Short Term Outlook In Current Major Cotton Yarn Markets

China

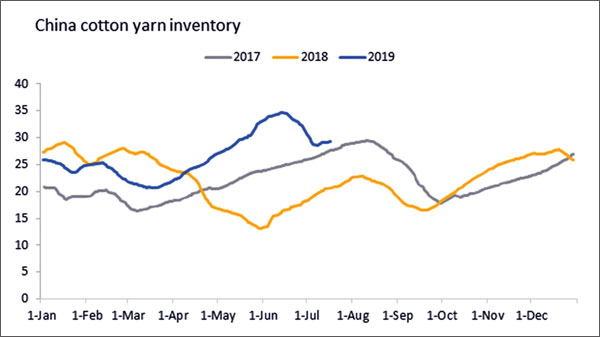

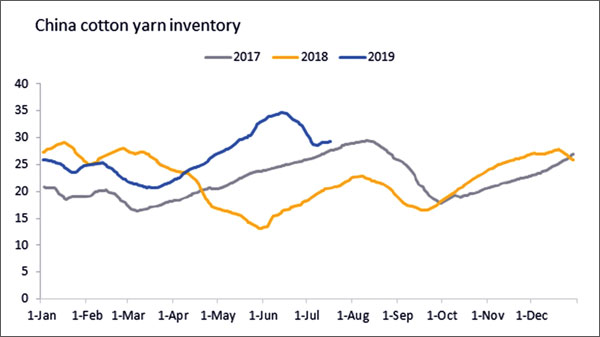

In terms of inventory, due to downstream replenishment after the G20 summit, cotton yarn market improved, but the continuity was not enough. It was a speculative replenishment of downstream mills that resulted in tolerable destocking rate of yarn mills and imported yarn traders. After ZCE cotton futures fell again on July 9, downstream mills resumed to purchase stocks passively, and cotton yarn sales were sluggish. Yarn mill inventory was still at high level, and destocking still needed time.

In terms of operating rate, Chinese yarn mills mostly cut production, and there was no significant recovery. However, as ZCE cotton futures dropped again, feedstock cost moved down again, and profits of spinners purchasing spot cotton recovered. Amid approaching peak season, operating rate of spinners with better operations are expected to recover. If mills cannot recover operating rate, then they have to cut production passively.

Although sales ratio is expected to recover somewhat, the price may still face pressure and fall, mainly due to shrinkage of consumption and uncertainties. Cotton and cotton yarn price decrease could be difficult to reverse. Macroeconomically, Sino-US relations are still challenging. Trade problems between Japan and South Korea continued to affect the healthy operation of China and the global economy. Under economic pressure, overall commodity remained tenuous.

India

Due to strong support of MSP, Indian cotton price was still at high level in the world, leading to high cost of Indian yarn mills and rarely competitive Indian yarn price. Capacity expansion and slack exports in the past few years led to huge sales pressure on domestic cotton yarn. At present, Indian yarn mills have high inventory, available for over two months. The liquidity problem is serious and operating rate generally moved down. Organised production cut emerged in Northern India, indicating that pessimistic mood will spread on cotton market in the next three to four months.

In terms of operating rate, Chinese yarn mills mostly cut production, and there was no significant recovery. However, as ZCE cotton futures dropped again, feedstock cost moved down again, and profits of spinners purchasing spot cotton recovered. Amid approaching peak season, operating rate of spinners with better operations are expected to recover. If mills cannot recover operating rate, then they have to cut production passively.

Although sales ratio is expected to recover somewhat, the price may still face pressure and fall, mainly due to shrinkage of consumption and uncertainties. Cotton and cotton yarn price decrease could be difficult to reverse. Macroeconomically, Sino-US relations are still challenging. Trade problems between Japan and South Korea continued to affect the healthy operation of China and the global economy. Under economic pressure, overall commodity remained tenuous.

India

Due to strong support of MSP, Indian cotton price was still at high level in the world, leading to high cost of Indian yarn mills and rarely competitive Indian yarn price. Capacity expansion and slack exports in the past few years led to huge sales pressure on domestic cotton yarn. At present, Indian yarn mills have high inventory, available for over two months. The liquidity problem is serious and operating rate generally moved down. Organised production cut emerged in Northern India, indicating that pessimistic mood will spread on cotton market in the next three to four months.

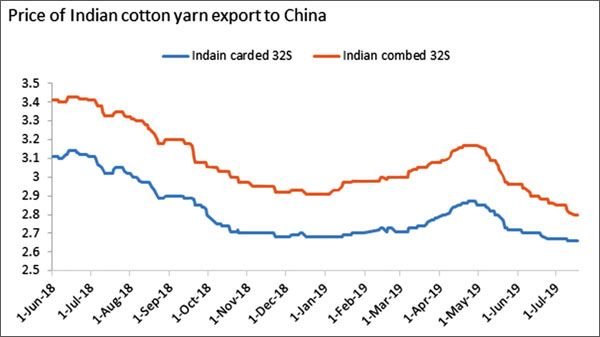

At present, price of Indian cotton yarn export to China remains weak amid poor sales. Price of second-lined combed 32S dyeing is around Rs195/kg, and export cost is about $2.8/kg, equal to 22,800 yuan/mt. The price is mainly the same as that of China spot market. However, amid bleak market of China knitting yarn, orders are still slack. The price of carded 32S for weaving is around Rs185/kg, cost of exporters is around $2.67/kg, equal to 21,800yuan/mt, 1,000yuan/ mt higher than China spot.

As MSP cannot change, Indian mills may force domestic high price down by importing cotton. However, cotton yarn will still not have global competitiveness in the short term, and spinners' burden is expected to continue. Weak anticipation towards price spread on the market, and only with price decrease, competitiveness will gradually recover and Indian yarn can regain export market.

Vietnam

After the G20 Summit, due to market recovery, downstream speculative replenishment led to tolerable sales, so the market had speculative orders for Vietnamese yarn. Due to high prices in India and China orders concentrated in Vietnam, sales in Vietnam improved significantly and prices rebounded.

At present, price of Indian cotton yarn export to China remains weak amid poor sales. Price of second-lined combed 32S dyeing is around Rs195/kg, and export cost is about $2.8/kg, equal to 22,800 yuan/mt. The price is mainly the same as that of China spot market. However, amid bleak market of China knitting yarn, orders are still slack. The price of carded 32S for weaving is around Rs185/kg, cost of exporters is around $2.67/kg, equal to 21,800yuan/mt, 1,000yuan/ mt higher than China spot.

As MSP cannot change, Indian mills may force domestic high price down by importing cotton. However, cotton yarn will still not have global competitiveness in the short term, and spinners' burden is expected to continue. Weak anticipation towards price spread on the market, and only with price decrease, competitiveness will gradually recover and Indian yarn can regain export market.

Vietnam

After the G20 Summit, due to market recovery, downstream speculative replenishment led to tolerable sales, so the market had speculative orders for Vietnamese yarn. Due to high prices in India and China orders concentrated in Vietnam, sales in Vietnam improved significantly and prices rebounded.

Current cargos are around August shipment, and spinners with better sales witness September shipment cargos. In general, amid advantages of shipping schedule and price of Vietnamese yarn, sales burden significantly reduced, and textile mills saw better operations. As long as cotton price does not plummet, Vietnamese yarn mills will run normally, and the price is expected to remain stable in the short term.

Pakistan

Exports to China remained stable due to policy advantages. In terms of price, due to more orders recently, price of forward yarn was the earliest to bottom up. In the previous period, lowest price of ordinary quality Pakistani siro-spun carded 10S dropped to $395-400/bale, and traded price rose to $405-410/bale. Shipment was around end-Aug to September. Due to policy advantages, orders are expected to remain stable in 2019. In terms of price, short-term price is expected to remain stable due to good sales of forward yarn. However, Pakistani domestic economy has poor economic performance and eyes are suggested to exchange rate.

Current cargos are around August shipment, and spinners with better sales witness September shipment cargos. In general, amid advantages of shipping schedule and price of Vietnamese yarn, sales burden significantly reduced, and textile mills saw better operations. As long as cotton price does not plummet, Vietnamese yarn mills will run normally, and the price is expected to remain stable in the short term.

Pakistan

Exports to China remained stable due to policy advantages. In terms of price, due to more orders recently, price of forward yarn was the earliest to bottom up. In the previous period, lowest price of ordinary quality Pakistani siro-spun carded 10S dropped to $395-400/bale, and traded price rose to $405-410/bale. Shipment was around end-Aug to September. Due to policy advantages, orders are expected to remain stable in 2019. In terms of price, short-term price is expected to remain stable due to good sales of forward yarn. However, Pakistani domestic economy has poor economic performance and eyes are suggested to exchange rate.

On the whole, cotton yarn market improved somewhat after the G20 Summit, and cotton yarn destocking improved. On the one hand, it was the replenishment of downstream mills, destocking of China mills and traders was faster, and some inventory transferred to downstream market. On the other hand, more China orders led to transfer of foreign yarn mill inventory to Chinese traders, especially Vietnamese and Pakistani one. However, pessimistic mood about overall cotton yarn market may still spread on the market, and there are still many problems to be solved if market wants to turn better. Firstly, cotton yarn liquidity improved but the price is still not tolerable, even if sales ratio improves, cotton and cotton yarn prices are still more difficult to climb up. Secondly, downstream orders are not materially improved. Thirdly, inventory of yarn and fabric mills is still large, which may lead to slack market in peak season. Fourthly, production cut of Chins and Indian yarn mills generally decreased. After operating rate recovered, whether sales ratio can reach 100% or not is hard to say.

On the whole, cotton yarn market improved somewhat after the G20 Summit, and cotton yarn destocking improved. On the one hand, it was the replenishment of downstream mills, destocking of China mills and traders was faster, and some inventory transferred to downstream market. On the other hand, more China orders led to transfer of foreign yarn mill inventory to Chinese traders, especially Vietnamese and Pakistani one. However, pessimistic mood about overall cotton yarn market may still spread on the market, and there are still many problems to be solved if market wants to turn better. Firstly, cotton yarn liquidity improved but the price is still not tolerable, even if sales ratio improves, cotton and cotton yarn prices are still more difficult to climb up. Secondly, downstream orders are not materially improved. Thirdly, inventory of yarn and fabric mills is still large, which may lead to slack market in peak season. Fourthly, production cut of Chins and Indian yarn mills generally decreased. After operating rate recovered, whether sales ratio can reach 100% or not is hard to say.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.