Deloitte Forecasts Mild Downturn To Severe Slowdown For Indian Economy

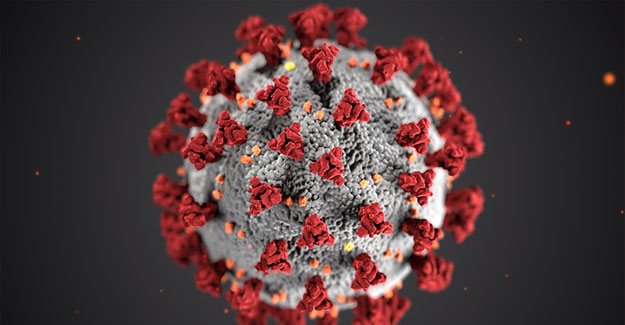

The COVID-19 pandemic has created a number of challenges for the government through its adverse impacts on economic growth and domestic demand. It is also likely to disrupt the domestic as well as global supply chain and create stress on the banking and financial sectors. These disruptions are likely to pose challenges not only in the next two quarters but could also linger for some more time before the economy revives, given the uncertainty on how long the pandemic would last. Global consulting firm Deloitte has recently issued its first policy paper on potential government response to the pandemic in the immediate to near term. The paper discusses three possible scenarios using a macro economic model to provide a probabilistic scenario, and its impact on the Indian economy. These scenarios range from mild downturn (where growth slows for a quarter or two and then, the economy bounces back immediately) to a severe slowdown (where growth slows for longer time followed by a tenuous recovery). "The COVID-19 outbreak has presented new and significant downside risk to the global economic outlook with all major countries like USA, China, UK being severely impacted. We expect that the resultant economic disruption will take time to address & any government response will also need to be properly calibrated and taken over a period of time. So this is actually the first paper from our side which is more focused on managing the immediate fallout. Going forward, we will be monitoring the situation closely and coming out with our suggestions through further policy papers as the situation evolves," says Arindam Guha, Partner, Deloitte India. As per the report the three scenarios are (a) an optimistic scenario, considering a temporary impact of COVID-19 and a V-shaped recovery, (b) a somewhat optimistic scenario, a severe and extended impact ofCOVID-19 and a U-shaped recovery, and (c) a pessimistic scenario, with a prolonged severe downturn, leading to a new low-level normal. These scenarios present a varying degree of the economic and financial crisis, and predict corresponding outcomes. In case of optimistic scenario, the report believes that the contagion, which started a few weeks later compared with other major economies, will be controlled efficiently by June 2020. This will be achieved by a complete lockdown of the nation as well as effective government investment in protecting the weaker sections, supporting specific sectors, boosting healthcare resources and services, and keeping the monetary policy benign. The model predicts the economy will start recovering from Q2FY2021 on the back of positive market sentiment and then rapidly grow from Q3FY2021 as consumer spending gains momentum. Overall, the model expects a synchronised global recovery from Q3FY2021. In the second scenario, the report assumes that initial supply chain problems from China will be multiplied as lockdowns in major economies affect other industries and the services sector globally. China takes more-than-expected time to get its production back on its feet and achieve full production capacity in Q3FY2021. Meanwhile, global demand sharply declines as several economies struggle to contain the spread and lockdowns are extended. Lower global economic activity, high unemployment, and company defaults create stress in the financial sector and slow growth. In the second scenario, the report believes India will witness limited success in controlling the spread, despite the government's focus on public health-related measures and fiscal policies to contain the pandemic. Movement restrictions will become stringent as lockdowns will be extended in several cities at varying degrees until September 2020. A few industries face pressure as rising debt and defaults affect market sentiments, stress the financial sector, and reduces domestic demand.The model suggests the economy will recover and resume normalcy from Q4 FY2021. Growth picks up pace rapidly in FY2022. The third pessimistic scenario posits that the regional outbreak of COVID-19 is followed by a series ofsuccessive variants of the disease (and several outbreaks) as the contagion continues globally for a prolonged period leading to negative consequences. Global production adjusts to a new low-level normal, which is way below the current level. High unemployment, increased household debt, and extended lockdowns affect consumer demand for goods and services.Global investment contracts fast while business sentiments remain low. In India, the disease will spread rapidly and movement restrictions will remain stringent across several cities until Q4FY2021. This will lead to a steep decline in demand and cuts in production capacity. The situation is expected to ease in Q1FY 2022 through medical interventions. After this, the economy will revive only modestly because consumers will remain wary of major expenses even after the pandemic dissipates. This will affect long-term spending demand. The model predicts that over the next two years, the economy will grow by 1.5-2%,lower than it would have grown otherwise, with unequal recovery across sectors. The report has also come up with suggestions and recommendations. Key Deloitte suggestions, some of which have already been announced by the government and RBI over the last couple of weeks, can essentially be grouped into three categories. Managing the endemic and the resultant public health crisis through augmenting financial resources, increasing insurance coverage, and using technology solutions is identified as the first priority. Protecting income and employment, particularly for the more vulnerable sections of society through direct cash transfer programmes backed by adequate monitoring and evaluation mechanisms and using existing digital payment infrastructure has been highlighted as the second key intervention. Finally, supporting businesses, particularly MSMEs, to minimise adverse economic impact and facilitate quick recovery has been identified as the third cornerstone of the potential government response. Proposed measures towards this objective include immediate credit support, providing focused support for retention of existing workforce etc. to slightly more medium-to-long measures like reconfiguring the existing supply chains.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.