Buyers Plan To Scale Up Organic Cotton Sourcing In Some Countries: Textile Exchange

The Textile Exchange's recent report on organic cotton reveals some interesting sourcing trends that could influence global organic cotton production.

The report - Organic Cotton Demand Insights Report - projects an average 10% increase in uptake each year through to 2025, and a 15% increase between 2025 and 2030. Overall, this represents an 84% increase in organic cotton demand by 2030 compared to the 2019/20 baseline.

One hundred and sixteen companies from 27 countries responded to the Textile Exchange survey, led mainly by those in Europe and the United States. According to The Textile Exchange, "While the sample size was relatively low, it has at least half of the companies that were in the top 10 for sourcing organic cotton in 2018-19. This report is intended as a 'temperature check' to build a picture of the demand for organic cotton over the next ten years. While the source data doesn't capture the whole sector, it is robust enough to provide some clear indications."

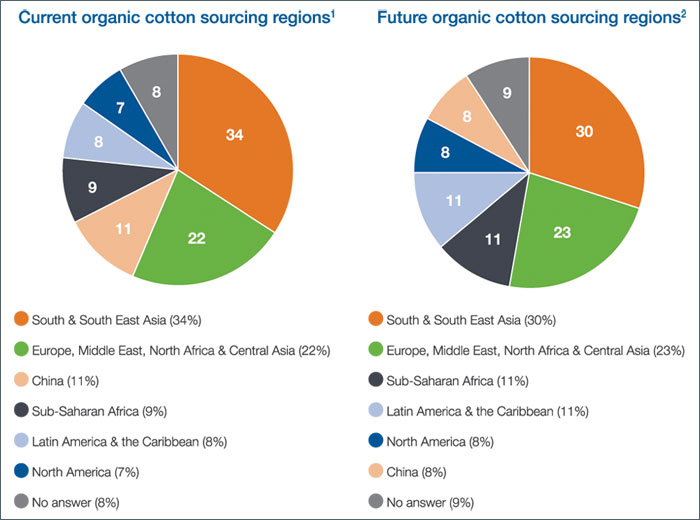

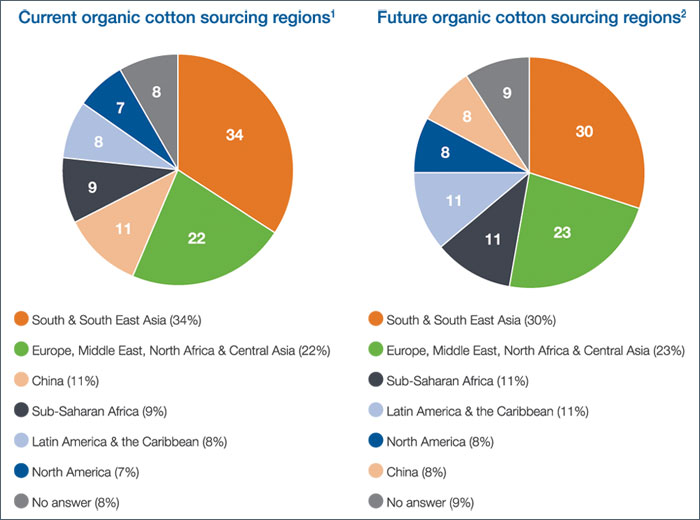

From which regions is organic cotton being sourced

Organic cotton sourcing is highest from South and Southeast Asia at 34%, followed by Europe, Middle East, North Africa & Central Asia at 22%. China supplies 11% of the organic cotton, according to the survey data.

According to the survey results, buyers could be shifting their sourcing in the coming years. Sub-Saharan Africa, Latin America & the Caribbean could become prominent sourcing destinations. China could lose out to some extent.

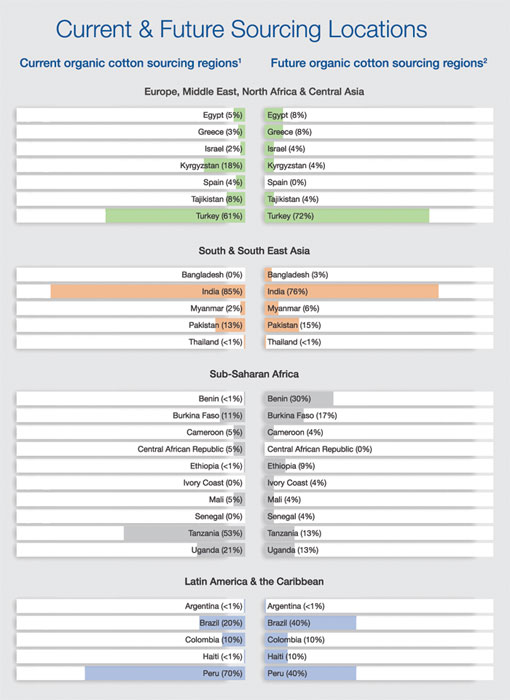

Within South and Southeast Asia, sourcing from India could come down from 85% currently to 76% in the future. Bangladesh could be supplying around 3% of the organic cotton from the region, from nil now.

Within South and Southeast Asia, sourcing from India could come down from 85% currently to 76% in the future. Bangladesh could be supplying around 3% of the organic cotton from the region, from nil now.

Turkey could increase its supply of organic cotton to 72% from the current 61%. It is expected that Egypt's share in the region could increase to 8% from 5% currently, and Greece could supply 8% from the current 3%. Sourcing from Kyrgyzstan is expected to go down to just 4% from the current 18%. Spain may no longer be supplying organic cotton in the future.

Within Sub-Saharan Africa, the survey results are quite interesting. Benin's share of organic cotton supply in the region is expected to increase to 30% from less than 1% currently. Burkina Faso could be supplying 17% of organic cotton in future, from 11% currently. Ethiopia is also expected to increase its share of organic cotton from less than 1% currently to 9% in the coming years. Tanzania, which currently supplies 53% of the organic cotton, could be supplying around 13%. Similarly, Uganda's share is expected to fall to 13% from 21% currently.

In Latin America & the Caribbean, Brazil is expected to double its share of organic cotton supply to 40% in the next few years. Haiti could emerge an important supplier, accounting for 10% share, from the less than 1% now. And Peru, the dominant supplier today, with 70% share, would be down to 40% in the future.

How buyers are overcoming obstacles to sourcing organic cotton

The primary barrier to meeting organic cotton sourcing goals cited was the cost of organic cotton (40%). The second greatest barrier was that there is not enough in-conversion cotton in the pipeline to meet demand (19%), demonstrating there is a keen interest in expanding despite the current price challenges. The two other primary concerns were that suppliers were not connected to producer groups (16%), and organic cotton of the desired quality was not available (13%).

Respondents are addressing the barriers to organic cotton sourcing in a number of ways, including entering into long-term commitments with farm groups, or suppliers working closely with the farmers (29%) and by incorporating in-conversion cotton into their sourcing strategies (27%). For example, 17% of respondents said they are booking capacity in advance. However, some saw the solution as choosing other preferred cottons instead of organic or incorporating more recycled cotton into their sourcing strategy.

In conclusion

Turkey could increase its supply of organic cotton to 72% from the current 61%. It is expected that Egypt's share in the region could increase to 8% from 5% currently, and Greece could supply 8% from the current 3%. Sourcing from Kyrgyzstan is expected to go down to just 4% from the current 18%. Spain may no longer be supplying organic cotton in the future.

Within Sub-Saharan Africa, the survey results are quite interesting. Benin's share of organic cotton supply in the region is expected to increase to 30% from less than 1% currently. Burkina Faso could be supplying 17% of organic cotton in future, from 11% currently. Ethiopia is also expected to increase its share of organic cotton from less than 1% currently to 9% in the coming years. Tanzania, which currently supplies 53% of the organic cotton, could be supplying around 13%. Similarly, Uganda's share is expected to fall to 13% from 21% currently.

In Latin America & the Caribbean, Brazil is expected to double its share of organic cotton supply to 40% in the next few years. Haiti could emerge an important supplier, accounting for 10% share, from the less than 1% now. And Peru, the dominant supplier today, with 70% share, would be down to 40% in the future.

How buyers are overcoming obstacles to sourcing organic cotton

The primary barrier to meeting organic cotton sourcing goals cited was the cost of organic cotton (40%). The second greatest barrier was that there is not enough in-conversion cotton in the pipeline to meet demand (19%), demonstrating there is a keen interest in expanding despite the current price challenges. The two other primary concerns were that suppliers were not connected to producer groups (16%), and organic cotton of the desired quality was not available (13%).

Respondents are addressing the barriers to organic cotton sourcing in a number of ways, including entering into long-term commitments with farm groups, or suppliers working closely with the farmers (29%) and by incorporating in-conversion cotton into their sourcing strategies (27%). For example, 17% of respondents said they are booking capacity in advance. However, some saw the solution as choosing other preferred cottons instead of organic or incorporating more recycled cotton into their sourcing strategy.

In conclusion

- Demand is strong, and growing

- More needs to be done to facilitate the journey to organic by supporting in-conversion cotton

- Unless proactive steps are taken there will be a missed opportunity to scale organic cotton and the positive impacts it brings.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.