Inside Amazon’s Department Store Plans: High-Tech Dressing Rooms, Its Own Apparel Brands

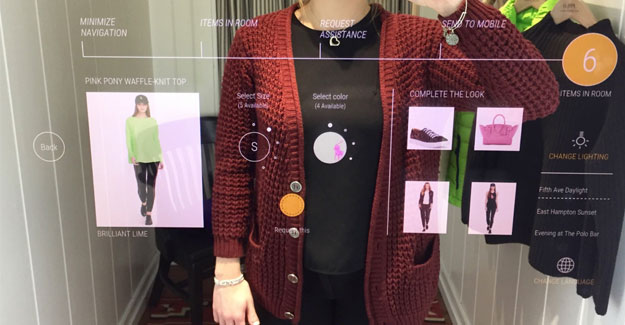

Company’s outlets could feature QR codes, touch screens and a nontraditional shopping experience Amazon.com Inc.’s planned department stores will aim to boost its apparel sales by offering shoppers a chance to try on clothes from its own private label brands in technology-fuelled dressing rooms, it is learnt. The department stores, which the online shopping company could open next year, will primarily function as a place for Amazon to sell t-shirts, jeans and other items from its own labels, as well as a mix of outside brands that sell clothing on its website. Amazon wants to see if the potential department stores can improve the brand recognition of its apparel while addressing some of the irritants of both online and bricks-and-mortar clothes shopping. One idea that has been tested is for customers to scan QR codes of items they want to try on by using a smartphone app and for associates in the store to gather the items and place them in fitting rooms, the people said. Once there, customers could ask for more items using a touch screen, which might be capable of recommending additional clothing based on the pieces shoppers liked. The rooms could use sliding doors for associates to bring more clothes without seeing shoppers, according to sources. Robots or other forms of automation could eventually be deployed in the stores, one of the people said. The online shopping company has made an effort to keep its clothing concept secret, giving it a code name. The first department stores are slated to open near San Francisco and Columbus, Ohio. Since it was founded in 1994, Amazon has aggressively pushed to expand the number of items sold online, gradually disrupting retail markets as it cemented its relationship with customers. Its online dominance helped usher many bricks-and-mortar stores into bankruptcy as shoppers gravitated more to purchasing items online. Now it is moving to inhabit the spaces those companies once commanded for decades, turning to physical retail for groceries, books and now clothing. It sees physical stores as a promising avenue to reaching new customers and testing out its technology prowess. The retail industry has seen a surge with people returning to physical shopping at certain points this year as lockdowns and stay-at-home mandates from the Covid-19 pandemic receded in some places. Chains including Macy’s Inc. and Kohl’s Corp. reported recent strong sales as shoppers restocked their closets after reducing clothing purchases last year. Promise: Fast Global Shipping The use of new tech by Amazon in physical outlets largely came with the opening of its Amazon Go cashierless convenience stores, which arrived in 2018. The company now has Go locations in Chicago, New York, San Francisco and Seattle and last year said it had started to sell the technology behind the stores to other retailers. Although the disruptive potential of Amazon’s expansions is well-known, the company has stumbled on occasion in rolling out new products, services or stores. It launched a doomed smartphone in 2014 and shelved a restaurant delivery service in 2019. That year it said it would close many “pop-up” stores it had opened in malls. The small shops were a showcase for such devices as smart speakers, tablets and Kindle e-readers. Amazon has for years focused on building its apparel sales. This year it surpassed Walmart Inc. as the country’s largest seller of clothing, according to a report from Wells Fargo, which predicted earlier this year that Amazon’s total sales of clothing and shoes, including those made by others, will surpass US$ 45 billion in 2021. Amazon doesn’t disclose the financial figures of its apparel sales. Goodthreads and Lark & Ro are among Amazon brands on the site. Fashion goods typically have higher profit margins than other items. Having physical space for clothes will enable Amazon customers to try outfits on before purchasing them and could reduce clothing returns. The company has historically given priority to gaining market share in industries over profits. The retailer has attempted to build out its fashion business by giving customers more options on how and where to buy. It has had a tougher time, though, scaling the high-end fashion business, with few luxury brands selling on its website. The Wells Fargo report said Amazon’s endless-store ethos in some ways has run counter to fashion industry culture, which thrives on premium shopping experiences, carefully chosen styles, quality design and brand power. Amazon has tried to rectify its shortfalls by offering features including a subscription model called Personal Shopper that provides customers with a stylist who makes personalised recommendations. In a survey by Wells Fargo, shoppers listed having to pay for shipping if they aren’t Prime members and preferring the experience of a physical store among the top reasons they disliked shopping on Amazon’s website. Many clothing brands such as Levi’s and Adidas have sold on Amazon, but others have resisted because of concerns that Amazon is downmarket or that the retail company could copy their products using data on their bestsellers. Moreover, some of Amazon’s plans for its stores aren’t entirely new concepts. Nike Inc., for example, is a retailer that has had associates prepare items ahead of time in fitting rooms if customers scan products on their phones.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.