Operating Costs: A Vital Factor In Investment Decisions

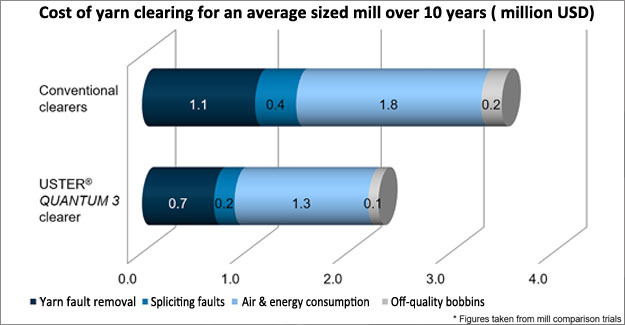

Textile mills need to calculate more than the immediate benefits, says Sivakumar Narayanan, Executive Vice President Uster Technologies When market demand is relatively low, textile mills have to perform a balancing act, involving many delicate choices. The deployment of capital and management of personnel levels are critical, not only to current profitability but also to long-term business success when an upturn arrives. When the going gets tough, customers become more demanding, especially regarding quality and value for money, making markets ever more competitive for suppliers. At such times, investment decisions might tend to focus on quality improvement as a key criterion. But there is often a temptation to snatch at a narrow range of perceived benefits, for instant gains: technology upgrades, extra features and, of course, capital costs/discounts. Purchasing choices can become bogged down in these details, ignoring the wider view of clearly-defined quality advantages and the vital aspect of ongoing operational costs. Yarn faults: counting the cost A striking example can be found in the case of a potential investment in new yarn clearing equipment. Here, practical calculations show that a typical winding installation with 500 positions can generate operating costs of over US$ 3.5 million over a 10-year period. This is a conservative estimate, based on the cost of splices – several millions of them – over this timescale, needed because of unacceptable yarn faults and bobbin changes when quality monitoring is not adequately controlled. It means that the initial capital investment can actually be dwarfed by these running costs: capital expenditure on the yarn clearers would turn out to be only a small fraction of the total lifetime spend. In fact, making prudent choices can result in the mill saving up to a million dollars over this time, depending on yarn type, quality and production conditions. Of course, it’s all too easy in a difficult trading environment, to seize an apparent bargain in terms of initial investment cost, especially where there’s a product upgrade promising a quick fix for a current problem. Not all investors take this short-term view, but those which do will often have some unpleasant surprises when starting to use their equipment. Investments: the bigger picture A profitable investment – as a general principle – should always focus on operational costs and savings opportunities as part of the essential ‘bigger picture’. Evaluation of investments should factor in the differences in operational costs between competing choices, instead of focusing too much on what will likely be quite small differences in the initial capital cost. Decision-makers should evaluate operational costs and capital expenditure as two totally different aspects of a new investment. Proper assessment of operational expenditure requires a closer look. It’s essential to find the real drivers of running costs and take product life-cycle into account, to calculate the savings. This is highly relevant in today’s difficult market environment – but it would be no less important even in better times.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.