Subdued Exports Could Hit Textile Sector’s Recovery: Ind-Ra

India Ratings and Research (Ind-Ra) believes that textile companies across the value chain could witness a top line contraction of 20%-25% yoy in FY21, on back of a muted domestic demand and sub-par exports during 1QFY21 due to the COVID-19 related disruptions. Subsequently, the companies in the ‘BBB’ and below rating categories could become extremely vulnerable to handle such exogenous shocks while the A and above category issuers’ median gross leverage could increase by 1.3x-1.5x. However, the liquidity profile of the majority of these issuers would remain resilient, barring a few companies where liquidity buffers are already thin.

Exports demand to take a hit, recovery to take longer

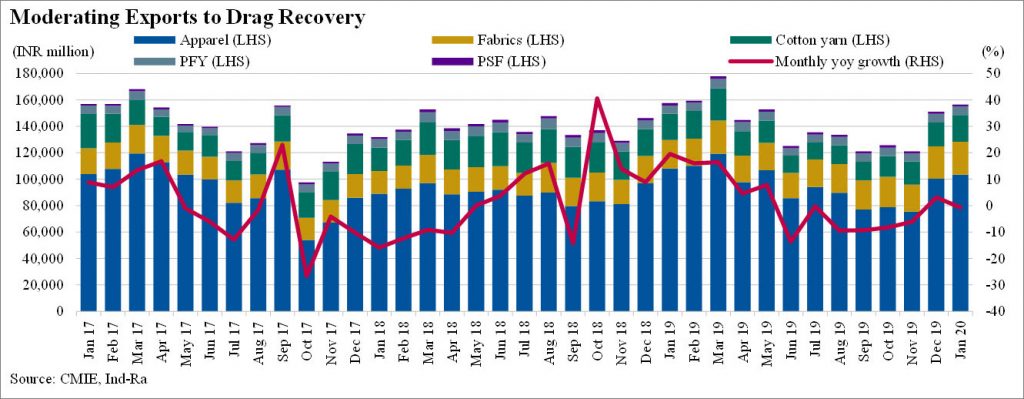

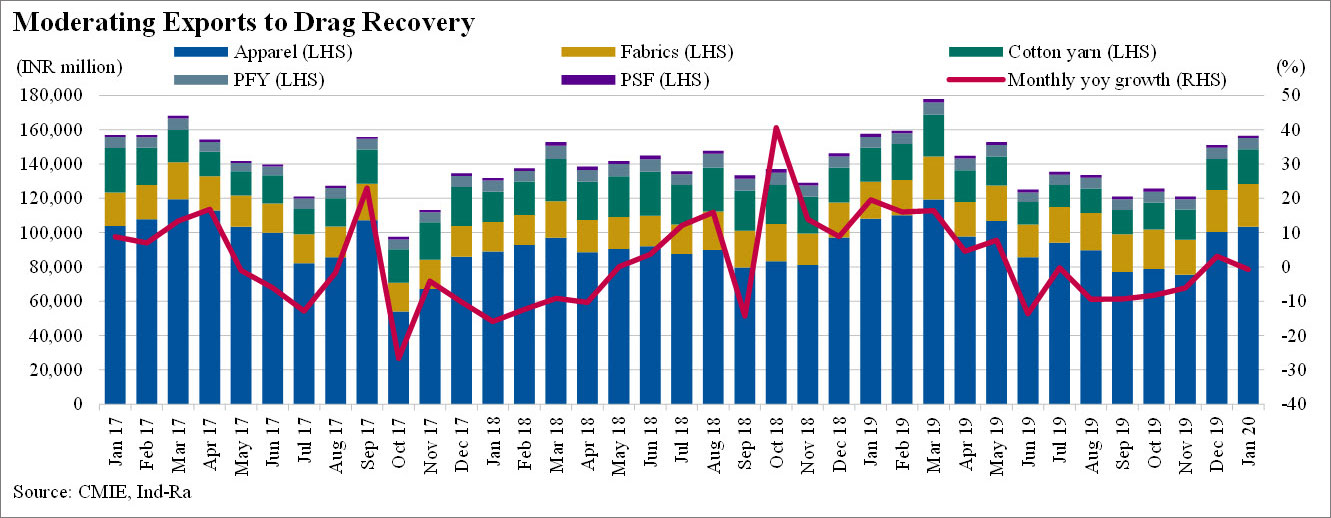

India exported US$ 28.36 billion worth of textiles from April 2019 till January 2020. The majority of domestic companies are facing massive order cancellations from the US and Europe, along with factory shutdowns, raw material shortage, delayed delivery of summer apparels. Average exports during Q1 typically stand at US$ 8-10 billion, hence the industry is staring at an equivalent quantum of revenue loss from exports across the value chain because of the extended lockdown which would take at least an additional month to resume.

Furthermore, the full-fledged resumptions of exports would mainly depend on the containment of pandemic in key export geographies. The US and Europe while being the worst hit geographies are also India’s major export markets for textile products, hence export recovery could take longer, especially given the discretionary nature of these products. Some US retail brands which are socially conscious are not fully cancelling orders but curtailing the volumes and to an extent bearing the brunt that manufacturers are facing.

Prolonged grim exports and muted domestic demand could lead to consolidation

The sector was already facing multiple headwinds in the form of a flattening demand from key exporting countries, higher production leading to lower realisations and increasing competition from neighbouring countries such as Bangladesh, Pakistan and Vietnam. Ind-Ra believes the COVID-19 related demand disruptions could substantially impact companies with weaker balance sheets and limited scale, should the recovery stretch beyond one quarter. In such a situation, Ind-Ra expects consolidation within sub-segments such as yarn producers, spinning and dyeing, since the industry is largely fragmented due to limited entry barriers. Also, any movement of orders out of China benefiting other competing countries would be limited in the short-run. China’s position as the largest exporter to the US may be challenged in the long-run, but will remain intact in the short run, given its strengths of scale, product integrity, price points and turnaround time in times of a shortening fashion cycle.

Impact on Ind-Ra rated issuers

Ind-Ra has analysed the impact of COVID-19 related disruption on its issuers rated A and above under two scenarios. The liquidity score for FY21 for most issuers remains resilient to demand shocks, backed by the availability of cash reserves and unutilised bank limits. While some issuers have heavy concentration on exports, their existing strong credit profiles would provide sufficient buffers under the stressed scenarios. However in a few A rated issuers, the liquidity scores contract closer to one, suggesting limited headroom available to honour debt obligations.

A weak rupee is a silver lining in the current situation. However, the majority of these issuers on an average maintain a hedge of 50%-60% of the receivable exposure, thus the currency benefits to an extent will be only moderate. In case of foreign currency debt, payments for the next 12 months are largely hedged, limiting any significant downside risk due to rupee depreciation.

Deleveraging pace likely to slow down

The agency believes material pressures on top line and hence EBITDA, would stretch the deleveraging pace of textile companies. Due to the higher fixed cost nature of the sector, the degree of operating leverage available to companies would significantly contract, limiting the fixed cost absorption. Among its A and above rated issuers, Ind-Ra expects the aggregate working capital requirement to remain limited, as a decline in commodity prices is likely to counter the incremental requirements of an elongated receivable cycle and higher inventory volumes. Hence, working capital related borrowings will inch up only moderately in FY21.

However, the benefit of a lower total debt in this scenario gets more than offset by the EBITDA loss, increasing the leverage levels. Ind-Ra expects the median gross leverage of the companies analysed to increase by 1.3x-1.5x as against its earlier assessment of a decline by around 0.5x in FY21. The ratios could revert to their FY20 levels in FY22, on the back of stabilised operations and a gradual revival of domestic as well as exports demand. While the working capital requirement would reduce, the working capital cycle is likely to elongate as collections from receivables would be delayed due to the typical cash flow pressures across the industry.

Government support critical for recovery post COVID-19

The textiles industry being heavily concentrated in medium and small scale enterprises, compared to large scale producers across the value chain, MSME players are highly vulnerable to the business risks. Subsequently, the resumption of operations for MSME’s heavily hinges on working capital availability and orders from large scale companies as well as exports. The extension of Rebate of Central & State Levies Scheme for readymade garments and made-ups is a step in the right direction in this regard, along with the ad-hoc incentive of 1%. The scheme would assist export-oriented units in these segments to claim a rebate on input costs at different rates for different cost heads. Furthermore, the moratorium announced by the Reserve Bank of India will only shift payment obligations and that too with a higher interest burden. The material relief especially to the MSME units in the sectors would depend on the domestic as well as export recovery, complimented with a focused government aid.

Impact on Ind-Ra rated issuers

Ind-Ra has analysed the impact of COVID-19 related disruption on its issuers rated A and above under two scenarios. The liquidity score for FY21 for most issuers remains resilient to demand shocks, backed by the availability of cash reserves and unutilised bank limits. While some issuers have heavy concentration on exports, their existing strong credit profiles would provide sufficient buffers under the stressed scenarios. However in a few A rated issuers, the liquidity scores contract closer to one, suggesting limited headroom available to honour debt obligations.

A weak rupee is a silver lining in the current situation. However, the majority of these issuers on an average maintain a hedge of 50%-60% of the receivable exposure, thus the currency benefits to an extent will be only moderate. In case of foreign currency debt, payments for the next 12 months are largely hedged, limiting any significant downside risk due to rupee depreciation.

Deleveraging pace likely to slow down

The agency believes material pressures on top line and hence EBITDA, would stretch the deleveraging pace of textile companies. Due to the higher fixed cost nature of the sector, the degree of operating leverage available to companies would significantly contract, limiting the fixed cost absorption. Among its A and above rated issuers, Ind-Ra expects the aggregate working capital requirement to remain limited, as a decline in commodity prices is likely to counter the incremental requirements of an elongated receivable cycle and higher inventory volumes. Hence, working capital related borrowings will inch up only moderately in FY21.

However, the benefit of a lower total debt in this scenario gets more than offset by the EBITDA loss, increasing the leverage levels. Ind-Ra expects the median gross leverage of the companies analysed to increase by 1.3x-1.5x as against its earlier assessment of a decline by around 0.5x in FY21. The ratios could revert to their FY20 levels in FY22, on the back of stabilised operations and a gradual revival of domestic as well as exports demand. While the working capital requirement would reduce, the working capital cycle is likely to elongate as collections from receivables would be delayed due to the typical cash flow pressures across the industry.

Government support critical for recovery post COVID-19

The textiles industry being heavily concentrated in medium and small scale enterprises, compared to large scale producers across the value chain, MSME players are highly vulnerable to the business risks. Subsequently, the resumption of operations for MSME’s heavily hinges on working capital availability and orders from large scale companies as well as exports. The extension of Rebate of Central & State Levies Scheme for readymade garments and made-ups is a step in the right direction in this regard, along with the ad-hoc incentive of 1%. The scheme would assist export-oriented units in these segments to claim a rebate on input costs at different rates for different cost heads. Furthermore, the moratorium announced by the Reserve Bank of India will only shift payment obligations and that too with a higher interest burden. The material relief especially to the MSME units in the sectors would depend on the domestic as well as export recovery, complimented with a focused government aid.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.