India's Overall T&C Exports Growing, But Apparels Witness A Downward Trend

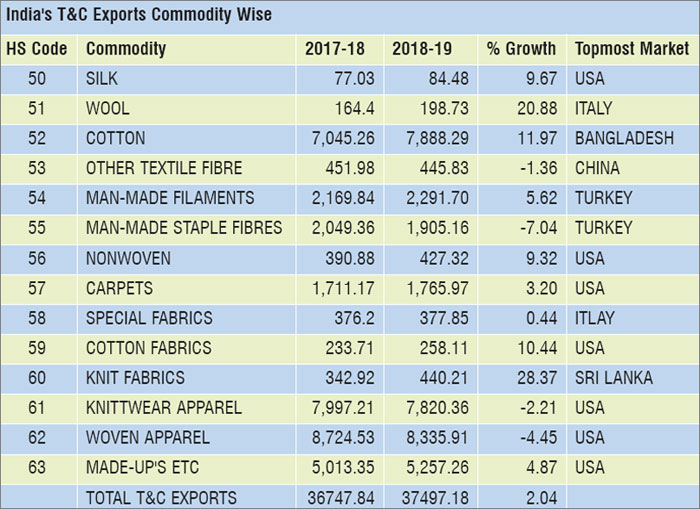

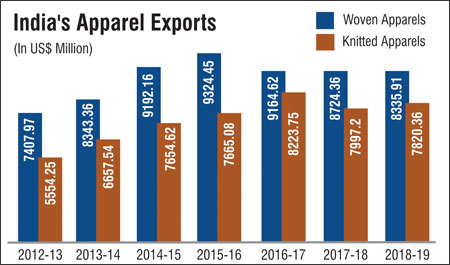

India's textile and clothing industry has witnessed growth a 2.04% in the export market in FY 2018-19 to US$ 37497.18 million, while in the previous fiscal exports witnessed a marginal growth of 0.7% only. Though the T&C export of India has witnessed a positive growth, the industry has still lost 1% of share in the overall exports of India, now accounting for 11% in the total exports of India for FY 18-19, while it was 12%, 13% and 14% in FY 2017-18, 2016-15 and 2015-16 respectively. If woven and knitted apparels are combined together, apparel exports have also been dominating the sector in the export market. In the last fiscal year (FY 18-19) apparel exports have gone down by 3.38% to US$ 16156.27 million over the corresponding period, where the apparel exports totalled to US$ 16721.74 million and it stakes 43% share in the total T&C export of India in FY 18-19. If taken as individual commodity, woven apparel is the ruling the basket of T&C exports with an exports of US$ 8,335.91 and accounts of 22% in the total T&C export of India. Followed by woven apparels are cotton exports with stake of 21% in FY 18-19 and export of US$ 7888.29 million with a growth of nearly 12%.

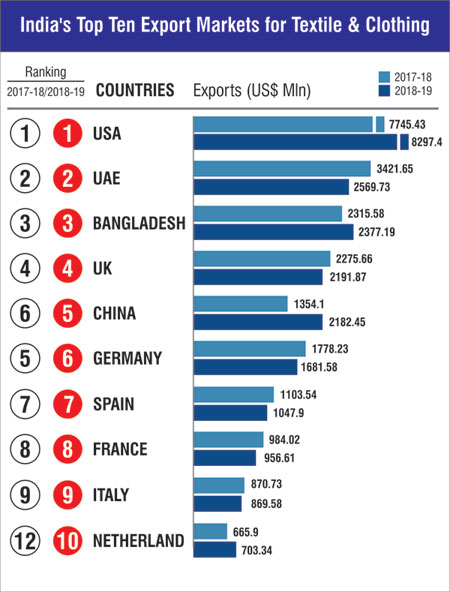

Countries-wise T&C Exports

USA has retained its place to be the leading market for India's T&C exports in FY 18-19 also. Exports to USA have gone up by 7.13% to US$ 8297.40 million in the last fiscal and currently it stakes 22% share in the total T&C exports of India.

Other made-up's of textile are ruling the basket in USA market with a total of US$ 2472.97 million and account for 30% share in the total T&C export to USA. Woven apparel is the second largest commodity exported to USA with a value of US$ 2231.06 million, growth of 4.86%, followed by knit apparels which have witnessed a growth of 11.41% in the export market.

T&C exports to the UAE continue to fall, and went down by 24.90% to US$ 2569.73 million in FY 18-19, but still the country manages to be the second largest export market for India's T&C products and accounts for a share of 7% in the total T&C exports of India. Apparel exports to UAE have been dropping every fiscal year now. Knit apparel which is exported the most to the country, has witnessed a drop of 27.65% in FY 18-19 totaling to US$ 1159.74 million, while woven apparel have witnessed a drop of 31.53% to US$ 831.41 million. Exports of carpets and other textile floor coverings to UAE have perceived steep rise by 38.71% to US$ 76.57 million.

Bangladesh, too has retained its position as the third largest market of India's T&C exports and perceived a growth of 2.66% to US$ 2377.19 million in FY 18-19. Cotton is the ruling basket here, the export of cotton totalled to US$ 1878.04 million with growth of 3.02% in the last fiscal year. Knitted fabric exports have too increased by 33.09% to US$ 71.76 million. Exports to UK have decreased by 3.68% to US$ 2191.87 million, but has retained is position in the fourth place in FY 2018-19. The country accounts for a share of 6% in the total T&C exports of India. Here woven apparel have been exported the most, the export value for the commodity totalled to US$ 825.51 million, but perceived a negative growth of 5.45%, also knit apparel have witnessed a negative growth of 7.73% to US$ 780 million.

Of sudden, exports to China to have increased by 61.17% in the last fiscal, totalling to US$ 2191.87 million and account for a share of 6% in the total T&C exports of India. China now stands as the fifth largest export market for India's T&C goods, while in 2017-18 China was in the sixth position. Cotton exports have increased by 78.09% to US$ 1786.77 million and is the largest commodity exported to China. Surprisingly the country's demand for Indian wool increased in the last fiscal year. Exports of the product totalled to US$ 13.44 million with growth of 166.14%. Even apparel exports haven shown a growth of 34.24% for knit and 14.45% for woven.

The other exports markets for India's T&C goods are Germany, Spain, France, Italy and Netherland.

Asian Countries Demand More Indian Cotton

Cotton which is the second most exported commodity to the world from India, has perceived a growth of 11.97% to US$ 7888.29 million and accounts for a share of 21% in the total T&C exports of India.

Bangladesh is the top market for India's cotton, the export totalled to US$ 1878.04 million with a growth of 3.02% in the last fiscal year. Exports to China have increased by 78.09% to US$ 1786.77 million. Cotton exports to Pakistan, Vietnam and Sri Lanka too have shown an increase in the last fiscal.

Indian cotton of staple length 28.5 mm and above, but below 34.5 mm has been exported the most. The export value of this product totalled US$ 1895.8 million with growth of 11.97% in FY 18-19 over the corresponding period.

On an average per kg of the product was traded at US$ 0.50 per kg in 2018-18 fiscal year, while in the previous year the same product was traded at US$ 0.56 per kg. India has exported this product to China with growth of 249.19% to US$ 464.72 million, while in the corresponding period the exports totalled to US$ 117.89 million. But Bangladesh remains the top market of this product with an export of US$ 674.03 million.

Single grey yarn of combed fibre is the second most exported product under the cotton commodity. The exports of this product totalled to US$ 883.46 million with a growth of 13.78% in the last fiscal over the corresponding period where the exports totalled to US$ 776.49 million.

The product was traded at an average price of US$ 0.32 per kg in FY 18-19, while in the previous fiscal too the product was traded at the same price. Here China is the top export market for Indian single grey yarn of combed fibres, with an export of US$ 211.90 million with a growth of 65.64%.

USA has retained its place to be the leading market for India's T&C exports in FY 18-19 also. Exports to USA have gone up by 7.13% to US$ 8297.40 million in the last fiscal and currently it stakes 22% share in the total T&C exports of India.

Other made-up's of textile are ruling the basket in USA market with a total of US$ 2472.97 million and account for 30% share in the total T&C export to USA. Woven apparel is the second largest commodity exported to USA with a value of US$ 2231.06 million, growth of 4.86%, followed by knit apparels which have witnessed a growth of 11.41% in the export market.

T&C exports to the UAE continue to fall, and went down by 24.90% to US$ 2569.73 million in FY 18-19, but still the country manages to be the second largest export market for India's T&C products and accounts for a share of 7% in the total T&C exports of India. Apparel exports to UAE have been dropping every fiscal year now. Knit apparel which is exported the most to the country, has witnessed a drop of 27.65% in FY 18-19 totaling to US$ 1159.74 million, while woven apparel have witnessed a drop of 31.53% to US$ 831.41 million. Exports of carpets and other textile floor coverings to UAE have perceived steep rise by 38.71% to US$ 76.57 million.

Bangladesh, too has retained its position as the third largest market of India's T&C exports and perceived a growth of 2.66% to US$ 2377.19 million in FY 18-19. Cotton is the ruling basket here, the export of cotton totalled to US$ 1878.04 million with growth of 3.02% in the last fiscal year. Knitted fabric exports have too increased by 33.09% to US$ 71.76 million. Exports to UK have decreased by 3.68% to US$ 2191.87 million, but has retained is position in the fourth place in FY 2018-19. The country accounts for a share of 6% in the total T&C exports of India. Here woven apparel have been exported the most, the export value for the commodity totalled to US$ 825.51 million, but perceived a negative growth of 5.45%, also knit apparel have witnessed a negative growth of 7.73% to US$ 780 million.

Of sudden, exports to China to have increased by 61.17% in the last fiscal, totalling to US$ 2191.87 million and account for a share of 6% in the total T&C exports of India. China now stands as the fifth largest export market for India's T&C goods, while in 2017-18 China was in the sixth position. Cotton exports have increased by 78.09% to US$ 1786.77 million and is the largest commodity exported to China. Surprisingly the country's demand for Indian wool increased in the last fiscal year. Exports of the product totalled to US$ 13.44 million with growth of 166.14%. Even apparel exports haven shown a growth of 34.24% for knit and 14.45% for woven.

The other exports markets for India's T&C goods are Germany, Spain, France, Italy and Netherland.

Asian Countries Demand More Indian Cotton

Cotton which is the second most exported commodity to the world from India, has perceived a growth of 11.97% to US$ 7888.29 million and accounts for a share of 21% in the total T&C exports of India.

Bangladesh is the top market for India's cotton, the export totalled to US$ 1878.04 million with a growth of 3.02% in the last fiscal year. Exports to China have increased by 78.09% to US$ 1786.77 million. Cotton exports to Pakistan, Vietnam and Sri Lanka too have shown an increase in the last fiscal.

Indian cotton of staple length 28.5 mm and above, but below 34.5 mm has been exported the most. The export value of this product totalled US$ 1895.8 million with growth of 11.97% in FY 18-19 over the corresponding period.

On an average per kg of the product was traded at US$ 0.50 per kg in 2018-18 fiscal year, while in the previous year the same product was traded at US$ 0.56 per kg. India has exported this product to China with growth of 249.19% to US$ 464.72 million, while in the corresponding period the exports totalled to US$ 117.89 million. But Bangladesh remains the top market of this product with an export of US$ 674.03 million.

Single grey yarn of combed fibre is the second most exported product under the cotton commodity. The exports of this product totalled to US$ 883.46 million with a growth of 13.78% in the last fiscal over the corresponding period where the exports totalled to US$ 776.49 million.

The product was traded at an average price of US$ 0.32 per kg in FY 18-19, while in the previous fiscal too the product was traded at the same price. Here China is the top export market for Indian single grey yarn of combed fibres, with an export of US$ 211.90 million with a growth of 65.64%.

MMF Exports Moves Up Marginally

In FY 17-18, India's manmade filament (MMF) exports grew 9.2%, Further in the last fiscal year (2018-19) the commodity perceived a growth of 5.62% to US$ 2291.70 million. Here Turkey is top export market. Exports to Turkey totalled US$ 296.26 million, but perceived a negative growth of 7.73%. MMF exports to Bangladesh and USA have witnessed a good growth of 37.94% and 15.24% respectively.

Under this commodity, textured yarn of polyester was exported the most the world, with a value of US$ 832.37 million in FY 18-19 over the corresponding period with a growth of 3.39%. The product was exported at an average price of US$ 0.61 per kg, while in previous fiscal it was US$ 0.65 per kg.

Textured yarn of polyester was exported the most to Turkey and the exports totalled to US$ 183.75 million, but witnessed a drop of 8.89% in the FY 18-19 over the corresponding period.

MMSF Exports Drop Further

Man-made staple fibre (MMSF) exports perceived a negative growth for consecutive second fiscal year now. In the last fiscal, the exports totalled to US$ 1905.16 million with a negative growth of 7.04% and accounts only 5% share in the total T&C exports of India.

Turkey is the top export market for India MMSF products and the exports totalled to US$ 184.96 million, but perceived a negative growth of 22.67% in FY 18-19 over the corresponding period. Even exports to Bangladesh witnessed a drop of 25.64% to US$ 167 million. Under this commodity, staple fibre of polyester not carded or combed is ruling the basket. The export of the product totalled to US$ 320.90 million with a growth of 22.28% in FY 18-19 over the corresponding period. The product was trade at average price of US$ 0.79 per kg in the last fiscal, while in the corresponding period the product was traded at US$ 0.87 per kg. For this product, USA is top export market with an export of US$ 50.35 million and a negative growth of 6.09%.

Fabric of polyester mixed with viscose rayon, which is the second largest exported under this commodity too have witnessed a growth of 4.14% to US$ 206.65 million in FY 18-19 over the previous fiscal, where the exports totalled to US$ 198.44 million. For this product, Bangladesh is the top export market. The exports of Bangladesh summed to US$ 35.49 million with growth 10.27%.

Apparel exports continue to fall

With falling demand from UAE, the Indian apparel products have witnessed drop again for a second consecutive fiscal year. In FY 18-19 the apparel exports have dropped by 3.38% to US$ 16156.27 million over the corresponding period.

Woven apparel exports witnessed a drop in the last fiscal year by 4.45% to US$ 8335.91 million and accounts for 22% share in the total T&C exports of India. USA is the top market for India's woven apparel products, the exports to USA totalled to US$ 2231.06 million with a growth of 4.86%. Exports to UAE have gone down drastically by 31.53% to US$ 831.41 million. Under this commodity, men's shirt made of cotton was exported the most to the world. The exports of shirts made of cotton for men's totalled to US$ 816.56 million, but perceived a negative growth of 1.45% in 2018-19 over corresponding period. The product was traded at average price of US$ 0.15 per piece in 2018-19, while in the corresponding period it was US$ 0.16 per piece. USA is the leading export market for Men's cotton shirt. The exports of same totalled to US$ 246.61 million, but perceived a negative growth of 6.21% in FY 18-19 over the corresponding period.

MMF Exports Moves Up Marginally

In FY 17-18, India's manmade filament (MMF) exports grew 9.2%, Further in the last fiscal year (2018-19) the commodity perceived a growth of 5.62% to US$ 2291.70 million. Here Turkey is top export market. Exports to Turkey totalled US$ 296.26 million, but perceived a negative growth of 7.73%. MMF exports to Bangladesh and USA have witnessed a good growth of 37.94% and 15.24% respectively.

Under this commodity, textured yarn of polyester was exported the most the world, with a value of US$ 832.37 million in FY 18-19 over the corresponding period with a growth of 3.39%. The product was exported at an average price of US$ 0.61 per kg, while in previous fiscal it was US$ 0.65 per kg.

Textured yarn of polyester was exported the most to Turkey and the exports totalled to US$ 183.75 million, but witnessed a drop of 8.89% in the FY 18-19 over the corresponding period.

MMSF Exports Drop Further

Man-made staple fibre (MMSF) exports perceived a negative growth for consecutive second fiscal year now. In the last fiscal, the exports totalled to US$ 1905.16 million with a negative growth of 7.04% and accounts only 5% share in the total T&C exports of India.

Turkey is the top export market for India MMSF products and the exports totalled to US$ 184.96 million, but perceived a negative growth of 22.67% in FY 18-19 over the corresponding period. Even exports to Bangladesh witnessed a drop of 25.64% to US$ 167 million. Under this commodity, staple fibre of polyester not carded or combed is ruling the basket. The export of the product totalled to US$ 320.90 million with a growth of 22.28% in FY 18-19 over the corresponding period. The product was trade at average price of US$ 0.79 per kg in the last fiscal, while in the corresponding period the product was traded at US$ 0.87 per kg. For this product, USA is top export market with an export of US$ 50.35 million and a negative growth of 6.09%.

Fabric of polyester mixed with viscose rayon, which is the second largest exported under this commodity too have witnessed a growth of 4.14% to US$ 206.65 million in FY 18-19 over the previous fiscal, where the exports totalled to US$ 198.44 million. For this product, Bangladesh is the top export market. The exports of Bangladesh summed to US$ 35.49 million with growth 10.27%.

Apparel exports continue to fall

With falling demand from UAE, the Indian apparel products have witnessed drop again for a second consecutive fiscal year. In FY 18-19 the apparel exports have dropped by 3.38% to US$ 16156.27 million over the corresponding period.

Woven apparel exports witnessed a drop in the last fiscal year by 4.45% to US$ 8335.91 million and accounts for 22% share in the total T&C exports of India. USA is the top market for India's woven apparel products, the exports to USA totalled to US$ 2231.06 million with a growth of 4.86%. Exports to UAE have gone down drastically by 31.53% to US$ 831.41 million. Under this commodity, men's shirt made of cotton was exported the most to the world. The exports of shirts made of cotton for men's totalled to US$ 816.56 million, but perceived a negative growth of 1.45% in 2018-19 over corresponding period. The product was traded at average price of US$ 0.15 per piece in 2018-19, while in the corresponding period it was US$ 0.16 per piece. USA is the leading export market for Men's cotton shirt. The exports of same totalled to US$ 246.61 million, but perceived a negative growth of 6.21% in FY 18-19 over the corresponding period.

Knitted apparels too have lost their exports in the international market by 2.21% to US$ 7820.36 million in the last fiscal over the corresponding period. The commodity stakes 21% share in the total T&C exports of India. Here USA is the leading market with the exports of US$ 1394.89 million and growth of 11.41%. It's the exports to UAE that have dropped drastically in FY 18-19 by 27.65% to US$ 1159.74 million from US$ 1603.03 in the corresponding period.

Cotton t-shirt were exported the most to the world and the export of the product totalled to US$ 1847.08 million with growth of 6.08% in FY 18-19 over the corresponding period and was traded at average price of US$ 0.40 per piece. Here too USA is the leading market for India's cotton t-shirt, the export value totalled to US$ 392.64 million, but perceived a negative growth of 1.58%.

Knitted Fabrics

In the exports market, knitted fabrics have shown a good improvement with a growth of 28.37% in FY 18-19 to US$ 440.21 million over the corresponding period. Sri Lanka is the leading export market for knitted fabric. The exports to Sri Lanka totalled to US$ 173.66 million with a growth of 25.66% in FY 18-19 over the corresponding period. Exports to USA, Bangladesh and Ethiopia too have shown interesting trends with a growth of 39.72%, 33.09% and 79.62% respectively. Here other knitted fabrics of cotton, bleached or unbleached is ruling the basket. The exports of the product totalled to US$ 130.05 with a growth of 29.34% in FY 18-19 over the corresponding and on an average the product was traded a price of US$ 0.29 per kg in 2018-19, while in 2017-18 the average trading price was US$ 0.30 per kg. For this product, USA is the leading market with an exports totalled to US$ 55.17 with a growth of 25.96% in the last fiscal year over the corresponding period.

Carpets And Other Textile Floor Coverings

Exports for Indian Carpet and other textile floor covering have increased by 3.20% to US$ 1765.97 million in the last fiscal over the corresponding period. The commodity stakes 5% share in the total T&C exports of India. In 2017-18 the exports of the same commodity had witnessed a drop of 3.81%. On an average the commodity was traded was US$ 0.10 per sq. meter. USA is the leading the market for Indian carpets. The exports to USA totalled to US$ 925.08 million with growth of 9.04% in 2018-19 over the corresponding period. Germany been the second the largest market for India's carpet and other textile floor covering had witnessed a drop of 26.22% to US$ 122.26 million in the FY 18-19 over the corresponding period where the exports totalled to US$ 152.16 million.

Silk & Wool Exports Both Have Improved

Silk exports have improved in the last fiscal year with growth of 9.67% to US$ 84.48 million over the corresponding period. USA is the leading market for Indian silk with exports of US$ 21.22 million and growth of 49.94% in the last fiscal over the corresponding period.

Wool exports have shown interesting trend in last fiscal year, the exports gathered a growth of 20.88% to US$ 198.73 million over the corresponding period. Italy is the leading market for this commodity with an export value of US$ 35.08 million with a growth of 21.42% in the last fiscal over the corresponding period.

Knitted apparels too have lost their exports in the international market by 2.21% to US$ 7820.36 million in the last fiscal over the corresponding period. The commodity stakes 21% share in the total T&C exports of India. Here USA is the leading market with the exports of US$ 1394.89 million and growth of 11.41%. It's the exports to UAE that have dropped drastically in FY 18-19 by 27.65% to US$ 1159.74 million from US$ 1603.03 in the corresponding period.

Cotton t-shirt were exported the most to the world and the export of the product totalled to US$ 1847.08 million with growth of 6.08% in FY 18-19 over the corresponding period and was traded at average price of US$ 0.40 per piece. Here too USA is the leading market for India's cotton t-shirt, the export value totalled to US$ 392.64 million, but perceived a negative growth of 1.58%.

Knitted Fabrics

In the exports market, knitted fabrics have shown a good improvement with a growth of 28.37% in FY 18-19 to US$ 440.21 million over the corresponding period. Sri Lanka is the leading export market for knitted fabric. The exports to Sri Lanka totalled to US$ 173.66 million with a growth of 25.66% in FY 18-19 over the corresponding period. Exports to USA, Bangladesh and Ethiopia too have shown interesting trends with a growth of 39.72%, 33.09% and 79.62% respectively. Here other knitted fabrics of cotton, bleached or unbleached is ruling the basket. The exports of the product totalled to US$ 130.05 with a growth of 29.34% in FY 18-19 over the corresponding and on an average the product was traded a price of US$ 0.29 per kg in 2018-19, while in 2017-18 the average trading price was US$ 0.30 per kg. For this product, USA is the leading market with an exports totalled to US$ 55.17 with a growth of 25.96% in the last fiscal year over the corresponding period.

Carpets And Other Textile Floor Coverings

Exports for Indian Carpet and other textile floor covering have increased by 3.20% to US$ 1765.97 million in the last fiscal over the corresponding period. The commodity stakes 5% share in the total T&C exports of India. In 2017-18 the exports of the same commodity had witnessed a drop of 3.81%. On an average the commodity was traded was US$ 0.10 per sq. meter. USA is the leading the market for Indian carpets. The exports to USA totalled to US$ 925.08 million with growth of 9.04% in 2018-19 over the corresponding period. Germany been the second the largest market for India's carpet and other textile floor covering had witnessed a drop of 26.22% to US$ 122.26 million in the FY 18-19 over the corresponding period where the exports totalled to US$ 152.16 million.

Silk & Wool Exports Both Have Improved

Silk exports have improved in the last fiscal year with growth of 9.67% to US$ 84.48 million over the corresponding period. USA is the leading market for Indian silk with exports of US$ 21.22 million and growth of 49.94% in the last fiscal over the corresponding period.

Wool exports have shown interesting trend in last fiscal year, the exports gathered a growth of 20.88% to US$ 198.73 million over the corresponding period. Italy is the leading market for this commodity with an export value of US$ 35.08 million with a growth of 21.42% in the last fiscal over the corresponding period.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.