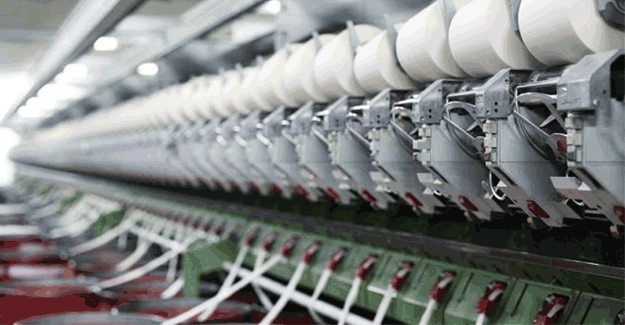

Cotton Spinners Cut Production To Tide Over Short Term Imbalances

The textile industry, especially cotton spinners, are cutting production, to tide over the current glut in the market, due to falling cotton yarn exports and dull domestic demand. In the first quarter (April-June) of the current financial year, cotton yarn exports have dropped 34.6% to US$ 696 million, compared to the same quarter of the previous financial year. Alongside, Indian weavers have accumulated sufficient stocks of cotton yarns. On the other side of the spectrum, Indian cotton prices are higher than international prices. There is a shortage of cotton in the market, even as Cotton Corporation of India (CCI) should have begun releasing its cotton stocks to stabilise prices. And seasonally, this is a dull season for textile processors, which will impact the downstream chain. These market pressures are thus forcing spinning mills across the country to cut production. This is a short term scenario, and as production for the festive season gains momentum, domestic market will start to pick up. The good news is that spinners are shifting to viscose and linen yarns, in keeping with consumer preferences. AP spinners declare weekly production holiday Spinning mills in Andhra Pradesh have declared a production holiday beginning July 22. The spinning mills' decision to cut down on the number of working days comes in the backdrop of a decline in exports and rising production costs. There are over 120 spinning mills in the state and many are cutting down their production of yarn. According to president of AP Spinning Mills Association, Lanka Raghurami Reddy, "China has been a major importer of cotton for several years but during the last two years, China has been gradually lowering its imports from India. Domestic demand has also slackened due to stiff competition. Moreover, the cost of production is going up and we have no other option except to reduce the production." North Indian spinners are staring at more severe production cuts Textile spinning mills of North India are also considering a weekly holiday to cut back production. According to Rajiv Garg, President, Northern India Textile Mills' Association, "The decision to take this extreme step has come as a result of excess spinning capacity in the country and poor demand for yarn from overseas markets leading to the accumulation of yarn stocks and poor liquidity." According to NITMA president, some textile units are considering a production cut of as much as 50% to bring down borrowing/outstanding and stocks. Weather and quality of inputs also seem unfavourable at present. Garg believes with these measures the demand-supply balance should get restored in the next 3-4 months. Gujarat spinning mills cut production by 15% Spinning mills in Gujarat too are foreseeing a significant cut in production because of reduction in demand for cotton yarn in the international market and have already reduced their production by 15%, according to the All Gujarat Spinners' Association (AGSA). A further decline in production is expected if the situation does not improve. According to AGSA president Saurin Parikh, Gujarat mills export 30% of their total cotton yarn production, while the rest is supplied to the domestic market. With the ongoing US-China trade war, Chinese fabric and garment manufacturers are facing a huge inventory pile-up, because their garment exports to the United States have declined. As a consequence, the demand for cotton yarn in the international market has gone down, he said. The demand for apparel and fabrics has been hit in the domestic market as well, affecting demand for cotton yarn. Gujarat has a total installed capacity of some 52 lakh spindles across all the spinning mills, of which more than 7 lakh spindles are lying idle, AGSA estimates. Production cut has already started hurting export revenues to the industry. Cotton spinning mills are facing multiple challenges this year Near-term prospects of cotton spinning mills are bleak. With falling acreage of cotton in India and easing global demand for yarn, the differential in prices between domestic and overseas markets is an additional challenge. Cotton prices fell 18% in international markets in the past fortnight, but domestic prices, which normally follow suit, have so far fallen only 5%. Perhaps, news of lower cotton acreage and decade-low productivity in the current season is keeping prices elevated. The Cotton Advisory Board of India's estimate of cotton output of 343 lakh bales for cotton season (CS) 2019 is lower than the year-ago figure, which itself was a 12-year low. Also, the increase in minimum support price for cotton - medium and long staple - by 2% and 1.8% for FY20, respectively, will support prices. Analysts say cotton imports in FY20 will therefore, rise. As such, news over the last two days about a drop in yarn production across 50-60% of mills in the south and north is not surprising. To be sure, large mills may be able to import cheaper cotton from international markets. However, small- and medium-sized spinners are facing multiple challenges. Lack of easy access to working capital and letter of credit facilities, and inventory holding costs make it tough for them to import cotton. Most of them carry two-three months inventory and may not be in a position to buy more from global markets. Moreover, yarn off-take has slowed across the globe. According to K. Selvarajau, secretary-general, Southern India Mills' Association, "Monthly cotton exports to China and Bangladesh have started falling and current levels show that they are down to half the levels in February." Domestic demand is ebbing, too, unless the forthcoming festival season brings some cheer. Weak demand is mirrored in the recent 6-7% drop in cotton yarn prices. Indian yarn imports into China and Bangladesh face duty and that makes it tough to compete, given stiff competition from Vietnam. Indian cotton yarn manufacturers are also losing the global trade due to China's access to duty-free market in Pakistan and Vietnam. In other words, high domestic cotton prices, poor liquidity and weak consumption by textile mills pose a threat to profit margins of mills going forward. This is a far cry from the previous two years when yarn mills were cushy with stable global cotton prices through cotton season (CS) 2018 and 2019. Cotton, cotton yarn imports by some important markets China's cotton yarn imports in June 2019 amounted to US$ 414.64 million, a fall of 4.44% compared to imports in January. Similarly, Vietnam's cotton yarn imports were down 4.32% in July, compared to imports in January. Vietnam's drop in imports is somewhat disturbing at a time when the country's textile and apparel sentiments are quite high due to the EVFTA. During January-March, Bangladesh imported cotton (including cotton textiles) worth US$ 492 million from India, compared to US$ 388.9 million in the previous quarter. Bangladesh's total cotton imports during January-March 2019 were valued at US$ 1292.9 million, compared to US$ 1111.1 million in the October-December 2018 quarter. While imports from China were the highest at US$ 574.7 million during Jan-March, imports grew just 3.23% over the previous quarter. Imports from USA at US$ 101.3 million grew 84.18%. Imports from Brazil at US$ 100.7 million were 20.02% higher than in the previous quarter. Cotton imports from Indonesia at US$ 12.5 million were 25% higher than in the previous quarter. Raw cotton imports dominate this segment. Turkey's imports of cotton (including cotton textiles), have shown a significant growth during the first five months of 2019. Imports in May 2019 were to the tune of US$ 304 million, a hike of 113% compared to imports in January. During the same period of 2018, cotton imports had grown at a normal rate of 15.41% to US$ 272.31 million in May 2018. This could be an indication of higher spinning activity in the coming days. Pakistan's imports of cotton (including cotton textiles) amounted to US$ 1610.81 million during the last financial year (July-June 2019), a drop of 2.72% compared to the previous fiscal year. Bangladesh moves into yarn exports Bangladesh's yarn and fabric exports rose 20.46% year-on-year to US$ 141.12 million between July and May, an indication that Bangladesh can become a major source for the raw materials if higher production is facilitated. Bangladesh imports yarn from China and India to meet the local demand. However, the export of yarn, especially cotton yarn, has grown recently. At least six large spinning mills have started exporting very fine, specialised cotton yarn to Indonesia, Sri Lanka and Turkey, said Monsoor Ahmed, Secretary, Bangladesh Textile Mills Association (BTMA). Turkey is strong in manufacturing knitwear with finer yarn and Bangladesh has become a good sourcing destination. Bangladesh does not have free trade agreements with most of the textile manufacturing countries, and thus faces higher duties. However, Bangladeshi yarn prices are quite competitive, and as production of yarns and fabrics improves, exports from Bangladesh will pick up. These figures indicate reduced global demand for cotton yarns, as textile manufacturing countries strengthen their own spinning sectors. While the current production cuts in the Indian spinning sector can be termed seasonal in nature, the industry needs to brace itself for long term changes that are taking place in the global textile marketplace.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.