Slowdown In Global Markets Worries Indian Textile Machinery Manufacturers

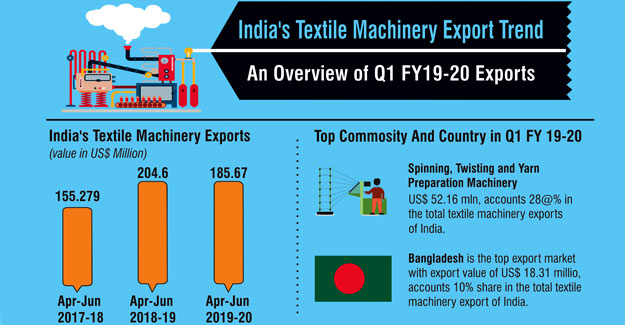

The beginning of this fiscal year has been a slow start for Indian textile machinery manufacturers. Exports of the industry slowed down in the first quarter (Q1) of FY 19-20. Looking at the current condition of the market, the sector could witness a further slowdown in the export market and adversely affect employment too.

Moreover, this was the year of ITMA, when the textile industry worldwide holds back on investment decisions to evaluate the latest technologies on offer.

India's textile machinery exports in Q1 FY 19-20 fell by 9.25% to US$ 185.67 million over the corresponding period of last year (CPLY) where the exports of machinery totalled to US$ 204.60 million. Though exports to Bangladesh have dropped by 39.21% in the Q1, the country still managed to be the largest export market for India's textile machinery goods.

SV Pittie's textile cluster in Oman attracts orders for Indian machines Spinning, twisting and yarn preparation commodity is the largest exported commodity under the textile machinery export segment.

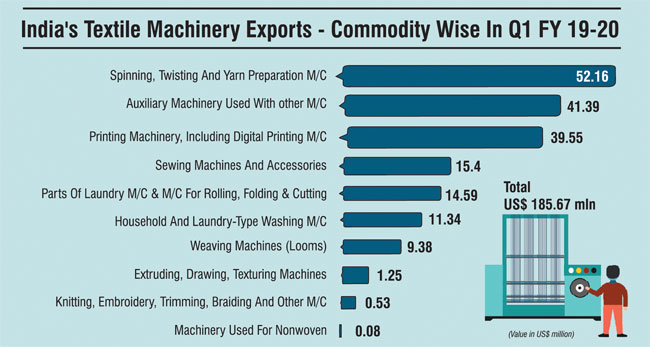

The exports of the commodity totalled to US$ 52.16 million in Q1 FY 19-20, a fall of 28.26% over the CPLY. Pakistan is the leading export market for this commodity, which stakes 26% share in the export of this commodity from India. The exports of spinning, twisting and yarn preparation totalled to US$ 13.85 million with a growth of 303.94% in Q1 FY 19-20 over the CPLY.

Bangladesh which was the top export market for this product in Q1 FY 18-19, perceived a negative growth of 48% to US$ 7.74 million in Q1 FY 19-20 over the CPLY. Now the country stands as the second largest market.

Interesting export trends have been seen from India to Oman. In the previous fiscal year Q1, the exports of spinning, twisting and yarn preparation commodity to Oman were zero, but in this fiscal year's Q1 the export totalled to US$ 3.55 million with a growth of 91035.90%. The SV Pittie Group inaugurated a textile cluster in Oman in December 2018, The cluster will have 300,000 spindles and 7,000 rotors.

Spinning machinery exports to Netherland has witnessed a drop of 76.67% to US$ 2.37 million in Q1 for this fiscal year, while in CPLY the exports totalled to US$ 10.17 million.

Under spinning, twisting and yarn preparation commodity, textile spinning machines were exported the most from India with value of US$ 31.84 million in the first quarter of this fiscal, but perceived a negative growth of 38.10% over the CPLY. Exports of carding, combing and roving machines too have witnessed a downward trend by 9.83%, 4.08% and 27.59% respectively, although these machineries are not exported in a large quantity. Machines for preparation of textile fibres witnessed a positive trend with a growth of 51.64% to US$ 8.19 million in Q1 FY19-20 over CPLY. Auxiliary machinery used with other textile machinery is the second largest commodity exported from India to the world. The exports of the commodity totalled to US$ 41.39 million, but perceived a negative growth of 2.51% in Q1 FY 19-20 over CPLY. Germany beats China in this commodity, marking itself as the largest export market of India's auxiliary machines. Exports to Germany to totalled to US$ 9.20 million with growth of 142.25% in Q1 FY 19-20 over CPLY, while the exports to China have dropped by 18.55% to US$ 4.34 million. Auxiliary machinery parts and accessories machines used for extruding,drawing,texturing or cutting man-made textile materials was exported the most under this commodity, the exports of same totalled US$ 12.48 million with a growth of 36.31% in Q1 FY 19-20 over CPLY. Exports of spindles, spindles flyers, spinning rings and ring travellers fell by 14.74% to US$ 2.08 million in Q1 FY 19-20 over the CPLY.

Exports of printing machinery (*), including digital printing machines have been booming for a quite long time now. Indian companies participating in the recent printing and garment machinery shows have cracked on many deals and serious inquires have been generated. This will further boost the exports to this segment. In Q1 FY 2019-20, the exports of this commodity have witnessed a growth of 37.25% to US$ 39.55 million over the CPLY. Philippines is the largest export market for this commodity with an export value of US$ 5.71 million with growth of 2790.18%, but it seems like these exports are re-exported to another country from Philippines, as the exports in the same quarter of the previous year was nearly zero. The second largest export market for India's printing machinery is Bangladesh. The country witnessed a growth of 14.39% to US$ 5.56 million in Q1 FY 2019-20 over CPLY. Exports to Italy have shown quite a good trend in the market, with a growth of 148.69% to US$ 4.88 million. Under this commodity, machines which perform two or more functions of printing were exported the most to the world. The exports totalled to US$ 7.05 million with a growth of 2194.76% in Q1 FY 19-20 over the CPLY.

Weaving machinery sector has observed a marginal growth in the export market in Q1 FY 2019-20, with an export value of US$ 9.38 million and a growth of 2.43% over the CPLY. For India's weaving machines, Vietnam is the largest market and the export totalled to US$ 1.64 million over CPLY. Weaving machines with a width of 30 cms shuttle type was exported the most under this category.The exports of this product totalled to US$ 8.41 million with a growth of 7.40% in Q1 FY 2019-20 over the CPLY.

Exports of extruding, drawing, texturing or cutting man-made textile materials commodity perceived a negative growth of 29.92% to US$ 1.25 million in Q1 FY 19-20 over CPLY. Sewing machines and accessories exports in Q1 FY 19-20 witnessed a growth of 9.65% to US$ 15.40 million over the CPLY. Germany is the top export market for India's sewing and accessories machines. The exports to the country totalled to US$ 5.02 million with a growth of 24.27% in the first quarter. Under this commodity, sewing machine needles was exported the most with a value of US$ 6.16 million with a minimal growth of 0.92% in Q1 FY 19-20 over the CPLY. Automatic sewing machine exports have witnessed a good growth of 85.85% to US$ 1.12 million.

Country-wise textile machinery exports

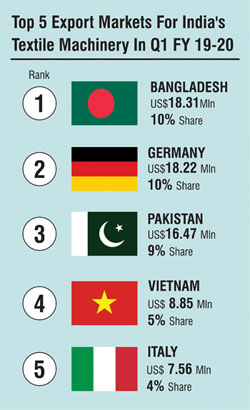

Bangladesh remains the top export market for India's textile machinery. Exports to Bangladesh totalled to US$ 18.31 million in Q1 FY 19-20, with a growth of 39.21% over the CPLY and stakes 10% share in the total export of India's textile machinery. Bangladesh is a top market for India's spinning, twisting and yarn preparation machine, the exports totalled to US$ 7.74 million, but exports have dropped by 48% in Q1 FY 2019-20 over the CPLY. Printing machines have witnessed a growth of 14.39% to US$ 5.56 million Q1 FY 19-20 over the CPLY where the exports totalled to US$ 4.86 million.

Exports of printing machinery (*), including digital printing machines have been booming for a quite long time now. Indian companies participating in the recent printing and garment machinery shows have cracked on many deals and serious inquires have been generated. This will further boost the exports to this segment. In Q1 FY 2019-20, the exports of this commodity have witnessed a growth of 37.25% to US$ 39.55 million over the CPLY. Philippines is the largest export market for this commodity with an export value of US$ 5.71 million with growth of 2790.18%, but it seems like these exports are re-exported to another country from Philippines, as the exports in the same quarter of the previous year was nearly zero. The second largest export market for India's printing machinery is Bangladesh. The country witnessed a growth of 14.39% to US$ 5.56 million in Q1 FY 2019-20 over CPLY. Exports to Italy have shown quite a good trend in the market, with a growth of 148.69% to US$ 4.88 million. Under this commodity, machines which perform two or more functions of printing were exported the most to the world. The exports totalled to US$ 7.05 million with a growth of 2194.76% in Q1 FY 19-20 over the CPLY.

Weaving machinery sector has observed a marginal growth in the export market in Q1 FY 2019-20, with an export value of US$ 9.38 million and a growth of 2.43% over the CPLY. For India's weaving machines, Vietnam is the largest market and the export totalled to US$ 1.64 million over CPLY. Weaving machines with a width of 30 cms shuttle type was exported the most under this category.The exports of this product totalled to US$ 8.41 million with a growth of 7.40% in Q1 FY 2019-20 over the CPLY.

Exports of extruding, drawing, texturing or cutting man-made textile materials commodity perceived a negative growth of 29.92% to US$ 1.25 million in Q1 FY 19-20 over CPLY. Sewing machines and accessories exports in Q1 FY 19-20 witnessed a growth of 9.65% to US$ 15.40 million over the CPLY. Germany is the top export market for India's sewing and accessories machines. The exports to the country totalled to US$ 5.02 million with a growth of 24.27% in the first quarter. Under this commodity, sewing machine needles was exported the most with a value of US$ 6.16 million with a minimal growth of 0.92% in Q1 FY 19-20 over the CPLY. Automatic sewing machine exports have witnessed a good growth of 85.85% to US$ 1.12 million.

Country-wise textile machinery exports

Bangladesh remains the top export market for India's textile machinery. Exports to Bangladesh totalled to US$ 18.31 million in Q1 FY 19-20, with a growth of 39.21% over the CPLY and stakes 10% share in the total export of India's textile machinery. Bangladesh is a top market for India's spinning, twisting and yarn preparation machine, the exports totalled to US$ 7.74 million, but exports have dropped by 48% in Q1 FY 2019-20 over the CPLY. Printing machines have witnessed a growth of 14.39% to US$ 5.56 million Q1 FY 19-20 over the CPLY where the exports totalled to US$ 4.86 million.

Germany remains the second largest export market for India's textile machinery goods. The country has witnessed a growth of 12.96% to US$ 18.22 million in Q1 FY 2019-20 over the CPLY and Germany also stakes 10% share in the total exports of India's textile machinery. Auxiliary machines were exported the most to Germany from India in Q1. The exports valued worth US$ 9.2 million with a growth of 142.25% over CPLY. Sewing machine and accessories were exported the most to the country with a value of US$ 5.02 million and registered a growth of 24.27% in Q1 FY 19-20 over the CPLY.

Pakistan which stood as the 11th leading export market for India's textile machinery in Q1 FY 2018-19, has witnessed a good trend in the Q1 FY 2019-20. The country now stands as the third largest export market for India's textile machinery goods. Exports totalled to US$ 16.47 million with a marvellous growth of 215.52% over the CPLY. The country stakes 9% share in the total exports of India's textile machinery. The robust growth over the period of one year is all because of the increased exports of spinning, twisting and yarn preparation to Pakistan from India. The exports of the commodity totalled to US$ 13.85 million with 303.94% growth in Q1 FY 19-20. Printing and sewing machines are the only commodities that have witnessed a downward trend of 75.61% and 42.15% respectively.

However, Pakistan will no longer be a market for Indian textile and textile machines, as trade between the two countries is suspended. Indian textile machinery exporters eager to supply to Pakistan would probably look for third-country routes.

India's textile machinery exports to Vietnam fell by 27.16% to US$ 8.85 million over the CPLY. But still the country has move up in India's textile machinery export market by one position, now standing as the fourth leading market. Vietnam currently stakes 5% share in the total exports of India's textile machinery. Spinning, twisting and yarn preparation is the leading commodity exported to Vietnam with an export value of US$ 5.95 million, but has perceived a negative growth of 43.34% in Q1 FY 19-20 over the CPLY. It's only weaving machine commodity export that has perceived a positive growth of 1625.40% to US$ 1.64 million, while rest all commodities have witnessed a negative growth. Textile machinery exports to Italy have moved up by 29.90% to US$ 7.56 million in Q1 FY 2019-20 over the CPLY where the exports totalled to US$ 5.82 million. Exports to other countries have dropped drastically therefore, Italy has managed to be the fifth largest export market in the Q1 for this fiscal year from 10th position in CPLY. Printing machinery including digital printing is exported the most to the country, the exports totalled to US$ 4.88 million with a growth of 148.69%. Auxiliary machine exports to Italy have dropped by 38.94% to US$ 2.31 million.

Germany remains the second largest export market for India's textile machinery goods. The country has witnessed a growth of 12.96% to US$ 18.22 million in Q1 FY 2019-20 over the CPLY and Germany also stakes 10% share in the total exports of India's textile machinery. Auxiliary machines were exported the most to Germany from India in Q1. The exports valued worth US$ 9.2 million with a growth of 142.25% over CPLY. Sewing machine and accessories were exported the most to the country with a value of US$ 5.02 million and registered a growth of 24.27% in Q1 FY 19-20 over the CPLY.

Pakistan which stood as the 11th leading export market for India's textile machinery in Q1 FY 2018-19, has witnessed a good trend in the Q1 FY 2019-20. The country now stands as the third largest export market for India's textile machinery goods. Exports totalled to US$ 16.47 million with a marvellous growth of 215.52% over the CPLY. The country stakes 9% share in the total exports of India's textile machinery. The robust growth over the period of one year is all because of the increased exports of spinning, twisting and yarn preparation to Pakistan from India. The exports of the commodity totalled to US$ 13.85 million with 303.94% growth in Q1 FY 19-20. Printing and sewing machines are the only commodities that have witnessed a downward trend of 75.61% and 42.15% respectively.

However, Pakistan will no longer be a market for Indian textile and textile machines, as trade between the two countries is suspended. Indian textile machinery exporters eager to supply to Pakistan would probably look for third-country routes.

India's textile machinery exports to Vietnam fell by 27.16% to US$ 8.85 million over the CPLY. But still the country has move up in India's textile machinery export market by one position, now standing as the fourth leading market. Vietnam currently stakes 5% share in the total exports of India's textile machinery. Spinning, twisting and yarn preparation is the leading commodity exported to Vietnam with an export value of US$ 5.95 million, but has perceived a negative growth of 43.34% in Q1 FY 19-20 over the CPLY. It's only weaving machine commodity export that has perceived a positive growth of 1625.40% to US$ 1.64 million, while rest all commodities have witnessed a negative growth. Textile machinery exports to Italy have moved up by 29.90% to US$ 7.56 million in Q1 FY 2019-20 over the CPLY where the exports totalled to US$ 5.82 million. Exports to other countries have dropped drastically therefore, Italy has managed to be the fifth largest export market in the Q1 for this fiscal year from 10th position in CPLY. Printing machinery including digital printing is exported the most to the country, the exports totalled to US$ 4.88 million with a growth of 148.69%. Auxiliary machine exports to Italy have dropped by 38.94% to US$ 2.31 million.

Netherland is now the sixth largest export market for India's textile machinery product in Q1 FY 2019-20, while CPLY the country was the third largest market. The exports in this fiscal year's Q1 totalled to US$ 7.12 million with a negative growth of 53.98%. Auxiliary machines is the most exported commodity to Netherl and with an export value of US$ 3.93 million, but has perceived a negative growth of 0.84% and printing machinery exports at US$ 10.17 million in Q1 FY 18-19 fell by 76.67% to US$ 2.37 million in Q1 FY 2019-20.

Exports to China witnessed a drastic fall of 46.60% in Q1 FY 2019-20, to US$ 6.36 million. The country now stands as the 9th largest export market, from sixth largest export market for Indian textile machinery in Q1 FY 2018-19. Spinning, twisting and yarn preparation commodity has gone down by 88.07% to US$ 0.58 million in Q1 FY 19-20 over the CPLY where the exports totalled to US$ 4.83 million. Auxiliary machine which is the largest exported commodity to China, too has witnessed a drop of 18.55% to US$ 4.34 million in Q1 FY 19-20 over the CPLY.

*Printing machinery also includes imports and exports of computer printers

Netherland is now the sixth largest export market for India's textile machinery product in Q1 FY 2019-20, while CPLY the country was the third largest market. The exports in this fiscal year's Q1 totalled to US$ 7.12 million with a negative growth of 53.98%. Auxiliary machines is the most exported commodity to Netherl and with an export value of US$ 3.93 million, but has perceived a negative growth of 0.84% and printing machinery exports at US$ 10.17 million in Q1 FY 18-19 fell by 76.67% to US$ 2.37 million in Q1 FY 2019-20.

Exports to China witnessed a drastic fall of 46.60% in Q1 FY 2019-20, to US$ 6.36 million. The country now stands as the 9th largest export market, from sixth largest export market for Indian textile machinery in Q1 FY 2018-19. Spinning, twisting and yarn preparation commodity has gone down by 88.07% to US$ 0.58 million in Q1 FY 19-20 over the CPLY where the exports totalled to US$ 4.83 million. Auxiliary machine which is the largest exported commodity to China, too has witnessed a drop of 18.55% to US$ 4.34 million in Q1 FY 19-20 over the CPLY.

*Printing machinery also includes imports and exports of computer printers

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.