The Market For Preferred Fibres And Materials Is Growing

The latest report by Textile Exchange – Preferred Fibre & Materials Market Report 2021 - shows the expansion of recycled polyester, preferred cotton, responsible mohair, preferred cashmere, certified rubber forests, and more. There isn’t time for the textile industry to pretend it can continue to go down the same path it has been on. In fact, the greater the growth of the conventional fibre and materials market, the greater the challenge to address GHG emissions reductions will be.

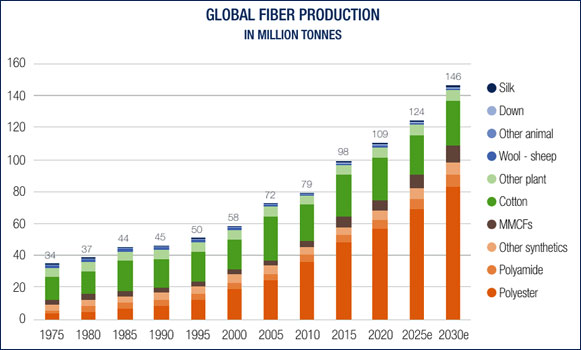

Global fibre production, hit by the Covid-19 pandemic, decreased from 111 million tonnes in 2019 to 109 million tonnes in 2020 after years of growth. While the overall fibre production declined in 2020, the market share of preferred fibre and materials is increasing. But even with this growth, preferred fibres still only represent less than one-fifth of the global fibre market. This number includes - in descending order - recycled polyester (8.4 million tonnes), preferred cotton as defined by a list of recognised standards (7.8 million tonnes), FSC/PEFC certified manmade cellulosic fibres (~3.9 million tonnes) and other recycled and biobased fibres produced according to recognised standards (0.57 million tonnes).

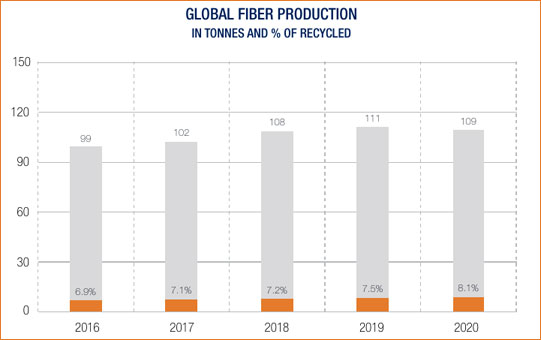

The market share of recycled fibres increased from 6.9% in 2016 to 8.1% in 2020 - with the majority (7.6%) coming from recycled PET bottles - and only a minor part (0.5%) from other recycled feedstock.

Overall, less than 0.5% of the global fibre market was from pre- and post-consumer recycled textiles in 2020. The increase of the preferred fibres market should not make us forget that the overall fibre and materials market continues to grow and with this also its overall impacts.

The market share of recycled fibres increased from 6.9% in 2016 to 8.1% in 2020 - with the majority (7.6%) coming from recycled PET bottles - and only a minor part (0.5%) from other recycled feedstock.

Overall, less than 0.5% of the global fibre market was from pre- and post-consumer recycled textiles in 2020. The increase of the preferred fibres market should not make us forget that the overall fibre and materials market continues to grow and with this also its overall impacts.

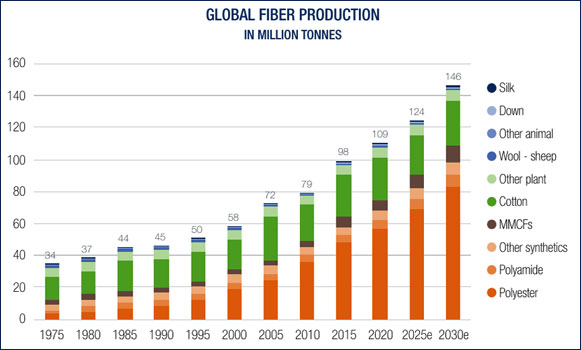

The global fibre production has almost doubled in the last 20 years from 58 million tonnes in 2000 to 109 million tonnes in 2020. While it is not yet clear how the pandemic and other factors will impact future development, global fibre production is expected to increase by another 34% to 146 million tonnes in 2030 if the industry will build back business as usual.

The global fibre production has almost doubled in the last 20 years from 58 million tonnes in 2000 to 109 million tonnes in 2020. While it is not yet clear how the pandemic and other factors will impact future development, global fibre production is expected to increase by another 34% to 146 million tonnes in 2030 if the industry will build back business as usual.

In absolute numbers, virgin fossil-based fibres also increased from 55.7 million tonnes in 2016 to 59.7 million tonnes in 2020.

Cotton

While the overall cotton production remained relatively stable over the last few years with a production volume of 26.2 million tonnes in 2020 (i.e., the 2019/20 ICAC harvest year), the market share of preferred cotton increased from 24% in 2018/19 to 30% in 2019/20. Yet, to grow the market share of preferred cotton to 50% by 2025 requires further acceleration of the preferred cotton market. Also, continuous improvement in terms of the impacts of all cotton grown is needed.

Polyester

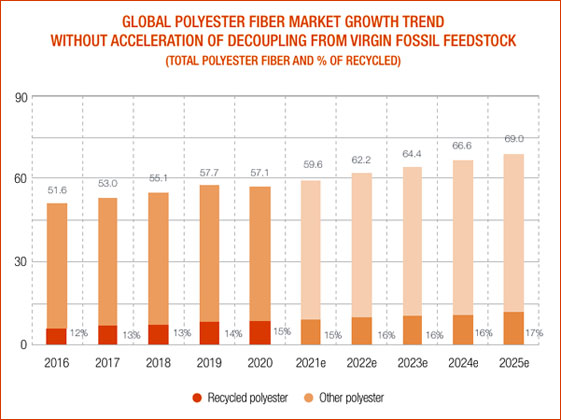

With a production volume of 57 million tonnes, polyester was the most used fibre accounting for 52% of the global fibre market in 2020. The market share of recycled polyester increased from 13.7% in 2019 to 14.7% in 2020. Due to the low prices of fossil-based polyester, the recycled polyester market has been growing slowly in the past years.

In absolute numbers, virgin fossil-based fibres also increased from 55.7 million tonnes in 2016 to 59.7 million tonnes in 2020.

Cotton

While the overall cotton production remained relatively stable over the last few years with a production volume of 26.2 million tonnes in 2020 (i.e., the 2019/20 ICAC harvest year), the market share of preferred cotton increased from 24% in 2018/19 to 30% in 2019/20. Yet, to grow the market share of preferred cotton to 50% by 2025 requires further acceleration of the preferred cotton market. Also, continuous improvement in terms of the impacts of all cotton grown is needed.

Polyester

With a production volume of 57 million tonnes, polyester was the most used fibre accounting for 52% of the global fibre market in 2020. The market share of recycled polyester increased from 13.7% in 2019 to 14.7% in 2020. Due to the low prices of fossil-based polyester, the recycled polyester market has been growing slowly in the past years.

The new 2025 Recycled Polyester Challenge was launched in 2021 by Textile Exchange and the UN Fashion Industry Charter for Climate Action to accelerate the recycled polyester market. By July 2021, over 100 brands and suppliers (including subsidiaries) have signed the challenge and committed to jointly increasing the share of recycled polyester to 45% by 2025. Due to increasing competition for reclaimed plastic bottles from the packaging and plastics industry, systems for textile-to-textile recycling are in development but most recycled polyester is currently still made from plastic bottles. The interest in and use of ocean or ocean-bound plastic is also increasing.

The market share of biobased polyester fibre remained very low at around 0.03% of the polyester fibre market. Key reasons are prices, availability, and also questions around the sustainability of biobased polyester.

Polyamide (Nylon)

Polyamide had a market share of 5% of the global fibre market in 2020. Due to technical challenges and low prices for fossil-based polyamide, the market share of recycled polyamide is only 1.94% of all polyamide fibre. As the second-most used synthetic fibre, polyamide offers significant impact potentials by transitioning to recycled and biobased polyamide. Most recycled polyamide is currently made from pre-consumer waste, some also from discarded fishing nets. Increasing the use of post-consumer textiles is needed.

The market share of biobased polyamide fibres in 2020 remained low at around 0.4% of the global polyamide fibre market. Similar to the reasons for the low uptake of biobased polyester, prices, availability, and also questions around the sustainability of biobased polyamide counteracted the increase of the market.

The new 2025 Recycled Polyester Challenge was launched in 2021 by Textile Exchange and the UN Fashion Industry Charter for Climate Action to accelerate the recycled polyester market. By July 2021, over 100 brands and suppliers (including subsidiaries) have signed the challenge and committed to jointly increasing the share of recycled polyester to 45% by 2025. Due to increasing competition for reclaimed plastic bottles from the packaging and plastics industry, systems for textile-to-textile recycling are in development but most recycled polyester is currently still made from plastic bottles. The interest in and use of ocean or ocean-bound plastic is also increasing.

The market share of biobased polyester fibre remained very low at around 0.03% of the polyester fibre market. Key reasons are prices, availability, and also questions around the sustainability of biobased polyester.

Polyamide (Nylon)

Polyamide had a market share of 5% of the global fibre market in 2020. Due to technical challenges and low prices for fossil-based polyamide, the market share of recycled polyamide is only 1.94% of all polyamide fibre. As the second-most used synthetic fibre, polyamide offers significant impact potentials by transitioning to recycled and biobased polyamide. Most recycled polyamide is currently made from pre-consumer waste, some also from discarded fishing nets. Increasing the use of post-consumer textiles is needed.

The market share of biobased polyamide fibres in 2020 remained low at around 0.4% of the global polyamide fibre market. Similar to the reasons for the low uptake of biobased polyester, prices, availability, and also questions around the sustainability of biobased polyamide counteracted the increase of the market.

Manmade Cellulosics

Production of manmade cellulosic fibres (MMCFs) decreased to 6.5 million tonnes in 2020 due to Covid-19. While the overall production volume of MMCFs decreased, the market share of preferred MMCFs increased. The market share of FSC and/or PEFC certified MMCFs increased to around 55-60% of all MMCFs in 2020(1).

First MMCF textile products with consumer facing FSC labels hit the market in 2020. While this is a significant achievement, eliminating the risk of sourcing MMCFs from ancient and endangered forests such as the carbon-rich peatlands of Indonesia and old-growth boreal forests of Canada should be the minimum bar for all MMCFs.

The market share of “recycled MMCFs” is estimated at around 0.4%. However, a lot of research and development is ongoing, so it is expected to increase significantly in the following years. With new standards such as bluesign® and ZDHC introduced for the pulp and fibre level, action is also likely to accelerate on the pulp and fibre level.

Wool

Global wool fibre production was around 1 million tonnes in 2020. Conventional wool dominates the wool market but the market for non-mulesing and preferred wool programs is increasing. The Responsible Wool Standard (RWS) market share increased to 1.25% in 2020 on a global average. In its initial focus countries, the market shares were as high as 25% in South Africa, 11% in Uruguay, and 9% in Argentina.

Transitioning to wool programs with both animal welfare and responsible land use criteria in place offers the potential to create positive impacts on animal welfare, land use, and biodiversity. Recycled wool had a market share of around 6% of the global total wool market.

Mohair

Global mohair fibre production in 2020 was around 4,320 tonnes of greasy fibres. The Responsible Mohair Standard (RMS), covering both animal welfare and responsible land use criteria, was launched in March 2020. Its market share jumped from 0 to 27% of all mohair produced worldwide in its first year of existence. In South Africa, it even increased to 51% in 2020.

Alpaca

The global alpaca fibre production was around 6,000 tonnes in 2020. In April 2021, the Responsible Alpaca Standard (RAS) was launched with animal welfare and responsible land use criteria. First RAS certified alpaca is expected to hit the market soon.

Cashmere

Global cashmere production was around 25,208 tonnes of greasy fibres in 2020. About 60% of the cashmere was produced in China, 20% in Mongolia, and the remaining 20% in other countries. The market share of preferred cashmere programs increased from 0.8% in 2019 to around 7% of all cashmere produced worldwide in 2020.

Down

Global down production volume was estimated at around 0.5 million tonnes in 2020. Awareness of animal welfare issues has led to successful growth in the use of standards such as the Responsible Down Standard (RDS) with a market share of 3% and Downpass with a market share of around 1.1% of the total down market. While influencing at the farm level is challenging, the use of preferred down standards helps to reduce the risks along the supply chain.

Other fibres

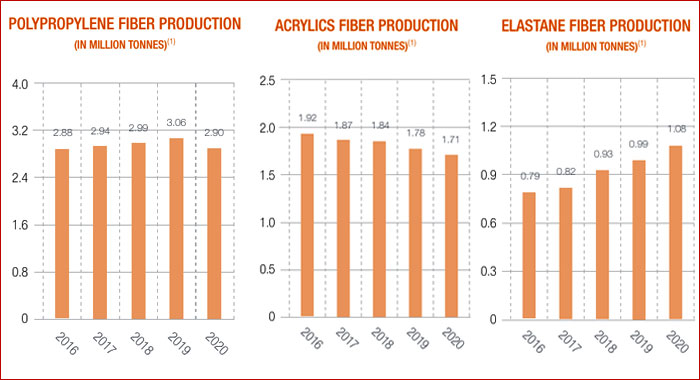

Other fibres - from hemp to elastane - are often not in the focus of the industry’s attention despite significant sustainability potentials and challenges.

Manmade Cellulosics

Production of manmade cellulosic fibres (MMCFs) decreased to 6.5 million tonnes in 2020 due to Covid-19. While the overall production volume of MMCFs decreased, the market share of preferred MMCFs increased. The market share of FSC and/or PEFC certified MMCFs increased to around 55-60% of all MMCFs in 2020(1).

First MMCF textile products with consumer facing FSC labels hit the market in 2020. While this is a significant achievement, eliminating the risk of sourcing MMCFs from ancient and endangered forests such as the carbon-rich peatlands of Indonesia and old-growth boreal forests of Canada should be the minimum bar for all MMCFs.

The market share of “recycled MMCFs” is estimated at around 0.4%. However, a lot of research and development is ongoing, so it is expected to increase significantly in the following years. With new standards such as bluesign® and ZDHC introduced for the pulp and fibre level, action is also likely to accelerate on the pulp and fibre level.

Wool

Global wool fibre production was around 1 million tonnes in 2020. Conventional wool dominates the wool market but the market for non-mulesing and preferred wool programs is increasing. The Responsible Wool Standard (RWS) market share increased to 1.25% in 2020 on a global average. In its initial focus countries, the market shares were as high as 25% in South Africa, 11% in Uruguay, and 9% in Argentina.

Transitioning to wool programs with both animal welfare and responsible land use criteria in place offers the potential to create positive impacts on animal welfare, land use, and biodiversity. Recycled wool had a market share of around 6% of the global total wool market.

Mohair

Global mohair fibre production in 2020 was around 4,320 tonnes of greasy fibres. The Responsible Mohair Standard (RMS), covering both animal welfare and responsible land use criteria, was launched in March 2020. Its market share jumped from 0 to 27% of all mohair produced worldwide in its first year of existence. In South Africa, it even increased to 51% in 2020.

Alpaca

The global alpaca fibre production was around 6,000 tonnes in 2020. In April 2021, the Responsible Alpaca Standard (RAS) was launched with animal welfare and responsible land use criteria. First RAS certified alpaca is expected to hit the market soon.

Cashmere

Global cashmere production was around 25,208 tonnes of greasy fibres in 2020. About 60% of the cashmere was produced in China, 20% in Mongolia, and the remaining 20% in other countries. The market share of preferred cashmere programs increased from 0.8% in 2019 to around 7% of all cashmere produced worldwide in 2020.

Down

Global down production volume was estimated at around 0.5 million tonnes in 2020. Awareness of animal welfare issues has led to successful growth in the use of standards such as the Responsible Down Standard (RDS) with a market share of 3% and Downpass with a market share of around 1.1% of the total down market. While influencing at the farm level is challenging, the use of preferred down standards helps to reduce the risks along the supply chain.

Other fibres

Other fibres - from hemp to elastane - are often not in the focus of the industry’s attention despite significant sustainability potentials and challenges.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.