2019 State Of The US Textile Industry

Rising Textile Production, Exports, Employment Makes Tariff Policies More Relevant

Outgoing Chairman Marty Moran outlined economic, employment and trade data; 2019 priority policies; and other NCTO activities during his "State of the US Textile Industry" address during NCTO's 16th annual meeting.

"It has been an amazing year for the US textile industry and the National Council of Textile Organizations (NCTO). President Trump's pro-manufacturing agenda is forcing Washington to question longstanding norms, forcing the Washington establishment to rethink policies on trade, taxation, regulatory reform and a host of other issues. The time for change is now and NCTO is committed to working with the Trump administration and our allies in Congress to achieve the best policy outcomes on these and other issues," said Marty Moran, in his address at NCTO's 16th annual meeting.

He went on to recap the US textile industry's performance in 2018.

US textile production, exports, employment are rising

Thanks to its productivity, flexibility and innovation, the US textile industry has cemented its position in the global market.

In 2018, the value of US man-made fibre and filament, textile, and apparel shipments totaled an estimated US$ 76.8 billion, this is an uptick from the US$ 73 billion in output in 2017, and an increase of 12% since 2009.

The breakdown of 2018 shipments by industry sector is:

The breakdown of 2018 shipments by industry sector is:

- US$ 30 billion for yarns and fabrics;

- US$ 27.4 billion for home furnishings, carpet & other non-apparel sewn products;

- US$ 11.6 billion for apparel; and

- An estimated US$ 7.7 billion for manmade fibres.

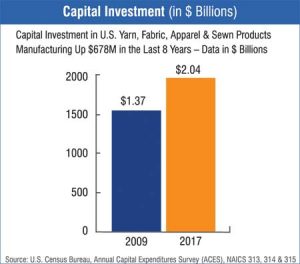

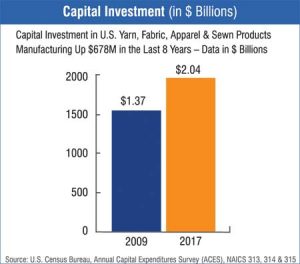

Capital expenditures also are healthy. Investment in fibre, yarn, fabric, and other non-apparel textile product manufacturing is up 79% from US$ 960 million in 2009 to US$ 1.7 billion in 2018.

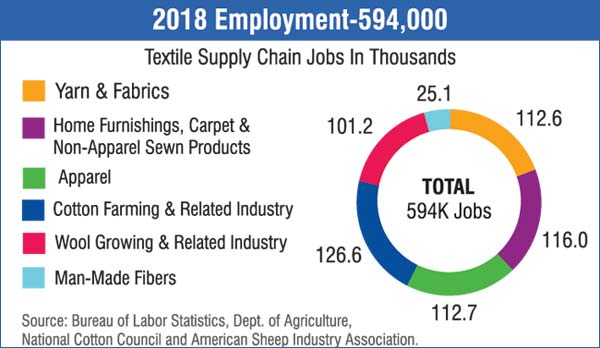

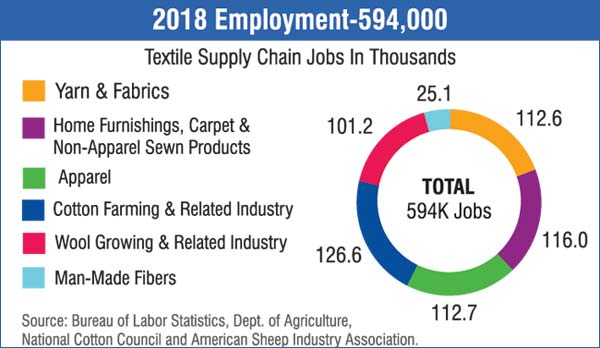

The sector's supply chain employs 594,147 workers. The 2018 figures include:

- 112,575 jobs in yarns and fabrics;

- 116,042 jobs in home furnishings, carpet, and other non-apparel sewn products;

- 112,692 jobs in apparel manufacturing;

- 25,100 jobs in manmade fibres;

- 126,553 jobs in cotton farming and related industry; and

- 101,186 jobs in wool growing and related industry.

The heavy job losses incurred because of massive import surges in the 1995-2008 timeframe, virtually have stopped. Today, like most other US manufacturing sectors, fluctuations in employment figures are generally due to normal business cycles, new investment, or productivity increases.

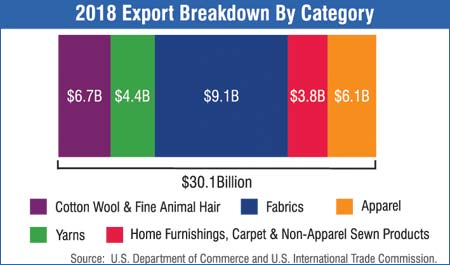

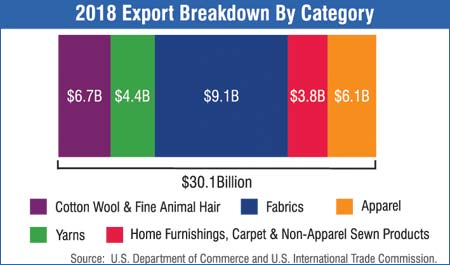

US exports of fibre, yarns, fabrics, made-ups, and apparel were US$ 30.1 billion in 2018.

This is 5.4% increase in export performance over the US$ 28.6 billion figure for 2017. Shipments to NAFTA and CAFTA-DR countries accounted for 47.5% of all US textile supply chain exports.

The breakdown of exports by sector is as follows:

- US$ 6.7 billion - cotton and wool;

- US$ 4.4 billion - yarns;

- US$ 9.1 billion - fabrics;

- US$ 3.8 billion - home furnishings, carpet & other non-apparel sewn products; and

- US$ 6.1 billion - apparel.

In 2018, the US was the world's second largest individual country exporter of fibres, yarns, fabrics, non-apparel sewn products.

The most important US export markets by region are:

- US$ 11.7 billion-USMCA;

- US$3.5 billion-CAFTA-DR;

- US$ 2.8 billion - Asia;;

- US$ 2.7 billion-Europe;; and

- US$ 2.8 billion - Rest of World.

Focusing solely on America's US$ 19.7 billion in manufactured fibre, yarn and fabric exports, the countries buying the most product are:

- US$ 4.4 billion - Mexico;

- US$ 2.1 billion - Canada;

- US$ 1.6 billion - China;

- US$ 1.5 billion - Vietnam; and

- US$ 1.4 billion-Honduras.

The numbers show that the fundamentals for the US textile industry are sound. This is true even though some markets for US textiles and apparel were soft last year. For the most part, any sluggishness was due to factors beyond control, such as disruption in the retail sector caused by the shifting of sales from brick-and-mortar outlets to the internet.

The US textile industry's commitment to capital reinvestment, and a continued emphasis on quality and innovation make it well-positioned to adapt to market changes and take advantage of opportunities as 2019 moves along.

Policy Issues

"For decades, US policy systematically undervalued the importance of domestic manufacturing, and President Trump is right that this has hurt America," said Moran.

"NCTO agrees with President Trump that US trading relationships must be rooted in fairness and reciprocity to benefit a broad swath of American society."

America's most important trading relationship is NAFTA, a pillar upon which the US-Western Hemisphere textile supply chain is built. At US$ 11.7 billion combined, Mexico and Canada are the US textile industry's largest export markets. Moreover, Mexico provides vital garment assembly capacity that the United States lacks at this time.

While strongly supporting the free trade structure established under NAFTA, NCTO also firmly agreed with President Trump's desire to improve the terms of the original agreement. Specifically, NCTO advocated for the following improvements as part of the NAFTA renewal negotiation:

- Maintain yarn forward as the fundamental rule-of-origin for the textile sector;

- Eliminate tariff preference levels (TPLs) on apparel, non-apparel sewn products, fabrics and yarn;

- Require use of NAFTA-origin components beyond the "essential character" of the fabric, i.e. sewing thread, pocketing and narrow elastics;

- Strengthen buy American laws for Department of Homeland Security textiles and clothing by closing the Kissell Amendment loophole for Canada and Mexico; and

- Strengthen customs enforcement.

Majority of these objectives were accomplished in the agreement reached between the parties late last year under what has come to be known as the United States-Mexico-Canada Agreement (USMCA). Especially the fact that the basic yarn forward rule was preserved as the origin requirement for duty-free treatment. In addition, the USMCA represents a demonstrative improvement for US manufacturers of component parts such as thread, pocketing, narrow elastics, and coated fabrics. These items will have stronger origin requirements under the new agreement that will certainly boost sales to North American customers.

The USMCA will also close the Kissell loophole for Transportation Security Administration contracts. This new requirement will make it impossible for TSA prime contractors to replace US textile inputs with competitive materials made in Mexico. Finally, there is an important fundamental objective that was achieved with the finalisation of an agreement between the three countries. When the United States first announced its intention to renegotiate NAFTA, there was overwhelming input from NCTO members that a dismantling of NAFTA, or a significant dilution of the yarn-forward rule of origin, would be disastrous. These fears were driven by the critical need to preserve the nearly US$ 12 billion in current US textile exports to our NAFTA partners. With the conclusion of a successful negotiation, these fears have now largely abated.

Trading with China

Moran, in his address, commended the US government for its work towards tackling the unfair trade practices adopted by China. However, higher tariffs on imported raw materials will hurt the US textile manufacturing industry, which is again gaining traction after many years.

"Overall, the vast majority of products identified for penalty tariffs in our sector have been inputs, and we think that a major opportunity is being missed by this approach. Throughout the process, NCTO has consistently pressed for a more precise and refined approach involving finished products as opposed to manufacturing inputs. Selecting finished goods, which generally contain 100% Chinese fibre, yarn and fabric components, would create benefits throughout the US supply chain. Further, end items - specifically apparel and home furnishings - are the root of our sector's problem with China. As a result, we feel that the targeting of finished products would dramatically improve the chances of bringing about serious reforms. NCTO will continue to make this case and engage heavily in the 301 process," he said.

New free trade agreements, but not with non-market economies

NCTO has already begun engagement with the Trump Administration in relation to its intention to negotiate new free trade agreements with the The European Union, the United Kingdom; and Japan.

The NCTO believes that the United States government should insist on the following fundamental aspects in these negotiations:

- Establishment of a strong yarn forward rule of origin;

- Extended duty phase-outs, where warranted, for products deemed to be sensitive; and

- Inclusion of effective and separate customs textile enforcement language.

He stated that NCTO supports President Trump's preference for individual bilateral free trade agreements (FTAs) over multilateral arrangements. Moreover, any new FTA targets should be limited to countries that trade in a fair, reciprocal manner. NCTO is opposing any FTAs with non-market economy countries like China and Vietnam because of the unfair advantages that producers in those countries derive from their state-run economies.

NCTO has worked to ensure that textiles be designated a Priority Trade Issue by Congress, recognising the fact that textile and apparel shipments comprise more than 40% of all duties collected by Customs and Border Protection (CBP). Noting that the US collected over US$ 13 billion in textile and apparel tariffs in 2018, there exists tremendous incentive to circumvent customs laws in the sector.

NCTO supports Miscellaneous Tariff Bill

In 2019, NCTO will reengage in the Miscellaneous Tariff Bill process. According to Moran, "NCTO members should be prepared to seek MTB treatment on inputs that are not available from a domestic source. Members should also be prepared to oppose MTB requests for items that would undermine US production and employment.

Further, NCTO will oppose the inclusion of finished products, noting that they distort the intended premise of providing duty relief on inputs that undergo further processing by US manufacturers."

NCTO is also monitoring and is prepared to oppose various evolving initiatives that are designed to undercut the US tariff structure. These include proposals such as:

- Granting duty relief under the Generalized System of Preferences for apparel;

- Expanding the use of Section 321 De Minimis duty breaks for importers; and

- Eliminating US duties on high-performance outerwear.

Strengthen Buy American

With respect to government procurement policy, NCTO steadfastly supports the Berry Amendment. This "buy American" provision for the military is an example of how the government and private sector can work together for mutual benefit.

The US military gets a secure US supply line for thousands of superior, highly-advanced products. In return, the domestic textile sector receives US$1.5-2 billion in annual Defense Department sales that boost US investment and employment. NCTO wants the government to work towards strengthening this law.

Strengthen market for functional textiles

NCTO urges Congress to follow President Trump's lead by drafting and passing a comprehensive plan to rebuild America's infrastructure. Besides boosting US productivity and facilitating commerce, infrastructure is a key market for textile products such as workwear, geosynthetics, and filtration systems.

Fostering a national culture of innovation is also important. NCTO urges continued support for the Advanced Functional Fabrics of America (AFFOA). This Defense Department-funded programme is matched three to one with private dollars, and tasked with making it easier to develop and commercialise the next generation of high-performance textiles.

Further support to US textile industry

NCTO also calls for the US government to invest in improving automation for garment assembly. This technology shows promising potential to reshore US textile and apparel production and jobs.

Another NCTO priority is ensuring that the US textile industry has uninterrupted access to reasonably priced energy. In addition, most man-made fibres are derivatives of petroleum products and many textile producers are reliant on natural gas to power manufacturing operations. Noting this, NCTO supports construction of expanded oil and gas pipeline capacity to keep energy prices low.

Finally, the US textile industry must acknowledge its workforce is aging, making the recruitment of new talent a priority. US companies must continue to forge links with local and state leaders, and educators to make sure government policy nurtures a labour pool both adequate in size and well prepared to succeed in a competitive global economy.

Other NCTO Activities

One year ago, NNCTO initiated a merger with the American Fiber Manufacturers Association (AFMA), a fellow trade association representing domestic manufacturers of man-made fibre. From NCTO's perspective, the merger with AFMA helped to add new members, financial resources and extend NCTO's political reach. It also solidified NCTO's status as the policy voice of every facet of the US textile production chain. From the perspective of former AFMA members, the merger has preserved a seat at the federal policy table for the multi-billion dollar US man-made fibre sector.

In terms of membership recruitment as a whole, NCTO enjoyed a superlative year. A total of 22 new companies joined NCTO's membership rolls for the first time. An additional three companies, rejoined NCTO's membership.

"This past year we also continued NCTO's American Textiles: We Make Amazing™ campaign, which is helping to rebrand the US textile sector's image. America's textile industry is world class thanks to leveraging the most cutting-edge production processes, investing in the best machinery, and leading in sustainability and innovation. Our We Make Amazing campaign is intent on making sure that policy makers and members of the press have an accurate and positive understanding of the modern US textile industry.

Textile Excellence

Previous News

"our zeal to innovate and excel - key elements for our market leadership position"

Next News

smriti irani retains textiles ministry, nirmala sitharaman becomes first woman finance minister

The breakdown of 2018 shipments by industry sector is:

The breakdown of 2018 shipments by industry sector is:

Capital expenditures also are healthy. Investment in fibre, yarn, fabric, and other non-apparel textile product manufacturing is up 79% from US$ 960 million in 2009 to US$ 1.7 billion in 2018.

The sector's supply chain employs 594,147 workers. The 2018 figures include:

Capital expenditures also are healthy. Investment in fibre, yarn, fabric, and other non-apparel textile product manufacturing is up 79% from US$ 960 million in 2009 to US$ 1.7 billion in 2018.

The sector's supply chain employs 594,147 workers. The 2018 figures include:

The heavy job losses incurred because of massive import surges in the 1995-2008 timeframe, virtually have stopped. Today, like most other US manufacturing sectors, fluctuations in employment figures are generally due to normal business cycles, new investment, or productivity increases.

US exports of fibre, yarns, fabrics, made-ups, and apparel were US$ 30.1 billion in 2018.

This is 5.4% increase in export performance over the US$ 28.6 billion figure for 2017. Shipments to NAFTA and CAFTA-DR countries accounted for 47.5% of all US textile supply chain exports.

The breakdown of exports by sector is as follows:

The heavy job losses incurred because of massive import surges in the 1995-2008 timeframe, virtually have stopped. Today, like most other US manufacturing sectors, fluctuations in employment figures are generally due to normal business cycles, new investment, or productivity increases.

US exports of fibre, yarns, fabrics, made-ups, and apparel were US$ 30.1 billion in 2018.

This is 5.4% increase in export performance over the US$ 28.6 billion figure for 2017. Shipments to NAFTA and CAFTA-DR countries accounted for 47.5% of all US textile supply chain exports.

The breakdown of exports by sector is as follows: