US Apparel Buyers Explored New Markets In 2018

After the turmoil of 2018, US apparel imports seem to be starting on a stronger note. US apparel imports in January 2019 totalled US$ 7.57 billion, 25% higher than in December 2018.

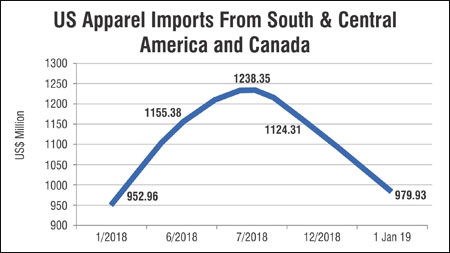

Analyses of the data reveals that US is again buying from its traditional markets - China, Vietnam, Bangladesh, India, and others, in 2019. We say again, because especially in the second half of 2018, there was a clear shift of US buying to nearby destinations of Central and South America. In January, imports from these regions have dropped, compared to a month ago.

In fact, after the US imposed tariffs on China, from July 2018, it seems that US apparel retailers and buying houses began exploring newer markets to source from, and near sourcing surely seemed the order of the day. Besides, the US also sourced a lot of high end apparel from Europe. And Ethiopia's exports to US are witnessing a robust increase. There are once again clear signs of shifting supply chains in the apparel market.

We take a closer look at how the US sourced its apparel in 2018, and did dwindling imports from China translate to more orders for other South Asian players or to suppliers in other regions.

US apparel imports from January-June 2018

US apparel imports in June 2018, compared to January 2018 had witnessed a drop of 6.2% in value terms. Despite the NAFTA ambiguity, imports from Canada and Mexico rose during this period, by 30% and 11.71% respectively.

US buyers were also sourcing more from Guatemala, El Salvador, Honduras, Costa Rica, Haiti, Dominican Republic, Bolivia, Chile, Argentina. Other nearby sourcing destinations - Nicaragua, Panama, Brazil, Paraguay - were not able to supply much to the US market during this period.

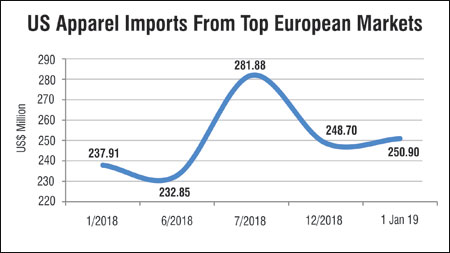

In Europe, US imports were up from Sweden, Denmark, United Kingdom, Ireland, the Netherlands, Belgium, France and Germany, either in terms of volume, or value or both. Imports from Italy too picked up, while from traditional markets of Spain and Portugal, imports were down.

Europe is known for high value apparel, and this is also evident from the unit value realisations that these countries earned from US buyers. For instance, Denmark's UVR in January was US$ 16.66 a piece, which had gone up to US$ 25.80 in June.

Similarly, goods from Belgium had improved their UVRs from US$ 22 to US$ 30.42 a piece. And France from US$ 24.81 to US$ 27.43. In other markets, UVRs either fell, or did not change much during the six months. But all remained in double digits, pointing to high fashion and functional apparel.

US imports from East Europe and Central Asia showed some interesting trends. Some new destinations that US buyers decided to source more from included Slovakia, Hungary, Belarus, Armenia, Kyrgyzstan (though quantities were in a few hundred pieces). From most of these markets too, UVRs remained in double digits, and in some cases, improved significantly over six months.

Imports were significantly higher from Bosnia-Herzgovina and Greece, while Turkey could not export much to the US, obviously due to the economic and political tensions between the two countries.

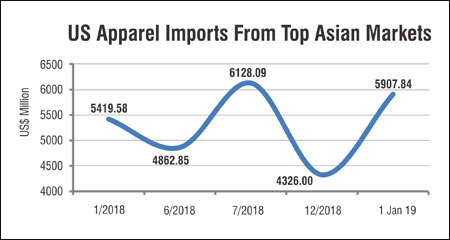

Surprisingly, US apparel imports from almost all of the traditional Asian suppliers-China, Bangladesh, India, Vietnam, Cambodia, Thailand, Pakistan, Indonesia, Philippines, among others-was significantly down in the first half of 2018.

Imports went up from South Korea and Japan. It is to be noted that in June 2018 compared to January 2018, US apparel imports from India, Cambodia, Vietnam and other countries fell in double digits.

Surprisingly, imports from China were down 5.53%, while imports from Bangladesh fell by around 3%. From the African region, imports were seen increasing from Ethiopia and Lesotho, and were dropping from Kenya, despite the AGOA.

More marked shift in sourcing choices in the second half of 2018

Between July and September, 2018, the US imposed tariffs on imported Chinese goods, including textile and apparel. And this led to an even more marked shift in sourcing from July to December 2018. In the second half of 2018, imports from Canada and Mexico fell by 27.3% and 17.88% respectively, as NAFTA was replaced.

Imports from South and Central America continued to rise, with a decline witnessed only from Dominican Republic and Peru. UVRs were significantly higher for Chile, Bolivia, Peru, Ecuador, Panama, Nicaragua.

While the US was sourcing a lot from Europe in the first half of 2018, by the second half, apparel exports from Europe to US showed a declining trend, except from Iceland and Norway (from where only a few thousand apparel were imported). US importers were paying a higher price for apparel in the second half of 2018, from most of the European markets, including Norway, UK, Ireland, Germany.

US apparel imports from Eastern Europe were falling during this period. In Central Asia, surprisingly, imports from Russia had picked up by 52% in the latter half of 2018. Imports from Armenia grew by 218%, from Georgia by 176.47%, and from Kyrgyzstan by 4473.27%. UVRs had improved for the Czech Republic, Lithuania, Russia, Belarus, and Uzbekistan. In the Middle East region, US apparel imports continued to rise from the UAE, as prices of apparel came down. While imports from Israel , Jordan, Oman continued to fall.

Between July and September, 2018, the US imposed tariffs on imported Chinese goods, including textile and apparel. And this led to an even more marked shift in sourcing from July to December 2018. In the second half of 2018, imports from Canada and Mexico fell by 27.3% and 17.88% respectively, as NAFTA was replaced.

Imports from South and Central America continued to rise, with a decline witnessed only from Dominican Republic and Peru. UVRs were significantly higher for Chile, Bolivia, Peru, Ecuador, Panama, Nicaragua.

While the US was sourcing a lot from Europe in the first half of 2018, by the second half, apparel exports from Europe to US showed a declining trend, except from Iceland and Norway (from where only a few thousand apparel were imported). US importers were paying a higher price for apparel in the second half of 2018, from most of the European markets, including Norway, UK, Ireland, Germany.

US apparel imports from Eastern Europe were falling during this period. In Central Asia, surprisingly, imports from Russia had picked up by 52% in the latter half of 2018. Imports from Armenia grew by 218%, from Georgia by 176.47%, and from Kyrgyzstan by 4473.27%. UVRs had improved for the Czech Republic, Lithuania, Russia, Belarus, and Uzbekistan. In the Middle East region, US apparel imports continued to rise from the UAE, as prices of apparel came down. While imports from Israel , Jordan, Oman continued to fall.

In Asia, which remains the main supplier to the US apparel market, US imports continued to slow down. Firstly, a clear impact of the trade war is seen on China's exports. Exports in December were 33.84% lower than in July 2018. Also, exports from Hong Kong, which in the first half of 2018 had witnessed a rise in terms of quantity, saw a major fall of 51% in value and 69.45% in volume of apparel exported to the US. China's UVRs were around US$ 2.21 a piece in December, 6.6% lower than in July. Exports to the US fell drastically from India, Pakistan, Nepal, Bangladesh, Vietnam, Cambodia, Malaysia, Indonesia, Philippines and also South Korea. US imported a little more apparel from Sri Lanka, Thailand, Laos and Japan.

Within the African region, imports from Ethiopia and Lesotho continued to rise, while Kenya suffered an export setback despite the large number of Chinese investments happening in Kenya's textile industry.

US apparel imports in January 2019

And the traditional supply chains seem to be operating again from the beginning of 2019. US apparel imports in January 2019 were 25.34% higher compared to a month before. In January, imports from Canada and Mexico picked up 9.86% and 3.87% respectively.

The January statistics seem to show a reversal in import trends in South and Central America. US apparel imports went up only from Guatemala (3.26%), Panama (151.79%), Ecuador (8.5%), and Peru (22.19). But fell from the other countries, after thriving for six to eight months.

US apparel imports from Europe remained sluggish in January.

Imports from Eastern Europe show a mixed trend, with imports rising from Czech Republic (19.95%), Lithuania (10.51%), Poland (29.30%). Imports from Russia were down 92.62% in January, while imports from Belarus increased 174.51%. Imports have also improved from Greece (43.21%), and Turkey (11.75%)

In Asia, which remains the main supplier to the US apparel market, US imports continued to slow down. Firstly, a clear impact of the trade war is seen on China's exports. Exports in December were 33.84% lower than in July 2018. Also, exports from Hong Kong, which in the first half of 2018 had witnessed a rise in terms of quantity, saw a major fall of 51% in value and 69.45% in volume of apparel exported to the US. China's UVRs were around US$ 2.21 a piece in December, 6.6% lower than in July. Exports to the US fell drastically from India, Pakistan, Nepal, Bangladesh, Vietnam, Cambodia, Malaysia, Indonesia, Philippines and also South Korea. US imported a little more apparel from Sri Lanka, Thailand, Laos and Japan.

Within the African region, imports from Ethiopia and Lesotho continued to rise, while Kenya suffered an export setback despite the large number of Chinese investments happening in Kenya's textile industry.

US apparel imports in January 2019

And the traditional supply chains seem to be operating again from the beginning of 2019. US apparel imports in January 2019 were 25.34% higher compared to a month before. In January, imports from Canada and Mexico picked up 9.86% and 3.87% respectively.

The January statistics seem to show a reversal in import trends in South and Central America. US apparel imports went up only from Guatemala (3.26%), Panama (151.79%), Ecuador (8.5%), and Peru (22.19). But fell from the other countries, after thriving for six to eight months.

US apparel imports from Europe remained sluggish in January.

Imports from Eastern Europe show a mixed trend, with imports rising from Czech Republic (19.95%), Lithuania (10.51%), Poland (29.30%). Imports from Russia were down 92.62% in January, while imports from Belarus increased 174.51%. Imports have also improved from Greece (43.21%), and Turkey (11.75%)

Imports are again picking up from Israel (148.62), Jordan (48.78%), UAE (50.54%), though volumes from UAE fell. In a complete reversal, every Asian supplier country has recorded strong sales of apparel to the US in January, except Japan. And in the African region, exports of apparel from Ethiopa to the US continue to rise, and Kenya's apparel exports in January rose 56% compared to exports in December 2018.

Will the trend continue in 2019?

US personal spending slowed for the first time in more than two years in December 2018, reflecting a weak consumer at the end of 2018, while personal income also dipped in January.

The Commerce Department said consumer spending, which accounts for more than two-thirds of US economic activity, dropped 0.5% last month, its first decline since September 2016. Economists had forecast a drop of 0.2%. The report also showed that personal income dropped 0.1% in January, its first decline in nearly three years.

US Q4 growth revised down to 2.2% from 2.6%

US economic growth cooled by more than initially reported last quarter on revisions to consumer and government spending. Gross domestic product grew at a 2.2% annualised rate, less than the initial 2.6% reading and projections for a revision of 2.3%. Policy makers have cut their outlook for growth this year and next and forecast no interest rate hikes for 2019.

Economists project that growth in GDP will slow to 1.5% in the first quarter, the slowest pace in two years. But economists said that underlying economic fundamental remain strong, unemployment rate is the lowest in many years.

Retail restructuring in the US market

According to Coresight Research, 4,810 store closures have been announced by US retailers till March. While many have declared bankruptcy, there are warning signs that some others may follow suit.

However, ecommerce remains strong, and Indian exporters will have to find ways to service this segment of demand, alongwith the traditional exports. It should be noted that 2018 was a year when US buyers went all out to explore markets across the globe, and have created diverse supply chains, and networks to distribute risks.

Imports are again picking up from Israel (148.62), Jordan (48.78%), UAE (50.54%), though volumes from UAE fell. In a complete reversal, every Asian supplier country has recorded strong sales of apparel to the US in January, except Japan. And in the African region, exports of apparel from Ethiopa to the US continue to rise, and Kenya's apparel exports in January rose 56% compared to exports in December 2018.

Will the trend continue in 2019?

US personal spending slowed for the first time in more than two years in December 2018, reflecting a weak consumer at the end of 2018, while personal income also dipped in January.

The Commerce Department said consumer spending, which accounts for more than two-thirds of US economic activity, dropped 0.5% last month, its first decline since September 2016. Economists had forecast a drop of 0.2%. The report also showed that personal income dropped 0.1% in January, its first decline in nearly three years.

US Q4 growth revised down to 2.2% from 2.6%

US economic growth cooled by more than initially reported last quarter on revisions to consumer and government spending. Gross domestic product grew at a 2.2% annualised rate, less than the initial 2.6% reading and projections for a revision of 2.3%. Policy makers have cut their outlook for growth this year and next and forecast no interest rate hikes for 2019.

Economists project that growth in GDP will slow to 1.5% in the first quarter, the slowest pace in two years. But economists said that underlying economic fundamental remain strong, unemployment rate is the lowest in many years.

Retail restructuring in the US market

According to Coresight Research, 4,810 store closures have been announced by US retailers till March. While many have declared bankruptcy, there are warning signs that some others may follow suit.

However, ecommerce remains strong, and Indian exporters will have to find ways to service this segment of demand, alongwith the traditional exports. It should be noted that 2018 was a year when US buyers went all out to explore markets across the globe, and have created diverse supply chains, and networks to distribute risks.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.