India's T&C Exports Fall 12.4% In CY Q1 2020

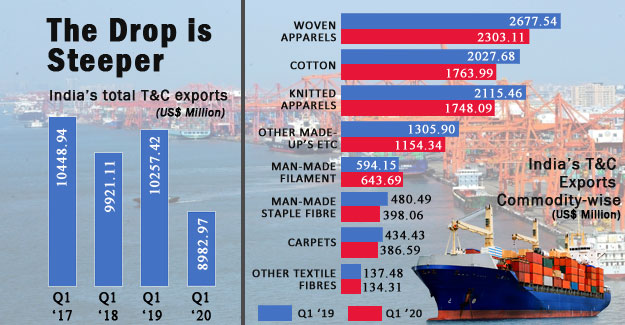

India's textile and clothing exports in the first quarter (Jan-Mar) of 2020 had witnessed a significant fall, as the Covid-19 pandemic impacted exports to China, US, UK, UAE, and other important markets.

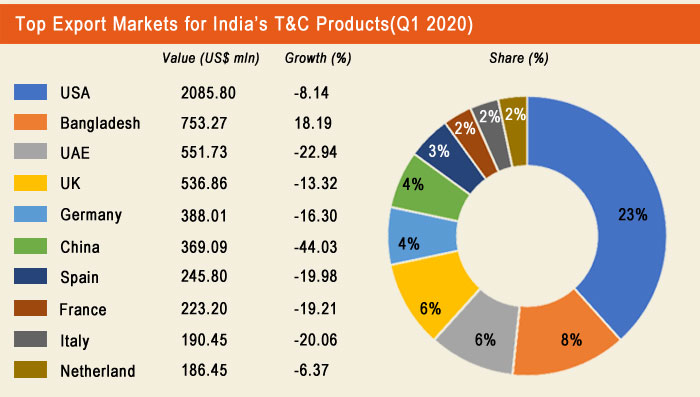

India's T&C exports registered a drop of 12.4% in Q1 2020 to US$ 8982.97 million compared to the corresponding period of last year (CPLY). India's exports to Bangladesh achieved a positive growth in Q1 2020. India's rising cotton exports to Bangladesh, and a drastic fall in exports to the UAE, has propelled Bangladesh to become the second largest market for Indian T&C exports. USA remains India's largest market. Product-wise, woven apparel was the largest category of exports, accounting for 26% share in total T&C exports.

India's cotton textile exports fall 13%

Indian cotton textile exports slumped by 13% in Q1 2020 over the CPLY and the export value totalled to US$ 1,763.99 million. Shrinking demand from China has led Bangladesh to be the largest export market of Indian cotton. Cotton exports to Bangladesh totalled to US$ 591.36 million with a growth of 21.5%, while to China it was US$ 289.02 million with a drop of 47.93% in Q1 2020.

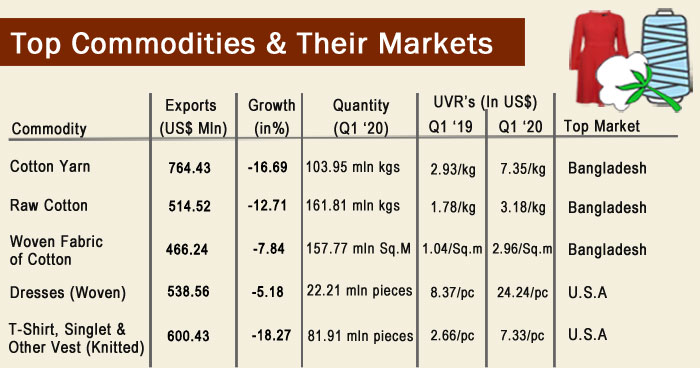

Cotton yarn exports fall 16.69%

Cotton yarn is the leading commodity under cotton exports. Exports of cotton yarn totalled US$ 764.43 million, a fall of 16.69% in Q1 2020 over the CPLY. Around 103.95 million kgs of cotton yarn was exported out of the country, but the quantity was down by 66.8% in Q1 2020 over the CPLY. On an average cotton yarn was traded at US$ 7.35 per kg in Q1 2020, while in CPLY the same commodity was traded at US$ 2.93 per kg. Raw cotton (carded or not carded) exports perceived a negative growth of 12.71% to US$ 466.24 million in Q1 2020. The total quantity of raw cotton exported summed to 161.8 million kgs with a drop of 51% in the first quarter of 2020. The UVR went up to US$ 3.18 per kg in Q1 2020 while in the CPLY US$ 1.78 per kg. The higher UVRs can be attributed to the hassles in exports during this quarter due to the pandemic, the uncertainty and the fluctuating currency rates.

Cotton woven fabric exports fall 7.84%

India exported around 157.77 million sqm of cotton woven fabric to the world. The value of these exports totalled to US$ 466.24 million, a fall of 7.84% in Q1 2020. Average UVR was US$ 2.96 per sqm, while in CPLY the product was sold at US$ 1.04 per sqm.

Woven apparel exports fall 13.98%

Woven apparel, the largest exported commodity in Q1 2020, shares a stake of 26% in the total T&C exports of India. However, exports were down by 13.98% to US$ 2303.11 million in Q1 2020 over the CPLY. USA remains the largest export market for the commodity and value totalled to US$ 666.33 million. Under this category, women's and girls' woven dresses were the most exported commodity, valued at US$ 538.56 million, a fall of 5.18% in Q1 2020. Around 22 million pieces of dresses were exported in Q1, 2020 while in CPLY 68 million pieces were traded. The average UVR seems to have spiralled up to US$ 24.24 per piece in Q1 '20, while in CPLY the same product was priced US$ 8.37 per piece.

Knitwear exports down 17.37%

Knitted apparel which is the third largest exported commodity perceived a negative growth of 17.37% to US$ 1748.09 million in Q1 2020 over the CPLY. USA remains the largest export market, with exports of US$ 466.61 million, a fall of 12% in Q1 2020. Under this category, t-shirts, singlets and other vests are the top exported products. The average UVR of this product is US$ 7.33 per piece in Q1 2020, whereas in CPLY it was US$ 2.99 per piece. Around 82 million pieces of t-shirts were exported with total value of US$ 600.43 million.

Bangladesh is second largest market for Indian T&C exports

Bangladesh has become the second largest export market for India's T&C goods. This was possible due to a number of reasons - continued increase in cotton exports to Bangladesh, significantly low demand from China, and UAE's high import duties to restrict trading across borders and encourage local manufacturing.

Exports to Bangladesh totalled to US$ 753.27 million with a growth of 18.19% in Q1 2020 over the CPLY. The country stakes 8% share in the total T&C export of India. Cotton textile exports to Bangladesh totalled to US$ 591.36 million with a growth of 21.5% in Q1 2020. Around 140.39 million kgs of cotton (not carded) was exported to Bangladesh with a total value of US$ 282.11 million in Q1 2020 over the CPLY. On an average per kg of cotton (not carded) was traded at US$ 2.01 per kg in Q1 '20, while in CPLY it was US$ 1.83 per kg.

Cotton yarn exports fall 16.69%

Cotton yarn is the leading commodity under cotton exports. Exports of cotton yarn totalled US$ 764.43 million, a fall of 16.69% in Q1 2020 over the CPLY. Around 103.95 million kgs of cotton yarn was exported out of the country, but the quantity was down by 66.8% in Q1 2020 over the CPLY. On an average cotton yarn was traded at US$ 7.35 per kg in Q1 2020, while in CPLY the same commodity was traded at US$ 2.93 per kg. Raw cotton (carded or not carded) exports perceived a negative growth of 12.71% to US$ 466.24 million in Q1 2020. The total quantity of raw cotton exported summed to 161.8 million kgs with a drop of 51% in the first quarter of 2020. The UVR went up to US$ 3.18 per kg in Q1 2020 while in the CPLY US$ 1.78 per kg. The higher UVRs can be attributed to the hassles in exports during this quarter due to the pandemic, the uncertainty and the fluctuating currency rates.

Cotton woven fabric exports fall 7.84%

India exported around 157.77 million sqm of cotton woven fabric to the world. The value of these exports totalled to US$ 466.24 million, a fall of 7.84% in Q1 2020. Average UVR was US$ 2.96 per sqm, while in CPLY the product was sold at US$ 1.04 per sqm.

Woven apparel exports fall 13.98%

Woven apparel, the largest exported commodity in Q1 2020, shares a stake of 26% in the total T&C exports of India. However, exports were down by 13.98% to US$ 2303.11 million in Q1 2020 over the CPLY. USA remains the largest export market for the commodity and value totalled to US$ 666.33 million. Under this category, women's and girls' woven dresses were the most exported commodity, valued at US$ 538.56 million, a fall of 5.18% in Q1 2020. Around 22 million pieces of dresses were exported in Q1, 2020 while in CPLY 68 million pieces were traded. The average UVR seems to have spiralled up to US$ 24.24 per piece in Q1 '20, while in CPLY the same product was priced US$ 8.37 per piece.

Knitwear exports down 17.37%

Knitted apparel which is the third largest exported commodity perceived a negative growth of 17.37% to US$ 1748.09 million in Q1 2020 over the CPLY. USA remains the largest export market, with exports of US$ 466.61 million, a fall of 12% in Q1 2020. Under this category, t-shirts, singlets and other vests are the top exported products. The average UVR of this product is US$ 7.33 per piece in Q1 2020, whereas in CPLY it was US$ 2.99 per piece. Around 82 million pieces of t-shirts were exported with total value of US$ 600.43 million.

Bangladesh is second largest market for Indian T&C exports

Bangladesh has become the second largest export market for India's T&C goods. This was possible due to a number of reasons - continued increase in cotton exports to Bangladesh, significantly low demand from China, and UAE's high import duties to restrict trading across borders and encourage local manufacturing.

Exports to Bangladesh totalled to US$ 753.27 million with a growth of 18.19% in Q1 2020 over the CPLY. The country stakes 8% share in the total T&C export of India. Cotton textile exports to Bangladesh totalled to US$ 591.36 million with a growth of 21.5% in Q1 2020. Around 140.39 million kgs of cotton (not carded) was exported to Bangladesh with a total value of US$ 282.11 million in Q1 2020 over the CPLY. On an average per kg of cotton (not carded) was traded at US$ 2.01 per kg in Q1 '20, while in CPLY it was US$ 1.83 per kg.

China slows down due to pandemic

China is now the sixth largest market for Indian T&C exports, compared to the third largest market in CPLY. Exports to China fell by 44.03% to US$ 369.09 million in Q1 2020 over CPLY. Cotton, the most exported product, fell by as much as 47.96% to US$ 289.02 million in Q1 2020, while in the CPLY the exports totalled to US$ 555.35 million.

The commodity stakes a share of 78% in the total T&C exports of India to China in Q1 2020. Under the cotton commodity, Indian cotton of staple length 28.5 mm and above but below 34.5mm was exported the most. The export of this product totalled to US$ 147.71 million. Exports of this commodity were down 34.15% in Q1 2020. About 76.45 million kgs of the product was traded in Q1 2020 with an average price of US$ 1.93 per kg. While in the CPLY the same product was traded at US$ 1.79 per kg.

Afghanistan emerges as market for MMF

Exports of man-made filaments to Afghanistan suddenly rose in Q1 2020 by 571.98% to US$ 91.77 million over the CPLY. Woven fabrics obtained from strip/the like was most exported item in the MMF lot with a total export value of US$ 55.16 million for around 20.74 million sqm of woven fabric. The UVR was US$ 2.66 per sqm.

Cotton exports to Indonesia shot up by 134.8% in Q1 2020 to US$ 50.62 million in Q1 2020.

China slows down due to pandemic

China is now the sixth largest market for Indian T&C exports, compared to the third largest market in CPLY. Exports to China fell by 44.03% to US$ 369.09 million in Q1 2020 over CPLY. Cotton, the most exported product, fell by as much as 47.96% to US$ 289.02 million in Q1 2020, while in the CPLY the exports totalled to US$ 555.35 million.

The commodity stakes a share of 78% in the total T&C exports of India to China in Q1 2020. Under the cotton commodity, Indian cotton of staple length 28.5 mm and above but below 34.5mm was exported the most. The export of this product totalled to US$ 147.71 million. Exports of this commodity were down 34.15% in Q1 2020. About 76.45 million kgs of the product was traded in Q1 2020 with an average price of US$ 1.93 per kg. While in the CPLY the same product was traded at US$ 1.79 per kg.

Afghanistan emerges as market for MMF

Exports of man-made filaments to Afghanistan suddenly rose in Q1 2020 by 571.98% to US$ 91.77 million over the CPLY. Woven fabrics obtained from strip/the like was most exported item in the MMF lot with a total export value of US$ 55.16 million for around 20.74 million sqm of woven fabric. The UVR was US$ 2.66 per sqm.

Cotton exports to Indonesia shot up by 134.8% in Q1 2020 to US$ 50.62 million in Q1 2020.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.