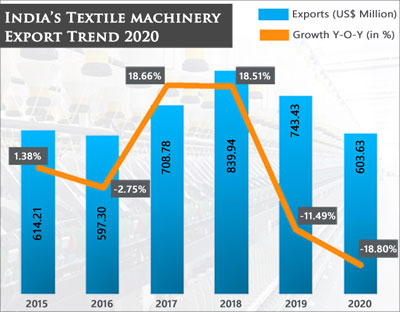

India’s Textile Machinery Exports Fell 18.8% In 2020

India’s textile machinery exports have been affected due to Covid-19 pandemic in 2020. Even the previous year (2019) had witnessed a fall in the exports due to the economic slowdown and poor capital investment. India’s textile machinery exports registered a fall of 18.8% to US$ 603.63 million in 2020 over the previous year.

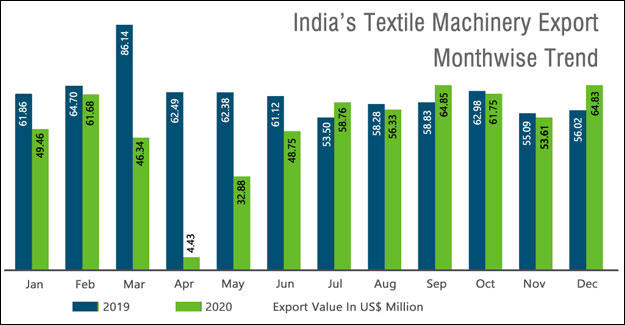

Though 2020 year has been one of the worst for the sector, the export market started to stabilise in May 2020 and remained stable for the rest of the year. In March 2020 exports dropped by 46.2% compared to previous year. In April 2020, the market had dropped drastically by 1310.6% to US$ 4.43 million, as the world was in lockdown. Spinning, twisting and yarn preparation machines continued to be the largest exported product in the segment. The product’s exports fell by 32.8% to US$ 144.37 million in 2020 over the previous year. Bangladesh remains as the top export market of India’s textile machinery goods.

Commodity-wise textile machinery exports from India

Spinning, twisting and yarn preparation machines, the largest exported product in the segment, stakes 29% share in the total textile machinery exports of India. Turkey is the top export market for this product with export of US$ 27.36 million and a rise of 84.5% in 2020 over the previous year. There has been a sharp decline from the Bangladesh market for this product. The exports to Bangladesh totalled to US$ 20.4 million with a drop of 43.31% in 2020 over the previous year. Even demand from Uzbekistan had reduced in 2020, with export of US$ 9.81 million with a drop of 44.99% in 2020.

Cotton spinning ring frame is the major exported item under this commodity. The product witnessed a drop of 39.78% to US$ 71.46 million in 2020 over the previous year. Pakistan which was the major market for Indian cotton spinning ring frame machine in 2019, witnessed a drop of 78.3% to US$ 5.4 million in 2020. The topmost market of this product is Turkey, with export of US$ 16.78 million, growth of 64.4%. Cotton processing machines exports have remained stable in the market. The exports of this product totalled to US$ 19.5 million, with a minor drop of 0.8% in 2020. For this product Benin is the major market, with an export of US$ 9.58 million.

Auxiliary machinery too remained as the second highest export commodity in 2020. The exports of the commodity totalled US$ 133.02 million with fall of 18.91% in 2020 over the previous year. The commodity stakes 22% share in the total textile machinery export of India. Here Netherland is the top market in 2020, the exports to the country totalled to US$ 21.06 million with growth of 12.18%. In 2019, the top market was Germany, but in 2020 the exports to Germany dropped by 62% to US$ 10.73 million.

Under this commodity, parts and accessories of HS code 8444 of their auxiliary machinery is the most exported item. The exports of this product totalled US$ 36.8 million, registered a drop of 24.2% in 2020 over the previous year.

Printing machinery* too perceived a negative growth of 26.9% to US$ 105.94 million in 2020 over the previous year. The commodity nearly stakes 19% in the total textile machinery export of India. Bangladesh remains as the top export market for printing machinery. The exports to Bangladesh totalled to US$ 8.99 million, with a fall of 48.19% in 2020.

Knitting machinery which is exported in a very small quantity, registered a positive growth of 39.66% to US$ 4.05 million in 2020 over the previous year. Italy is the top market of knitting machinery with an export of US$ 1.45 million

Weaving machinery and sewing machinery both too perceived a fall of 11.41% and 5.57% respectively in the export market. Weaving machinery exports totalled to US$ 30.76 million, while sewing machinery totalled to US$ 55.42 million in 2020 over the previous year. For weaving, Bangladesh is the top market with an export of US$ 3.95 million and growth of 44.59%, Vietnam is not far, exports to the country totalled to US$ 3.64 million in 2020.

For sewing machinery, Germany is top market with an export of US$ 12.94 million, but registered a fall of 19.7% in 2020 over the previous year.

Country-wise textile machinery exports from India

Though 2020 year has been one of the worst for the sector, the export market started to stabilise in May 2020 and remained stable for the rest of the year. In March 2020 exports dropped by 46.2% compared to previous year. In April 2020, the market had dropped drastically by 1310.6% to US$ 4.43 million, as the world was in lockdown. Spinning, twisting and yarn preparation machines continued to be the largest exported product in the segment. The product’s exports fell by 32.8% to US$ 144.37 million in 2020 over the previous year. Bangladesh remains as the top export market of India’s textile machinery goods.

Commodity-wise textile machinery exports from India

Spinning, twisting and yarn preparation machines, the largest exported product in the segment, stakes 29% share in the total textile machinery exports of India. Turkey is the top export market for this product with export of US$ 27.36 million and a rise of 84.5% in 2020 over the previous year. There has been a sharp decline from the Bangladesh market for this product. The exports to Bangladesh totalled to US$ 20.4 million with a drop of 43.31% in 2020 over the previous year. Even demand from Uzbekistan had reduced in 2020, with export of US$ 9.81 million with a drop of 44.99% in 2020.

Cotton spinning ring frame is the major exported item under this commodity. The product witnessed a drop of 39.78% to US$ 71.46 million in 2020 over the previous year. Pakistan which was the major market for Indian cotton spinning ring frame machine in 2019, witnessed a drop of 78.3% to US$ 5.4 million in 2020. The topmost market of this product is Turkey, with export of US$ 16.78 million, growth of 64.4%. Cotton processing machines exports have remained stable in the market. The exports of this product totalled to US$ 19.5 million, with a minor drop of 0.8% in 2020. For this product Benin is the major market, with an export of US$ 9.58 million.

Auxiliary machinery too remained as the second highest export commodity in 2020. The exports of the commodity totalled US$ 133.02 million with fall of 18.91% in 2020 over the previous year. The commodity stakes 22% share in the total textile machinery export of India. Here Netherland is the top market in 2020, the exports to the country totalled to US$ 21.06 million with growth of 12.18%. In 2019, the top market was Germany, but in 2020 the exports to Germany dropped by 62% to US$ 10.73 million.

Under this commodity, parts and accessories of HS code 8444 of their auxiliary machinery is the most exported item. The exports of this product totalled US$ 36.8 million, registered a drop of 24.2% in 2020 over the previous year.

Printing machinery* too perceived a negative growth of 26.9% to US$ 105.94 million in 2020 over the previous year. The commodity nearly stakes 19% in the total textile machinery export of India. Bangladesh remains as the top export market for printing machinery. The exports to Bangladesh totalled to US$ 8.99 million, with a fall of 48.19% in 2020.

Knitting machinery which is exported in a very small quantity, registered a positive growth of 39.66% to US$ 4.05 million in 2020 over the previous year. Italy is the top market of knitting machinery with an export of US$ 1.45 million

Weaving machinery and sewing machinery both too perceived a fall of 11.41% and 5.57% respectively in the export market. Weaving machinery exports totalled to US$ 30.76 million, while sewing machinery totalled to US$ 55.42 million in 2020 over the previous year. For weaving, Bangladesh is the top market with an export of US$ 3.95 million and growth of 44.59%, Vietnam is not far, exports to the country totalled to US$ 3.64 million in 2020.

For sewing machinery, Germany is top market with an export of US$ 12.94 million, but registered a fall of 19.7% in 2020 over the previous year.

Country-wise textile machinery exports from India

Due to Covid-19 pandemic and low on investment, the demand for India’s textile machinery products has been low from most of the countries in 2020 compared the previous year. Though Bangladesh remains as the top export market, the exports to the country declined by 25.7% to US$ 61.63 million and lost its share by one percent, now with 10% of the total textile machinery exports of India. Spinning, twisting and yarn preparation machines were the most exported commodity in 2020, but the commodity fell by 43% to US$ 20.4 million in 2020 over the previous year. Weaving machinery, sewing machinery and washing machine exports to Bangladesh spiked by 45%, 44% and 119% respectively.

As per 2019 statistics, Turkey was the seventh largest export market for India’s textile machinery exports. But with the rise in demand for India’s spinning, twisting and yarn preparation machines and high investment happening in the country, Turkey is the second largest export market to India for textile machinery goods. Export to the country in 2020 totalled to US$ 44.4 million with a rise of 70.9% over the previous year. Turkey increased its stake to 7% from 3% in 2020 of the total textile machinery exports of India. Out of the total exports to Turkey, export of spinning, twisting and yarn preparation was US$ 27.36 million.

Germany registered a decline in the exports as orders for Indian auxiliary machines were low in demand. The exports of Germany dropped 41.4% to US$ 37.10 million in 2020 over the previous year. Currently the country stakes 6% share in the total exports of India’s textile machinery products. Auxiliary machine exports to Germany totalled to US$ 10.73 million with drop of 62% in 2020.

After Turkey, USA is the next economy to gain a positive growth of 40.6% in textile machinery export market of India. The export value to USA registered to US$ 32.69 million. USA gained this growth, as there was high demand for washing machines, the exports of the commodity totalled to US$ 17.94 million with a growth of 79.6% in 2020.

Exports to China, which was the fourth largest market for Indian textile machinery goods in 2019, fell by 34.44% to US$ 19.8 million in 2020. It’s only the printing machinery exports to China that has witnessed a rise of 11.44%, to US$ 5.45 million.

Vietnam had started to make investments and was buying Indian textile machinery products on a good scale, but witnessed a drop of 41.8% to US% 15.57 million in 2020. Spinning, twisting and yarn preparation machines exports to the country fell by more than 50%. Textile machinery exports to Japan witnessed a sudden rise of 31% in 2020, as the demand for auxiliary machinery has gone up by 530.5% to US$ 6.63 million in 2020 over the previous year.

From the top ten exports markets, Turkey, USA, UAE and Poland are the only countries to witness a positive growth in 2020. Exports to UAE totalled to US$ 25.97 million and Poland US$ 20.6 million. Both shared the same growth of 2.5% in 2020 over the previous year

*Printing machinery also includes exports of computer printers

Due to Covid-19 pandemic and low on investment, the demand for India’s textile machinery products has been low from most of the countries in 2020 compared the previous year. Though Bangladesh remains as the top export market, the exports to the country declined by 25.7% to US$ 61.63 million and lost its share by one percent, now with 10% of the total textile machinery exports of India. Spinning, twisting and yarn preparation machines were the most exported commodity in 2020, but the commodity fell by 43% to US$ 20.4 million in 2020 over the previous year. Weaving machinery, sewing machinery and washing machine exports to Bangladesh spiked by 45%, 44% and 119% respectively.

As per 2019 statistics, Turkey was the seventh largest export market for India’s textile machinery exports. But with the rise in demand for India’s spinning, twisting and yarn preparation machines and high investment happening in the country, Turkey is the second largest export market to India for textile machinery goods. Export to the country in 2020 totalled to US$ 44.4 million with a rise of 70.9% over the previous year. Turkey increased its stake to 7% from 3% in 2020 of the total textile machinery exports of India. Out of the total exports to Turkey, export of spinning, twisting and yarn preparation was US$ 27.36 million.

Germany registered a decline in the exports as orders for Indian auxiliary machines were low in demand. The exports of Germany dropped 41.4% to US$ 37.10 million in 2020 over the previous year. Currently the country stakes 6% share in the total exports of India’s textile machinery products. Auxiliary machine exports to Germany totalled to US$ 10.73 million with drop of 62% in 2020.

After Turkey, USA is the next economy to gain a positive growth of 40.6% in textile machinery export market of India. The export value to USA registered to US$ 32.69 million. USA gained this growth, as there was high demand for washing machines, the exports of the commodity totalled to US$ 17.94 million with a growth of 79.6% in 2020.

Exports to China, which was the fourth largest market for Indian textile machinery goods in 2019, fell by 34.44% to US$ 19.8 million in 2020. It’s only the printing machinery exports to China that has witnessed a rise of 11.44%, to US$ 5.45 million.

Vietnam had started to make investments and was buying Indian textile machinery products on a good scale, but witnessed a drop of 41.8% to US% 15.57 million in 2020. Spinning, twisting and yarn preparation machines exports to the country fell by more than 50%. Textile machinery exports to Japan witnessed a sudden rise of 31% in 2020, as the demand for auxiliary machinery has gone up by 530.5% to US$ 6.63 million in 2020 over the previous year.

From the top ten exports markets, Turkey, USA, UAE and Poland are the only countries to witness a positive growth in 2020. Exports to UAE totalled to US$ 25.97 million and Poland US$ 20.6 million. Both shared the same growth of 2.5% in 2020 over the previous year

*Printing machinery also includes exports of computer printers

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.