Africa, Western Hemisphere Catch The Interest Of US Buyers

USFIA's 2021 Fashion Industry Benchmarking Study reveals some interesting trends:

- US fashion industry is recovering

- Surging sourcing costs are a concern in 2021

- The US-China tariff war has further added to the costs of sourcing

- US companies focus on strengthening relations with key vendors

- China remains a formidable force in the supply chain

- US companies are sourcing more from the Western Hemisphere

- US companies are interested in sourcing from, and committing to the African countries

Surging sourcing costs are a significant concern in 2021

As many as 97% of respondents anticipate the sourcing cost to increase further this year, with 37% expecting a "substantial increase" from 2020. More than 70% of respondents expect the shipping and logistics cost, cost of textile raw materials, cost of sourcing as a result of currency value and exchange rate changes, and labour costs to go up.

US-China tariff war exacerbates cost pressures

Nearly 90% of respondents say the US-China tariff war directly increased their company's sourcing cost this year. Because of the tariff war, US fashion companies had to pay an average 23.4% import duty rate for apparel (HTS Chapters 61 and 62) imports from China in 2020, much higher than 16.5% back in 2017 (or US$ 1,078 million additional tariffs).

Even fewer Chinese vendors are willing to "absorb the additional sourcing cost" this year, as they face rising cost pressures from raw material to labour.

Surging sourcing costs are a significant concern in 2021

As many as 97% of respondents anticipate the sourcing cost to increase further this year, with 37% expecting a "substantial increase" from 2020. More than 70% of respondents expect the shipping and logistics cost, cost of textile raw materials, cost of sourcing as a result of currency value and exchange rate changes, and labour costs to go up.

US-China tariff war exacerbates cost pressures

Nearly 90% of respondents say the US-China tariff war directly increased their company's sourcing cost this year. Because of the tariff war, US fashion companies had to pay an average 23.4% import duty rate for apparel (HTS Chapters 61 and 62) imports from China in 2020, much higher than 16.5% back in 2017 (or US$ 1,078 million additional tariffs).

Even fewer Chinese vendors are willing to "absorb the additional sourcing cost" this year, as they face rising cost pressures from raw material to labour.

Strengthening relationships with key vendors means less diversified sourcing base

US fashion companies report sourcing from 43 countries or regions in 2021, covering almost all continents in the world. However, only 36.7% of respondents currently source from 10+ different countries or regions, down from 42.1% in 2020, 57.1% in 2019, and 60.7% in 2018.

Consolidating the sourcing base is even more common among larger companies with 1,000+ employees. The percent of respondents who plan to diversify their sourcing base fell to a new record low of 16.7%, far fewer than 25.7% in 2019 and 32.1% in 2018.

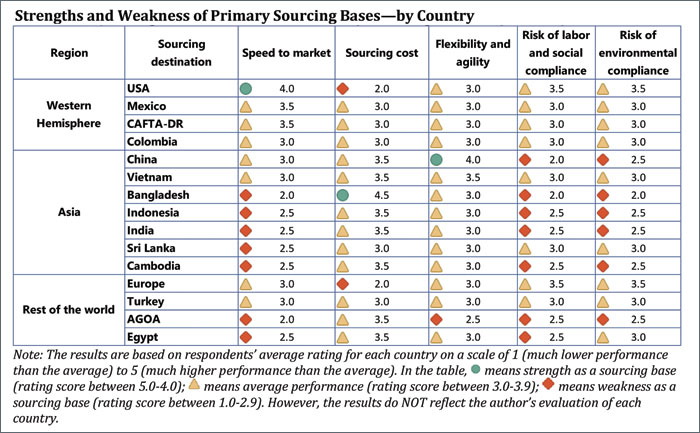

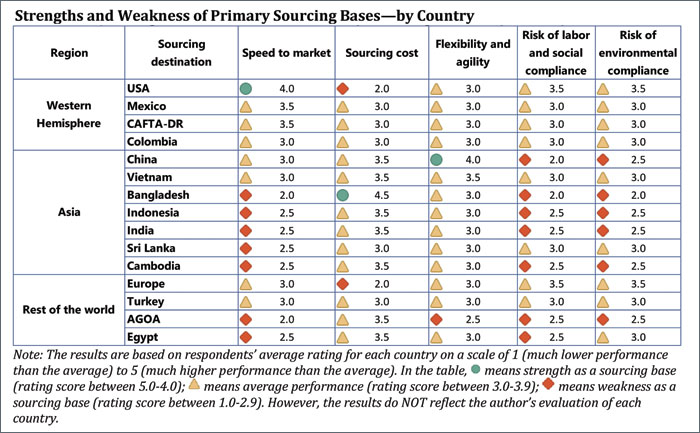

Asia remains the dominant apparel sourcing base Almost all the top ten most-utilised apparel sourcing destinations in 2021 are Asia-based, led by China (93%), Vietnam (87%), India (77%), and Bangladesh (73%).

Fewer buyers plan to reduce China exposure in short to medium term

Respondents see "finding a new sourcing base other than China" as a more critical challenge this year (i.e., ranks 4th in 2021 vs. 6th in 2020, 7th in 2018, and 13th in 2017). Most US fashion companies still plan to source from China in short to medium term. While 63% of respondents plan to decrease sourcing from China further over the next two years, it is a notable decrease from 70% in 2020 and 83% in 2019.

Most respondents still see China as a competitive and balanced sourcing base from a business perspective - offering flexibility, agility, production capacity, speed to market, and lower sourcing cost and as China's role in the textile and apparel supply chain goes far beyond garment production and continues to expand, it becomes ever more challenging to find China's alternatives.

US fashion companies actively explore new sourcing opportunities

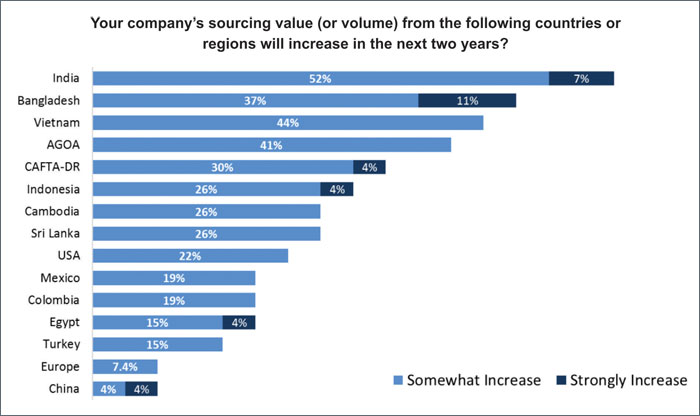

More than 85% of respondents plan to increase sourcing from a few Asian countries over the next two years, including India, Bangladesh, Indonesia, Philippines, Vietnam, and Cambodia. These countries, in general, will serve as alternatives to sourcing from China.

US fashion companies are interested in sourcing more from Bangladesh over the next two years. Respondents say apparel "Made in Bangladesh" enjoys a prominent price advantage over many other Asian suppliers. However, the competition among Bangladeshi suppliers could intensify as US fashion companies plan to "work with fewer vendors in the country."

Sub-Saharan Africa is an interesting sourcing option

Respondents are interested in sourcing more from Sub-Saharan Africa. Respondents also demonstrate a growing interest in investing more in AGOA members directly. "Replace AGOA with a permanent free trade agreement that requires reciprocal tariff cuts and continues to allow the "third country fabric provision" is respondents' most preferred policy option after AGOA expires in 2025.

Sourcing from Western Hemisphere gaining new momentum

This year, approximately 43% of respondents source from US-Mexico-Canada Trade Agreement (USMCA) members (up from 38% in 2020). Another 63% source from Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) members (up from 55% in 2020).

Overall, US fashion companies' growing interest in the Western Hemisphere is more about diversifying sourcing away from China and Asia than moving the production back to the region (i.e., reshoring or near - shoring).

Strengthening relationships with key vendors means less diversified sourcing base

US fashion companies report sourcing from 43 countries or regions in 2021, covering almost all continents in the world. However, only 36.7% of respondents currently source from 10+ different countries or regions, down from 42.1% in 2020, 57.1% in 2019, and 60.7% in 2018.

Consolidating the sourcing base is even more common among larger companies with 1,000+ employees. The percent of respondents who plan to diversify their sourcing base fell to a new record low of 16.7%, far fewer than 25.7% in 2019 and 32.1% in 2018.

Asia remains the dominant apparel sourcing base Almost all the top ten most-utilised apparel sourcing destinations in 2021 are Asia-based, led by China (93%), Vietnam (87%), India (77%), and Bangladesh (73%).

Fewer buyers plan to reduce China exposure in short to medium term

Respondents see "finding a new sourcing base other than China" as a more critical challenge this year (i.e., ranks 4th in 2021 vs. 6th in 2020, 7th in 2018, and 13th in 2017). Most US fashion companies still plan to source from China in short to medium term. While 63% of respondents plan to decrease sourcing from China further over the next two years, it is a notable decrease from 70% in 2020 and 83% in 2019.

Most respondents still see China as a competitive and balanced sourcing base from a business perspective - offering flexibility, agility, production capacity, speed to market, and lower sourcing cost and as China's role in the textile and apparel supply chain goes far beyond garment production and continues to expand, it becomes ever more challenging to find China's alternatives.

US fashion companies actively explore new sourcing opportunities

More than 85% of respondents plan to increase sourcing from a few Asian countries over the next two years, including India, Bangladesh, Indonesia, Philippines, Vietnam, and Cambodia. These countries, in general, will serve as alternatives to sourcing from China.

US fashion companies are interested in sourcing more from Bangladesh over the next two years. Respondents say apparel "Made in Bangladesh" enjoys a prominent price advantage over many other Asian suppliers. However, the competition among Bangladeshi suppliers could intensify as US fashion companies plan to "work with fewer vendors in the country."

Sub-Saharan Africa is an interesting sourcing option

Respondents are interested in sourcing more from Sub-Saharan Africa. Respondents also demonstrate a growing interest in investing more in AGOA members directly. "Replace AGOA with a permanent free trade agreement that requires reciprocal tariff cuts and continues to allow the "third country fabric provision" is respondents' most preferred policy option after AGOA expires in 2025.

Sourcing from Western Hemisphere gaining new momentum

This year, approximately 43% of respondents source from US-Mexico-Canada Trade Agreement (USMCA) members (up from 38% in 2020). Another 63% source from Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) members (up from 55% in 2020).

Overall, US fashion companies' growing interest in the Western Hemisphere is more about diversifying sourcing away from China and Asia than moving the production back to the region (i.e., reshoring or near - shoring).

Textile Excellence

Subscribe To Textile Excellence Print Edition

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.