India's Cotton Production Drops In The Last Season

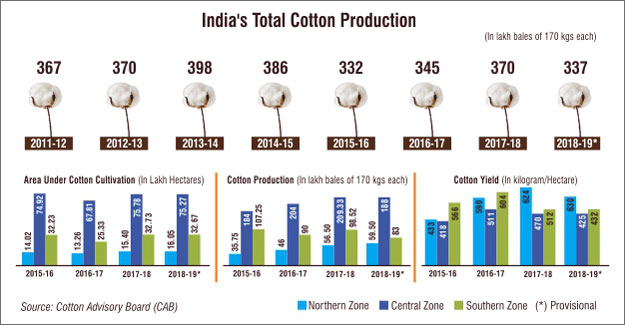

India's cotton production trend

In the last season of cotton (2018-19: Oct-Sep) India has produced 337 lakh bales of cotton and has witnessed a negative growth of 8.91% over the previous season. The central zone which includes Gujarat, Maharashtra and Madhya Pradesh is the highest producing zone in 2018-19 and has always been the largest producing zone in India. The production of cotton in central zone totalled to 188 lakh bales in 2018-19 and stakes 56% of share in the total production of cotton in India. But the production has gone down by 10.19% over the previous season. Even the south zone has witnessed a drop of 15.75% in the production with total of 83 lakh bales of cotton. It's only the north zone that a has perceived a growth of 5.31% in the production of cotton with total of 59.50 lakh bales of cotton. State-wise, Gujarat remains as the topmost state in the production of cotton in 2018-19 seasons with production of 87 lakh bales of cotton, but has perceived a growth negative growth of 16.22% over the previous season.

Several reports have estimated that cotton production might see a rise by 20% in the current season (2019-20) to 404 lakh bales of cotton, thanks to the good amount of rainfall in all the cotton growing zones. Cotton prices in India are currently higher than global rates. The industry expects domestic prices to remain firm till December as new crop arrivals have taken time due to late sowing and continuing rainfall, which delays harvesting.

As per the latest United States Department of Agriculture (USDA) estimates for 2019-20, India's cotton production would touch at 390 lakh bales of cotton. Harvested area in India is projected at a record 12.9 million hectares in 2019-20, as domestic prices and internal support price prospects favour cotton over competing crops. While, the first advance estimate by the Government of India has projected cotton production in the country at 322.7 lakh bales. Many of cotton trade bodies in India are yet to come out with their own crop estimates.

Northern Zone

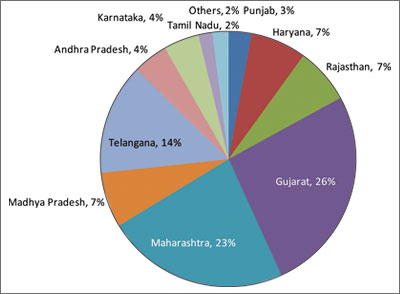

In 2018-19 cotton seasons, the cotton production in the northern zone was 59.5 lakh bales and witnessed a growth of 5.31% from the previous season. In this zone, Rajasthan produced cotton of 25 lakh bales in 2018-19 with a growth of 7.08% over the previous season, making itself the topmast state in the northern zone and the state share 42% in the northern zone and 7% in the total cotton production of India.

Haryana too have improved its cotton production in the last season with total production of 23 lakh bales of cotton. The state witnessed a growth of 7.08% over the previous season and stakes a share of 39% in the zone and 7% in the total cotton production of India.

Punjab which had improved its production of cotton in 2017-18 by 30.66% has again witnessed a drop of 2.21% in 2018-19 with a total production of 11.5 lakh bales of cotton. Punjab stakes a share of 19% in the northern zone and 3% in the total cotton production of India.

Central Zone

Central zone accounts for about 56% of the total cotton production in India. The main states in the central zone are Gujarat, Maharashtra and Madhya Pradesh where cotton is cultivated as full season crop. In the last season (2018-19) the zone's production totalled to 188 lakh bales of cotton and perceived a negative growth of 10.19% over the previous season.

Gujarat is the topmost producing cotton state in the country and in the central zone. In the last season, Gujarat produced 87 lakh bales of cotton in 2018-19 but perceived a negative growth of 16.22% over the previous season. The state stakes 46% in the zone and 26% in the total cotton production of India.

Maharashtra is the second highest cotton producing state in the country, but this state also has perceived a negative growth in the last season. The production of cotton in Maharashtra totalled to 77 lakh of bales with a negative growth of 7.62% over the previous season. The state stakes 41% in the zone and 23% in the total cotton production of India.

Madhya Pradesh which has always been an average cotton growing state has witnessed a positive growth of 8.40% 2018-19 over the previous season. The production of cotton in Madhya Pradesh touched to 24 lakh bales in 018-19 while in the previous season it was 22.14 lakh bales. The state share 13% in the zone and 7% in the total cotton production of India.

Southern Zone

This zone of India is the second largest cotton producing zone in the country. But the zone has perceived a negative growth of 15.75% in the last season (2018-19) over the previous season. The zone stakes a share of 25% in the total cotton production of India. The production of cotton in this zone totalled to 83 lakh bales in 2018-19 while in the previous season the production was 98.52 lakh bales.

Out of these four states, Telangana produces the most amount of cotton. The state stakes 57% share in the zone and 14% in the country's total production. In 2018-19, the state produced 47 lakh bales of cotton, which witnessed a drop of 13.67% over the previous season.

Andhra Pradesh currently stakes 18% in the zone and 4% in the country's total production of cotton. The state perceived a negative growth of 29.44% to 15 lakh bales of cotton in 2018-19 seasons over the previous season. Karnataka perceived a growth of 13.39% to 15 lakh bales of cotton in 2018-19 over the previous season and stakes 20% share in the zone area and 5% in the total cotton production of the country. The least volume of cotton is produced Tamil Nadu, the average has been 5 to 7.5 lakh bales of cotton from 1991 to 2017. In the last season of cotton, the state produced 6 lakh bales of cotton and witnessed a growth of 23.29% to 4.5 lakh bales of cotton. The state stakes 7% share in the total cotton production of India.

[caption id="attachment_17645" align="alignleft" width="400"] States Share In the Country's Total Cotton Production in 2018-19[/caption]

India's Cotton Cultivation (Area) Trend

In the last season, are under cotton cultivated has gone up with a minimal growth of 0.17% over the previous season. India's cultivated land for cotton in 2018-19 went to 126.07 lakh hectares from 125.86 lakh hectares. Area-wise, 63% of the total area cultivated for cotton comes from the central zone, followed by the southern zone with 26%, and northern zone by 13%.Out of the top ten states, six states have shown a drop in area under cotton. State-wise, Maharashtra has used the maximum of its land to cultivate cotton crop amongst the other cotton growing states. Though the cultivated area of cotton has increased, but the cotton productivity growth has gone down by 9.20% with an yield of 454 kg/hectare over the previous season yield 500 kg/hectare.

Northern zone

In the northern zone, cotton cultivate area has witnessed a rise of 4.22% in the last season to 16.05 lakh hectares of area over the previous season where the cultivated area was 15.4 lakh hectares. The cotton productivity growth in the northern zone went up by 0.96% with a yield of 630 lakh hectares.

Haryana has used 7.08 lakh hectares of area for the cultivation of cotton in the last season making itself the top state in the zone and perceived a growth of 6.47% over the previous season. The state stakes 44% in the zone and 6% in the country's total are covered under the cultivation of cotton. The cotton productivity growth in the state has gone up by 0.55% with a yield of 552 kg/hectare over the previous season's yield of 549 kg/hectare.

Punjab is the only state in the zone that has registered a negative in the last season of cotton. The state perceived a negative growth of 7.90% with an area of 2.68 lakh hectares under the cotton cultivation in 2018-19 over the previous season where the area registered was 2.91 lakh hectares. The state stakes a share of 17% in the zone and 2% in the country's total are covered under the cultivation of cotton. Though the area under cultivation for Punjab has gone down the cotton productivity growth in the state has gone by 6.11% with a yield of 729 kg/hectare in 2018-19 over the previous season, where the yield was registered at 687 kg/hectare.

In Rajasthan an area of 6.29 lakh hectares was registered under the cotton cultivation in 2018-19 with a growth of 7.71% over the previous season where the area was 5.84 lakh hectares. Rajasthan stakes a share of 39% in the zone and 5% in the country's total area covered under the cultivation of cotton. In the state, the area used of cultivation and production for cotton both have witnessed a rise in the last season, but productivity yield as gone down by 0.15% with an yield of 676 kg/hectare in 2018/19 over the previous season, where the yield was registered at 624 kg/hectare.

Central Zone

Area-wise this is top zone that cultivates major amount of cotton crop on their land. But in the last season, the zone has witnessed a minor negative growth of 0.67% with an area of 75.27 lakh hectares of area over the previous season where the cultivated land was 74.78 lakh hectares. The central zone stakes 60% share in the country's total area covered under the cultivation of cotton. Where the yield is concerned, the zone has perceived a negative growth of 9.57% with a yield of 425 kg/hectare in 2018-19 over the previous season where the yield was 470 kg/hectare.

Here Maharashtra leads the scoreboard with 57% share in the zone and 34% in the total area used for the cultivation of cotton crop. In the last season of cotton, Maharashtra used 42.54 lakh hectares of area for cotton, but witnessed a drop of by 2.23% in 2018-19 over the previous season where the cultivated area was 43.51 lakh hectares. As the cultivated area and production of cotton both have dropped in Maharashtra the productivity yield too has dropped by 5.52% to 308 kg/hectare in the last season over the previous season.

Gujarat been the topmost state in producing cotton has witnessed a growth of 1.33 in the area cultivated for cotton in the last season with an area of 26.59 lakh hectares in 2018-19 over the previous season. The state share 35% in the zone and 21% in the country's total area used for the cultivation of cotton. In the zone, Gujarat has drop the most while compared to the productivity yield of the crop by 17.38% to 556 kg/hectare in 2018-19 over the previous season yield 673 kg/hectare.

The last season has been good for Madhya Pradesh, as the production as increased 8.40% in 2018-19 over the previous season, the area used for the cultivation of cotton and productivity yield has too witnessed an increase. The area used for the cultivation of cotton has gone up by 1.82% to 6.14 lakh hectares over the previous season area registered was 6.03 lakh hectares. The state stakes a share of 8% in the zone and 5% in the country's total area used for cotton crop. The productivity yield of the state has gone up by 6.41% to 664 kg/hectare over the previous season the yield was 624 kg/hectares.

Southern Zone

In the southern zone the cultivation area for cotton has witnessed a drop of -0.18% to 32.67 lakh hectares in the last season. The zone stakes 26% share in the country total area used for the cultivation cotton. All the states have witnessed a drop in the area used for cultivation of cotton crop except for Karnataka.

Telangana leads in the zone with a share of 56% in the zone and 14% in the total areas cultivated with cotton crop in the country. In the last season the state cultivated cotton with an area of 18.27 lakh hectares, but registered a negative growth of 3.69% in 2018-19 over the previous season. The yield too has dropped 10.45% to 437 kg/hectare over the previous season, where the yield was 488 kg/hectare.

Andhra Pradesh also has registered a fall of 3.87% in the cultivation area totaling to 6.21 lakh hectares in the last season. The state stake a share of 19% in the zone and 5% in the country's total area used for the cultivation of cotton crop.In this state as the area and production has witnessed a downward trend, the productivity yield too as witnessed a drop of 26.48% in 2018-19 with yield of 411 kg/hectare over the previous season where the yield was 559 kg/hectare.

Karnataka has cultivated cotton crop with a good more amount of area in 2018-19 over the previous season. The area totalled to 6.88 lakh hectares with growth 25.78% and stakes a share of 21% in the zone and 5% in the country's total cultivated area used for the production of cotton crop. The productivity yield has dropped by 31.04% in the last season with a yield of 371 kg/hectare over the previous season yield which totalled to 538 kg/hectare.

Area-wise Tamil Nadu cultivates cotton on least size area from the top ten cotton growing states. In the last season Tamil Nadu cultivated cotton with an area 1.31 lakh hectares and has perceived a drop of 28.42% in 2018-19 over the previous season where the area was 1.83 lakh hectares.But the state has witnessed a good growth in the yield of cotton by 52.45% to 779 kg/hectare over the previous season where the yield was 511 kg/hectare.

India's Cotton Exports

Asian Countries Demand More Indian Cotton

Cotton which is the second most exported commodity to the world from India, has perceived a growth of 11.97% to US$ 7888.29 million in FY 18-19 and accounts for a share of 21% in the total T&C exports of India. Bangladesh is the top market for India's cotton, the export totalled to US$ 1878.04 million with a growth of 3.02% in the last fiscal year. Exports to China have increased by 78.09% to US$ 1786.77 million. Cotton exports to Pakistan, Vietnam and Sri Lanka too have shown an increase in the last fiscal.

Indian cotton of staple length 28.5 mm and above, but below 34.5 mm has been exported the most. The export value of this product totalled US$ 1895.8 million with growth of 11.97% in FY 18-19 over the corresponding period. On an average per kg of the product was traded at US$ 0.50 per kg in 2018-18 fiscal year, while in the previous year the same product was traded at US$ 0.56 per kg. India has exported this product to China with growth of 249.19% to US$ 464.72 million, while in the corresponding period the exports totalled to US$ 117.89 million. But Bangladesh remains the top market of this product with an export of US$ 674.03 million.

World's Cotton Production And Consumption

As per the ICAC data released, world cotton production was witnessed a downward trend in 2018-19 by 4.70% to 25.75 million metric tons over the CPLY where the production totalled to 27.02 million metric tons and this was the highest recorded cotton production in the last nine years. The lowest production was witnessed in 2015-19 with production of 21.49 million metric tons. It is projected that in 2019-20 the world cotton production would rise by 6.83% to 27.51 million metric tons over 2018-19 production quantity. India took over China in the production of cotton in 2014-15, but in the last season(2018-19) China has again took the position as the largest cotton producing country.

Though the world's production has dropped in 2018-19, the consumption of cotton has witnessed an increase of 0.49% to 26.66 million metric tons. It is China that consumption major amount of cotton and stakes 32% in the world total consumption of cotton. It is estimated that the world cotton consumption witness a downward trend of 1.16% to 26.35 million metric tons of cotton.

In China, the cotton production has been falling 2013-14 and has the witnesses the production of 4.9 million metric tons to cotton production in 2016-17. In the last season the production totalled to 6.04 million metric tons with a growth of 2.55% over the previous season and the country stakes a share of 23% in the world total cotton production.

It is estimated that the cotton production in China for 2019-20 would touch to 5.92 million metric tons which would be fall of 2%. The consumption in China has gone down by 0.59% to 8.45 million metric tons over the previous season where the consumption was 8.50 million metric ton.

Cotton production in India has witnessed a drop of 13.39% to 5.5 million metric tons over the previous season, where the cotton production totalled to 6.35 million metric tons. India is now the second largest cotton producing country. The country stakes a share of 21% in the world's total cotton production and it is projected that in 2019-20 the country would produce 5.75 million metric ton of cotton, which would yield a growth of 4.55%. India's consumption of cotton was gone down by 0.37% to 5.40 million metric ton from 5.42 in the previous season.

In USA, the production has too gone down by 12.09% to 4 million metric tons in 2018-19 over the previous season and the country stakes 16% share in the world's total cotton production and the country is estimated to produce cotton 4.79 million metric tons with a growth of 19.75%. Here the consumption has dropped by 7.79% to 0.71 million metric tons from 0.77 in 2018-19 from the previous season.

Pakistan has always had an average cotton production trend. The country has witnessed the lowest production value in 2015-16, where it totalled to 1.54 million metric tons. In 2018-19 the production of cotton totalled to 1.67 million metric tons with a negative growth of 7.22% and it stakes 6% in the world's total cotton production. It is estimated that the country would produce 1.97 million metric tons of cotton in 2019-20 with growth of 17.96%. Pakistan cotton consumption has dropped by 6.72%. to 2.36 million metric tons from 2.53 in 2018-19 over the previous season.

States Share In the Country's Total Cotton Production in 2018-19[/caption]

India's Cotton Cultivation (Area) Trend

In the last season, are under cotton cultivated has gone up with a minimal growth of 0.17% over the previous season. India's cultivated land for cotton in 2018-19 went to 126.07 lakh hectares from 125.86 lakh hectares. Area-wise, 63% of the total area cultivated for cotton comes from the central zone, followed by the southern zone with 26%, and northern zone by 13%.Out of the top ten states, six states have shown a drop in area under cotton. State-wise, Maharashtra has used the maximum of its land to cultivate cotton crop amongst the other cotton growing states. Though the cultivated area of cotton has increased, but the cotton productivity growth has gone down by 9.20% with an yield of 454 kg/hectare over the previous season yield 500 kg/hectare.

Northern zone

In the northern zone, cotton cultivate area has witnessed a rise of 4.22% in the last season to 16.05 lakh hectares of area over the previous season where the cultivated area was 15.4 lakh hectares. The cotton productivity growth in the northern zone went up by 0.96% with a yield of 630 lakh hectares.

Haryana has used 7.08 lakh hectares of area for the cultivation of cotton in the last season making itself the top state in the zone and perceived a growth of 6.47% over the previous season. The state stakes 44% in the zone and 6% in the country's total are covered under the cultivation of cotton. The cotton productivity growth in the state has gone up by 0.55% with a yield of 552 kg/hectare over the previous season's yield of 549 kg/hectare.

Punjab is the only state in the zone that has registered a negative in the last season of cotton. The state perceived a negative growth of 7.90% with an area of 2.68 lakh hectares under the cotton cultivation in 2018-19 over the previous season where the area registered was 2.91 lakh hectares. The state stakes a share of 17% in the zone and 2% in the country's total are covered under the cultivation of cotton. Though the area under cultivation for Punjab has gone down the cotton productivity growth in the state has gone by 6.11% with a yield of 729 kg/hectare in 2018-19 over the previous season, where the yield was registered at 687 kg/hectare.

In Rajasthan an area of 6.29 lakh hectares was registered under the cotton cultivation in 2018-19 with a growth of 7.71% over the previous season where the area was 5.84 lakh hectares. Rajasthan stakes a share of 39% in the zone and 5% in the country's total area covered under the cultivation of cotton. In the state, the area used of cultivation and production for cotton both have witnessed a rise in the last season, but productivity yield as gone down by 0.15% with an yield of 676 kg/hectare in 2018/19 over the previous season, where the yield was registered at 624 kg/hectare.

Central Zone

Area-wise this is top zone that cultivates major amount of cotton crop on their land. But in the last season, the zone has witnessed a minor negative growth of 0.67% with an area of 75.27 lakh hectares of area over the previous season where the cultivated land was 74.78 lakh hectares. The central zone stakes 60% share in the country's total area covered under the cultivation of cotton. Where the yield is concerned, the zone has perceived a negative growth of 9.57% with a yield of 425 kg/hectare in 2018-19 over the previous season where the yield was 470 kg/hectare.

Here Maharashtra leads the scoreboard with 57% share in the zone and 34% in the total area used for the cultivation of cotton crop. In the last season of cotton, Maharashtra used 42.54 lakh hectares of area for cotton, but witnessed a drop of by 2.23% in 2018-19 over the previous season where the cultivated area was 43.51 lakh hectares. As the cultivated area and production of cotton both have dropped in Maharashtra the productivity yield too has dropped by 5.52% to 308 kg/hectare in the last season over the previous season.

Gujarat been the topmost state in producing cotton has witnessed a growth of 1.33 in the area cultivated for cotton in the last season with an area of 26.59 lakh hectares in 2018-19 over the previous season. The state share 35% in the zone and 21% in the country's total area used for the cultivation of cotton. In the zone, Gujarat has drop the most while compared to the productivity yield of the crop by 17.38% to 556 kg/hectare in 2018-19 over the previous season yield 673 kg/hectare.

The last season has been good for Madhya Pradesh, as the production as increased 8.40% in 2018-19 over the previous season, the area used for the cultivation of cotton and productivity yield has too witnessed an increase. The area used for the cultivation of cotton has gone up by 1.82% to 6.14 lakh hectares over the previous season area registered was 6.03 lakh hectares. The state stakes a share of 8% in the zone and 5% in the country's total area used for cotton crop. The productivity yield of the state has gone up by 6.41% to 664 kg/hectare over the previous season the yield was 624 kg/hectares.

Southern Zone

In the southern zone the cultivation area for cotton has witnessed a drop of -0.18% to 32.67 lakh hectares in the last season. The zone stakes 26% share in the country total area used for the cultivation cotton. All the states have witnessed a drop in the area used for cultivation of cotton crop except for Karnataka.

Telangana leads in the zone with a share of 56% in the zone and 14% in the total areas cultivated with cotton crop in the country. In the last season the state cultivated cotton with an area of 18.27 lakh hectares, but registered a negative growth of 3.69% in 2018-19 over the previous season. The yield too has dropped 10.45% to 437 kg/hectare over the previous season, where the yield was 488 kg/hectare.

Andhra Pradesh also has registered a fall of 3.87% in the cultivation area totaling to 6.21 lakh hectares in the last season. The state stake a share of 19% in the zone and 5% in the country's total area used for the cultivation of cotton crop.In this state as the area and production has witnessed a downward trend, the productivity yield too as witnessed a drop of 26.48% in 2018-19 with yield of 411 kg/hectare over the previous season where the yield was 559 kg/hectare.

Karnataka has cultivated cotton crop with a good more amount of area in 2018-19 over the previous season. The area totalled to 6.88 lakh hectares with growth 25.78% and stakes a share of 21% in the zone and 5% in the country's total cultivated area used for the production of cotton crop. The productivity yield has dropped by 31.04% in the last season with a yield of 371 kg/hectare over the previous season yield which totalled to 538 kg/hectare.

Area-wise Tamil Nadu cultivates cotton on least size area from the top ten cotton growing states. In the last season Tamil Nadu cultivated cotton with an area 1.31 lakh hectares and has perceived a drop of 28.42% in 2018-19 over the previous season where the area was 1.83 lakh hectares.But the state has witnessed a good growth in the yield of cotton by 52.45% to 779 kg/hectare over the previous season where the yield was 511 kg/hectare.

India's Cotton Exports

Asian Countries Demand More Indian Cotton

Cotton which is the second most exported commodity to the world from India, has perceived a growth of 11.97% to US$ 7888.29 million in FY 18-19 and accounts for a share of 21% in the total T&C exports of India. Bangladesh is the top market for India's cotton, the export totalled to US$ 1878.04 million with a growth of 3.02% in the last fiscal year. Exports to China have increased by 78.09% to US$ 1786.77 million. Cotton exports to Pakistan, Vietnam and Sri Lanka too have shown an increase in the last fiscal.

Indian cotton of staple length 28.5 mm and above, but below 34.5 mm has been exported the most. The export value of this product totalled US$ 1895.8 million with growth of 11.97% in FY 18-19 over the corresponding period. On an average per kg of the product was traded at US$ 0.50 per kg in 2018-18 fiscal year, while in the previous year the same product was traded at US$ 0.56 per kg. India has exported this product to China with growth of 249.19% to US$ 464.72 million, while in the corresponding period the exports totalled to US$ 117.89 million. But Bangladesh remains the top market of this product with an export of US$ 674.03 million.

World's Cotton Production And Consumption

As per the ICAC data released, world cotton production was witnessed a downward trend in 2018-19 by 4.70% to 25.75 million metric tons over the CPLY where the production totalled to 27.02 million metric tons and this was the highest recorded cotton production in the last nine years. The lowest production was witnessed in 2015-19 with production of 21.49 million metric tons. It is projected that in 2019-20 the world cotton production would rise by 6.83% to 27.51 million metric tons over 2018-19 production quantity. India took over China in the production of cotton in 2014-15, but in the last season(2018-19) China has again took the position as the largest cotton producing country.

Though the world's production has dropped in 2018-19, the consumption of cotton has witnessed an increase of 0.49% to 26.66 million metric tons. It is China that consumption major amount of cotton and stakes 32% in the world total consumption of cotton. It is estimated that the world cotton consumption witness a downward trend of 1.16% to 26.35 million metric tons of cotton.

In China, the cotton production has been falling 2013-14 and has the witnesses the production of 4.9 million metric tons to cotton production in 2016-17. In the last season the production totalled to 6.04 million metric tons with a growth of 2.55% over the previous season and the country stakes a share of 23% in the world total cotton production.

It is estimated that the cotton production in China for 2019-20 would touch to 5.92 million metric tons which would be fall of 2%. The consumption in China has gone down by 0.59% to 8.45 million metric tons over the previous season where the consumption was 8.50 million metric ton.

Cotton production in India has witnessed a drop of 13.39% to 5.5 million metric tons over the previous season, where the cotton production totalled to 6.35 million metric tons. India is now the second largest cotton producing country. The country stakes a share of 21% in the world's total cotton production and it is projected that in 2019-20 the country would produce 5.75 million metric ton of cotton, which would yield a growth of 4.55%. India's consumption of cotton was gone down by 0.37% to 5.40 million metric ton from 5.42 in the previous season.

In USA, the production has too gone down by 12.09% to 4 million metric tons in 2018-19 over the previous season and the country stakes 16% share in the world's total cotton production and the country is estimated to produce cotton 4.79 million metric tons with a growth of 19.75%. Here the consumption has dropped by 7.79% to 0.71 million metric tons from 0.77 in 2018-19 from the previous season.

Pakistan has always had an average cotton production trend. The country has witnessed the lowest production value in 2015-16, where it totalled to 1.54 million metric tons. In 2018-19 the production of cotton totalled to 1.67 million metric tons with a negative growth of 7.22% and it stakes 6% in the world's total cotton production. It is estimated that the country would produce 1.97 million metric tons of cotton in 2019-20 with growth of 17.96%. Pakistan cotton consumption has dropped by 6.72%. to 2.36 million metric tons from 2.53 in 2018-19 over the previous season.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.