Narendra Modi has approved the Scheme to Rebate State and Central Embedded Taxes to Support the Textile Sector. This will enable the Government to take various measures for making exports of apparel and made-ups zero rated. At present, apparel and made-ups segments are supported under the Scheme for Rebate of State Levies (RoSL). However, certain State as well as Central Taxes continued to be present in the cost of exports. The Cabinet decision provides for a scheme to rebate all embedded State and Central Taxes/levies for apparel and made-ups which have a combined share of around 56% in India’s textile export basket. Rebate of taxes/levies has been permitted through an IT-driven scrip system at notified rates. The proposed measures are expected to make the textile sector competitive. Rebate of all Embedded State and Central taxes/levies for apparel and made-ups segments would make exports zero-rated, thereby boosting India’s competitiveness in export markets and it will ensure equitable and inclusive growth of textile and apparel sector.

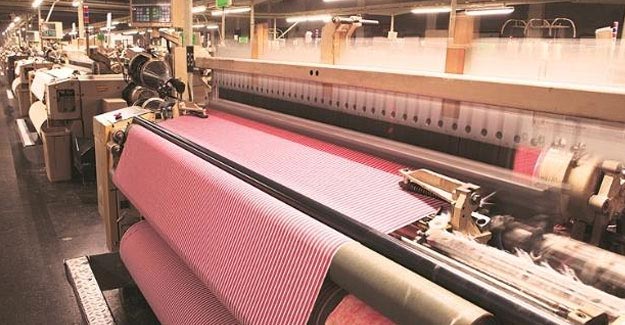

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.