Market Slowdown Affects India's Textile Machinery Exports

The market slowdown and the pandemic have impacted India's textile machinery exports. Largest exported commodity, spinning, twisting and yarn preparation machine has witnessed a major drop. Bangladesh remains the top export market despite a decline in exports.

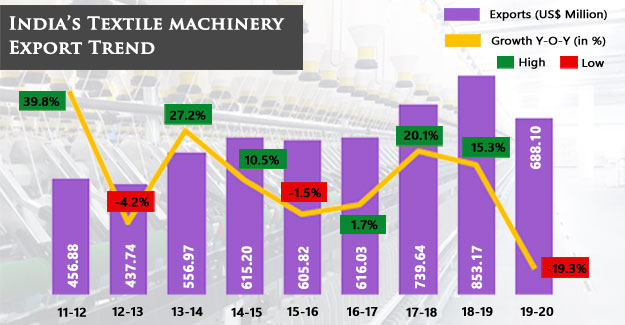

India's textile machinery exports in FY 2019-20 fell by 19.35% to US$ 688.10 million over the previous year, where the exports of machinery totalled to US$ 853.17 million. A further slowdown in exports looks to be inevitable as global textile investments have been delayed. The Indian textile machinery sector had witnessed a slowdown in the beginning of 2019-20 fiscal year (FY) and continued to remain sluggish till the end of the year. Additionally Covid-19, the deadly virus which broke out in China in December 2019, has added fuel to the fire. Investment happening in the Indian spinning industry was low straight from the first month of 2019. Hence the spinning, twisting and yarn preparation machine exports have witnessed a major drop in the market.

The global textile machinery players too have witnessed poised growth in the export market. The global textile machinery exports totalled to US$ 109337.86 million in FY 2019-20 with a drop of 12.57% over the previous FY. Major exporting countries China, Germany, Japan, Netherlands, Italy, and Belgium have witnessed a drop in the market due the pandemic. China's trading borders were sealed in January and February 2020, which brought China's textile machinery exports down by 8.45% in FY 19-20.

Looking at the current condition of the market in India and aboard, the sector could witness a further slowdown in the export market. Many reports have claimed that recovery in the sector would start by September or mid-October.

India's textile machinery exports in FY 19-20 fell by 19.35% to US$ 688.10 million over the previous year, where the exports of machinery totalled to US$ 853.17 million. The top commodity is spinning, twisting and yarn preparation machine and top export market is Bangladesh.

Exports of spinning and related machines fell 40.86%

Though spinning, twisting and yarn preparation machine exports have been ruling the basket, exports of this commodity have dropped by 40.86% to US$ 182.82 million over the previous year. Bangladesh is the largest market of India's spinning, twisting and yarn preparation machine commodity. Exports of this commodity to the country totalled US$ 31.85 million in FY 19-20, however this was 47.37% lower that in the previous year. Pakistan, Uzbekistan, Vietnam, Turkey, U.A.E, Netherland, and Indonesia are the other top export markets who have registered a fall in the exports of India's spinning twisting and yarn preparation commodity.

The global textile machinery players too have witnessed poised growth in the export market. The global textile machinery exports totalled to US$ 109337.86 million in FY 2019-20 with a drop of 12.57% over the previous FY. Major exporting countries China, Germany, Japan, Netherlands, Italy, and Belgium have witnessed a drop in the market due the pandemic. China's trading borders were sealed in January and February 2020, which brought China's textile machinery exports down by 8.45% in FY 19-20.

Looking at the current condition of the market in India and aboard, the sector could witness a further slowdown in the export market. Many reports have claimed that recovery in the sector would start by September or mid-October.

India's textile machinery exports in FY 19-20 fell by 19.35% to US$ 688.10 million over the previous year, where the exports of machinery totalled to US$ 853.17 million. The top commodity is spinning, twisting and yarn preparation machine and top export market is Bangladesh.

Exports of spinning and related machines fell 40.86%

Though spinning, twisting and yarn preparation machine exports have been ruling the basket, exports of this commodity have dropped by 40.86% to US$ 182.82 million over the previous year. Bangladesh is the largest market of India's spinning, twisting and yarn preparation machine commodity. Exports of this commodity to the country totalled US$ 31.85 million in FY 19-20, however this was 47.37% lower that in the previous year. Pakistan, Uzbekistan, Vietnam, Turkey, U.A.E, Netherland, and Indonesia are the other top export markets who have registered a fall in the exports of India's spinning twisting and yarn preparation commodity.

In this segment, textile spinning machines were exported the most at US$ 114.27 million. Now under this cotton spinning ring frames products contributes about 85% of the total export value of textile spinning machine.

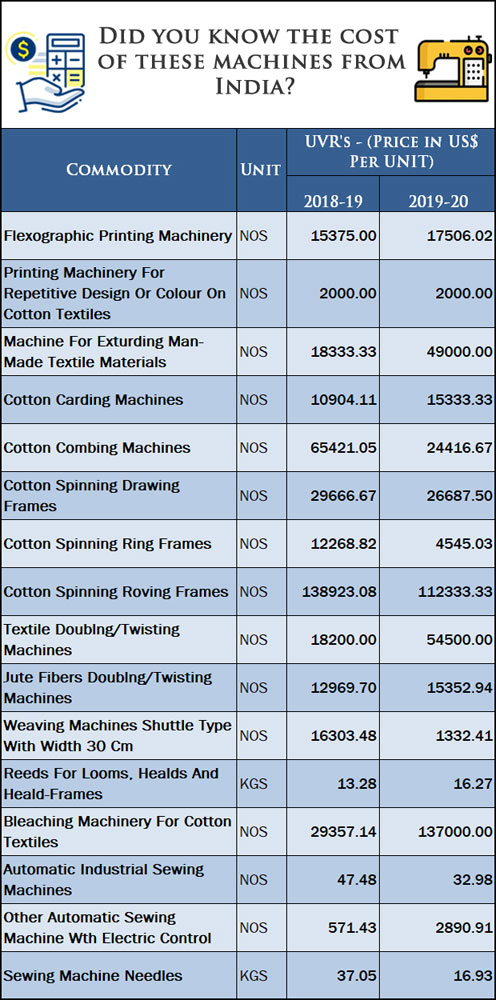

Cotton spinning ring frame exports totalled to US$ 96.90 million in FY 19-20 and witnessed a drop of 47.83% over the previous year. On an average this product was traded at US$ 4545.02 per unit in FY 19-20, while in the previous FY the ring frame was traded at US$ 12268.82 per unit.

Cotton carding machine was trade at US$ 15333.33 per unit, cotton combing machine at US$ 24416.67 per unit and cotton yarn winding machine was exported at US$ 1933.33 per unit in FY 19-20.

Auxiliary machine exports rose 17.34%

Second top commodity in the segment is auxiliary machines. Exports under this category totalled to US$ 149.78 million with a growth of 17.34% in FY 19-20 over the previous year where the exports totalled to US$ 181.19 million. Germany is the top market for India's auxiliary machines. The exports of this commodity to Germany totalled to US$ 21.42 million, but perceived a growth of -28.77% in FY 2019-20. The exports of auxiliary machines to China, Indonesia, Bangladesh and Italy have dropped by 22.09%, 26.87%, 23.90% and 46.65% respectively.

Under this commodity, parts and accessories used for extruding, drawing,

texturing machines was traded the most. The export of this product totalled to US$ 40.89 million, but perceived a drop of 18.44% and unit value of realisation (UVR's) is US$ 7.93 per kg in 2019-20, while in the previous year it was US$ 4.99 per kg. Healds and reeds exports totalled to US$ 3.4 million, a drop of 23.61% in FY 19-20 over the previous year. On an average healds and reeds were trade at US$ 16.27 per kg in last FY.

Weaving machinery exports fell 15.07%

Exports of weaving machines too have dropped. The exports totalled to US$ 32.79 million with a drop of 15.07% in FY 19-20 over the previous year. For Indian weaving machines, Vietnam is the top market. Exports totalled to US$ 5.34 million with a growth of 47.49% in FY 19-20. Under this umbrella, shuttle type weaving machine for fabric of a width 30 cm was exported the most. The exports of the product totalled to US$ 28.98 million with a drop of 11.53% and registered a UVR of US$ 1332.41 per unit in FY 19-20 and in the previous year it was US$ 16303.48 per unit.

Knitting machine exports, though not much, grew 80.74%

Knitting machines has a very low share in India's textile machinery exports. The exports of the commodity totalled to US$ 4.41 million in FY 19-20 registering a growth of 80.74% over the previous FY. For knitting machines, Italy is the top market with an export of US$ 1.43 million. Under this commodity, knitting machines, N.E.S is exported the most. The value totalled to US$ 2.33 million with growth of 240.57% in FY 19-20 over the previous and on an average the product was traded at US$ 12263.16 per machine.

Printing machinery exports continue to rise

Printing machinery exports including digital printing have picked up in the FY 2019-20 by 8.85% to US$ 140.70 million and it is the third highest commodity in the segment. For printing machinery, again Italy is the top market. Exports of this commodity to Italy totalled to US$ 14.45 million with a growth of 71.26%. Second largest market is Bangladesh with an export of US$ 14.39 million. Under this basket, flexographic printing machinery is exported on an average price of US$ 17506.02 per unit in FY 19-20, while in the previous year the exports totalled to US$ 15375 per unit. Exports value of flexographic printing machinery totalled to US$ 14.53 million in FY 19-20. Another commodity under the umbrella i.e. machinery for printing repetitive word or design or colour on cotton textiles was traded at a price of US$ 2000 per unit.

In the sewing machinery segment, needles for other than HH type sewing machine was exported at a price of US$ 41.10 per kg. An industrial automatic sewing machine was traded at US$ 32.98 per unit, while the export of the same product totalled to US$ 2 million. Automatic sewing machine with full electrical control was sold at US$ 2890.91 per unit.

Exports to top market Bangladesh fell by 34.41%

In this segment, textile spinning machines were exported the most at US$ 114.27 million. Now under this cotton spinning ring frames products contributes about 85% of the total export value of textile spinning machine.

Cotton spinning ring frame exports totalled to US$ 96.90 million in FY 19-20 and witnessed a drop of 47.83% over the previous year. On an average this product was traded at US$ 4545.02 per unit in FY 19-20, while in the previous FY the ring frame was traded at US$ 12268.82 per unit.

Cotton carding machine was trade at US$ 15333.33 per unit, cotton combing machine at US$ 24416.67 per unit and cotton yarn winding machine was exported at US$ 1933.33 per unit in FY 19-20.

Auxiliary machine exports rose 17.34%

Second top commodity in the segment is auxiliary machines. Exports under this category totalled to US$ 149.78 million with a growth of 17.34% in FY 19-20 over the previous year where the exports totalled to US$ 181.19 million. Germany is the top market for India's auxiliary machines. The exports of this commodity to Germany totalled to US$ 21.42 million, but perceived a growth of -28.77% in FY 2019-20. The exports of auxiliary machines to China, Indonesia, Bangladesh and Italy have dropped by 22.09%, 26.87%, 23.90% and 46.65% respectively.

Under this commodity, parts and accessories used for extruding, drawing,

texturing machines was traded the most. The export of this product totalled to US$ 40.89 million, but perceived a drop of 18.44% and unit value of realisation (UVR's) is US$ 7.93 per kg in 2019-20, while in the previous year it was US$ 4.99 per kg. Healds and reeds exports totalled to US$ 3.4 million, a drop of 23.61% in FY 19-20 over the previous year. On an average healds and reeds were trade at US$ 16.27 per kg in last FY.

Weaving machinery exports fell 15.07%

Exports of weaving machines too have dropped. The exports totalled to US$ 32.79 million with a drop of 15.07% in FY 19-20 over the previous year. For Indian weaving machines, Vietnam is the top market. Exports totalled to US$ 5.34 million with a growth of 47.49% in FY 19-20. Under this umbrella, shuttle type weaving machine for fabric of a width 30 cm was exported the most. The exports of the product totalled to US$ 28.98 million with a drop of 11.53% and registered a UVR of US$ 1332.41 per unit in FY 19-20 and in the previous year it was US$ 16303.48 per unit.

Knitting machine exports, though not much, grew 80.74%

Knitting machines has a very low share in India's textile machinery exports. The exports of the commodity totalled to US$ 4.41 million in FY 19-20 registering a growth of 80.74% over the previous FY. For knitting machines, Italy is the top market with an export of US$ 1.43 million. Under this commodity, knitting machines, N.E.S is exported the most. The value totalled to US$ 2.33 million with growth of 240.57% in FY 19-20 over the previous and on an average the product was traded at US$ 12263.16 per machine.

Printing machinery exports continue to rise

Printing machinery exports including digital printing have picked up in the FY 2019-20 by 8.85% to US$ 140.70 million and it is the third highest commodity in the segment. For printing machinery, again Italy is the top market. Exports of this commodity to Italy totalled to US$ 14.45 million with a growth of 71.26%. Second largest market is Bangladesh with an export of US$ 14.39 million. Under this basket, flexographic printing machinery is exported on an average price of US$ 17506.02 per unit in FY 19-20, while in the previous year the exports totalled to US$ 15375 per unit. Exports value of flexographic printing machinery totalled to US$ 14.53 million in FY 19-20. Another commodity under the umbrella i.e. machinery for printing repetitive word or design or colour on cotton textiles was traded at a price of US$ 2000 per unit.

In the sewing machinery segment, needles for other than HH type sewing machine was exported at a price of US$ 41.10 per kg. An industrial automatic sewing machine was traded at US$ 32.98 per unit, while the export of the same product totalled to US$ 2 million. Automatic sewing machine with full electrical control was sold at US$ 2890.91 per unit.

Exports to top market Bangladesh fell by 34.41%

Bangladesh remains the top export market for India's textile machinery. Exports to Bangladesh totalled to US$ 76.44 million in FY 19-20 compared to US$ 116.55 million in the previous year. Spinning, twisting and yarn preparation machinery commodity has dropped by 47.37% to US$ 31.85 million in FY 19-20 over the previous FY.

Germany too has registered a drop of 22.41% in FY 2019-20 due to the drop in auxiliary machinery exports. Sewing machines exports to Germany have witnessed a rise of 12.32% to US$ 16.15 million in FY 19-20 over the previous FY.

Exports to UAE, USA, Italy rose in FY 19-20

From the top ten export markets, its only UAE, USA and Italy that have perceived a positive growth in FY19-20. Textile machinery exports to UAE picked up as the export of printing machinery including digital printing and spinning, twisting and yarn preparation machine rose by 75.41% and 39.67% respectively.

China is the world's largest textile machinery exporter

In the global textile machinery exports, China is the largest exporter and contributes about 23% share in the global textile machinery exports. The country's exports dropped by 8.45% to US$ 24842.87 million due to complete lockdown in China. Printing machinery including digital printing is the top commodity exported from China to the world. Exports of the commodity totalled to US$ 15131.90 million with drop of 12.67% in FY 19-20 over the previous year and it stakes 61% share in the total exports of China's textile machinery. Exports of spinning, twisting and yarn preparation machinery registered a drop of 19.34% in FY 19-20 by China totalling to US$ 483.13 million. Machines for extruding, drawing, texturing or cutting man-made textile materials commodity has perceived the maximum growth compared to other positive trending commodity.

The commodity registered a growth of 19.80% to US$ 308.86 million. USA remains the the largest buyer for Chinese textile machineries.

Bangladesh remains the top export market for India's textile machinery. Exports to Bangladesh totalled to US$ 76.44 million in FY 19-20 compared to US$ 116.55 million in the previous year. Spinning, twisting and yarn preparation machinery commodity has dropped by 47.37% to US$ 31.85 million in FY 19-20 over the previous FY.

Germany too has registered a drop of 22.41% in FY 2019-20 due to the drop in auxiliary machinery exports. Sewing machines exports to Germany have witnessed a rise of 12.32% to US$ 16.15 million in FY 19-20 over the previous FY.

Exports to UAE, USA, Italy rose in FY 19-20

From the top ten export markets, its only UAE, USA and Italy that have perceived a positive growth in FY19-20. Textile machinery exports to UAE picked up as the export of printing machinery including digital printing and spinning, twisting and yarn preparation machine rose by 75.41% and 39.67% respectively.

China is the world's largest textile machinery exporter

In the global textile machinery exports, China is the largest exporter and contributes about 23% share in the global textile machinery exports. The country's exports dropped by 8.45% to US$ 24842.87 million due to complete lockdown in China. Printing machinery including digital printing is the top commodity exported from China to the world. Exports of the commodity totalled to US$ 15131.90 million with drop of 12.67% in FY 19-20 over the previous year and it stakes 61% share in the total exports of China's textile machinery. Exports of spinning, twisting and yarn preparation machinery registered a drop of 19.34% in FY 19-20 by China totalling to US$ 483.13 million. Machines for extruding, drawing, texturing or cutting man-made textile materials commodity has perceived the maximum growth compared to other positive trending commodity.

The commodity registered a growth of 19.80% to US$ 308.86 million. USA remains the the largest buyer for Chinese textile machineries.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.