Global Textile Industry Turnover 2020 Dropped 9% On Average Vs 2019: ITMF

Companies see light at the end of the pandemic tunnel

Between January 25th and March 10th, 2021, ITMF conducted the 7th ITMF Corona-Survey among ITMF members and affiliated companies and associations about the impact the pandemic has had on the global textile value chain. In total, 196 companies from around the world participated. The 1st ITMF corona-survey was conducted in March 2020 when the first lockdowns were announced in Europe.

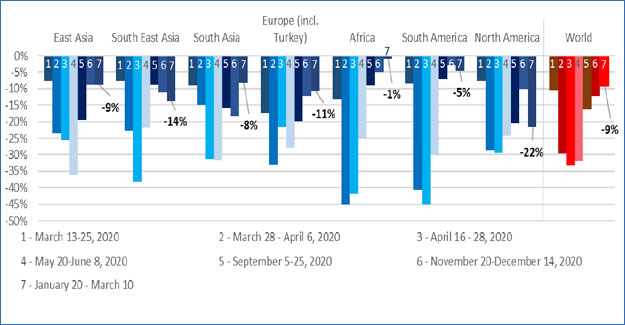

The 7th survey revealed that actual turnover in 2020 was 9% lower compared to 2019. While this decrease is significantly better than the expected drop of 33% in the third survey at the height of the first Covid-19 wave in April 2020, the year 2020 will go down into history as one of the worst years for the global textile and apparel industry.

In comparison to the expectations expressed in the sixth ITMF Corona-Survey (November 20th – December 14th, 2020), actual turnover for 2020 compared to 2019 has improved by three percentage points from -12% to now -9%.

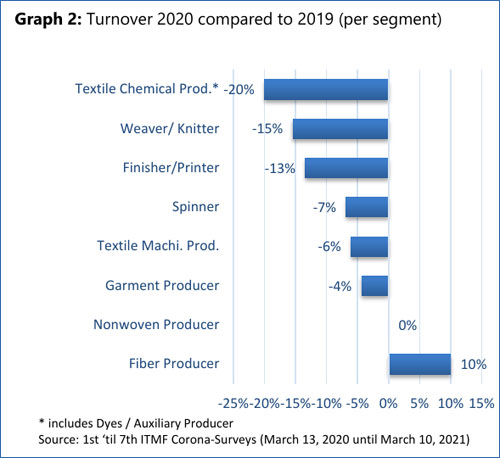

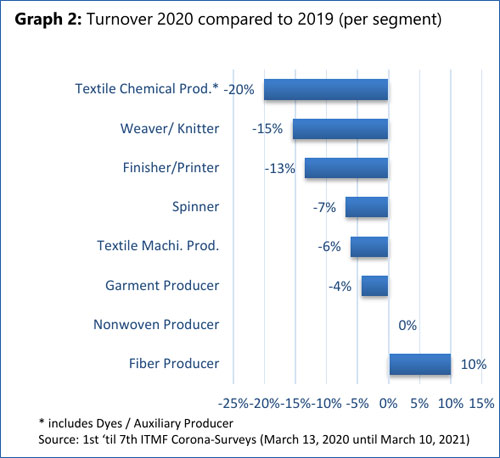

As expected the entire textile value chain was hit hard by the pandemic including textile machinery producers. Practically all segments under review were impacted negatively to different degrees in 2020. The two segments standing out positively are the producers of nonwovens (+/-0%) and of fibres (+10%). It can be assumed that those two segments have benefitted from the extraordinary demand for masks during 2020, which compensated to a significant extent for the loss in other areas like automotive or apparel.

The 7th survey revealed that actual turnover in 2020 was 9% lower compared to 2019. While this decrease is significantly better than the expected drop of 33% in the third survey at the height of the first Covid-19 wave in April 2020, the year 2020 will go down into history as one of the worst years for the global textile and apparel industry.

In comparison to the expectations expressed in the sixth ITMF Corona-Survey (November 20th – December 14th, 2020), actual turnover for 2020 compared to 2019 has improved by three percentage points from -12% to now -9%.

As expected the entire textile value chain was hit hard by the pandemic including textile machinery producers. Practically all segments under review were impacted negatively to different degrees in 2020. The two segments standing out positively are the producers of nonwovens (+/-0%) and of fibres (+10%). It can be assumed that those two segments have benefitted from the extraordinary demand for masks during 2020, which compensated to a significant extent for the loss in other areas like automotive or apparel.

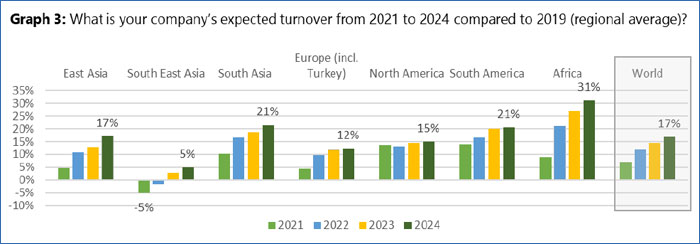

For 2021 and the following years up to 2024, turnover expectations are positive and have overall not changed compared to previous surveys. On a global level, turnover expectations are especially strong for 2021 and 2022, an indication that companies are expecting a strong recovery. For 2023 and 2024 companies’ growth expectations are weaker. Looking at the various regions the most striking result is the positive expectations of companies in Africa (+31% by 2024), compared to the other regions that range between +12 and +21%.

For 2021 and the following years up to 2024, turnover expectations are positive and have overall not changed compared to previous surveys. On a global level, turnover expectations are especially strong for 2021 and 2022, an indication that companies are expecting a strong recovery. For 2023 and 2024 companies’ growth expectations are weaker. Looking at the various regions the most striking result is the positive expectations of companies in Africa (+31% by 2024), compared to the other regions that range between +12 and +21%.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.