India’s MMF Textile Exports Stabilise in Q3,2020

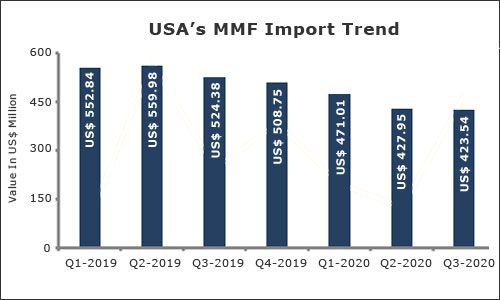

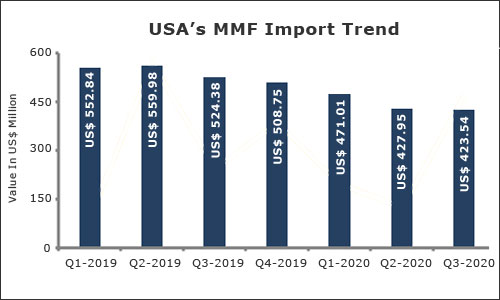

US, the world’s largest importer of man-made filament (MMF) textiles, has reduced its buying. US imports of MMF textiles have been declining from the second half of 2019. The country’s MMF imports in the third quarter (Q3) 2020 perceived a negative growth of 19.23% to US$ 423.54 million over the corresponding period of last year (CPLY). And over the previous quarter, imports registered a decline by 1.03%.

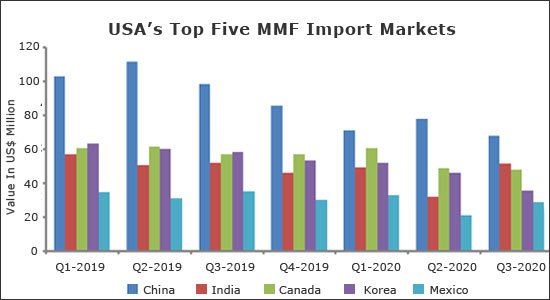

China remains the largest sourcing market for USA and imports totalled to US$ 67.92 million of MMF from China in Q3 2020, with a decline of 31% over CPLY and 13% over the previous quarter. Trade conflicts and Covid-19 pandemic have reduced the sourcing from China.

Commodity-wise, woven fabric of synthetic filament yarn was imported the most by USA from the world. The imports of woven fabric totalled to US$ 187.13 million with growth of 19.80% in Q3 2020 over the previous quarter, while over CPLY the imports declined by 8.50%. The UVR of this commodity in Q3 2020 was US$ 3.64 per kg, while a year ago for the same quarter the UVR was US$ 4.32 per kg.

Synthetic filament yarn was the second most imported product by USA under MMF segment. The product witnessed a drop 15.27% in Q3 2020 over the previous quarter and 31.14% over CPLY. The import of synthetic filament yarn totalled to US$ 175.08 million in Q3 2020. USA has imported synthetic filament yarn at a price of US$ 2.81 per kg in Q3 2020, while in the previous quarter it was US$ 3.09 per kg and at CPLY the trading price was US$ 3.18 per kg.

China remains largest supplier of MMF textiles to USA

China remains the largest sourcing market for USA and imports totalled to US$ 67.92 million of MMF from China in Q3 2020, with a decline of 31% over CPLY and 13% over the previous quarter. Trade conflicts and Covid-19 pandemic have reduced the sourcing from China.

Commodity-wise, woven fabric of synthetic filament yarn was imported the most by USA from the world. The imports of woven fabric totalled to US$ 187.13 million with growth of 19.80% in Q3 2020 over the previous quarter, while over CPLY the imports declined by 8.50%. The UVR of this commodity in Q3 2020 was US$ 3.64 per kg, while a year ago for the same quarter the UVR was US$ 4.32 per kg.

Synthetic filament yarn was the second most imported product by USA under MMF segment. The product witnessed a drop 15.27% in Q3 2020 over the previous quarter and 31.14% over CPLY. The import of synthetic filament yarn totalled to US$ 175.08 million in Q3 2020. USA has imported synthetic filament yarn at a price of US$ 2.81 per kg in Q3 2020, while in the previous quarter it was US$ 3.09 per kg and at CPLY the trading price was US$ 3.18 per kg.

China remains largest supplier of MMF textiles to USA

China is the largest MMF sourcing market for USA. US imports from China totalled to US$ 67.92 million in Q3 2020 with decline of 12.74% over the previous quarter. Woven fabric of synthetic filament yarn commodity stakes the maximum share of 52% in the total MMF imports from China to USA. The commodity witnessed increase of 2% in Q3 2020 with an import of US$ 35.02 million over the previous quarter. The second most imported product i.e synthetic filament yarn perceived a drop of 27.73% in Q3 2020, from China, over the previous quarter. As per the quarter wise trend, China’s MMF exports to USA have been falling from the first quarter of this year and US buyers are shifting their souring market to India.

International buyers shift sourcing to India

India is the second largest producer of polyester and viscose globally. The MMF industry in India is self-reliant across the entire value chain from raw material to garmenting. According to Investing India, by 2040, consumption of polyester globally will be approximately three times that of cotton fibre. Currently the consumption of sportswear, gym wear and active wear is increasing rapidly, where polyester and other MMF are the dominant fibres.

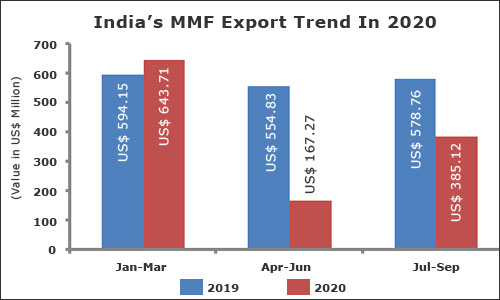

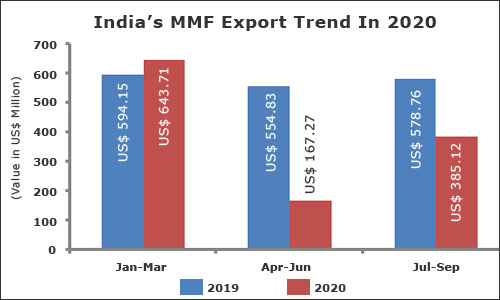

India’s MMF exports are now stabilising in the market. This year from January- September, MMF exports totalled to US$ 1196.10 million, perceiving a negative growth of 30.77% over the CPLY. In the second quarter (April-June) 2020, India’s exports of MMF dropped by nearly 74% to US$ 167.27 million over the previous quarter, while over CPLY the commodity witnessed a drop of 70%. Recovery of the MMF exports was witnessed in the third quarter (Q3) of 2020 with a growth of 130% over the previous quarter. The exports in Q3 totalled to US$ 385.12 million. Though over the previous quarter the growth has been on a recovery mode, compared to CPLY, exports have dropped by 33.46%.

China is the largest MMF sourcing market for USA. US imports from China totalled to US$ 67.92 million in Q3 2020 with decline of 12.74% over the previous quarter. Woven fabric of synthetic filament yarn commodity stakes the maximum share of 52% in the total MMF imports from China to USA. The commodity witnessed increase of 2% in Q3 2020 with an import of US$ 35.02 million over the previous quarter. The second most imported product i.e synthetic filament yarn perceived a drop of 27.73% in Q3 2020, from China, over the previous quarter. As per the quarter wise trend, China’s MMF exports to USA have been falling from the first quarter of this year and US buyers are shifting their souring market to India.

International buyers shift sourcing to India

India is the second largest producer of polyester and viscose globally. The MMF industry in India is self-reliant across the entire value chain from raw material to garmenting. According to Investing India, by 2040, consumption of polyester globally will be approximately three times that of cotton fibre. Currently the consumption of sportswear, gym wear and active wear is increasing rapidly, where polyester and other MMF are the dominant fibres.

India’s MMF exports are now stabilising in the market. This year from January- September, MMF exports totalled to US$ 1196.10 million, perceiving a negative growth of 30.77% over the CPLY. In the second quarter (April-June) 2020, India’s exports of MMF dropped by nearly 74% to US$ 167.27 million over the previous quarter, while over CPLY the commodity witnessed a drop of 70%. Recovery of the MMF exports was witnessed in the third quarter (Q3) of 2020 with a growth of 130% over the previous quarter. The exports in Q3 totalled to US$ 385.12 million. Though over the previous quarter the growth has been on a recovery mode, compared to CPLY, exports have dropped by 33.46%.

India’s top five export markets of MMF are Turkey, Bangladesh, Afghanistan, USA and UAE. Turkey is the leading market for Indian MMF. Exports to Turkey totalled to US$ 150.18 million in 2020 (January-September). But exports to Turkey have dropped by 33.66%. Bangladesh, the second largest market for India’s MMF, witnessed a drop of 15.6% in 2020 (January-September) to US$ 118.29 million over the previous year. Demand from Afghanistan has increased. India’s MMF exports to that market increased by 35% to US$ 108.42 million in 2020 (Jan-Sep) over the previous year,.

India’s exports to the USA are stabilising from the third quarter onwards. US imports of MMF textiles from India totalled to US$ 51.46 million, a slight drop of 1.06% in Q3 2020 over the CPLY, while over the previous quarter the growth was up by 60%. Exports to USA during January-September, 2020 totalled to US$ 133.03 million with a drop of 16.62% over the CPLY.

Woven fabric of synthetic filament yarn is imported the most from India, the imports totalled to US$ 41.52 million. This product stakes a share of 81% in the total MMF USA imports from India. During the second quarter of 2020 (April-June), India’s MMF exports to USA had dropped by 33.41% over the previous quarter. But in the third quarter (July-September) 2020, the imports from India rose by 71.78% over the previous quarter.

After USA, Turkey is the second largest MMF importer in the world and second largest market to Indian MMF. Turkey’s total MMF imports from the world totalled to US$ 339.35 million in Q3 2020. The imports in this quarter declined by 21.5% over the previous quarter and over CPLY the imports dropped 37.7%.

India is the second largest MMF supplier to Turkey. Turkey’s imports from India totalled to US$ 106.99 million in Q3 2020 with a growth of 14.04% over the previous quarter. The imports did drop by 41.5 % compared to the corresponding quarter of last year. Though China remains the main supplier to Turkey, imports have been dropping month over month from the last quarter of 2019. Eventually it seems like Turkish buyers too could be shifting their souring market and searching for competitive and reasonable MMF products.

India’s top five export markets of MMF are Turkey, Bangladesh, Afghanistan, USA and UAE. Turkey is the leading market for Indian MMF. Exports to Turkey totalled to US$ 150.18 million in 2020 (January-September). But exports to Turkey have dropped by 33.66%. Bangladesh, the second largest market for India’s MMF, witnessed a drop of 15.6% in 2020 (January-September) to US$ 118.29 million over the previous year. Demand from Afghanistan has increased. India’s MMF exports to that market increased by 35% to US$ 108.42 million in 2020 (Jan-Sep) over the previous year,.

India’s exports to the USA are stabilising from the third quarter onwards. US imports of MMF textiles from India totalled to US$ 51.46 million, a slight drop of 1.06% in Q3 2020 over the CPLY, while over the previous quarter the growth was up by 60%. Exports to USA during January-September, 2020 totalled to US$ 133.03 million with a drop of 16.62% over the CPLY.

Woven fabric of synthetic filament yarn is imported the most from India, the imports totalled to US$ 41.52 million. This product stakes a share of 81% in the total MMF USA imports from India. During the second quarter of 2020 (April-June), India’s MMF exports to USA had dropped by 33.41% over the previous quarter. But in the third quarter (July-September) 2020, the imports from India rose by 71.78% over the previous quarter.

After USA, Turkey is the second largest MMF importer in the world and second largest market to Indian MMF. Turkey’s total MMF imports from the world totalled to US$ 339.35 million in Q3 2020. The imports in this quarter declined by 21.5% over the previous quarter and over CPLY the imports dropped 37.7%.

India is the second largest MMF supplier to Turkey. Turkey’s imports from India totalled to US$ 106.99 million in Q3 2020 with a growth of 14.04% over the previous quarter. The imports did drop by 41.5 % compared to the corresponding quarter of last year. Though China remains the main supplier to Turkey, imports have been dropping month over month from the last quarter of 2019. Eventually it seems like Turkish buyers too could be shifting their souring market and searching for competitive and reasonable MMF products.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.